- Buyers are funnelling funds into Quick-BTC merchandise after fourth consecutive week of outflows

- With the Shanghai Improve coming quickly, traders might be cautious with ETH

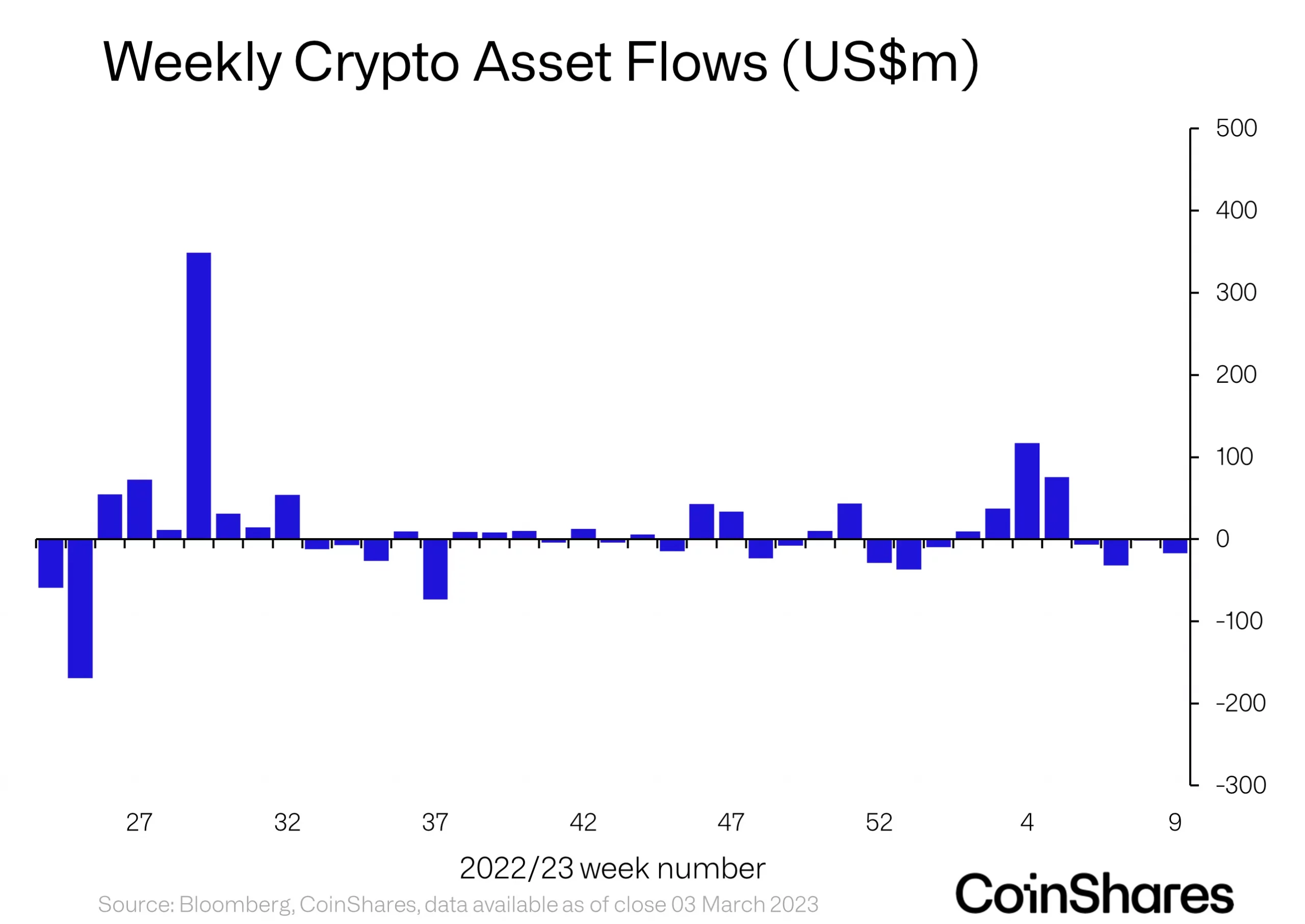

In a brand new report, digital asset funding agency CoinShares discovered that ongoing apprehension amongst traders concerning the unsure regulatory panorama of crypto-assets led to a fourth consecutive week of outflows for Bitcoin [BTC]. This, as traders rallied round quick funding merchandise as a substitute.

The worth of BTC sharply declined within the early buying and selling hours of three March, inflicting investor confidence within the coin’s short-term worth rally to drop even additional as a result of uncertainty round Silvergate Capital. This occasion contributed to lengthy liquidations hovering to a seven-month excessive, knowledge from Coinglass revealed. In keeping with CoinShares,

“The poor sentiment possible represents continued investor issues over regulatory uncertainty for the asset class.”

Supply: CoinShares

To quick or to not quick?

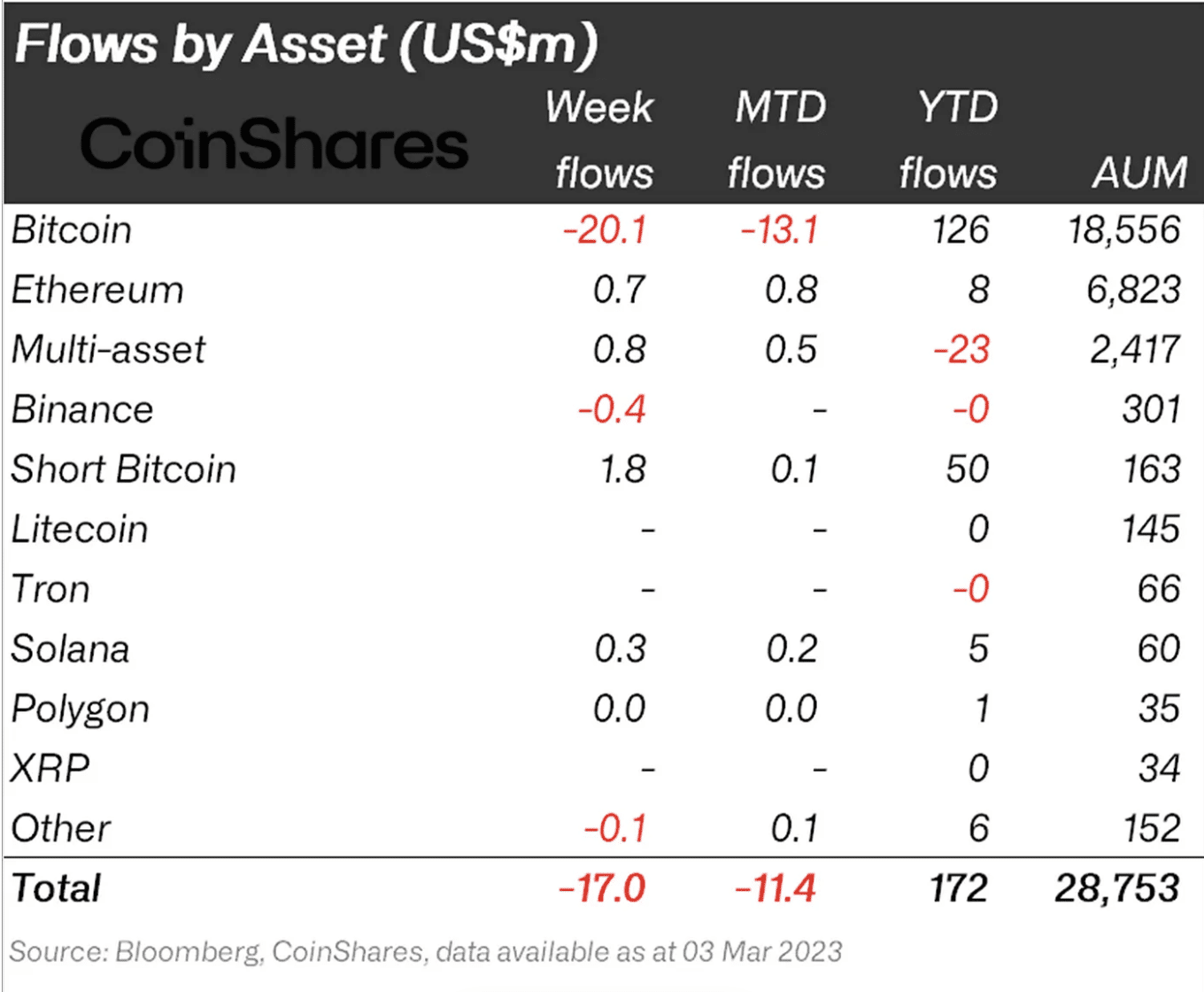

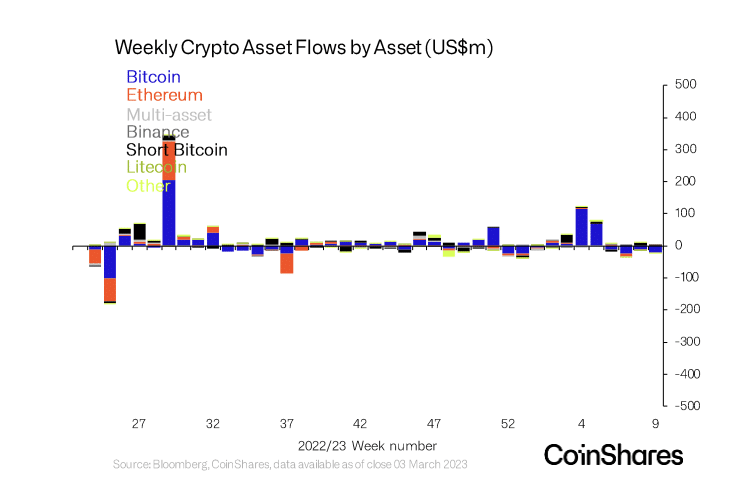

In keeping with CoinShares, final week, traders funnelled funds into Quick-Bitcoin merchandise. Consequently, Quick-Bitcoin noticed inflows of $1.8 million. On a year-to-date foundation, Quick-Bitcoin merchandise have logged inflows of $50 million.

Apparently, regardless of the current inflows into Quick-Bitcoin, the worth of its whole property below administration (AuM) has solely risen by 4.2% TYD. This starkly contrasted with Lengthy-Bitcoin AuM, which has hiked by 36%.

Citing issues over regulatory uncertainty for the asset class, CoinShares added that the discrepancy in efficiency instructed that quick positions are but to ship the returns that some traders expect.

Supply: CoinShares

For its half, Bitcoin logged its fourth consecutive week of outflows totaling $20 million. As a result of coin’s spectacular efficiency in direction of the start of the 12 months, its YTD inflows stood at $126 million.

Whereas the whole funding merchandise market suffered low volumes as a result of outflows final week, BTC skilled a lower-than-usual market quantity, CoinShares discovered. In keeping with the report,

“Volumes throughout funding merchandise have been low at US$844m for the week, however an analogous scenario was seen for the whole Bitcoin market volumes, averaging US$57bn, 15% decrease than ordinary.”

General, the low funding product volumes and lower-than-usual BTC market volumes instructed that traders have been exercising warning and would possibly undertake a wait-and-see strategy.

Minor inflows into Ether forward of the Shanghai Improve

There have been minor inflows into altcoins final week, with Ethereum [ETH] and Solana [SOL] receiving $700,000 and $340,000, respectively. Alternatively, Binance’s BNB and Cosmos’ ATOM logged outflows of $380,000 and $210,000, respectively.

Buyers have exercised warning because the date for Ethereum’s Shanghai Improve is approaching. There’s a normal sense of uncertainty concerning the route of ETH’s worth after beforehand locked ETH cash turn into out there.

Supply: CoinShares

![Bitcoin [BTC]: Short products for the win as investors shy away from long positions](https://ambcrypto.com/wp-content/uploads/2023/03/dan-dennis-pZ56pVKd_6c-unsplash-1-1-1000x600.jpg)