- Axie Infinity (AXS) elevated by over 10% because it regarded to interrupt into a brand new worth vary.

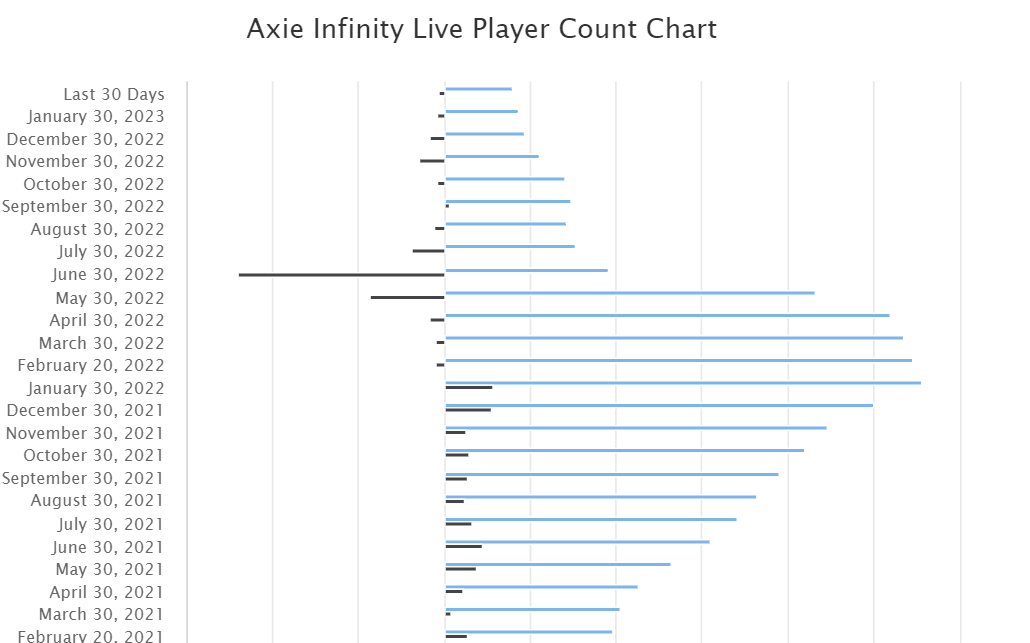

- Axie Infinity’s energetic gamers have lowered by 8% within the final 30 days.

Axie Infinity [AXS] has seen exceptional worth motion over the previous few days, based on a publish by Alicharts. However do these different metrics suggest that the spectacular advance will proceed, or will the value euphoria be short-lived?

#AxieInfinity might be the following one! 🚀📈 $AXS seems prime to interrupt out to $13 so long as the $10.7 help stage holds. #AXS pic.twitter.com/wnWWYD3Mtv

— Ali (@ali_charts) February 21, 2023

Reasonable or not, right here’s AXS market cap in BTC’s phrases

Value rise for AXS

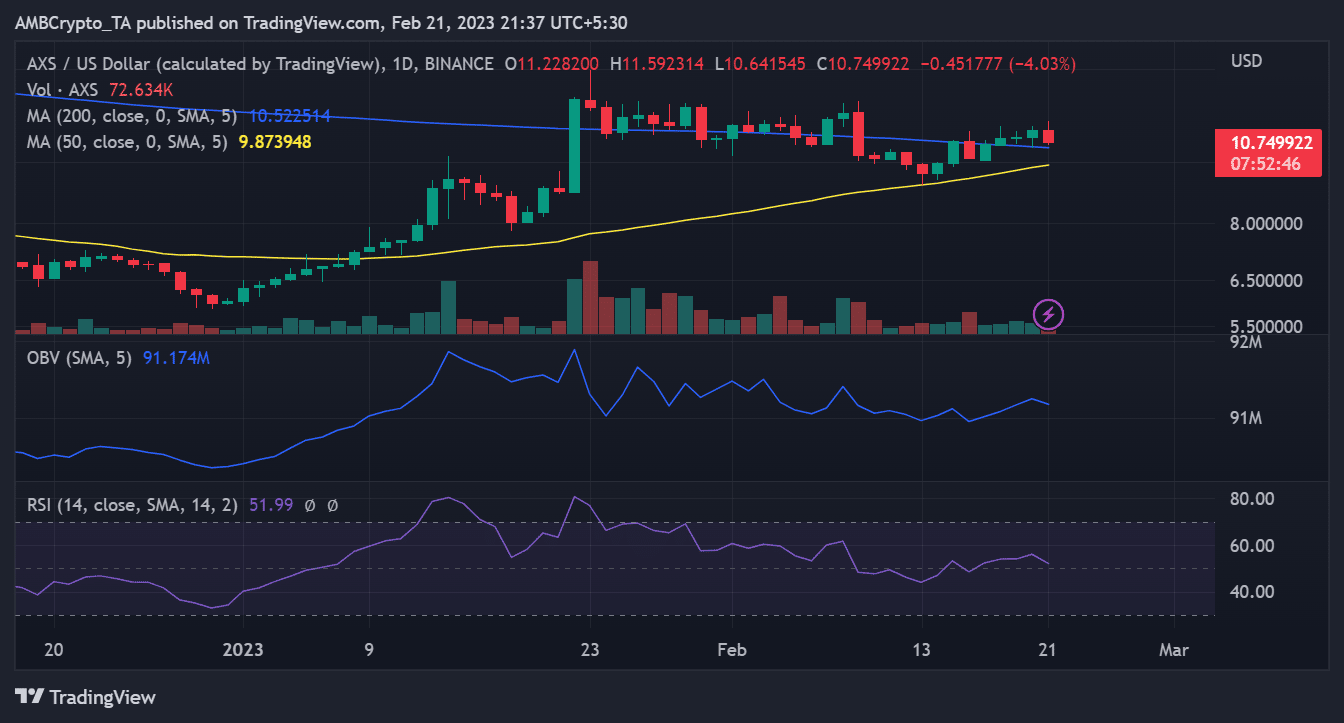

AXS, when seen on a each day timescale, was in an uptrend for 4 days in a row till descending on 21 February. All through these 4 days, it elevated by over 10% earlier than declining by over 3% as of this writing. All through the monitored buying and selling time, it was buying and selling round $10.82.

Supply: TradingView

Additionally, the lengthy and brief Shifting Averages (blue and yellow traces) had been beneath the present worth motion. Due to their relative positions, the blue and yellow traces successfully served because the help space for the asset round $10.5 and $9.8, respectively.

In keeping with the Relative Energy Index (RSI), the asset was nonetheless in a bull pattern, however the pattern was eroding because of the worth decline. Though the RSI line was nonetheless above the impartial line, it indicated a doable downward pattern.

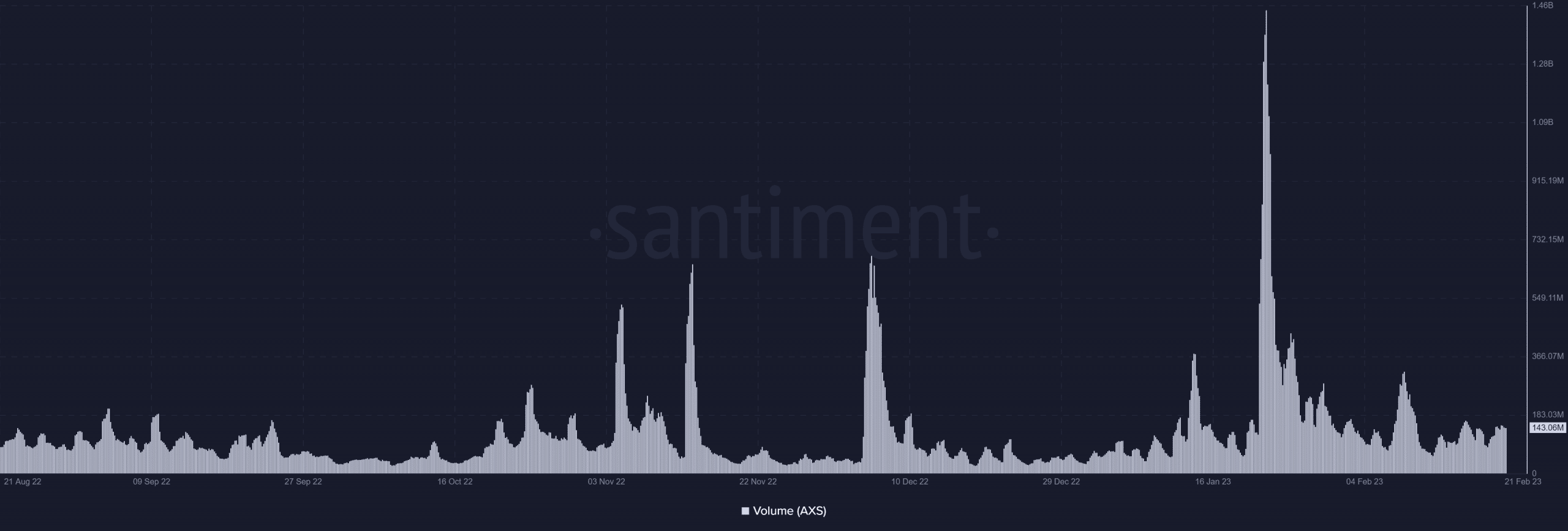

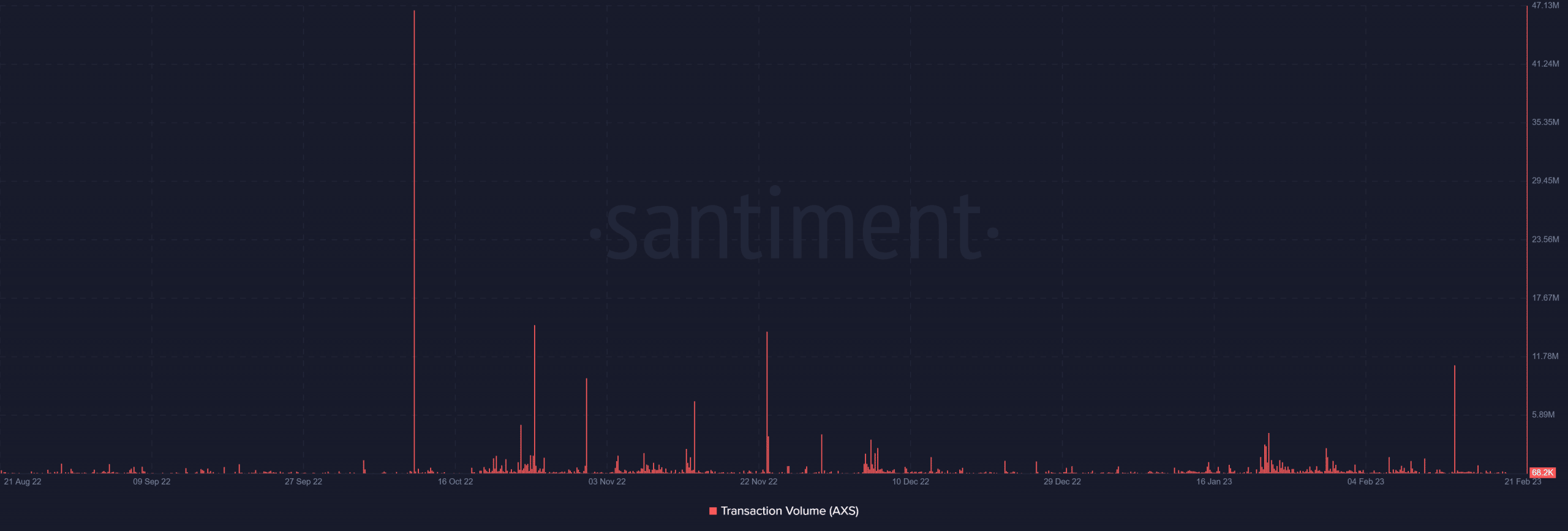

Quantity and transaction quantity go separate methods

The Santiment quantity indicator revealed that the quantity of transactions of Axie Infinity has elevated and has been maintained since January. As of this writing, the quantity was above 143 million, and the general quantity for the yr has been larger than within the previous months.

Supply: Santiment

The transaction quantity indicator, nevertheless, responded in another way, although the quantity indicator confirmed an uptick all year long. Apart from a spike on 15 February, the indicator indicated that the transaction quantity had been comparatively low. The variety of transactions was over 50,000 as of the time of writing.

Supply: Santiment

Lively gamers decline

Nevertheless, regardless of these rising metrics, Axie Infinity had been shedding gamers all through the months, as evidenced by the variety of players actively taking part in the sport, per activeplayers.io. The statistic revealed that since February 2022, there had been hundreds of losses. As well as, it misplaced over 20% of its energetic gamers in November 2022, and throughout the previous 30 days, it has misplaced 8% of these gamers.

Supply: activeplayers.io

Is your portfolio inexperienced? Try the Axie Infinity Revenue Calculator

Regardless of the AXS token’s wonderful motion, its worth could also be impacted by the low transaction quantity and the regular drop within the variety of energetic individuals. If interplay with the ecosystem is deteriorating, it’s obscure how the utility can develop or stay fixed.

It will likely be attention-grabbing to look at if the value of AXS can change independently of the utilization discount.