- Yearn Finance ( YFI) launched a brand new DeFi function to permit customers to earn via varied commerce methods

- YFI continued rising even after a 7% improve in worth over the previous week

The launch of the Yearn Finance [YFI] Permissionless Vault Manufacturing facility coincided with the rise within the worth of the YFI token. For the reason that begin of the 12 months, Yearn Finance skilled a unbelievable value run. The DeFi coin has been on the rise, and a current protocol improvement would possibly improve the worth of buyers’ holdings.

Learn Yearn Finance’s [YFI] value prediction 2023-2024

Making Permissionless extra Permissionless

On 9 January, Yearn Finance notified its subscribers {that a} new addition was being made to the Decentralized Finance platform.

The protocol’s newest replace, known as the Permissionless Vault Manufacturing facility, would let anybody arrange a vault, primarily a protected haven the place crypto belongings could be saved to earn curiosity via varied investing strategies.

At first, customers can solely create vaults for Curve Finance LP tokens and deposits within the decentralized market maker (AMM). Manufacturing facility vaults may have preconfigured ways developed by the Yearn workforce.

Moreover, the methods reap the benefits of Yearn’s stockpile of veCRV tokens. This improves protocol yields and, by extension, boosts returns for any Curve liquidity supplier.

What Yearn’s TVL is saying

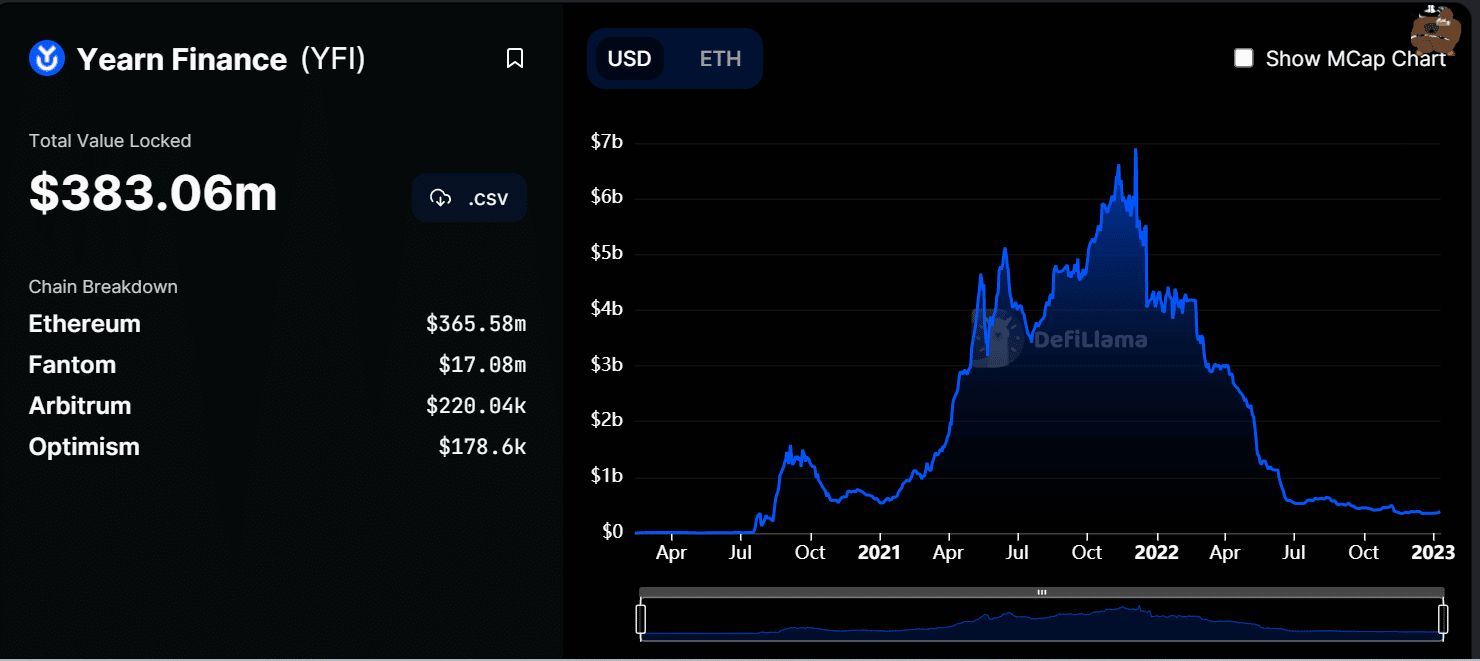

In line with knowledge from DeFiLlama, Yearn Finance had a Whole Worth Locked (TVL) at $383.06 million on the time of this writing. Nonetheless, no current surge within the TVL may very well be seen, however there was a fall. The present state of the market would be the trigger, as was seen within the bigger DeFi market.

Supply: DefiLlama

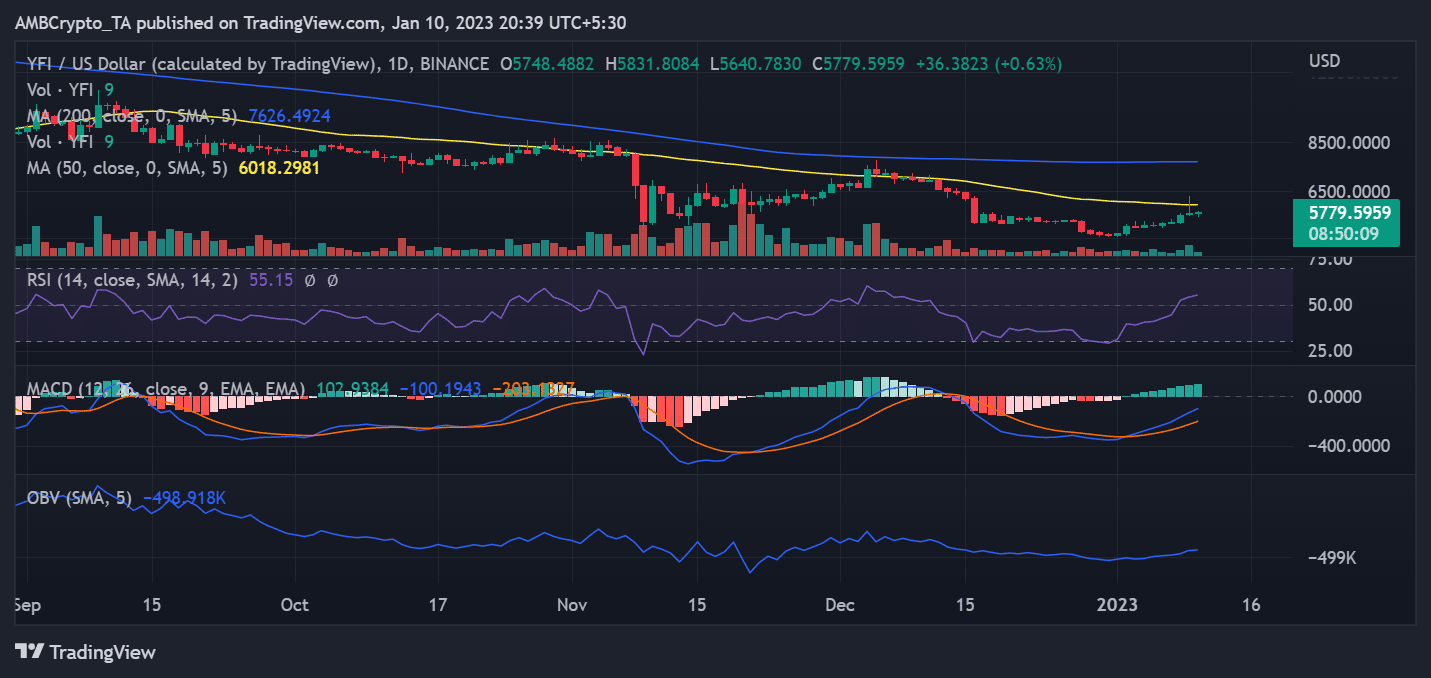

Moreover, the YFI token’s worth steadily elevated during the last a number of days. On the time of writing, a cumulative 7% improve in worth had been seen. The present value sample confirmed a rally from the world the place costs had fallen in December 2022.

What number of YFIs are you able to get for $1?

The asset was now buying and selling at about $5,700 in a day by day on the time of writing. Moreover, the resistance degree was close to $7,000 and was represented by the lengthy shifting common (blue line).

Supply: TradingView

In line with the Relative Energy Index, the asset had successfully been pulled right into a bullish pattern by the current value motion. A bull pattern was indicated when the RSI line was proven to be above the 50 line.

Moreover, the Shifting Common Convergence Divergence (MACD) indicator additionally indicated an upward flip. Moreover, a mixture of the RSI and MACD indicators additional supported the current pattern revealed by the YFI token.