- Whales with greater than 1,000 BTC had been concerned in promoting for many of 2022.

- Elevated BTC dump might drive the value additional down within the mid-term.

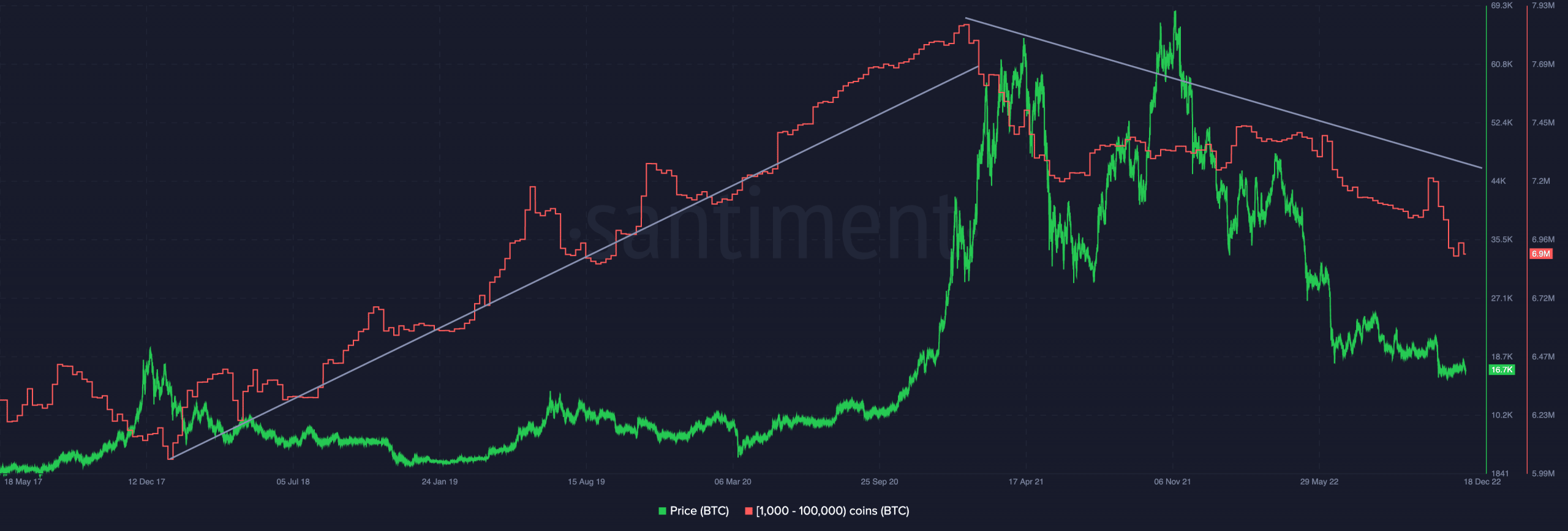

Bitcoin [BTC] whales’ influence within the broader crypto market has by no means been unsure, however their latest conduct might ship the king coin additional down the charts, a 29 December Santiment report revealed.

Traditionally, accumulation or sell-offs from whales had considerably impacted the BTC value development, however in 2022, it was extra of the latter.

A 0.45x cutback if BTC hits Ethereum’s market cap?

In line with the report, addresses that maintain between 1,000 to 100,000 BTC had been the highest culprits in motion. However, BTC couldn’t exempt its affect with its motion because it dropped 64.22% within the final twelve months.

Supply: Santiment

Do away with holdings, proceed the decline

Due to the deeds, Bitcoin whales posed a fantastic measure to find out the potential motion within the subsequent six to 12 months. If the gesture continues, then discussions round BTC hitting backside might come to a halt. Santiment famous that BTC may very well be close to $14,600 or drop to $12,200, relying on the quantity gaps. The report learn,

“Just lately, it seems like they’ve been internet sellers, and the value has been following swimsuit. It’s with confidence that we will predict sideways and even decrease costs for BTC within the subsequent 6-12 months.”

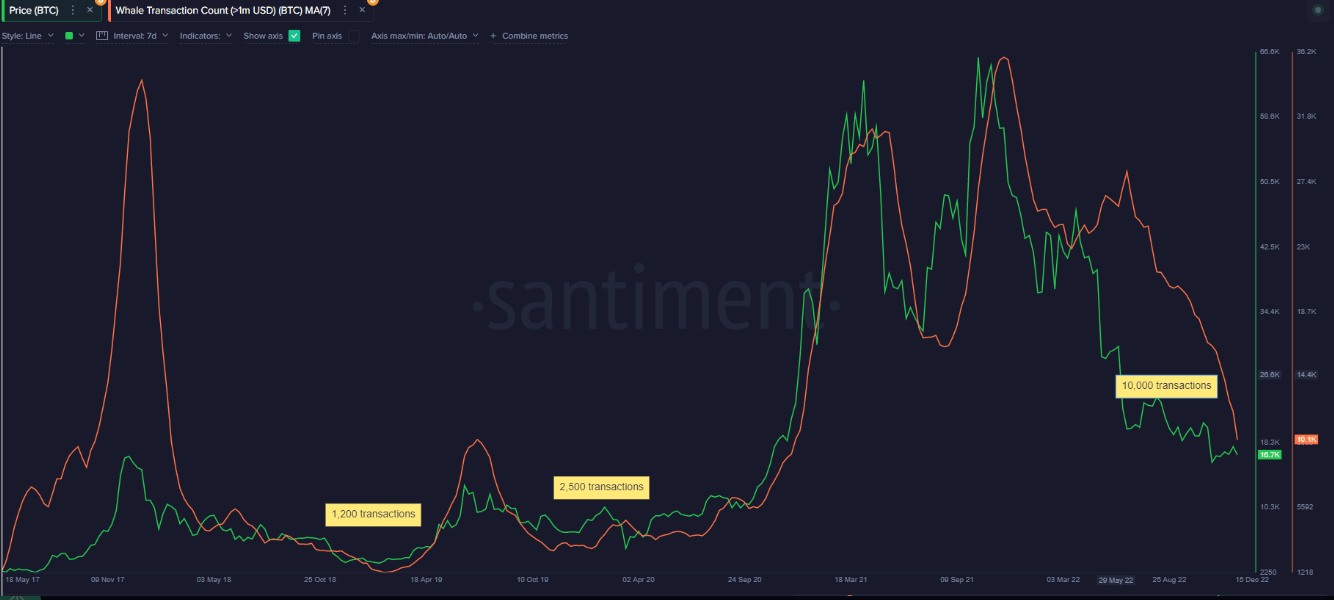

Apart from the BTC dump, Santiment famous that bottoms in previous cycles had been related to minimal whale exercise. Nevertheless, on-chain information confirmed that whale transactions across the $1 million on the seven-day Shifting Common (MA) had been nonetheless larger than 10,000.

Supply: Santiment

Because of this development, there was much less tendency to confess to a backside hit. In occasions previous, a 1,200 to 1,500 related transaction rely adopted the BTC backside affirmation.

Are your BTC holdings flashing inexperienced? Verify the Revenue Calculator

Make or mar as the brand new 12 months begins

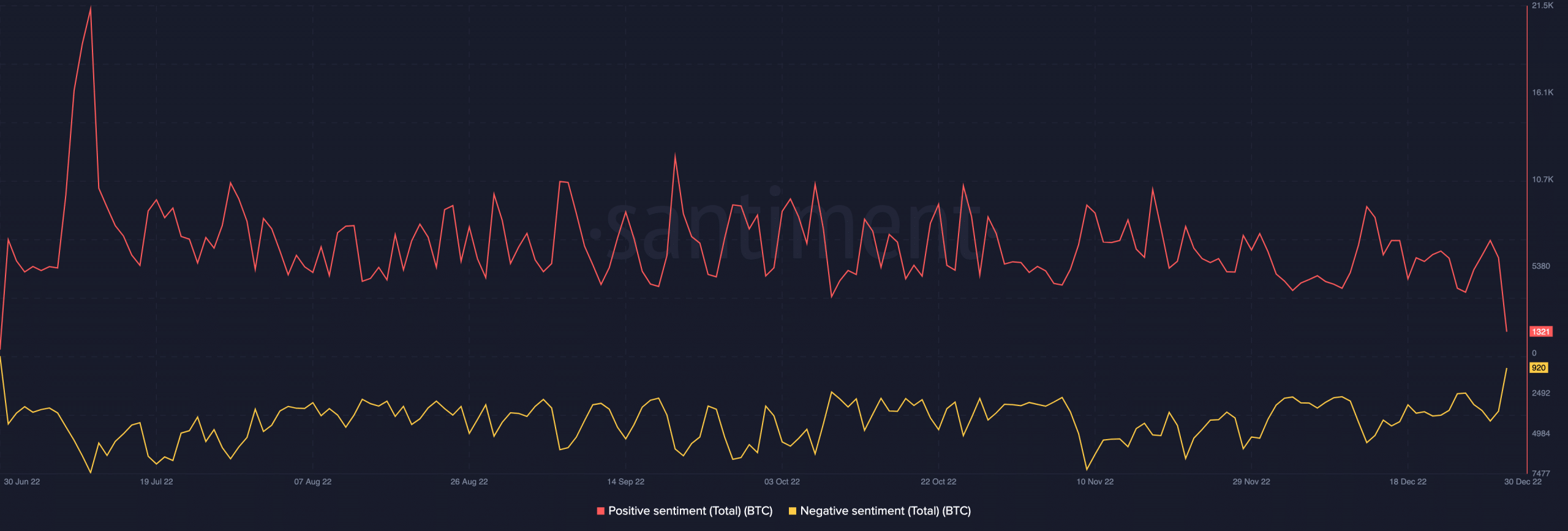

For buyers who’ve endured the torrid 2022 season, it will be the hope that BTC overcomes the burden within the fast-approaching new 12 months. Alas, optimism was lesser than might have been supposed. This was as a result of on-chain data confirmed declining constructive sentiment and an uprise towards damaging notion.

Supply: Santiment

At press time, BTC was buying and selling at $16,548. In the meantime, there was hardly any hankering for respite within the quick time period. Per the each day chart, indications from the Directional Motion Index (DMI) disregarded shopping for energy.

This was as a result of the constructive DMI indicator (inexperienced) subdued at 17.98. However, the damaging DMI (purple) appreciated at 26.70. Nonetheless, it was not throughout a few potential bearish path as a result of development displayed by the Common Directional Index (ADX).

Because the ADX (yellow) was a lot lower than 25, BTC’s possible path might keep impartial, barring any unstable change.

![Bitcoin [BTC] price action](https://ambcrypto.com/wp-content/uploads/2022/12/BTCUSD_2022-12-30_07-47-33.png)

Supply: TradingView