- Binance clears the air of doubts about its complete well-being.

- Futures and choices merchants hold again on buying and selling BNB.

- On-chain information exhibits losses for traders amid recovering deposits.

After weeks of allegations and counter-accusations, Binance has lastly addressed the problems raised because it goals to finish the uncertainty and doubt rocking the change.

In its seven-section blog post, Binance identified that it was essential to formally reply to the false data spreading across the crypto group because it was a transparency and openness advocate.

What number of BNBs are you able to get for $1?

Recall that Binance had been dealing with challenges throughout the board because the collapse of its competitor, FTX. At one level, the US Division of Justice (DOJ) was transferring towards full prosecution of the change. Extra just lately, the audit agency, Mazars, backed out of the scrutiny of the change’s monetary well being.

Hale and in good situation, change says

In addressing the issues of traders and the ecosystem at massive, Binance clarified that it had no points with liquidity regardless of the suspension of USDC withdrawals. Concerning its reserves, the change famous that it was very a lot wholesome financially.

Contemplating the Mazars problem, Binance defined that the audit of encrypted firms like theirs was a brand new idea. So, the talks concerning the huge 4 accounting corporations rejecting the audit course of had no legitimate grounds.

As for the DOJ prosecution, the weblog publish indicated hesitation on full clarification. Nonetheless, it famous that it had duly adopted the regulatory insurance policies throughout a number of international locations and it was going to deal with that at a later date. The publication learn,

“We’re at present unable to answer any controversial judicial discussions, however within the face of unilateral allegations from the media, we additionally hope to make clear and emphasize the next details which have been ignored by the general public for a very long time.”

BNB quantity rises however falters in…

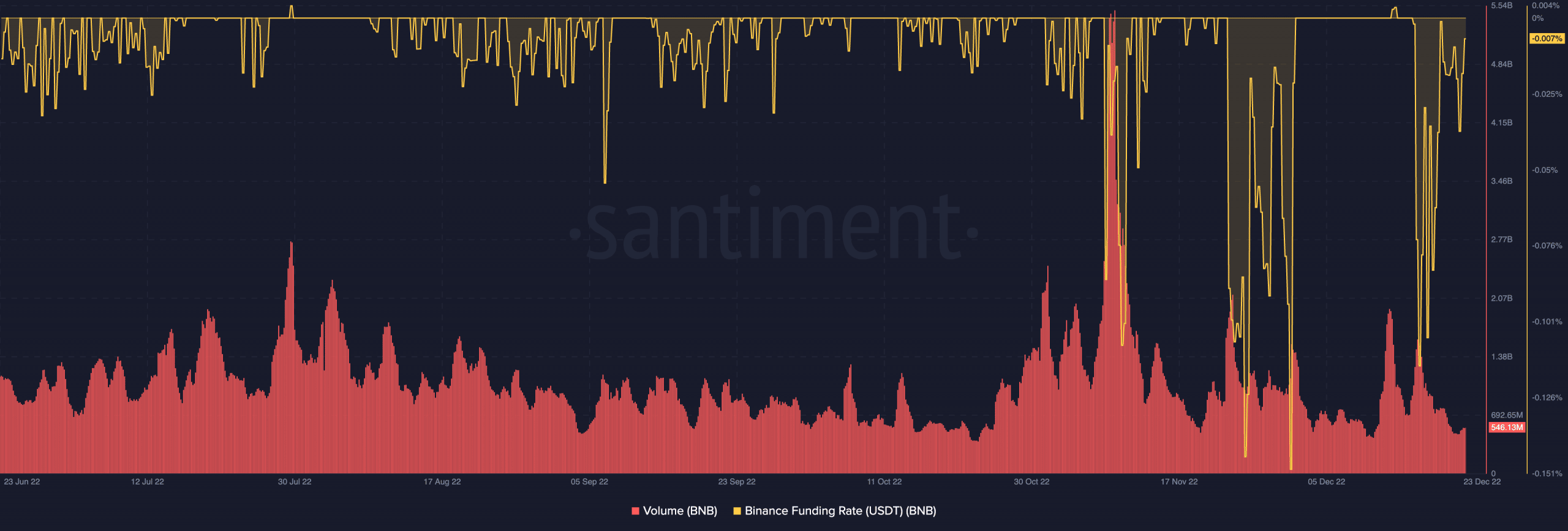

Regardless of the reason, Binance Coin [BNB], backslid on selecting up a big uptick. Nonetheless, the 24-hour buying and selling quantity was in a position to supersede the value stagnancy with an 18.36% improve. In line with on-chain information supplier Santiment, the BNB quantity was $546.13 million at press time.

Are your BNB holdings flashing inexperienced? Test the Revenue Calculator

This situation mirrored an try by merchants to leap in on BNB primarily based on value motion. The merchants’ motion within the derivatives market was opposite to the show within the general market.

This was as a result of Santiment information revealed a large dump in funding price on the change at -0.007%, indicating retracement in futures and choices contract positions.

Supply: Santiment

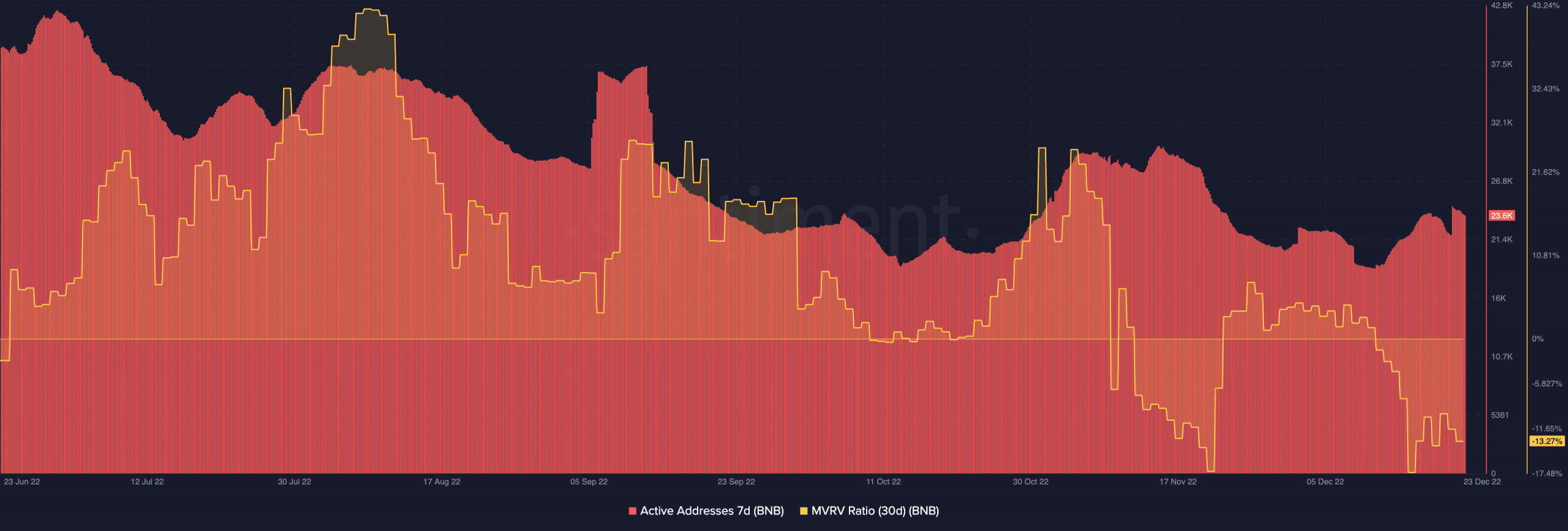

With regards to its energetic addresses, on-chain information confirmed that BNB was competent in attracting and bettering consumer exercise. This was because of the increment within the seven-day energetic addresses on 21 December though the metric had dropped to 23,600 on the time of writing.

In consequence, Binance was within the process of reestablishing belief after billions of {dollars} in outflows from the change.

Per its 30-day Market Worth to Realized Worth (MVRV) ratio, BNB remained resolute in retaining traders in losses. At -13.27%, the MVRV depicted an undervalued situation. Nonetheless, it additionally signified damaging outcomes for holders who purchased at a value increased than the present worth.

Supply: Santiment