Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

Cryptocurrency markets thus far this yr have seen a major uptrend, which many have thought of a reward for surviving the aftermath of the collapse of Terra-Luna in Could 2022 and the numerous losses attributable to the sudden fallout of cryptocurrency change FTX in November 2022.

The costs of main cash Bitcoin [BTC] and Ethereum [ETH], on a year-to-date (YTD), have elevated by 30% and 28%, respectively, each buying and selling momentarily at worth ranges final seen previous to FTX’s collapse.

Since 1 January, the costs of different cash resembling Fantom [FTM] have witnessed a outstanding improve of over 100%, whereas the comparatively current Aptos [APT] has skilled an exponential development of 300%.

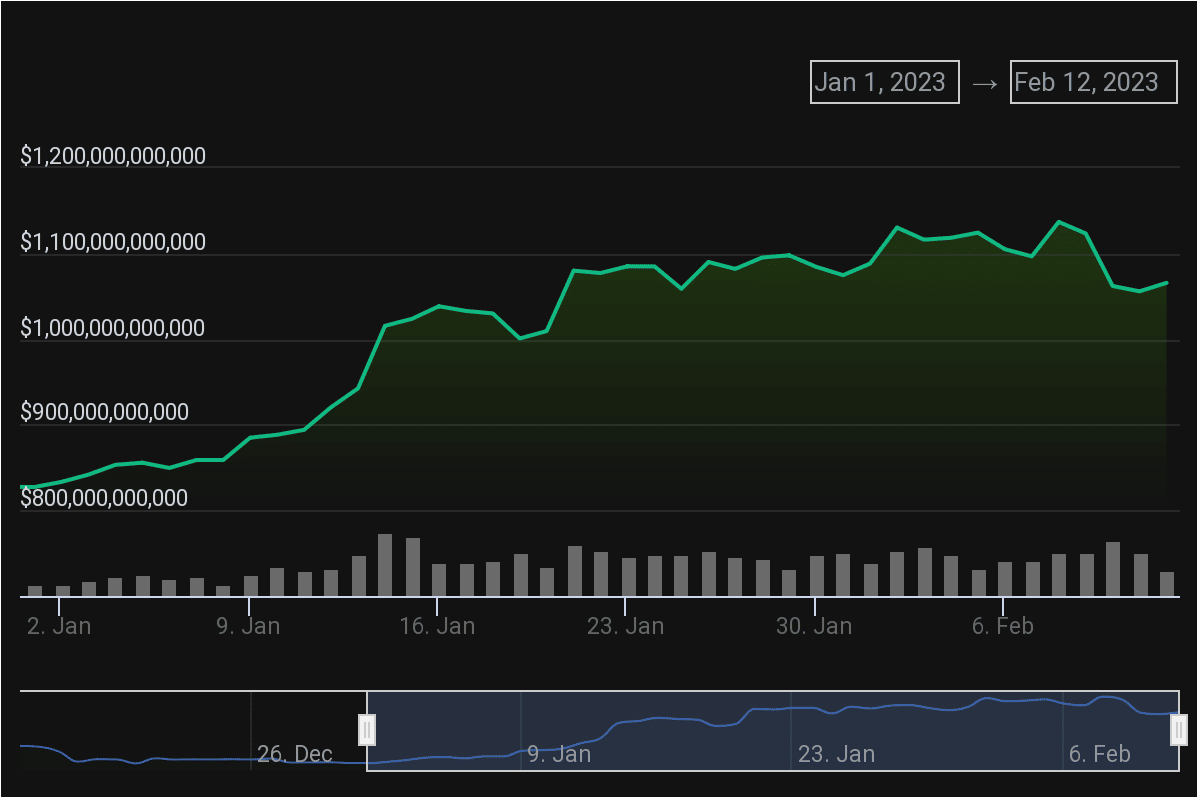

Per information from CoinGecko, prior to now 42 days, international cryptocurrency market capitalization has rallied by 24%.

Supply: CoinGecko

Whereas the holders of king coin BTC and main altcoin ETH have recorded income for the primary time in a number of months, the query nonetheless stays as to what different belongings to put money into for max revenue in the long run.

These altcoins is likely to be your protected haven, analyst says

Crypto market analyst Jessica Doosan in a blog post revealed in December 2022, opined that there have been 25 “lossless” crypto cash that traders “will make extraordinarily vital income within the years 2024–2025.”

They embody Polkadot [DOT], Ocean Protocol [OCEAN], Mate [MATE], Close to [NEAR], Loopring [LRC], Decentraland [MANA], The SandBox [SAND], ZCash [ZEC], Dogecoin [DOGE], Biconomy [BICO], PancakeSwap [CAKE], Rarible [RARI], Mobox [MBOX], dYdX [DYDX], Avalon [AVA], Avalanche [AVAX], Lossless [LSS], Gala [GALA], Theta [THETA], Bloktopia [BLOK], Victoria VR [VR], Ravencoin [RVN], MultiversX [EGLD], Algorand [ALGO], and MoonRiver [MOVR].

Let’s consider the efficiency outlook of the highest three altcoins with the very best market capitalization among the many 25 really useful by Doosan, specifically DOT, DOGE, and AVAX within the brief time period, and what might be anticipated by those that maintain them.

Count on a worth decline within the brief time period

An examination of the day by day chart worth traits of DOT, DOGE, and AVAX revealed a shared sample – all three have began a brand new bearish cycle.

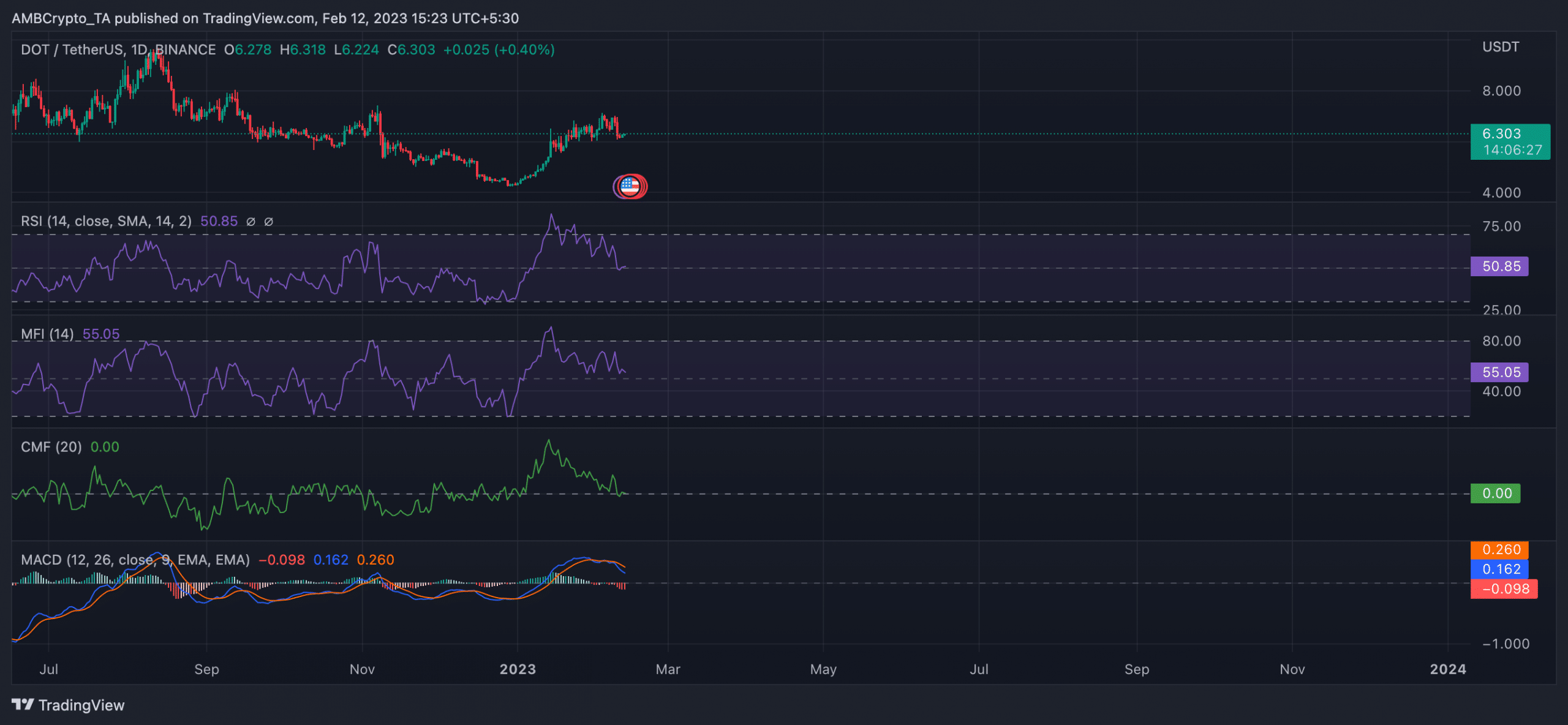

As for DOT, its YTD worth has grown by 45%, information from CoinGecko confirmed. Following a number of weeks of the rally, its worth finally peaked at $7.10 on 3 February and has since been on a downtrend.

This coincided with when the MACD line intersected with the pattern line in a downtrend ushering within the new bear cycle. At press time, DOT traded at $6.29, having declined by 11%.

With a continued decline in shopping for momentum, key indicators such because the Relative Energy Index (RSI) and Cash Stream Index (MFI) have been noticed mendacity near their respective impartial zones.

In a continued decline, the positions of those momentum indicators revealed that purchasing strain for DOT had weakened prior to now few weeks, and a shortfall of liquidity to drive up worth will event a protracted worth decline.

Supply: DOT/USDT on TradingView

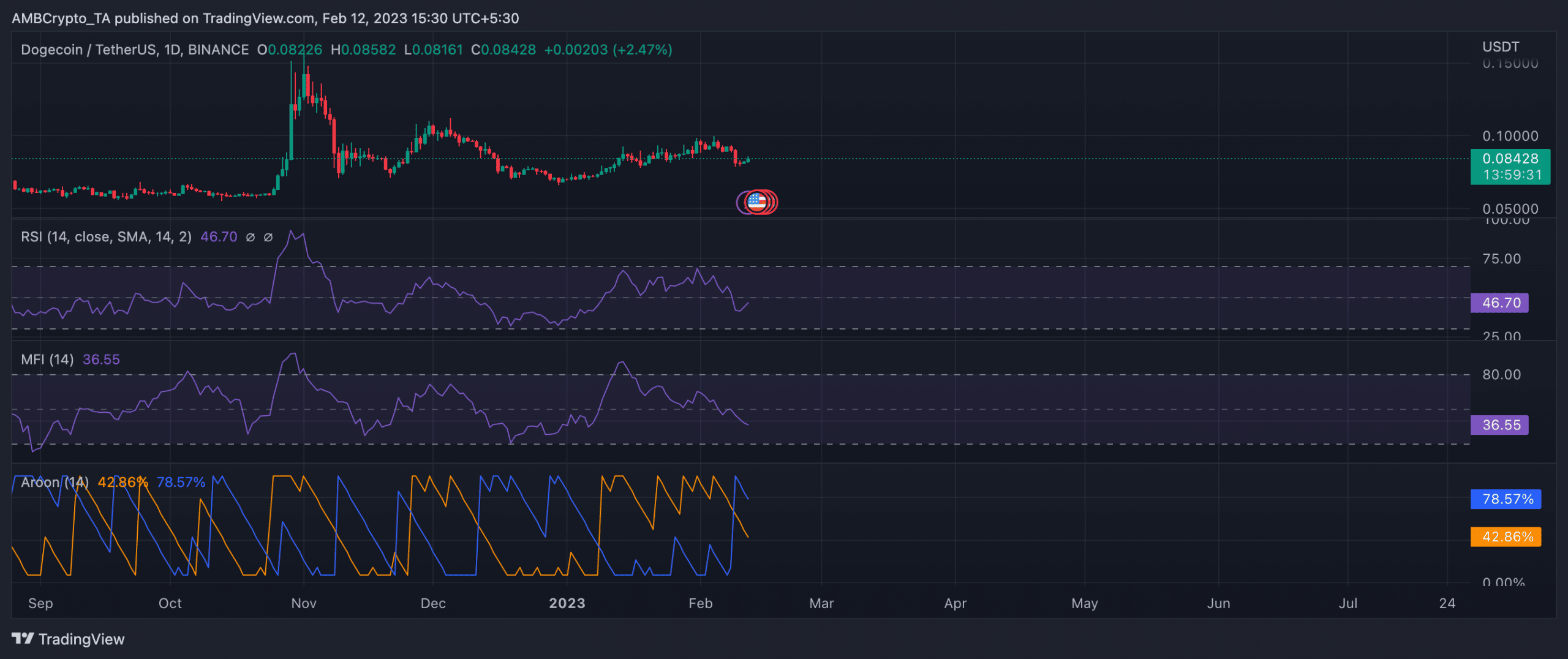

Issues have been the identical for the main meme coin DOGE. At press time, DOGE exchanged arms at $0.08456. Its worth has grown by 20% because the starting of the yr. Additionally lingering beneath vital bearishness, its RSI and MFI have breached their respective impartial spots and have been headed towards oversold areas.

This confirmed that DOGE’s accumulation pattern had slowed considerably as many holders have been invested in promoting their holdings to appreciate income.

The Aroon Up line (orange) at 42.86% confirmed the weakened shopping for pattern within the DOGE market. However, the Aroon Down line (blue) rested at 78.57%.

When the Aroon Up line is near zero, the uptrend is weak, and the newest excessive was reached a very long time in the past. This may be a sign of a possible pattern reversal.

Likewise, when the Aroon Down line is near 100, it signifies that the downtrend is robust and that the newest low was reached comparatively just lately.

Supply: DOGE/USDT on TradingView

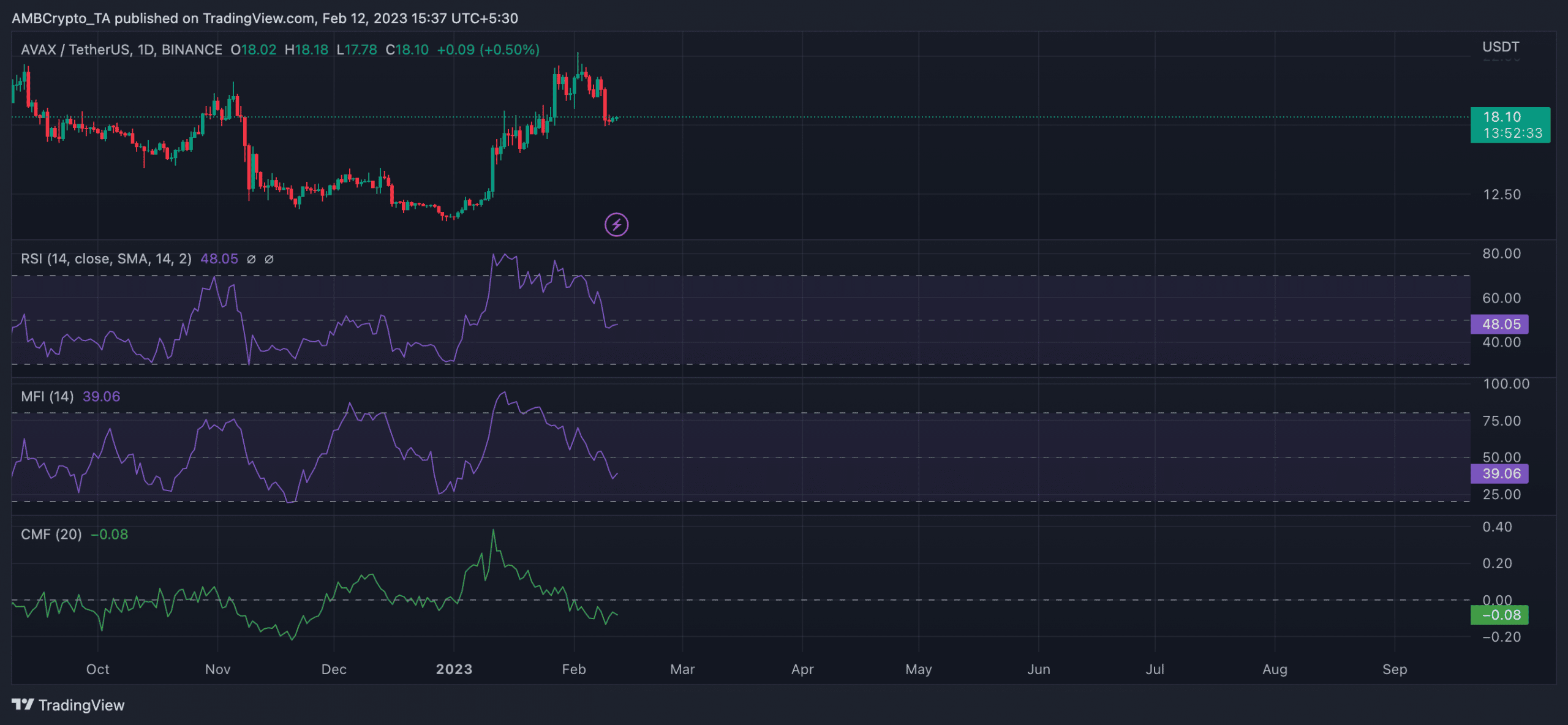

As for AVAX, its key momentum indicators have been additionally located near oversold lows at press time. As well as, its Chaikin Cash Stream (CMF) had breached the middle line in a downtrend and was destructive -0.08 at press time.

This confirmed that purchasing momentum had declined considerably, and distribution was underway. With the CMF in a downtrend, AVAX’s worth is predicted to fall additional.

Supply: AVAX/USDT on TradingView

Detrimental sentiment continues to path these belongings

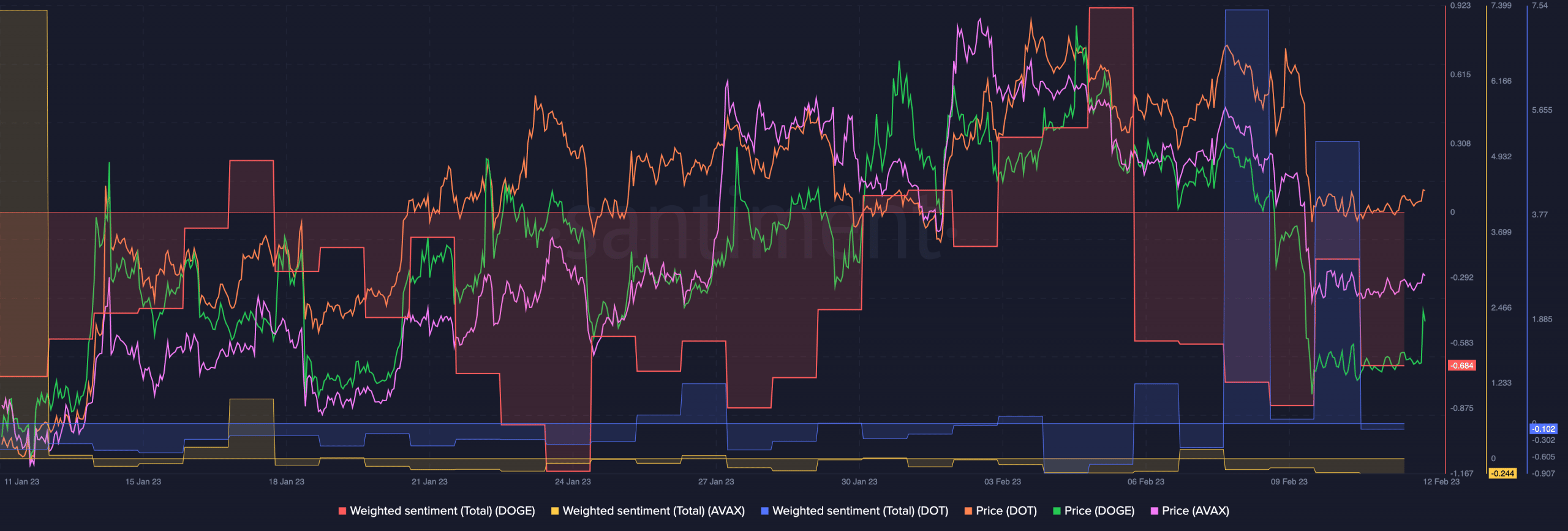

Within the final month, DOT, DOGE, and AVAX have been trailed by destructive traders sentiments, information from Santiment confirmed.

With weighted sentiment nonetheless destructive for all three belongings on the time of writing, a worth correction upwards is barely believable if investor conviction additionally modifications.

Supply: Santiment