- UNI was among the many cryptos that the highest 100 ETH whales had been holding

- Funding charge and MVRV Ratio elevated, with development within the NFT area

Uniswap [UNI] outperformed a number of different cryptos with a bigger market capitalization by registering double digit positive factors in a single day.

CoinMarketCap’s data revealed that UNI’s value elevated by over 11% and 23% within the final 24 hours and week, respectively. On the time of writing, UNI was valued at $6.78 with a market cap of greater than $5.1 billion.

Life like or not, right here’s UNI’s market cap in BTC’s phrases

The latest uptrend may need performed a key function in garnering whale curiosity. WhaleStats, a preferred Twitter deal with that posts updates associated to whale exercise, revealed that UNI was among the many cryptos that the highest 100 Ethereum whales had been holding.

🐳 The highest 100 #ETH whales are hodling

$143,904,510 $BEST

$82,328,580 $LOCUS

$69,548,634 $SHIB

$54,079,306 $BIT

$45,040,571 #UnknownToken

$38,364,578 $MATIC

$35,607,938 $UNI

$29,912,204 $MOCWhale leaderboard 👇https://t.co/N5qqsCAH8j pic.twitter.com/0EYhh5oRAs

— WhaleStats (monitoring crypto whales) (@WhaleStats) January 13, 2023

What’s working in UNI’s favor?

LunarCrush’s information additionally painted a bullish image for UNI, as its Galaxy Rating was optimistic. This urged a continued value surge within the coming days.

TOP 15 cash by @LunarCRUSH Galaxy Rating

Galaxy Rating – proprietary rating that’s consistently measuring crypto towards itself with respect to the neighborhood metrics pulled in from throughout net$YOOSHI $WAN $FTM $WAVES $UNI $HOOK $ANKR $ROSE $NAKA $XAVA $ANC $BOO $QUICK $PNG $LPOOL pic.twitter.com/pfyJERChUu

— 🇺🇦 CryptoDiffer – StandWithUkraine 🇺🇦 (@CryptoDiffer) January 13, 2023

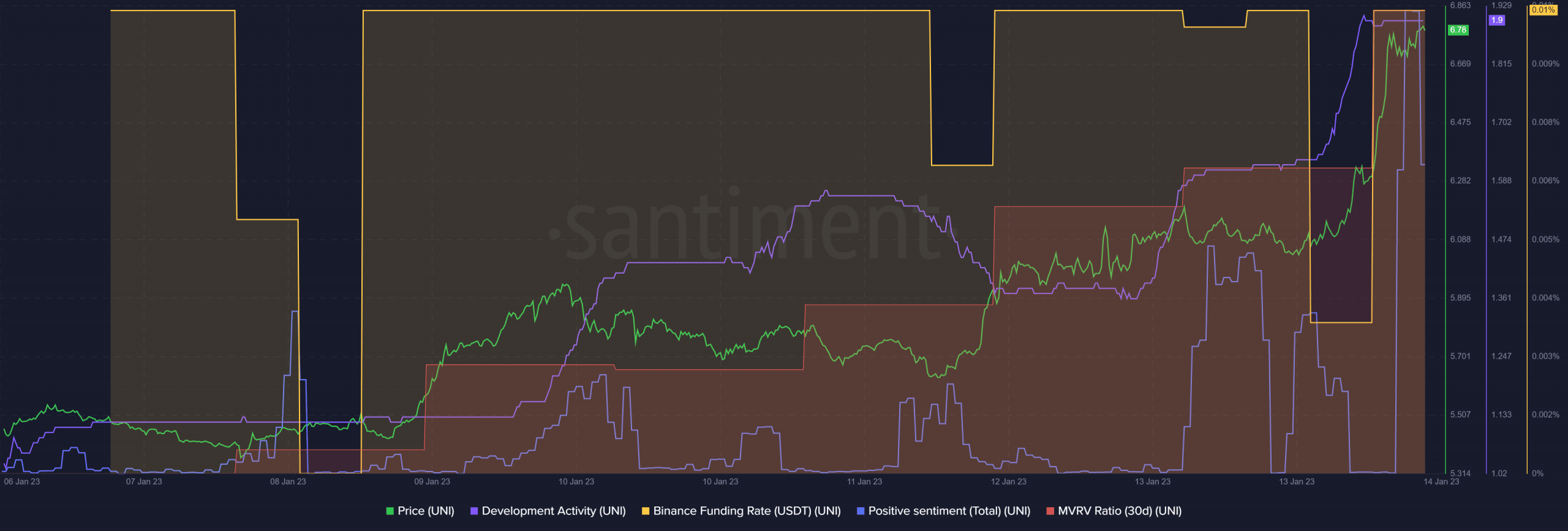

Furthermore, a take a look at Santiment’s chart identified that, aside from the Galaxy Rating, a couple of of the opposite on-chain metrics remained supportive during the last seven days.

As an example, UNI‘s demand rose within the derivatives market as its Binance Funding Charge remained persistently excessive. UNI’s MVRV ratio additionally elevated throughout the previous few days, which was bullish. The community’s improvement exercise steadily elevated as effectively, implying that builders had been working arduous to enhance the community.

Constructive sentiments round UNI spiked at press time, which marked the neighborhood’s belief and religion in UNI.

Supply: Santiment

Learn Uniswap’s [UNI] Value Prediction 2023-24

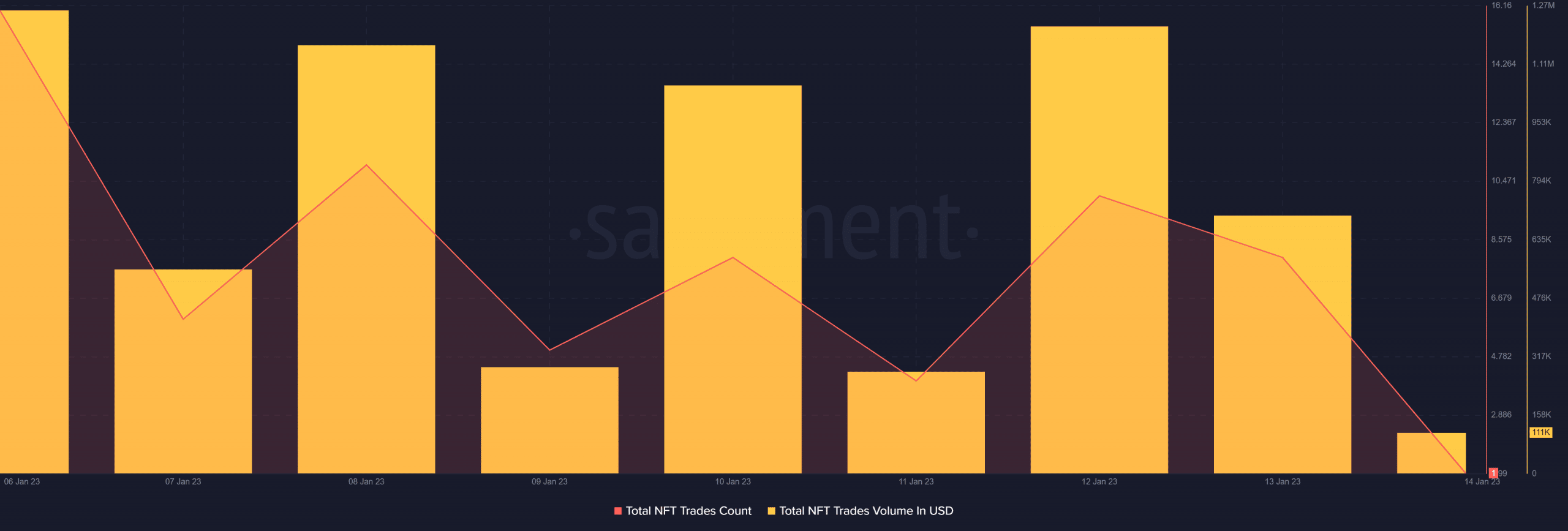

A fast take a look at the NFT area of Uniswap

A number of days in the past, Uniswap introduced the launch of a brand new NFT aggregator in its newest effort to safe a bit of the NFT market. NFT listings from a number of marketplaces, equivalent to OpenSea, might be mixed within the combination in order that they are often seen from a single interface.

Since then, UNI’s NFT area has witnessed development, as revealed by Santiment’s chart. Although UNI’s complete NFT commerce rely went down barely, its complete NFT commerce quantity in USD went up over the previous week.

Supply: Santiment