Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- The construction was bearish however a major bounce in costs was a chance.

- Brief sellers can look forward to a revisit to a major zone earlier than trying to promote ETC.

Ethereum Traditional noticed a big rally from $15 on 3 January and reached $23.9 on 14 January. The rally of Bitcoin was on 8 January, after it burst out previous the $17k resistance. Bitcoin’s rally was slower and a bit later than ETC’s.

Learn Ethereum Traditional’s [ETC] Value Prediction 2023-24

Identical to the features had been delayed, it appeared that the losses and shift in development had been obvious in Ethereum Traditional sooner than for Bitcoin. Whereas BTC rested at $22.3k, ETC fell beneath its six-week vary.

On the time of writing, the following transfer on the ETC chart was unclear, however a bounce towards $19.5 may not be stunning.

The assist from November was examined but once more

Supply: ETC/USDT on TradingView

The implication made above was not that ETC leads BTC, however fairly an commentary that ETC occurred to maneuver earlier than Bitcoin did. This may or may not repeat itself. Taking the charts of Ethereum Traditional, we see that the bulls is not going to discover a lot to be enthused about.

The worth made a sequence of decrease highs and decrease lows since 24 February, which meant the development was bearish. The RSI stood at 28 to point out oversold circumstances on the 4-hour chart, however this didn’t point out a reversal.

Nonetheless, the CMF climbed above +0.05 to point out important capital influx into the market.

Thrice within the three months of November, December, and January, a check of the $18 degree of assist noticed a notable bullish response.

May March be the fourth such occasion? It remained to be seen. In both case, shorting Ethereum Traditional across the $18 mark was not possible when it comes to risk-to-reward.

Is your portfolio inexperienced? Verify the Ethereum Traditional Revenue Calculator

In November and December, the $19-$19.5 space was a spot the place ETC consolidated on decrease timeframes earlier than a transfer above or beneath both of those ranges.

This marked it as an space of significance. A revisit to this area may provide promoting alternatives, with invalidation above the latest decrease excessive at $19.84.

To the south, the massive truthful worth hole (white) from $16-$17.5 would seemingly be stuffed ought to the bears drive costs beneath $18.

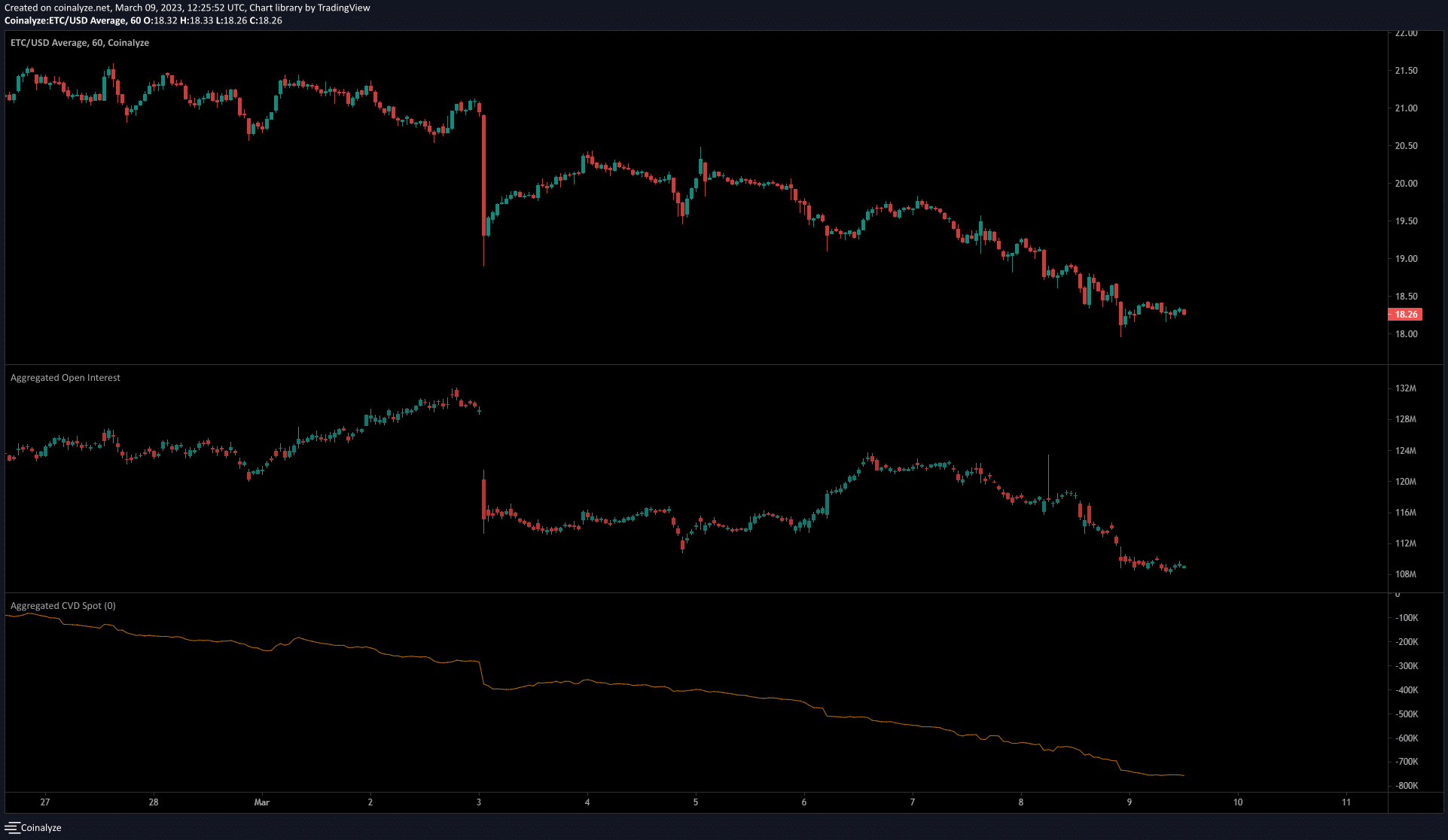

The dwindling Open Curiosity highlighted additional losses had been seemingly

Supply: Coinalyze

The 1-hour chart on Coinalyze confirmed the spot CVD to be in a gentle downtrend. This signaled relentless promoting strain over the previous two weeks. The OI was additionally falling over the previous few days alongside the worth. This confirmed bearish momentum remained out there.

It additionally highlighted the chance that Ethereum Traditional may quickly drop beneath the $18 degree.