- Bitcoin whales drop to a brand new two-year low

- Bitcoin additionally confirmed resistance on the $17,000 degree

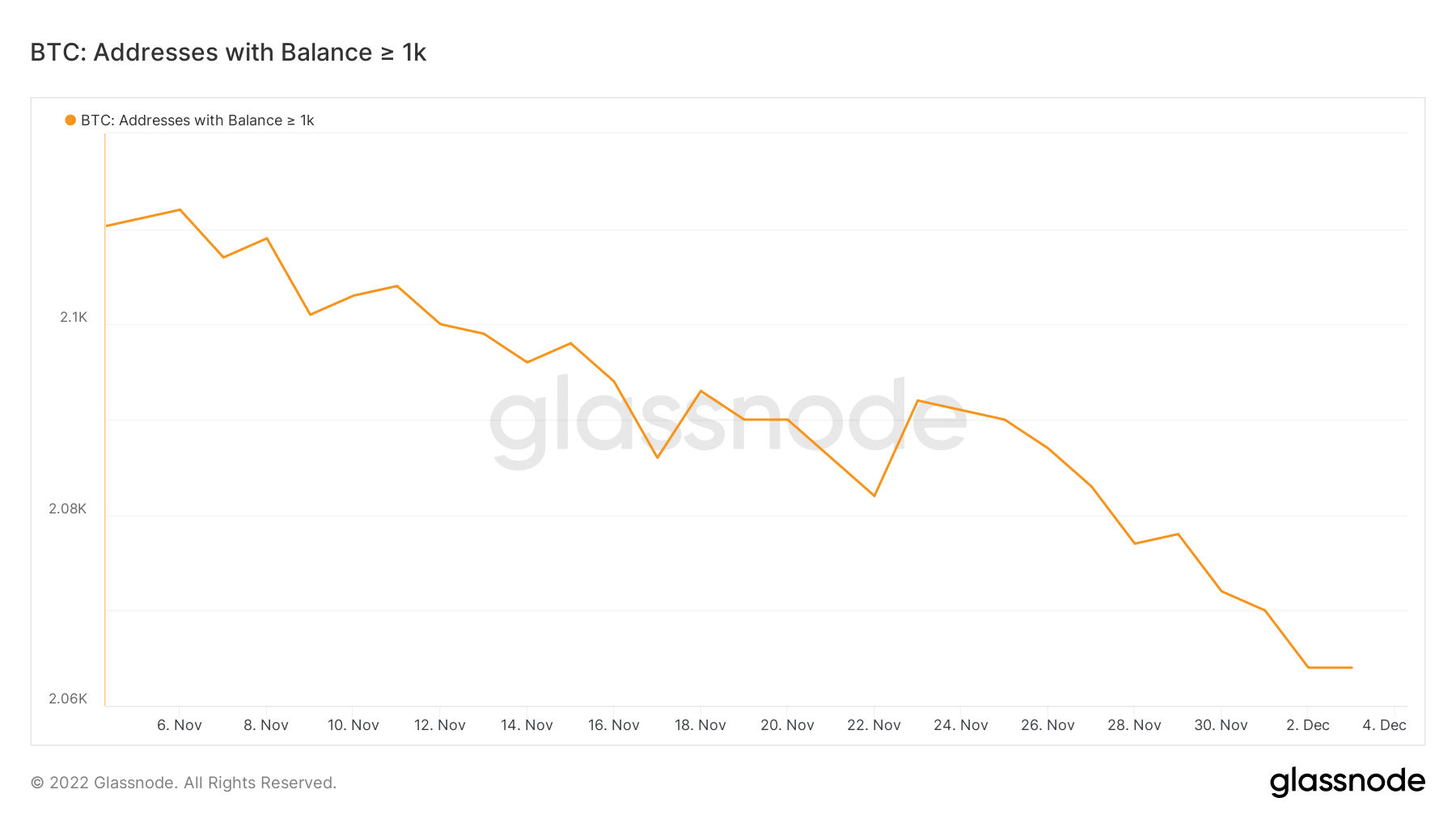

Bitcoin [BTC] managed to bounce again above the $17,000 worth vary. Whereas the present expectation was that it would proceed to rally, whale exercise prompt in any other case. In keeping with a latest Glassnode replace, the variety of Bitcoin whales have been on the decline.

📉 #Bitcoin $BTC Variety of Whales simply reached a 2-year low of 1,665

Earlier 2-year low of 1,671 was noticed on 22 November 2022

View metric:https://t.co/k1K8OK2tl3 pic.twitter.com/CPJxLaybbH

— glassnode alerts (@glassnodealerts) December 4, 2022

Learn Bitcoin’s [BTC] worth prediction 2023-2024

The Glassnode replace revealed that the variety of whales holding BTC dropped to the bottom ranges within the final two years. In keeping with the replace, the variety of whales stood decrease than it was on 21 November. Moreover, the latter occurs to be the date when Bitcoin dropped to its present 12-month low.

Such a decline typically indicated that whales have been promoting or the dearth of robust demand from whales. The above remark may stand according to the month-to-month decline within the variety of addresses holding greater than 1,000 BTC.

Supply: Glassnodeitcoi

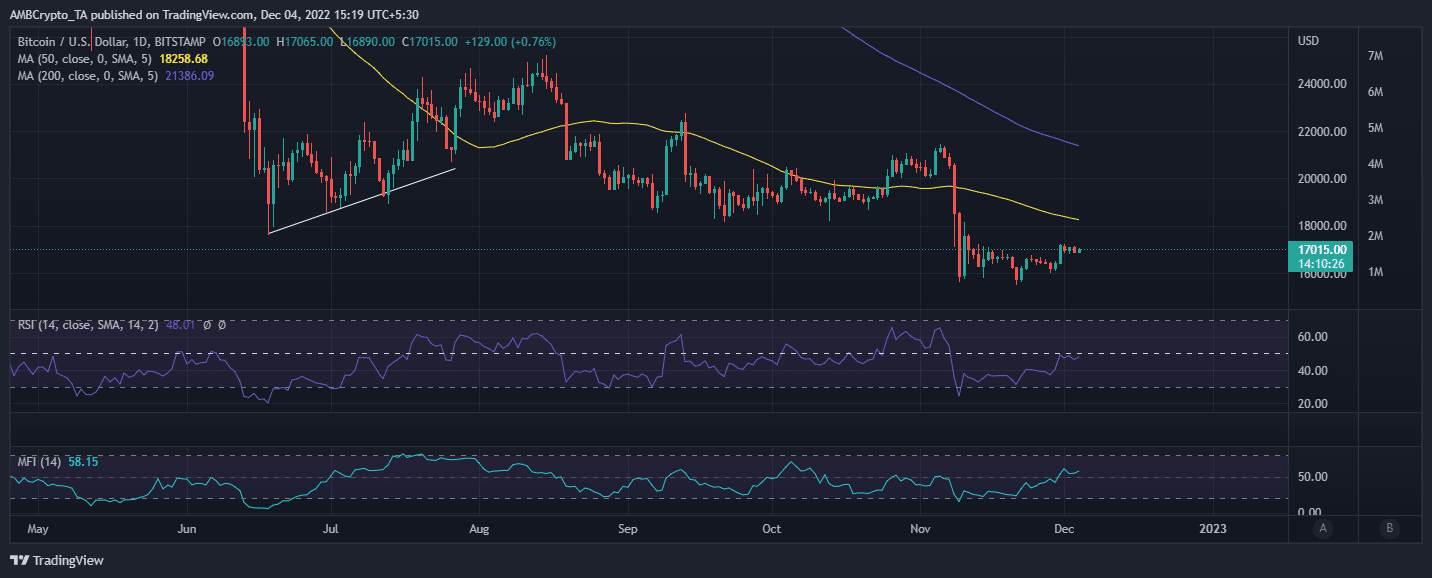

Regardless of the noticed decrease curiosity from whales, Bitcoin’s present worth degree indicated important accumulation to assist the slight upside. This was particularly in comparison with its present month-to-month low. It notably demonstrated some resilience above the $17,000 worth degree.

Supply: TradingView

However why has the worth gone up regardless of decrease participation by the whales? A possible clarification may very well be that retail merchants have been aggressively accumulating BTC. This may increasingly clarify why the Cash Move Indicator (MFI) might have achieved noteworthy upside because the second week of November. It additionally defined why the upside may very well be weak or comparatively restricted.

Assessing the prevailing Bitcoin retail demand

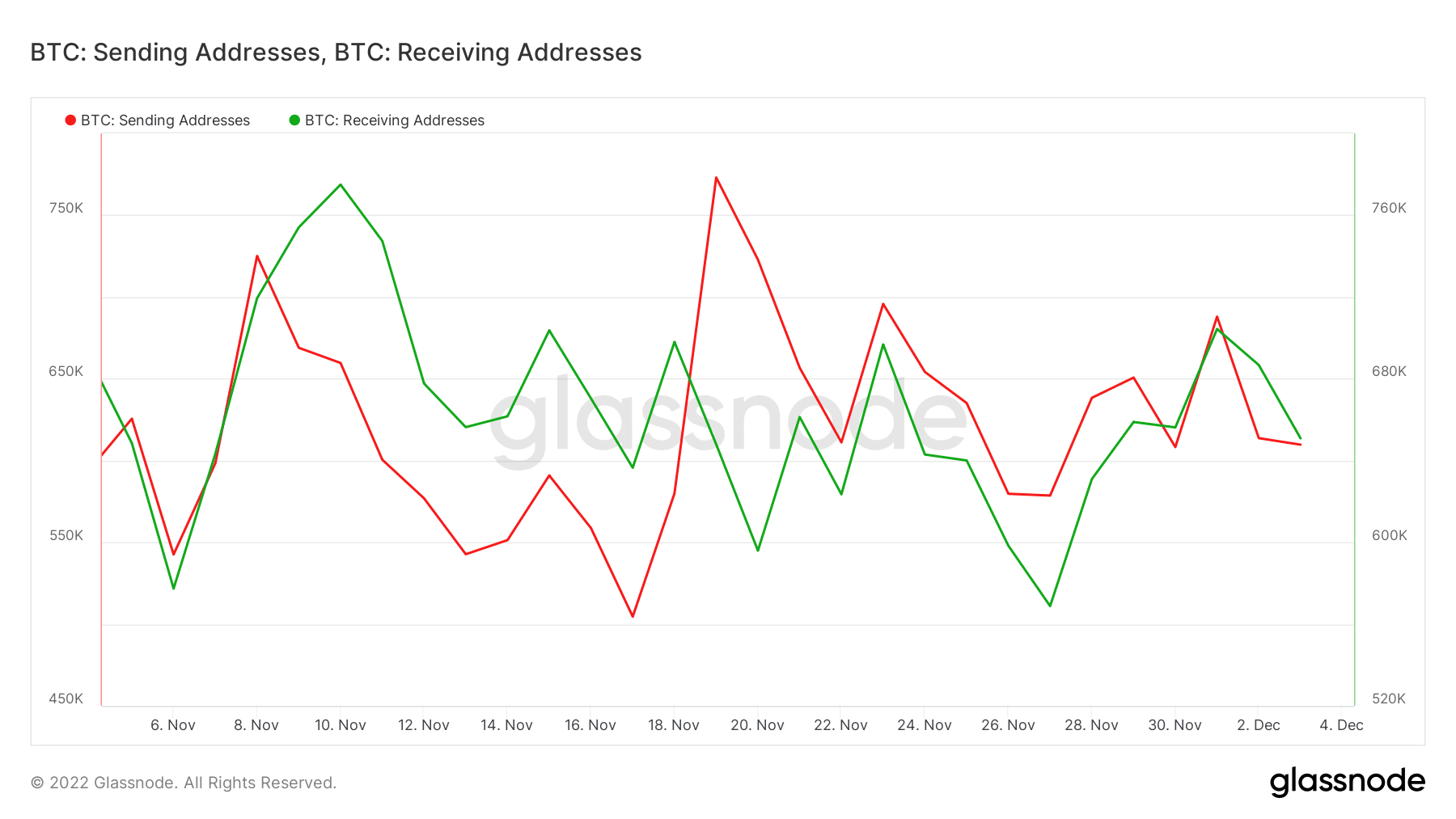

A take a look at the sending and receiving addresses additional supported the above conclusion concerning the retail section supporting the upside. In keeping with the most recent Glassnode readings, the variety of receiving addresses outweighed sending addresses.

In different phrases, the purchase strain outmatched the prevailing promote strain. This defined why BTC managed to remain above $17,000 in the previous few days.

Supply: Glassnode

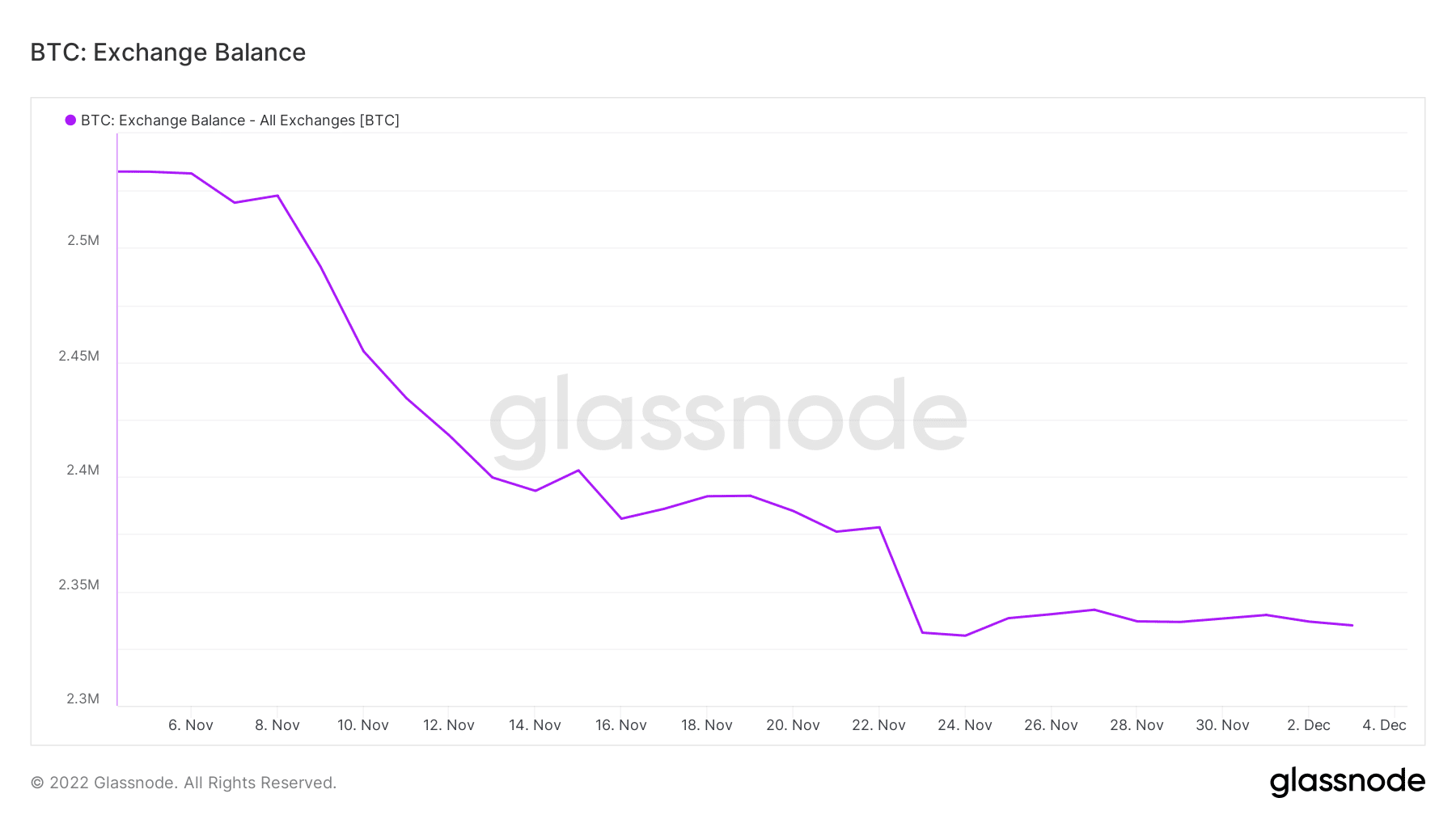

As well as, the dearth of extra draw back might have been backed by the truth that trade balances haven’t elevated. As an alternative, the stability of Bitcoin on exchanges nonetheless stood inside its month-to-month lows. This was affirmation across the absence of great promote strain to assist extra draw back because of robust retail demand.

Supply: Glassnode

Bitcoin will doubtless proceed shifting sideways if the present market circumstances prevail. A scarcity of whale participation might additionally imply that the demand would stay restricted. Moreover, it might not notably serve extra upside within the short-term. Particularly if retail accumulation will get exhausted.

The present state of affairs additionally prompt there was a chance that would observe a return of promote strain. Alternatively, merchants may even see continued bullish momentum if whales regain curiosity in BTC.