- Bitcoin’s social dominance has hit its highest level since September 2022

- Longs have been unable to keep away from liquidations as losses proceed to pour in

Bitcoin’s [BTC] worth drop for the reason that new month started might need been demoralising for traders. Nevertheless, the king coin continues to exert supreme dominance available in the market. This declare is as a result of the primary cryptocurrency in market worth has outperformed high altcoins over the aforementioned time interval.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

A fast evaluation of the market places BTC with a 6.21% declinem on the time of writing. Nevertheless, fellow opponents like Litecoin [LTC] fell by 12.54% whereas Cardano [ADA] dropped by 10.37%.

For sure, there may be solely a tiny probability that BTC may imitate its January and February efficiency. Nevertheless, the crypto’s preliminary resistance to its historic March falls might now be in movement.

Is a historic recoil on the best way?

Santiment, in its 7 March tweet, affirmed that BTC has been comparatively outperforming a majority of the market’s altcoins. Regardless of the admission, nonetheless, the on-chain analytics platform additionally pointed to the social dominance pattern.

🧐 #Bitcoin‘s worth is -6% in March, however nonetheless performing higher relative to most #altcoins. With #crypto giving up a lot of their Jan/Feb positive factors, consideration has returned to $BTC. Greater Bitcoin social dominance traditionally has initiated market rebounding. https://t.co/jNM0hwCyeR pic.twitter.com/J0re8Kok87

— Santiment (@santimentfeed) March 7, 2023

Social dominance gauges the share of debate referring to an asset. In accordance with Santiment, the metric surged to its highest stage since September 2022. Traditionally, such occasions put together the best way for a market rebound.

The aforementioned statement implies that BTC is getting hyped. Nevertheless, the case for capitalizing on short-term bottoms might once more be non-existent because the dominance, beforehand at 19.19%, fell to 13.86% at press time.

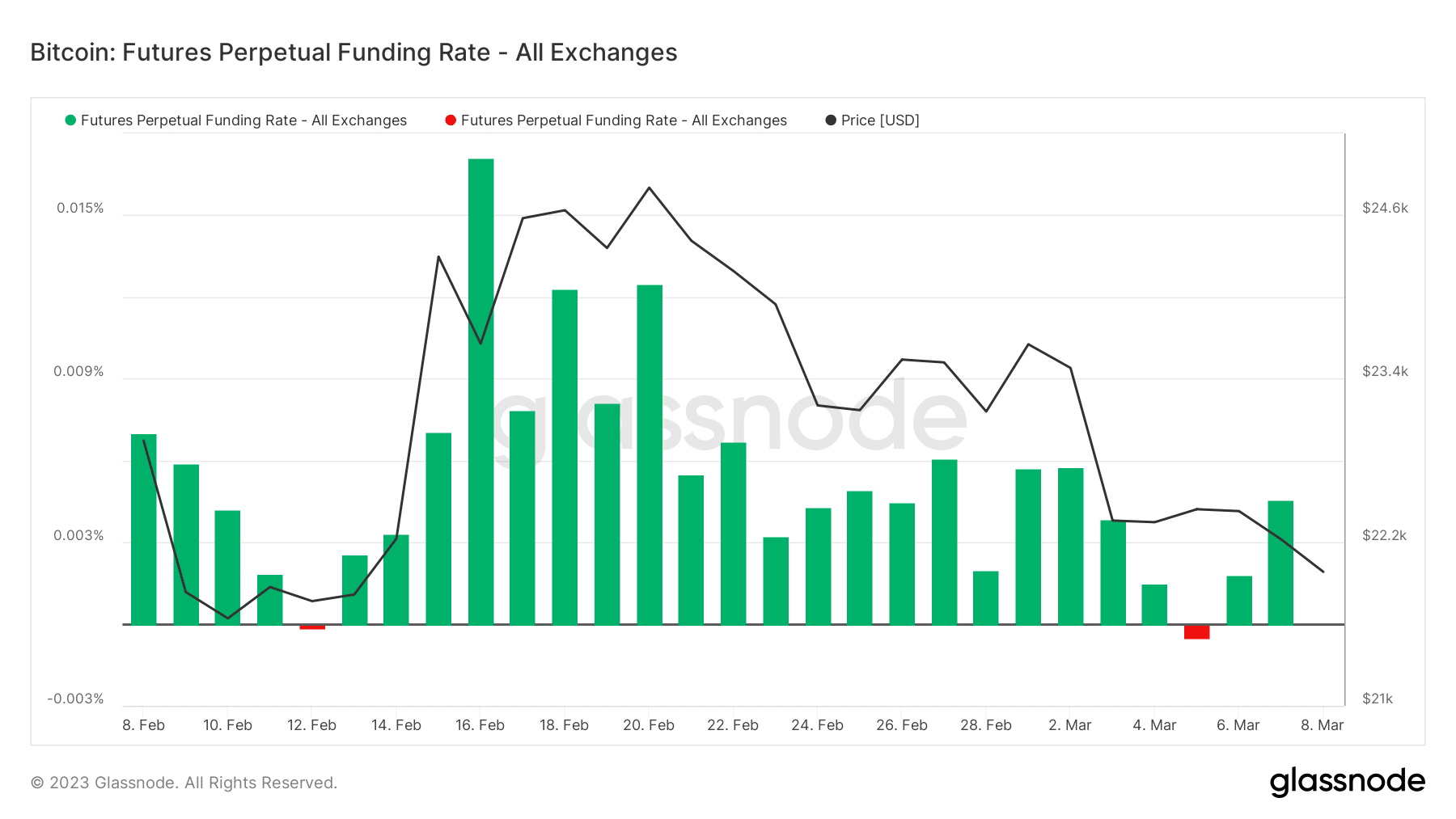

Regardless of the preliminary hike, short-positioned merchants didn’t renege on sustaining their place and gained considerably over longs. This was as a result of Futures perpetual funding rate, in accordance with Glassnode.

A constructive fee implies that lengthy positions paid shorts whereas a unfavorable fee implies in any other case. At press time, the perpetual funding fee was 0.05%, that means that almost all longs have been liquidated throughout exchanges.

Supply: Glassnode

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

Taking place the drain?

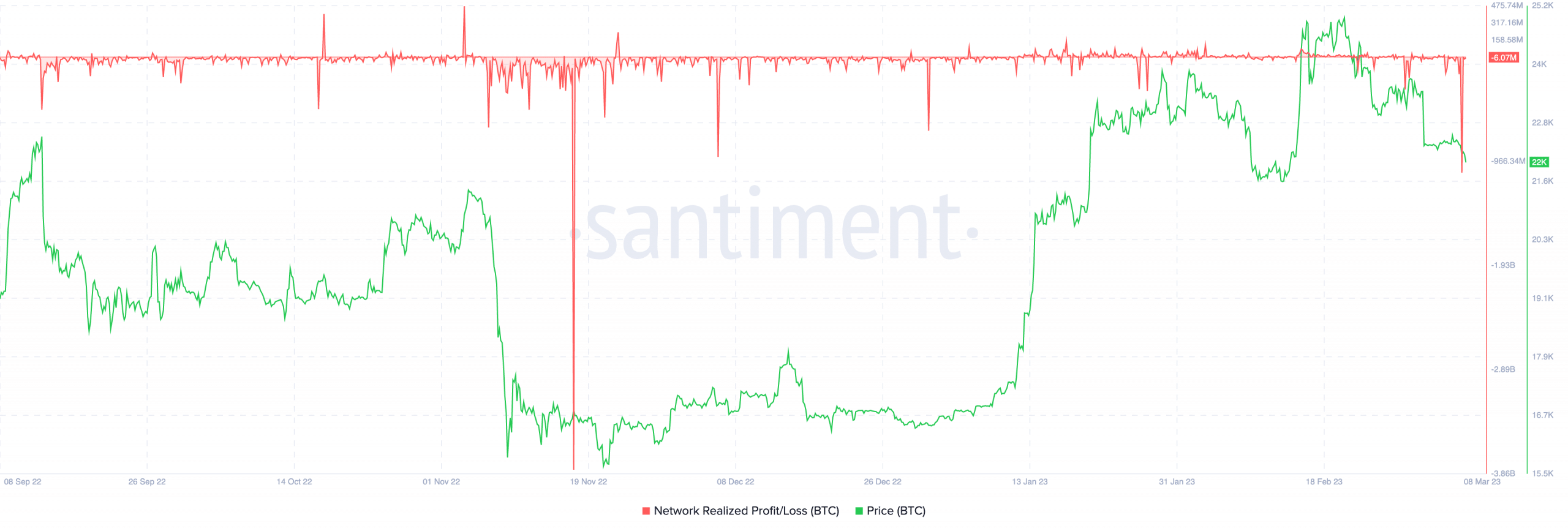

On account of the newest worth dip, the greens recorded within the first two months appear inadequate to exclude holders from accruing losses. Primarily based on Santiment’s knowledge, the community’s realized profit and loss remained unfavorable at -6.07 million.

A typical interpretation of the framework signifies capital inflows to soak up the sell-side whereas on-chain earnings are being realized. On the flip aspect, unfavorable values keep the course when the value traits decrease and capital outflows happen.

Supply: Santiment

Nonetheless, the metric situation may additionally sign an upside reversion, as steered by the social dominance hike.

Even so, BTC is on the verge of dropping its maintain on $22,000. Moreover, developments just like the Silvergate dump and total sentiment may additionally propel the coin beneath its prevailing worth.

![Bitcoin [BTC]: What its social dominance stats tell us about its ‘king coin’ label](https://ambcrypto.com/wp-content/uploads/2023/03/po-2023-03-08T100248.746-1000x600.png)