- Analyst declared Litecoin may face market wipeout, together with two different cryptocurrencies

- LTC merchants opted for unbias as investor sentiment remained unfavourable

Chief of the CNBC Investing Membership, Jim Cramer, categorized Litecoin [LTC] as one of many cryptocurrencies which may not see the sunshine of one other day within the coming years. Showing at an interview with CNBC’s Squawk Field, Cramer additionally added Ripple [XRP] and Dogecoin [XRP] to the checklist that would face an eradication.

“I believe you ought to be unfavourable on #crypto. I am unfavourable on $XRP, $LTC, and $DOGE as a result of I have not been capable of finding anybody that takes them,” says @jimcramer. “It is like $80 billion value of non-Bitcoin that is destined to be worn out.” pic.twitter.com/lrFbjtT0Wn

— Squawk Field (@SquawkCNBC) December 16, 2022

Learn Litecoin’s [LTC] Value Prediction 2023-24

Whereas chatting with the present host, Becky Fast, the “bull market finder” opined that his negativity was born out of investor disregard for the belongings. Cramer’s judgment may, nonetheless, sound shocking particularly as LTC’s value increased 9.38% within the final 30 days.

Moreover, a number of developments adopted Litecoin’s efficiency in between random social spikes. Nonetheless, it may also not be a shock for the reason that buyers had been a relentless critic of different cryptocurrencies other than Bitcoin [BTC] and Ethereum [ETH].

Merchants want to not take a facet

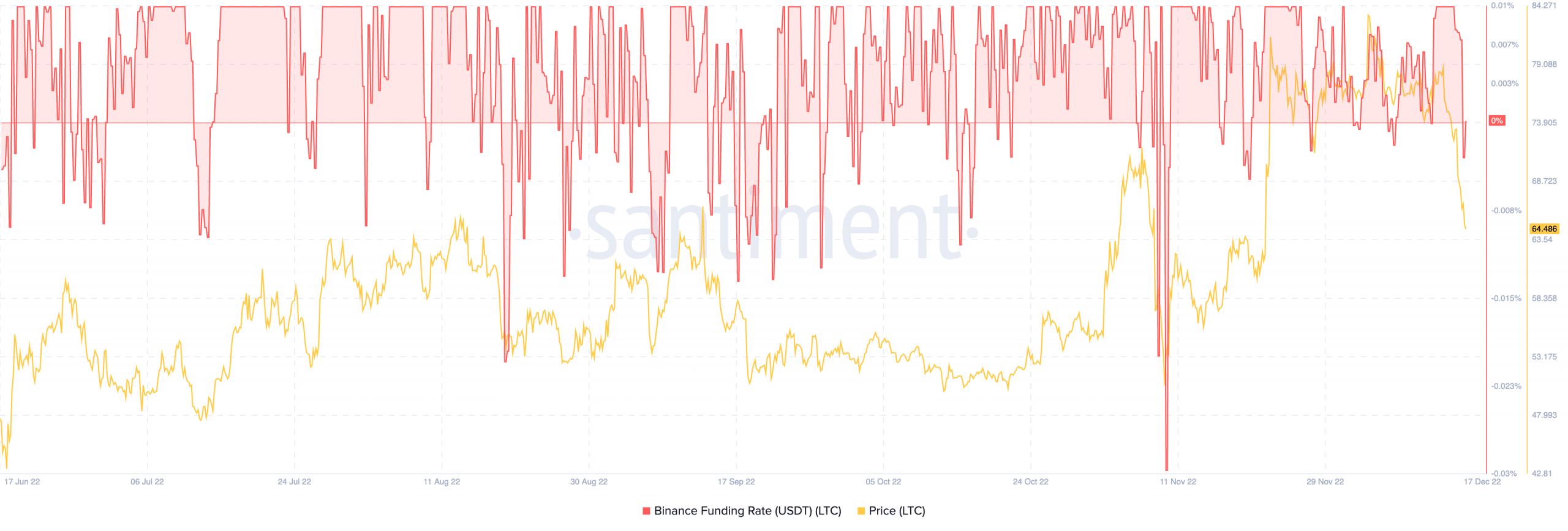

Heedless of the scenario, Litecoin merchants remained in a neutral position. Based on on-chain knowledge, Litecoin’s discovering fee on the Binance change was 0% as of 17 December. Because it was neither constructive nor unfavourable, it implied no dominance amongst quick place and lengthy place merchants.

Supply: Santiment

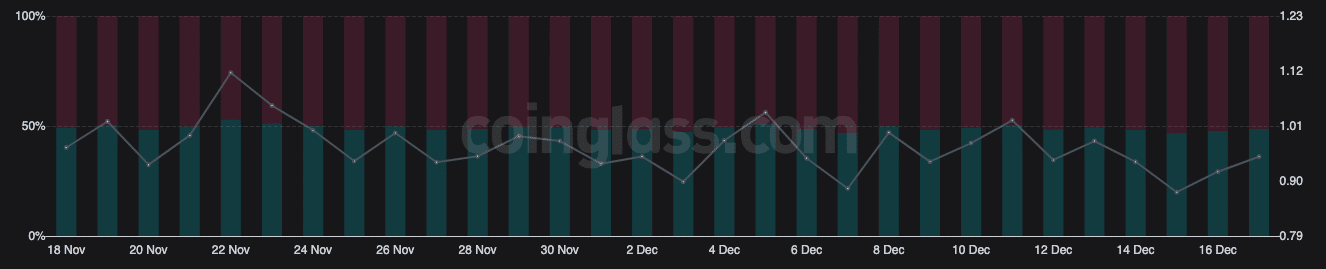

Within the case of its open curiosity, Litecoin merchants appeared to have modified their stance. As of 17 December, the 24-hour curiosity was primarily in decline. Knowledge from Coinglass confirmed decreased consideration in the direction of LTC throughout a number of exchanges. Therefore, Cramer’s opinion about no person choosing up curiosity within the coin appeared to have some parts of justification.

On additional analysis of merchants’ exercise with LTC, the derivatives data portal revealed that longs-shorts ratio was 0.95. The indicator illustrates the quantity of Litecoin accessible for brief promote towards these actually bought. Moreover, it serves as a measure for projected buyers’ expectations.

As of this writing, LTC’s quick promote was 51.32% whereas lengthy purchase was 48.68%. Because it turned out to be a low ratio, it indicated unfavourable investor expectations.

Supply: Coinglass

Now could be the season to endure

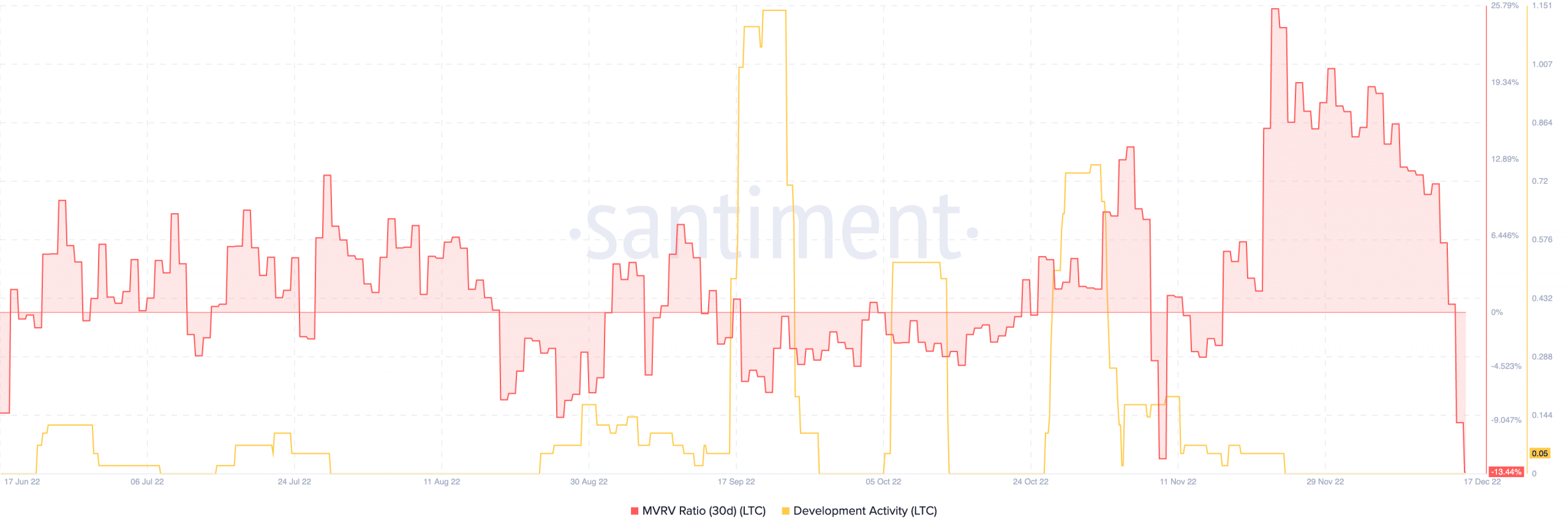

Indications from the 30-day Market Worth to Realized Worth (MVRV) ratio mirrored huge dips in revenue for holders since 23 November. Based mostly on Santiment knowledge, the MVRV ratio downhilled to -13.44%. This standing implied that Litecoin was in a bubble territory the place it didn’t present certainty with the coin’s worth being honest or not.

Per its improvement exercise, Litecoin remained settled in its flatline state since 25 November. As much as the time of writing on 17 December, improvement exercise was 0.05.

Therefore, Litecoin had not added any notable upgrades to its community. Nonetheless, the present market may very well be a nasty season to conclude if Litecoin could be worn out or in any other case.

Supply: Santiment

![Will Litecoin [LTC] be a victim of market tittle-tattle as this investing guru says…](https://ambcrypto.com/wp-content/uploads/2022/12/po-2022-12-17T131511.800-1000x600.png)