The worth of Bitcoin retains smashing resistance ranges whereas reclaiming beforehand misplaced territory. Not like different rallies into the present space, this value motion may recommend a persistent development and a brand new daybreak for the trade following months of collapsing corporations and bankruptcies.

As of this writing, Bitcoin (BTC) trades at $22,800 with sideways motion within the final 24 hours. Within the earlier week, the cryptocurrency data a ten% revenue. Different cryptocurrencies within the high 10 by market capitalization are experiencing related value motion with substantial earnings over this era.

Is Bitcoin Lastly At Backside Ranges?

Based on an analyst at Jarvis Labs, the present Bitcoin rally outcomes from a protracted interval of consolidation under the 200-Day Shifting Common (MA). This transferring common is one among BTC’s most necessary ranges working as essential assist throughout the bearish cycles.

As Bitcoin reclaims the 200-day MA at round $19,520, the analyst desires to see a consolidation above this stage. The rally may lengthen if the cryptocurrency can maintain above it, pushing BTC into additional highs, solidifying “a flip of the 200-day MA from resistance to assist.”

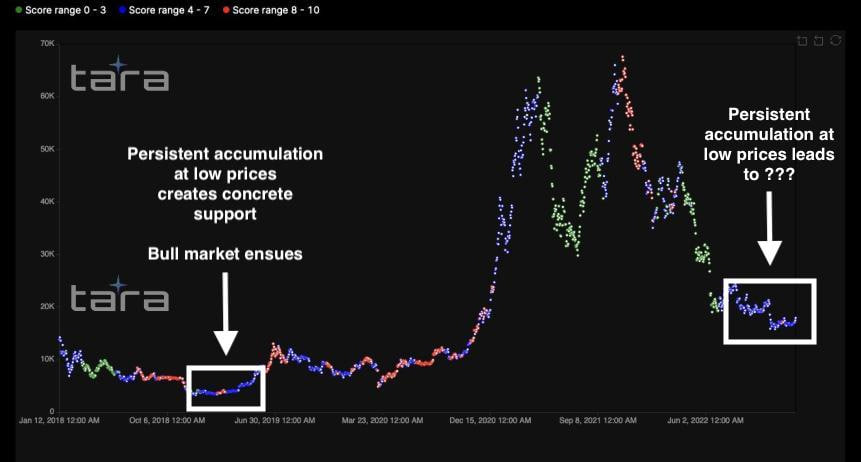

As seen within the chart under, throughout the 2019 bear market, BTC noticed a protracted consolidation under its 200-day MA earlier than reclaiming these ranges later within the 12 months. Based on the analyst, the longer the consolidation, the higher the development for BTC’s total market construction as different transferring averages rise.

The above doesn’t suggest that Bitcoin will repeatedly development to the upside, again to its all-time excessive of $69,000. As an alternative, it means that BTC’s market well being is enhancing, with the muse for additional positive factors rising.

This new established order makes any potential decline a chance for optimistic traders. The Jarvis Labs analyst wrote:

(…) And whereas there may be nonetheless a fairly excessive chance that early January value ranges shall be revisited once more in some unspecified time in the future in 2023, there may be additionally a powerful piece of information which suggests any such retest would current a chief shopping for alternative.

Accumulation Ranges Trace At 2019 Like BTC Backside

Along with this era of consolidation under the 200-day MA, which hints at a 2019-like backside, BTC has seen “persistent accumulation.” The picture under exhibits that Bitcoin traders have been “reasonably accumulating” (Blue dots within the chart under) extra of the cryptocurrency.

Just like the 2018-2019 bear market, this accumulation interval preceded market rallies. Within the coming months, Bitcoin ought to see extra aggressive accumulation (Purple dots within the chart under) to assist one other bullish season.

The US Federal Reserve (Fed) stays the most important impediment to a Bitcoin rally. The monetary establishment is mountain climbing rates of interest to cut back inflation whereas hurting monetary markets.

Market contributors anticipate the Fed to pivot its financial coverage, however positive factors in shares and crypto, mixed with sticky inflation, might set off the alternative. If this occurs, optimistic traders may see the shopping for alternative offered by the Jarvis Labs analyst.