- The full annualized issuance fee of ETH lowered considerably

- Circulation additionally decreased, including to Ethereum’s deflationary nature

Many speculations had been made relating to what would lie forward for Ethereum [ETH] submit the Merge. One of many doubts that the majority had was round ETH’s deflationary nature. Nevertheless, there was some readability seen on that entrance as in accordance with official sources, ETH achieved an almost zero complete annualized issuance fee.

____________________________________________________________________________________________

Learn Ethereum’s [ETH] Value Prediction 2023-24

____________________________________________________________________________________________

Final yr, Ethereum builders pushed the London improve that enabled the Ethereum burning. The lowered issuance fee, when coupled with the Ethereum burn, added to its deflationary nature and painted a constructive image for Ethereum’s future.

Deflationary traits amplified

As per Messari’s knowledge, ETH’s provide additionally lowered significantly over the previous few days. This additional supported its deflationary traits.

#ETH reached a declining provide this week.

Is the “ultra-sound” narrative now not a meme? 🦇 🔊 pic.twitter.com/Tez25ZjEi6

— Messari (@MessariCrypto) November 13, 2022

Curiously, whereas the availability continued to lower, Ethereum’s variety of addresses holding 10+ cash simply reached an ATH of 326,899. This improvement was constructive, because it confirmed the arrogance of buyers in ETH.

📈 #Ethereum $ETH Variety of Addresses Holding 10+ Cash simply reached an ATH of 326,899

Earlier ATH of 326,856 was noticed on 12 November 2022

View metric:https://t.co/6ggy1nLJIb pic.twitter.com/7T3DSrg6fO

— glassnode alerts (@glassnodealerts) November 13, 2022

In idea, all the pieces seemed to be working in favor of ETH. Nevertheless, these new updates didn’t appear to impression ETH’s worth, because it was down by over 21% within the final week. At press time, ETH was trading at $1,259.72, with a market capitalization of over $153.5 billion.

Maintain on! This may be regarding for ETH

The king of altcoins’ metrics urged that issues would possibly get even worse for ETH. This was as a result of there was a risk of an extra worth decline within the days to return. In response to CryptoQuant, the online deposits on exchanges had been excessive in comparison with the seven-day common, which was a adverse signal because it indicated larger promoting strain.

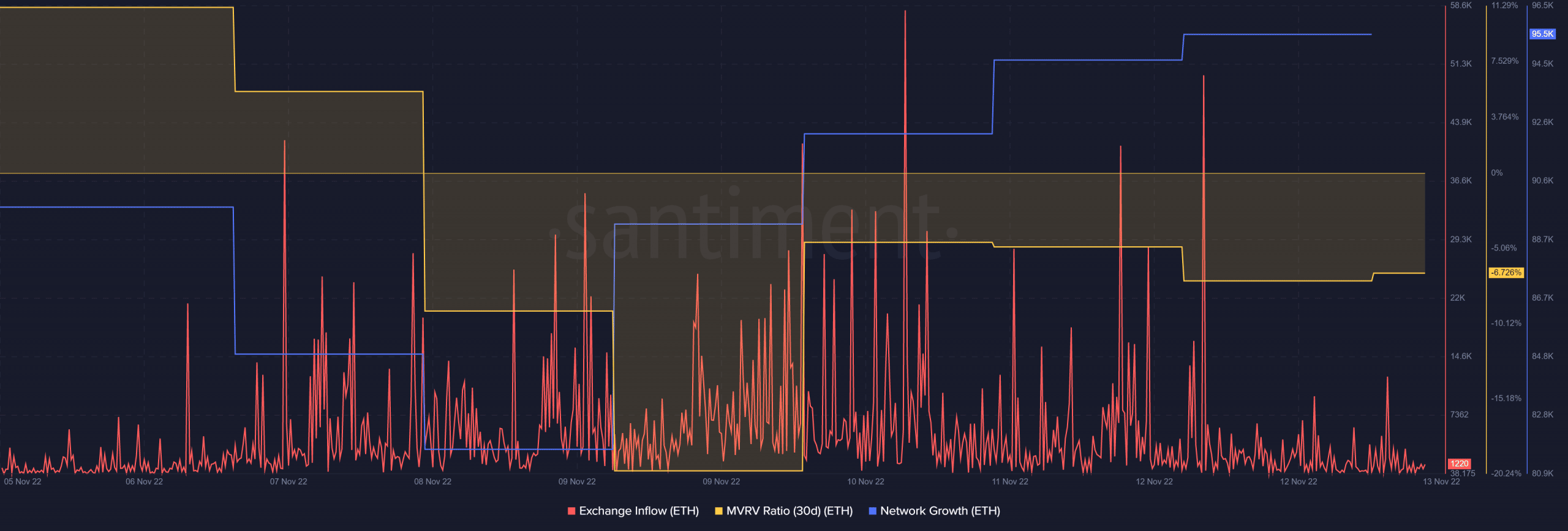

Ethereum’s variety of energetic addresses went down. This urged a decrease variety of customers on the community. The full variety of transactions additionally adopted an identical route, which was one more bearish sign. Santiment’s chart additionally supplemented the aforementioned metrics. Although ETH’s Market Worth to Realized Worth (MVRV) went up during the last week, it was nonetheless not satisfactory. ETH’s trade outflow additionally registered a spike, which was a bearish signal too.

Supply: Santiment

Regardless, not all the pieces was towards Ethereum, as a couple of metrics indicated in direction of a pattern reversal. As an example, ETH’s trade reserve was declining. This was a constructive signal indicating decrease promoting strain.

Furthermore, ETH’s community development registered a substantial uptick in the previous few days, suggesting the potential for higher days within the close to future.