- BTC’s NUPL means that the coin has commenced a brand new bull cycle.

- Nonetheless, growing coin dump signifies a scarcity of buyers’ confidence.

In a brand new report, CryptoQuant analyst Sachi discovered that the evaluation of Bitcoin’s [BTC] Web Unrealized Revenue/Loss (NUPL) revealed that the main coin has commenced a brand new bull cycle.

The NUPL is a metric used to guage the revenue margin of the BTC market in relation to its market capitalization. A price under zero signifies an accumulation part, whereas values above 0.5 counsel a distribution part.

In keeping with Sachi, “the essential threshold to observe is 0.2.” Within the present market, BTC’s NUPL has reached this “essential” place.

The overview carried out by the analyst on BTC’s historic efficiency discovered {that a} golden cross, which generally happens between the 128 and 200-day transferring averages, indicators the tip of the buildup part when the NUPL metric reaches or surpasses 0.2. This signifies the graduation of a bull market.

Sachi concluded {that a} bull cycle was underway as all three crucial elements had been current as soon as once more within the present cycle.

Supply: CryptoQuant

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Accumulation has slowed, however solely as a result of…

For the primary time because the sudden fallout of cryptocurrency alternate FTX, BTC traded momentarily above the $25,000 worth mark on 16 February.

Though the king coin’s worth later went on to commerce under $25,000, for just a few weeks, buyers anticipated that BTC would reclaim the value place, main them to open a number of lengthy positions.

Nonetheless, issues didn’t go as anticipated, resulting in dwindling conviction in any additional worth rally. Investor’s confidence plummeted additional on 3 March when BTC’s worth immediately fell by 5%, dropping from $23,500 to $22,240 as a result of a way of insecurity and doubt surrounding Silvergate Capital.

This led to the liquidation of the lengthy positions earlier opened.

Whereas Sachi opined that the decline in accumulation and different elements ushered in a brand new bull cycle, a take a look at on-chain knowledge and worth chart revealed in any other case.

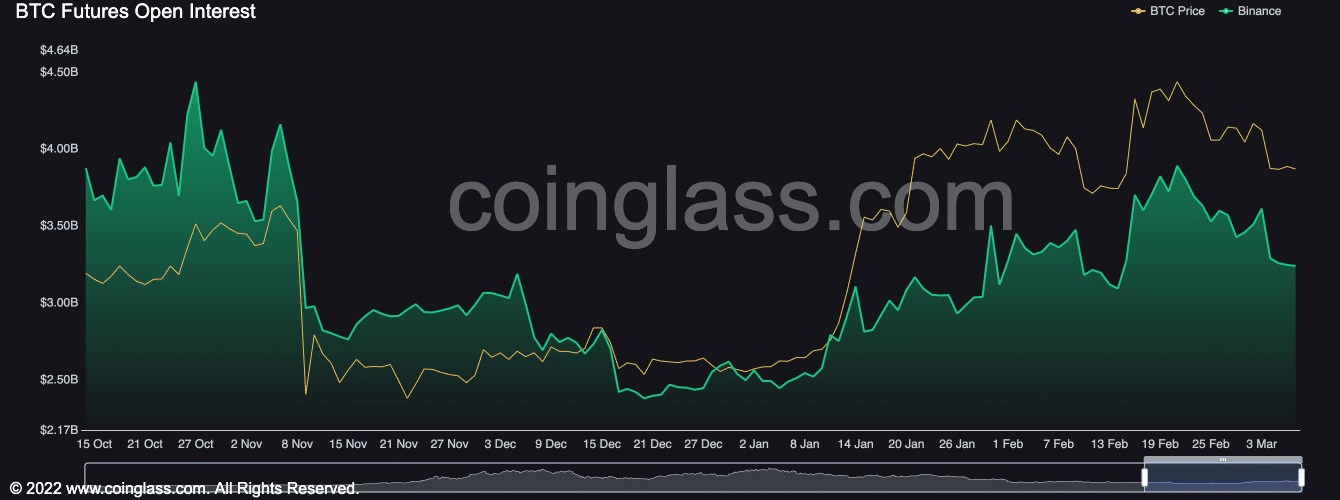

First, BTC’s Open Curiosity has been in a downtrend since 21 February. The autumn in Open Curiosity coincides with a ten% fall within the asset’s worth.

When the Open Curiosity of a crypto asset falls, it implies that the variety of excellent contracts or positions out there has decreased.

It’s typically accompanied by a decline in market sentiment or a lower within the variety of merchants prepared to take positions out there. As anticipated, this drives down the worth of an asset.

Supply: Coinglass

Learn Bitcoin [BTC] Worth Prediction 2023-24

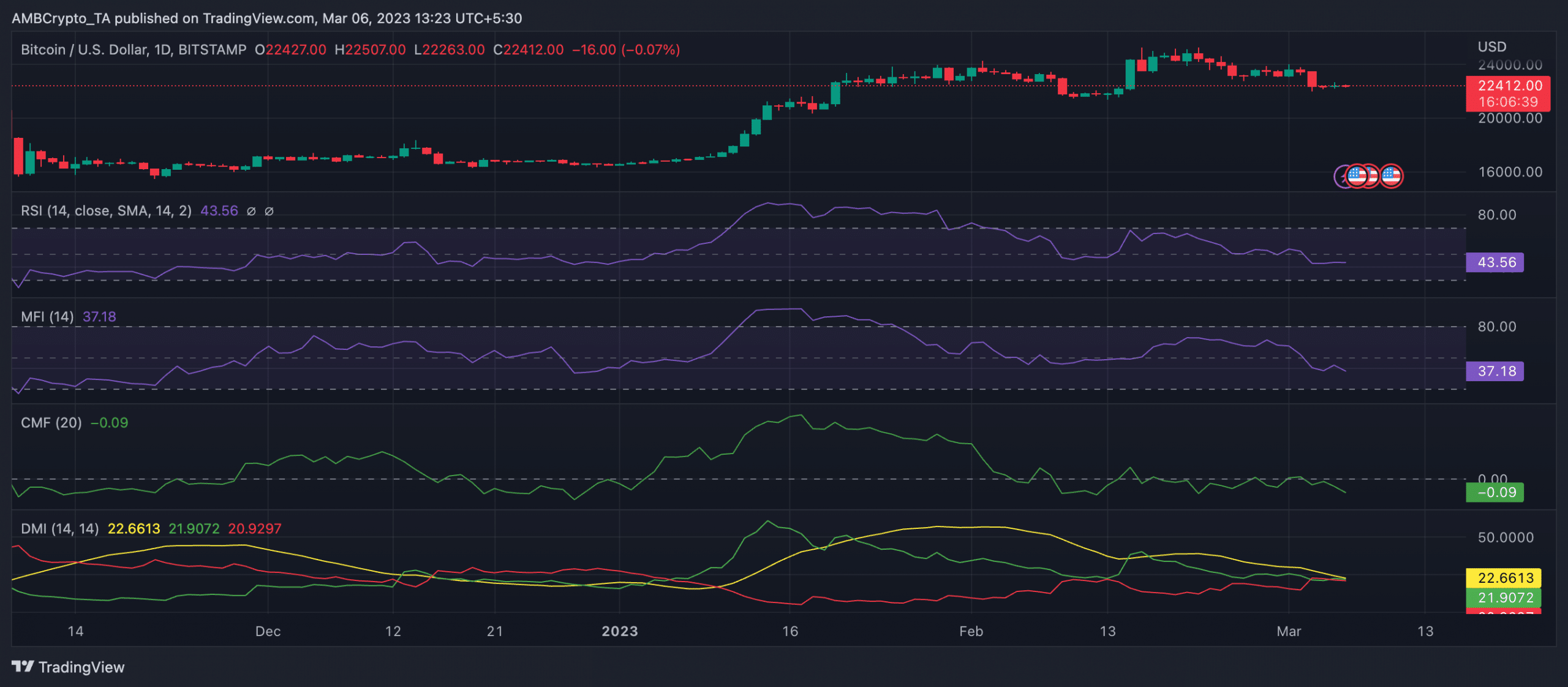

Additional, on a day by day chart, elevated coin distribution has put the patrons on the sellers’ mercy. Key momentum indicators such because the RSI and MFI had been positioned in downward tendencies and rested under their respective impartial areas.

Likewise, the coin’s Chaikin Cash Move (CMF) returned a destructive -0.09 at press time, indicating the severity of coin distribution. With no change in conviction, this often precedes an additional worth drawdown.

Supply: BTC/USDT on TradingView

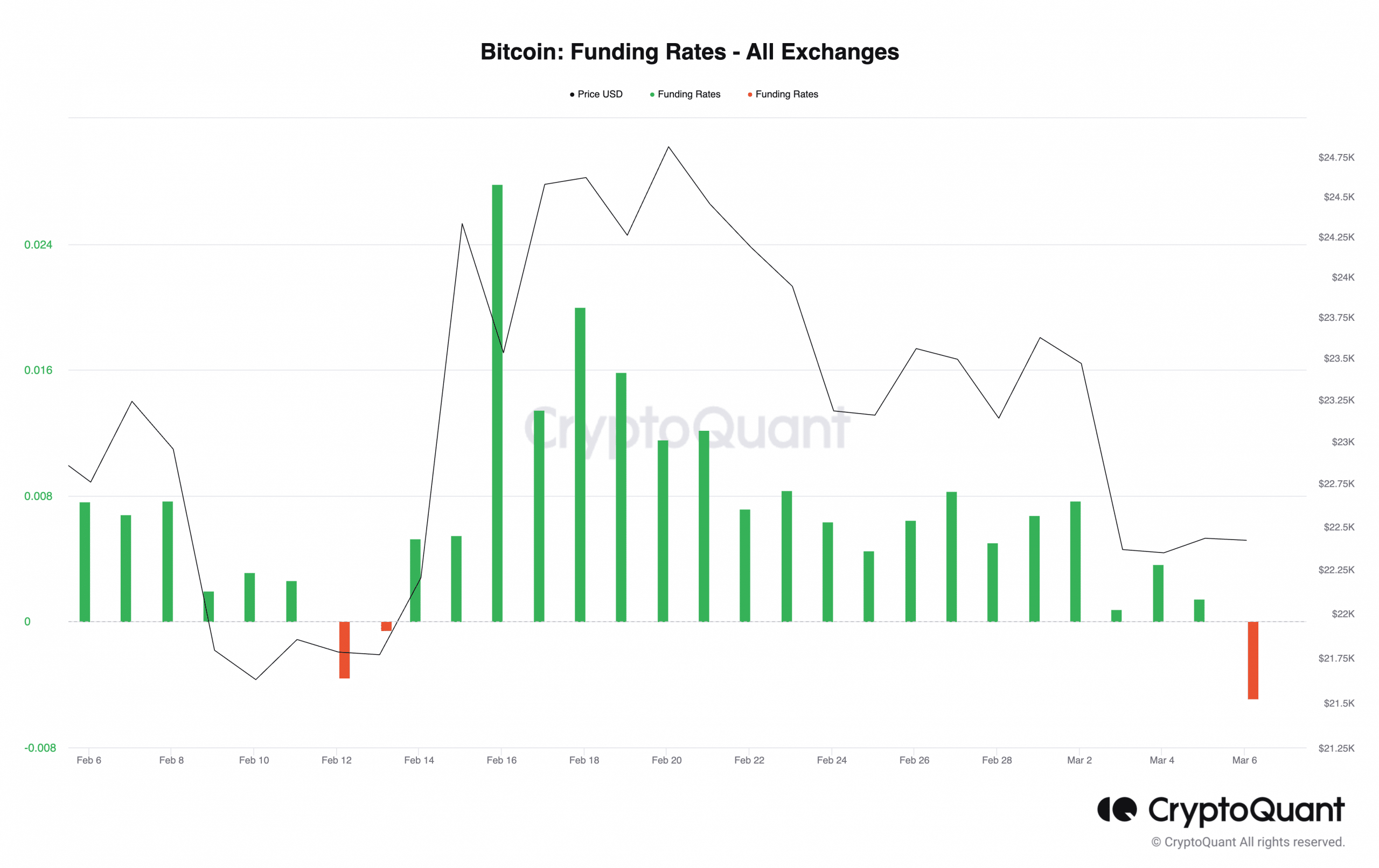

Lastly, a take a look at BTC’s funding charges throughout exchanges confirmed the insecurity that permeated the market at press time. Per knowledge from CryptoQuant, as of this writing, brief positions exceeded lengthy positions. It was the very best destructive funding fee year-to-date.

Supply: CryptoQuant

![Bitcoin [BTC]: Indicators point at a bull cycle, and on-chain data reveals…](https://ambcrypto.com/wp-content/uploads/2023/03/shubham-s-web3-xNtRVF2o7tk-unsplash-1-1000x600.jpg)