Aave, one of many main lending protocols within the crypto business, simply accomplished voting on a proposal that will have it deployed on zkSynch. zkSync occurs to be a zero-knowledge protocol take a look at internet and the deployment was authorized by a large margin with the purpose of enabling faster and cheaper transactions.

Nonetheless, latest stories indicated that the neighborhood was ready to solid yet one more essential vote. This time on the utility of USDT inside the Aave V3 protocol.

USDT as Collateral?

In accordance with the brand new proposal submitted, solely USDC and DAI had been presently supported as collateral on Aave. This was due to the idea that these stablecoins supplied fewer dangers. It was proposed that Aave increase its stablecoin collateral choices to incorporate USDT.

______________________________________________________________________________________

Right here’s AMBCrypto’s Value Prediction for Aave [AAVE] for 2022-2023

______________________________________________________________________________________

The elevated number of stablecoins on Aave was thought to mitigate the dangers related to the failure of any certainly one of them. A “Sure” vote would make USDT a viable stablecoin different within the protocol’s collateral. Moreover, it will additionally permit it for use alongside different cryptocurrencies.

A “No”, nonetheless, would restrict the stablecoin to characteristic on Aave. Regardless of being essentially the most broadly used stablecoin, USDT has been met with blended evaluations. This has thus, prompted considerations and limitations on its use inside Aave.

Some reservations about USDT

The skepticism round USDT was fueled by Tether’s purported lack of transparency. A couple of weeks in the past, it was reported {that a} courtroom in america had ordered Tether to supply proof of its backings.

Within the wake of the Terra USTC’s demise, a number of cryptocurrency initiatives went down. Moreover, some had been nonetheless making an attempt to recuperate from the devastating monetary blow. It is not uncommon apply to judge a stablecoin’s diploma of stability to make sure that the forex isn’t weak to related fluctuations sooner or later.

Regardless of these considerations, USDT continues to guide all stablecoins by way of market capitalization and day by day quantity, as reported by Coinmarketcap. One of many causes individuals put their religion in it’s as a result of it has been round lengthy sufficient. Moreover, the stablecoin has witnessed the rise and fall of different stablecoins.

Simply recently, JP Morgan applied a change that facilitated communication between DeFi and TradFi. Tokenizing the Japanese Yen (JPY) and the Singapore Greenback (SGD) allowed for this transaction to happen on the blockchain. With the assistance of an enhanced Aave Arc, it decided its personal curiosity and forex change charges. This represented a serious step ahead as a result of it indicated the scalability of the system each inside and out of doors of DeFi.

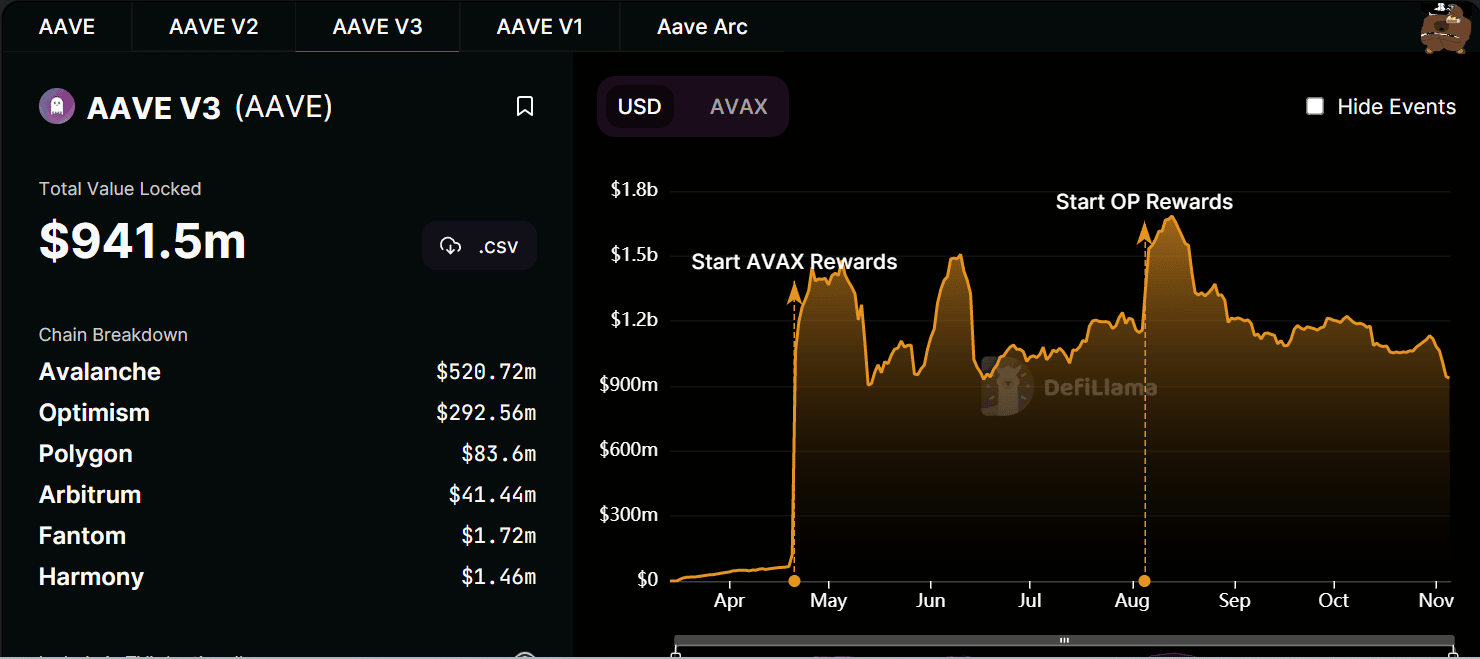

Supply: DeFiLlama

Supply: DeFiLlama

On the time of writing, the Complete Worth locked (TVL) on Aave 3 was $941.5 million in accordance with DefiLlama. A decline in worth was additionally proven within the TVL graph. Unquestionably, the TVL would rise if USDT had been accepted as collateral on the protocol, however that’s one thing the neighborhood must decide within the coming weeks.