Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- Is that this a deviation earlier than a nuke, or consolidation earlier than a pump?

- Proof advised that bulls and bears can anticipate a correct break earlier than coming into positions.

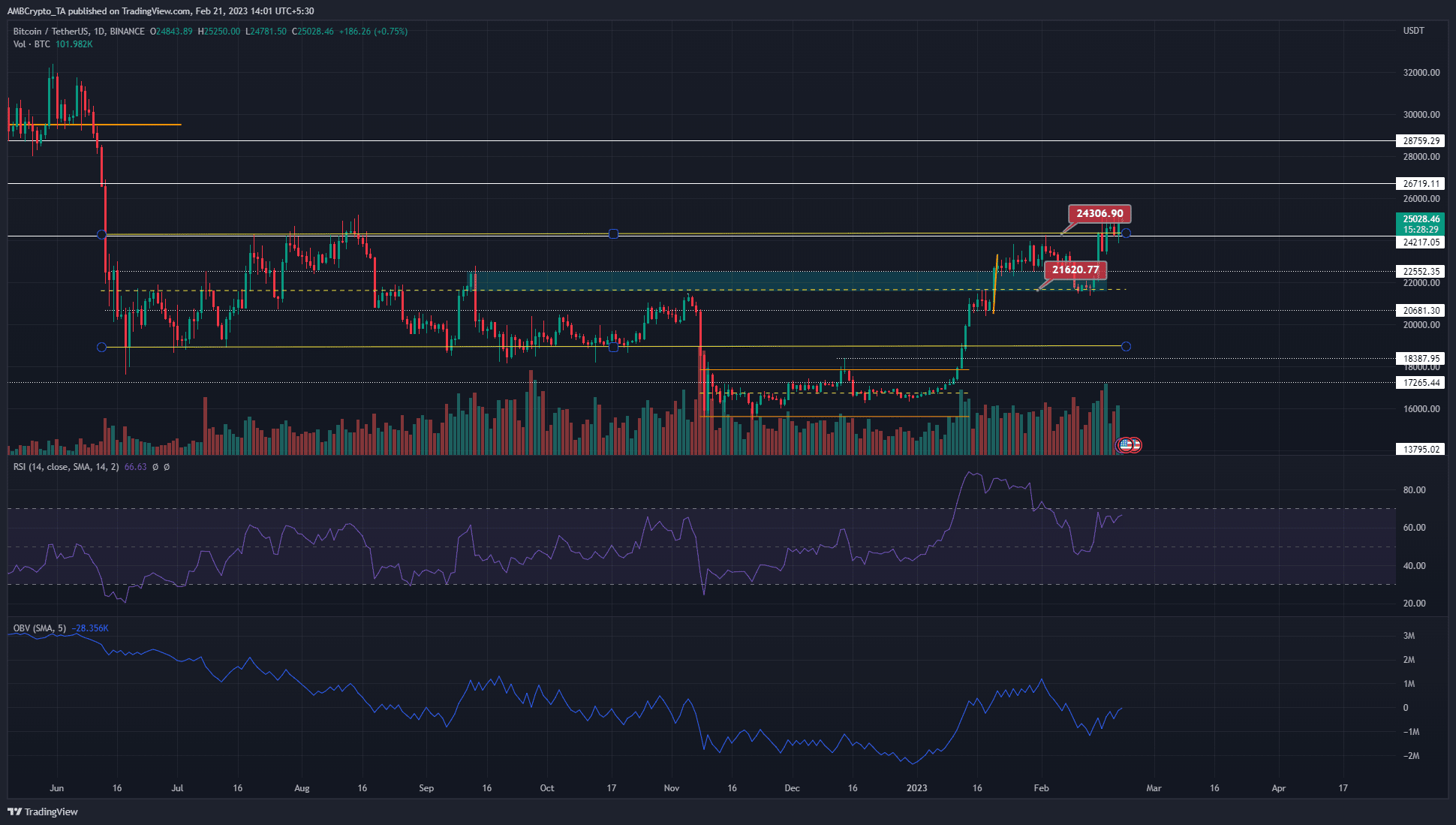

January was a solidly bullish month for Bitcoin [BTC]. The costs climbed from $16.5k to $23.7k. It retraced to the $21.6k help stage in February earlier than rallying laborious to the $25.2k resistance. As issues stand, additional beneficial properties appeared seemingly for BTC.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Alongside the crypto market rally, USDT’s [Tether] dominance fell, which meant Bitcoin’s rally was mirrored throughout the altcoin market as nicely. A breakout previous the resistance from July would seemingly see giant beneficial properties comparatively fast.

Stiff resistance at $25.2k however comparatively skinny air past

Supply: BTC/USDT on TradingView

On the day by day chart, a former bearish order block stood on the $22k area. It was transformed to a bullish breaker after the retest of $21.6k as help in early February. This stage additionally marked the mid-point of a variety that BTC traded from July to November, thus marking it as a big help stage.

The RSI was at 66, and has not slipped under the impartial 50 mark since January. This indicated that bullish sentiment was dominant and that the development hadn’t shifted. Taking a look at it from a market construction perspective, we are able to see that BTC has solely made increased lows for the reason that transfer above $17.8k in January.

On the time of writing, this bullish construction was unbroken. A day by day session shut under $21.6k could be required to flip the bias to bearish.

In the course of the current pullback, the OBV additionally noticed a decline. The rally since then has been backed by a rising OBV. Therefore, there have been no divergences between the worth motion and the OBV. Sustained shopping for stress will seemingly see a breakout previous $25.2k. The drop from $28k to $22k occurred shortly in June, taking solely three days. This meant a big FVG was above $25.2k, which BTC may rush upward and fill.

But, bulls should be cautious. There was an opportunity {that a} push to $25.5k could possibly be a deviation earlier than a downturn. Therefore, threat administration should be a precedence for any patrons.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

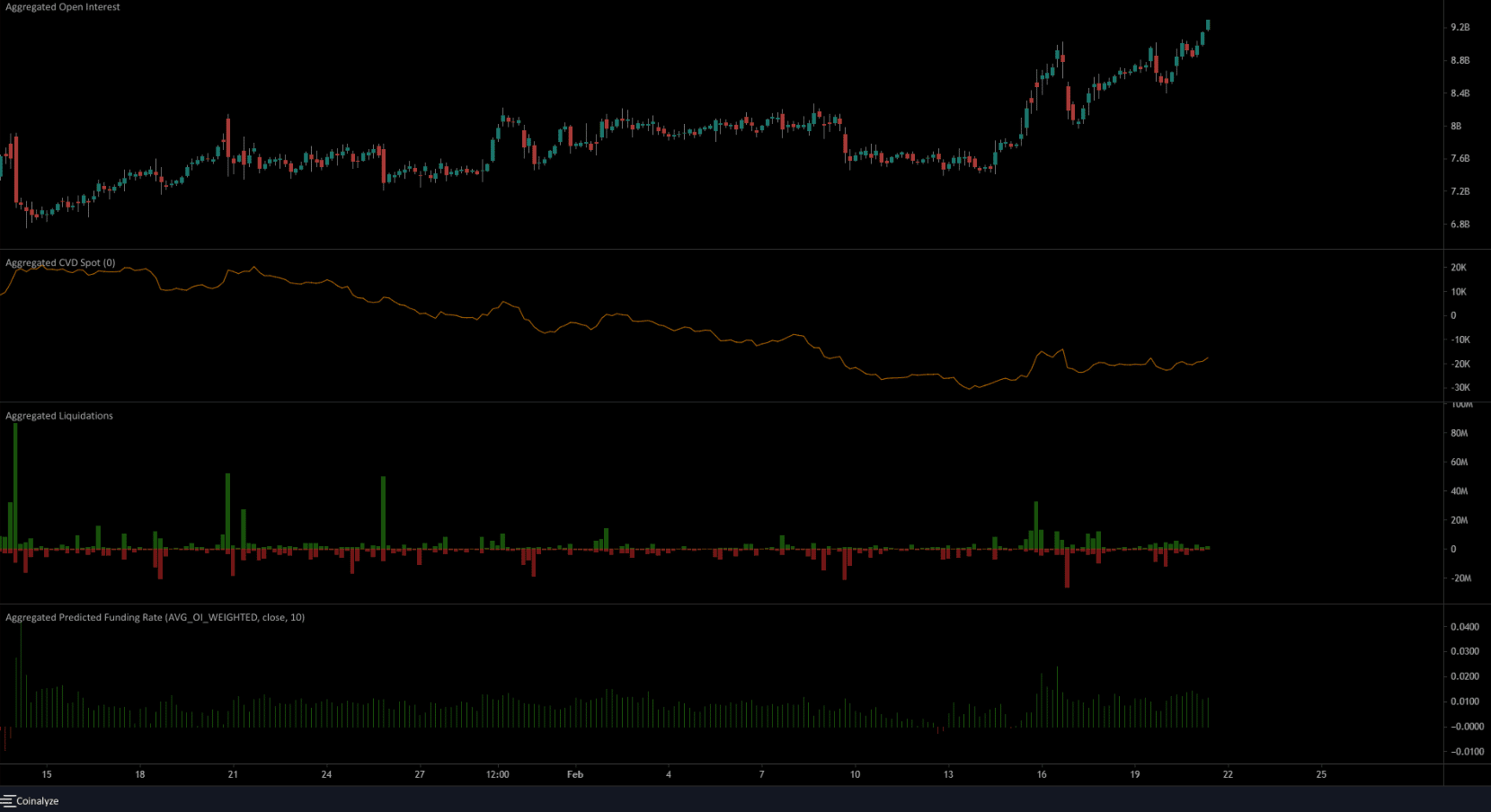

Open Curiosity pushes increased and spot CVD takes a constructive flip

On the four-hour chart, the spot CVD has made increased lows over the previous month. This was an encouraging signal for patrons because it strengthened bullish stress. The expected funding price was additionally constructive to spotlight bullish sentiment, regardless that the worth sat beneath the next timeframe resistance.

Most significantly, the rising costs additionally noticed a surge in Open Curiosity. This was one other think about favor of the bulls and confirmed market individuals have been seemingly positioned for a bullish breakout. Conversely, keen patrons close to the $25k mark may present liquidity to the sellers earlier than a leg downward, which might trigger huge ache for many market individuals.