- BAYC and MAYC have seen a fall of their flooring worth since June 2022.

- This, has, nonetheless, impacted gross sales by no means.

The marketplace for high Ethereum-based PFP (Profile Image) NFT collections continues to indicate indicators of weak point, with continued drawdowns of their flooring costs since final yr, information from Delphi Digital has revealed.

Since June 2022, Bored Ape Yacht Membership (BAYC) and Mutant Ape Yacht Membership (MAYC), two of the preferred PFP NFT collections, have skilled a 20% decline of their flooring costs.

In the meantime, different collections, reminiscent of Clone X and Moonbirds, have suffered even steeper declines, with decreases of 55% and 65%, respectively.

High Ethereum PFP NFT collections have continued their drawdowns since final yr. pic.twitter.com/t0abvUNEz7

— Delphi Digital (@Delphi_Digital) March 4, 2023

For the reason that begin of the yr, the NFT ecosystem has skilled a surge in buying and selling quantity, which has contributed to elevated buying and selling exercise for varied NFT collections.

Notably, BAYC and MAYC have seen important surges of their gross sales quantity year-to-date, regardless of the decline of their flooring costs.

BAYC and MAYC fail to relinquish high spots

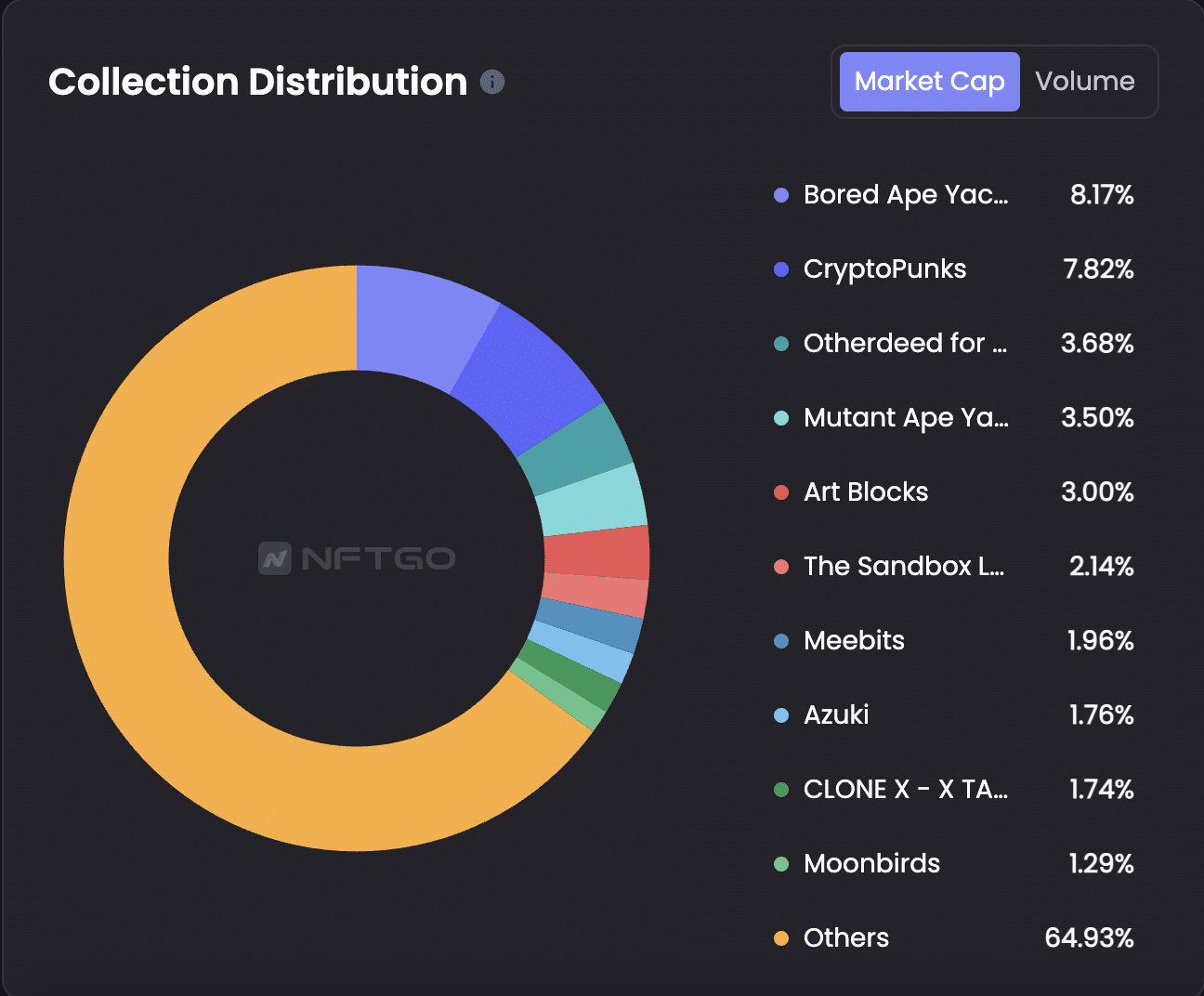

In direction of the top of 2022, CryptoPunks briefly overtook BAYC because the NFT assortment with the biggest share of the market capitalization within the NFT market.

Nevertheless, regardless of the regular decline in its flooring worth, BAYC regained its place as the highest NFT venture and presently holds 8.17% of the whole market share.

Whereas CryptoPunks’ temporary takeover of the highest spot within the NFT market signifies the rising competitors within the house, BAYC’s potential to keep up its place as a number one NFT venture demonstrates its resilience and enduring recognition.

On the time of writing, CryptoPunks’ market capitalization represented 7.82% of all the market worth.

Supply: NFTGo

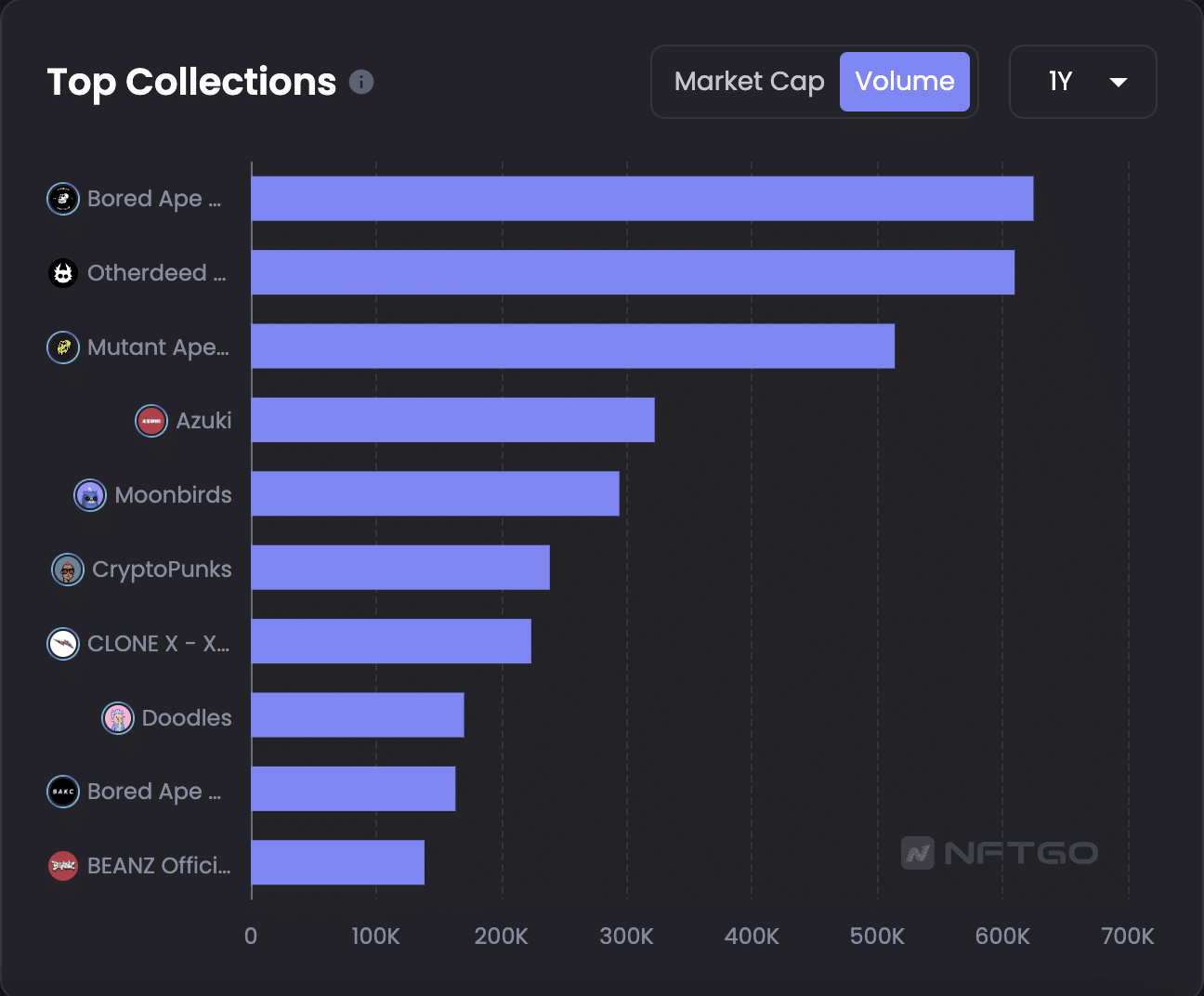

Furthermore, whereas MAYC has additionally seen a continuous drop in its TVL within the final yr, the gross sales quantity for the NFT venture continues to climb.

In response to information from NFTGo, MAYC’s gross sales quantity within the final yr represented 6.33% of all the market gross sales quantity. BAYC stood forward with 7.69% throughout the identical interval.

Actually, the mixed gross sales quantity of Yuga Labs’ BAYC, Otherdeed, and MAYC represented 22% of all the gross sales recorded within the NFT market within the interval below overview.

Supply: NFTGo

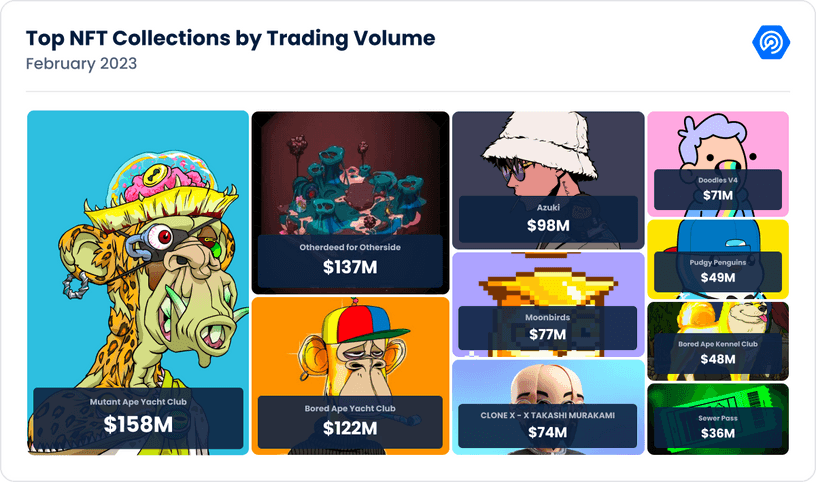

Yuga Labs tells different creators to go dwelling

In response to a brand new report from DappRadar, Yuga Labs led the NFT market in February with 5 collections, BAYC, MAYC, BAKC, Otherdeeds, and Sewer Go, occupying the highest 10 positions of the highest-grossing NFT collections on the Ethereum blockchain.

These collections represented 30% dominance over all the NFT buying and selling quantity on Ethereum, which quantities to a staggering $1.6 billion.

Supply: DappRadar