- BTC ends 2022 on the $16,500 value vary.

- On-chain knowledge factors to an extra depreciation in BTC’s worth within the coming yr.

Regardless of closing the 2022 buying and selling yr throughout the $16,500 value vary, on-chain knowledge advised that Bitcoin’s [BTC] value would expertise an extra decline in 2023.

A 0.45x cutback if BTC hits Ethereum’s market cap?

CryptoQuant analyst oinonen_t discovered that BTC’s present Unspent Transaction Output (UTXO) distribution exhibited related traits to that of the 2019 bear market, which Delphi Digital efficiently used to forecast a market capitulation.

In January 2019, Delphi Digital analyzed BTC’s UTXO age traits and in contrast their progress in earlier cycles.

0/ Since December, our staff has continued to state our perception that $BTC would backside by Q1 2019. Right now, we’re excited to share an up to date #Bitcoin Outlook report the place we stroll via why we proceed to imagine the underside is in. Learn extra right here: https://t.co/920MD8d7fk

— Delphi Digital (@Delphi_Digital) May 2, 2019

The analysis agency analyzed the proportion of unspent Bitcoin that had been untouched for various intervals of time. This ranged from lower than three months to over 5 years.

It discovered that because the variety of cash that have been untouched for at the least one yr had elevated, the variety of UTXOs untouched for at the least one yr decreased as properly.

This led to the analysis agency concluding that long-term BTC holders had commenced accumulation. It then likened to the one which occurred on the finish of 2014. It then predicted a value backside within the first quarter of 2019.

What do Bitcoin analysts say?

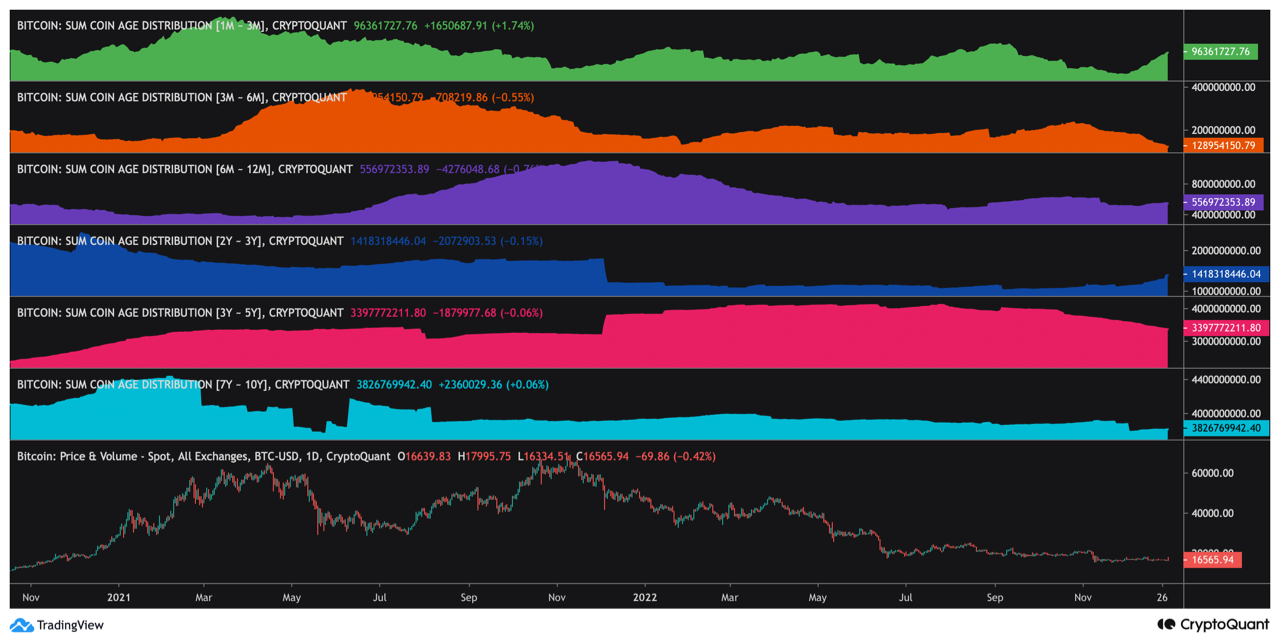

Likening BTC’s present UTXO to that of early 2019, oinonen_t discovered,

“Whereas the retail 1M-3M wave (inexperienced) mirrors a constructive sentiment, longer timeframes like 3Y-5Y (crimson) clearly present de-risking. The shorter-term merchants 3M-6M (orange) are nonetheless reeling from heavy losses. Nonetheless, the institutional degree 2Y-3Y (deep blue) exhibits indicators of accumulation.”

Supply: CryptoQuant

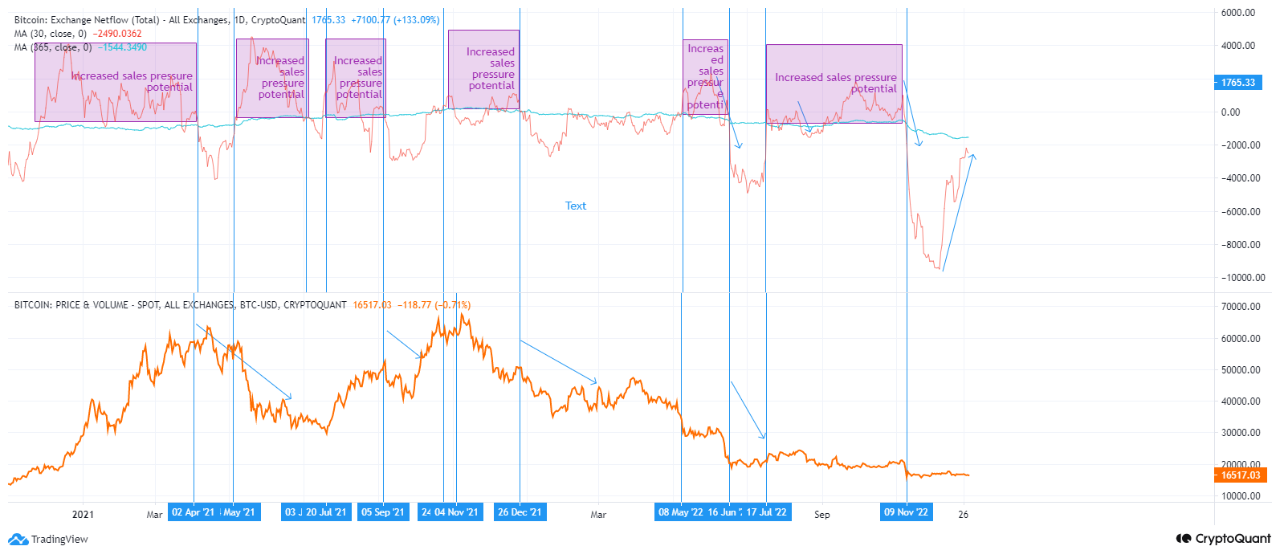

Additionally, predicting an extra decline in BTC’s value in 2023, one other CryptoQuant analyst, Ghoddusifar, noticed a gradual motion of BTC’s Netflow into the constructive area. This meant that sellers saturated the BTC market. Ghoddusifar mentioned,

“This implies fewer patrons and extra sellers. Most likely, similtaneously it turns into constructive, we’ll see an area prime after which a rise in promoting strain sooner or later market, which may result in the continuation of the downtrend and lack of present assist.”

Supply: CryptoQuant

Are your BTC holdings flashing inexperienced? Verify the Revenue Calculator

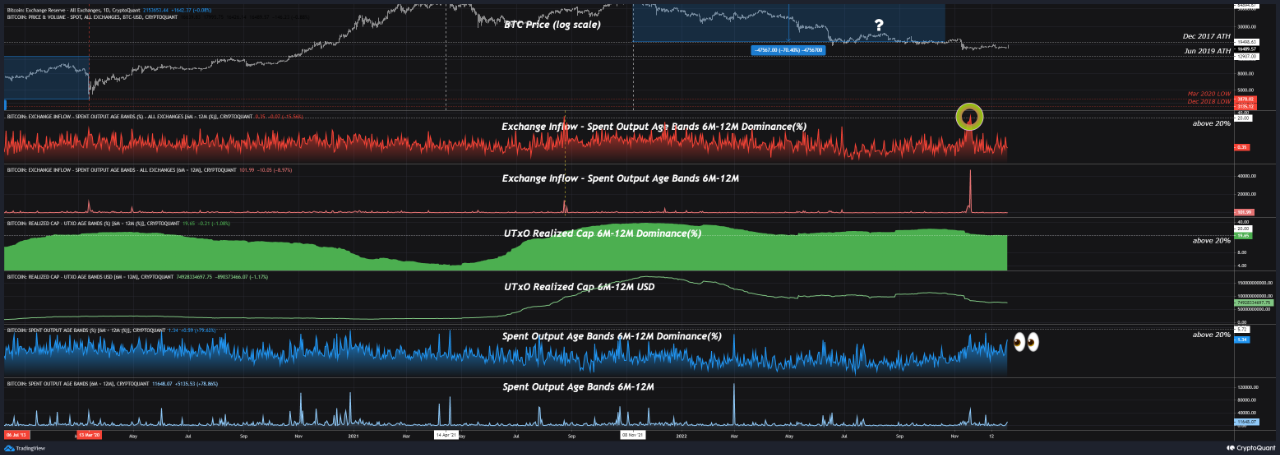

Providing a touch of hope, CryptoQuant analyst Nino assessed BTC’s Spent Output Age Bands (SOAB) dominance on a every day chart and located that BTC’s long-term outlook had flipped from bearish to impartial.

Based on Nino, the every day trade influx of BTC UTXOs which might be lower than one yr previous to 2 years previous rose above 20%. This indicated a rise in buying and selling exercise for BTC inside this age band.

Supply: CryptoQuant

![With Bitcoin [BTC] mirroring 2019 price plummet, will 2023 see panic-driven investors](https://ambcrypto.com/wp-content/uploads/2022/12/kanchanara-Lta5b8mPytw-unsplash-1-1000x600.jpg)