The Stellar Growth Basis, builders of the Stellar community, launched a monetary inclusion framework for judging the efficacy of rising market blockchain tasks. The framework was developed in cooperation with consultants PricewaterhouseCoopers Worldwide (PwC) and was defined in a white paper printed on September 25.

Utilizing this framework, the groups concluded that blockchain funds options considerably elevated entry to monetary merchandise by decreasing charges to 1% or much less. In addition they discovered that blockchain merchandise have elevated the velocity of funds and helped customers to keep away from inflation.

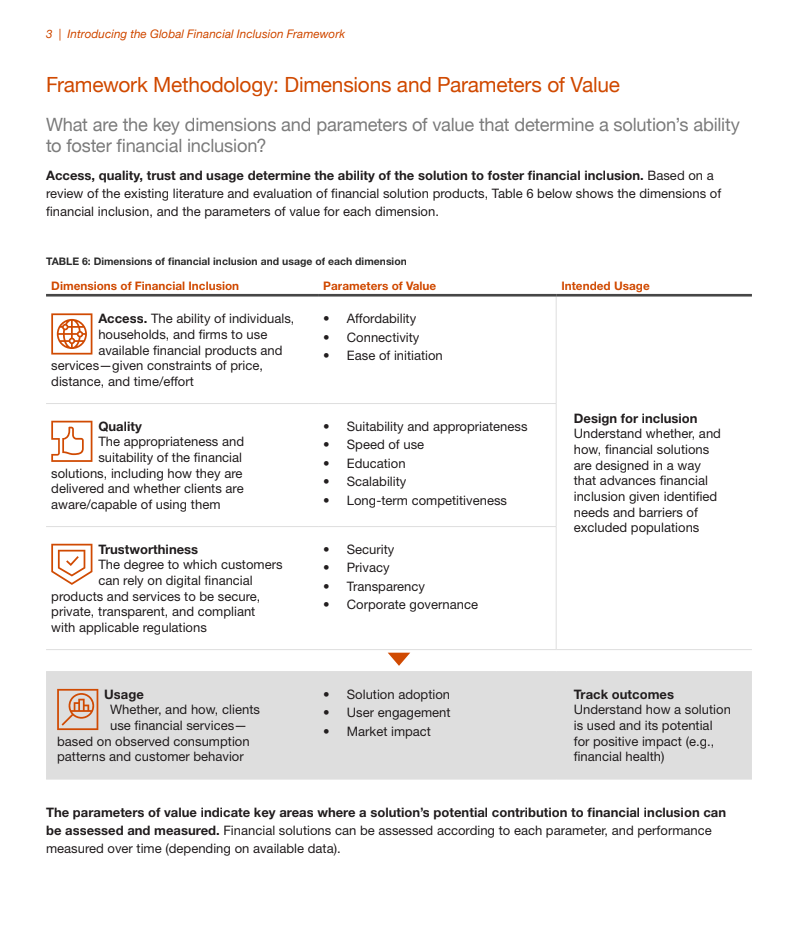

Monetary inclusion framework parameters. Supply: Stellar, PwC.

Some blockchain builders declare their merchandise can improve “monetary inclusion.” In different phrases, they are saying their merchandise can present companies to unbanked folks dwelling within the growing world. Making this declare has grow to be an efficient method for some Web3 tasks to achieve funding. For instance, the United Nations Worldwide Youngsters’s Emergency Fund (UNICEF) has listed eight blockchain tasks that it has helped fund to date primarily based on this concept.

Nevertheless, of their paper, Stellar and PwC argued that tasks can fail to boost monetary inclusion in the event that they don’t have a framework for evaluating what is required for fulfillment. “As with all technological innovation, the necessity for strong governance and accountable design ideas are key to profitable implementation,” they stated.

To assist foster this governance, the 2 groups proposed a framework to evaluate whether or not a mission will possible promote monetary inclusion. The framework consists of 4 parameters: entry, high quality, belief and utilization. Every of those parameters is damaged down into additional sub-parameters. For instance, “entry” is damaged down additional into affordability, connectivity, and ease of initiation.

Every rationalization of a sub-parameter features a proposed method of measuring it. For instance, Stellar and PwC checklist “# of CICO [cash in/cash out] areas inside related goal inhabitants area” as a method of measuring the “connectivity” metric. That is meant to assist make sure that tasks can scientifically measure their effectiveness as a substitute of counting on guesswork.

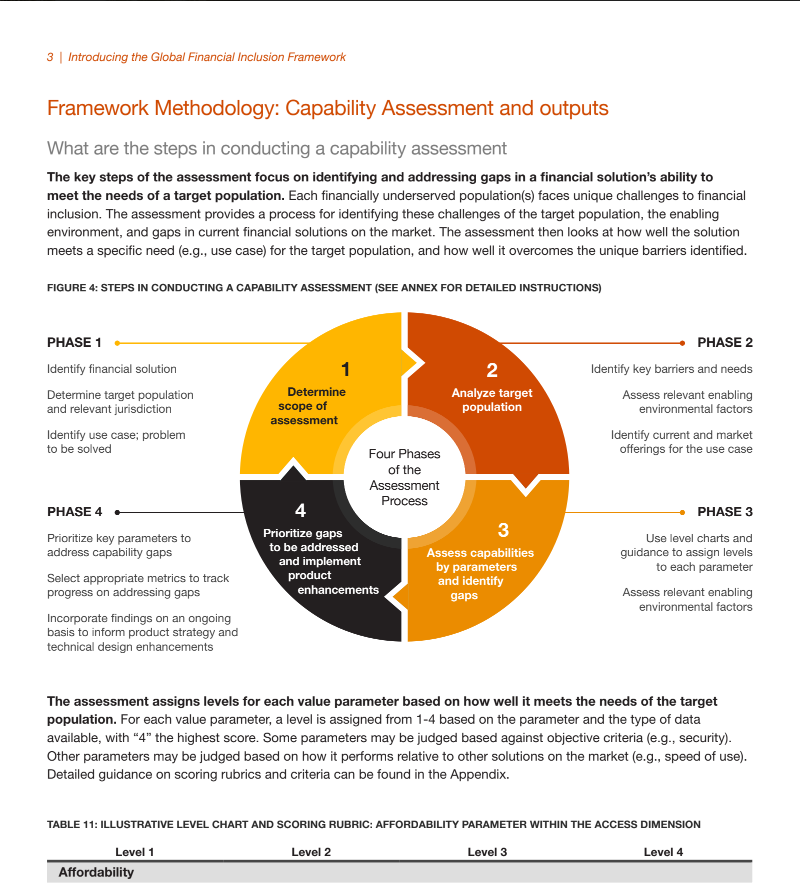

The groups additionally prompt a four-phase evaluation course of that tasks ought to bear to resolve a monetary inclusion drawback. The mission ought to establish an answer, goal inhabitants, and related jurisdiction within the first section. In section 2, they need to establish boundaries stopping the goal inhabitants from receiving monetary companies. In section 3, they need to use “stage charts and steering” to find out the most important roadblocks to onboarding customers. And within the last section, they need to implement options that “prioritize key parameters” to make the simplest use of funds.

Phases to implement monetary inclusiveness framework. Supply: Stellar, PwC.

Utilizing this framework, the groups recognized not less than two blockchain options which have confirmed to be efficient at enhancing monetary inclusion. The primary is funds. The groups discovered that conventional monetary apps cost a mean of two.7-3.5% to ship cash between the US and the market being studied, whereas blockchain-based options charged 1% or much less, primarily based on a research of 12 functions working in Colombia, Argentina, Kenya, and the Philippines. They discovered that these functions elevated entry by making digital funds out there to individuals who in any other case couldn’t afford them.

The second efficient resolution they discovered was financial savings. The group claimed {that a} stablecoin software in Argentina permits customers to spend money on an inflation-resistant digital asset, serving to them to protect their wealth after they in any other case would have misplaced it.

Stellar community has been on the forefront of fee inclusion in underserved monetary markets. In December, it introduced a program to assist charity organizations distribute funds to assist Ukrainian refugees fleeing conflict. On September 26, they introduced a partnership with Moneygram to provide a non-custodial crypto pockets that can be utilized in over 180 nations. Nevertheless, some monetary and financial consultants have criticized the usage of cryptocurrency in rising markets. For instance, a paper printed by the Financial institution of Worldwide Settlements on August 22 argued that cryptocurrency has “amplified monetary dangers” in rising market economies.