- Bitcoin may head in direction of yet one more fall earlier than accumulation results change to the marke

- Sellers had been exhausted as income and loss maintained maximal distinction

Perseverance, stormy classes, and repeated capitulation— these three are a number of the issues Bitcoin [BTC] traders have endured because the crypto winter started. Nonetheless, as 2022 nears its finish, the hopes of those traders could be caught in proffering respite.

Paradoxically, BTC might need to take care of yet one more nosedive earlier than the bears can supply a respiratory area, CryptoQuant analyst Joaowedson opined.

Learn Bitcoin’s [BTC] worth prediction 2023-2024

Inertia actions as historical past would possibly recur

The analyst, by way of his publication, revealed that Bitcoin long-term holders had been transferring their cash once more. This time to promote. This impacted the typical dormancy to extend.

Circumstances surrounding the typical dormancy uptick meant that the variety of Coin Days Destroyed (CDD) had been additionally affected. Therefore, this might drive one other BTC worth drop. This projection aligned with an earlier forecast that BTC may have one ultimate bearish name.

Supply: CryptoQuant

After all, the dormancy enhance signaled a possible worth lower, combating losses was not the one potential final result. Historical past, like in 2021, confirmed {that a} change in beforehand unmoved property may set off an finish to the bear market.

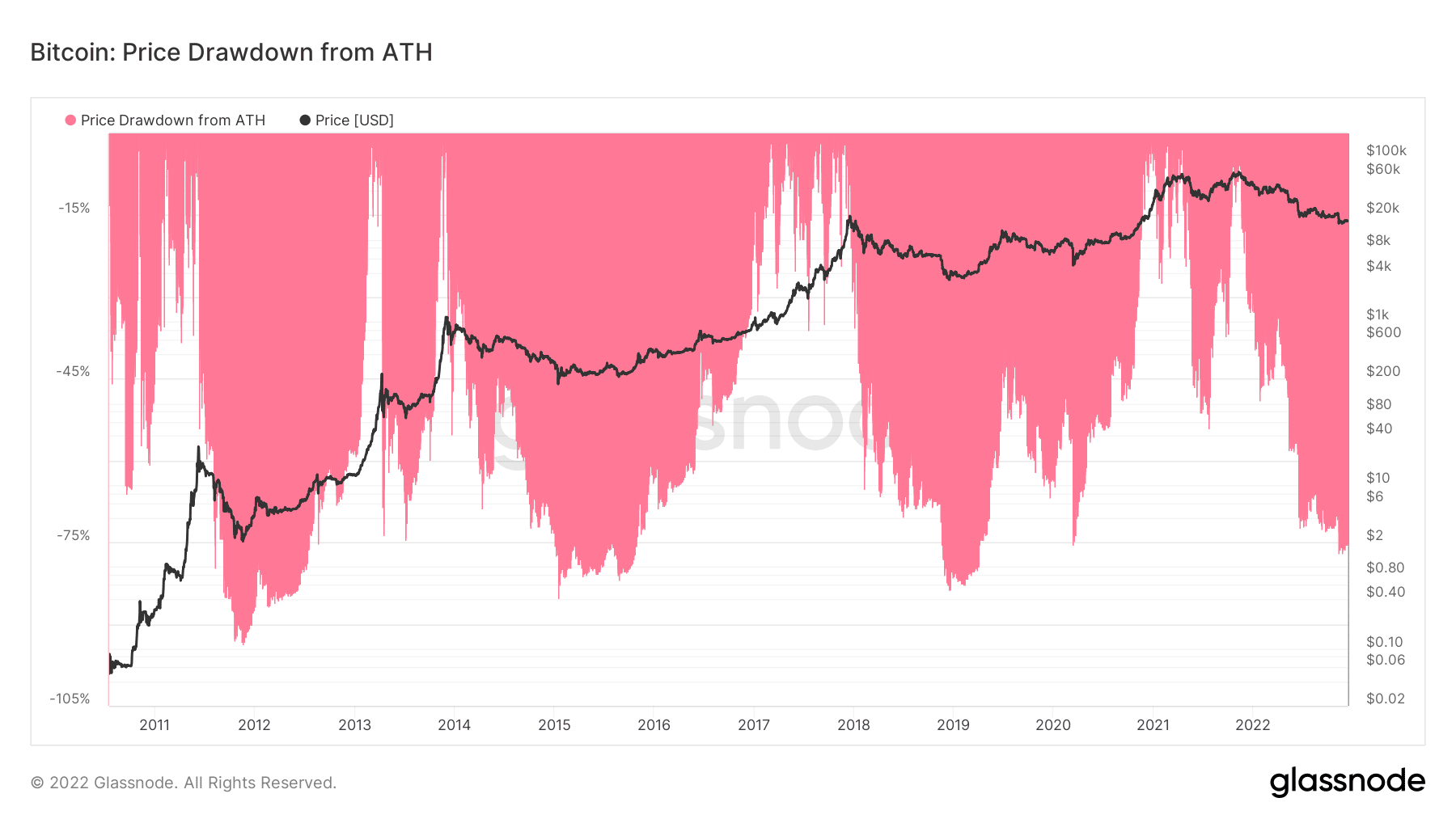

On this occasion, BTC may observe the steps of the previous stays. However, it didn’t subdue the notion of elevated volatility if the coin approaches one other backside. On assessing the value drawdown from All-Time Excessive (ATH), Glassnode showed that it was -75.30%.

Traditionally, BTC was at an analogous stage in 2012 (-75.98%), 2015 (-79.29%), and 2020 (-75.46%). In all of those earlier cycles, BTC didn’t instantly skyrocket because it hit the underside. On that account, BTC would possibly probably endure consolidations as a swift uptrend won’t start within the meantime.

Supply: Glassnode

Administering the antidote

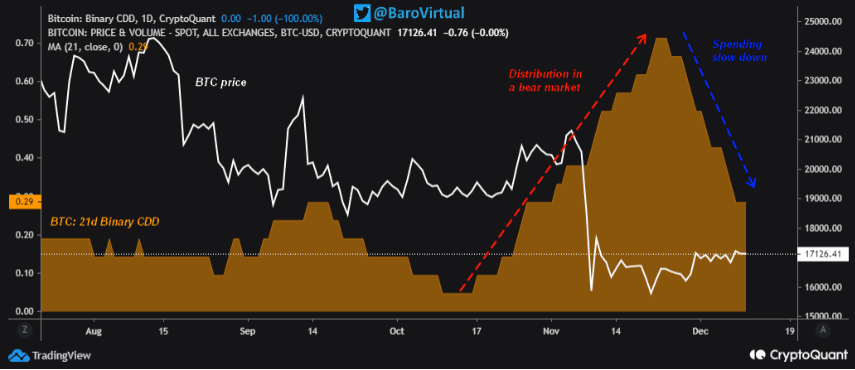

In one other CryptoQuant publication, Analyst BaroVirtual mentioned that the much-anticipated accumulation season was nearer than thought. Backing up his claim, the analyst pointed to the 21-day Binary CDD.

Based on him, the metric displayed distribution acts that paved the best way for BTC’s rise to its ATH. BaroVirtual mentioned,

“Based on the 21d Binary CDD, from 9 Jul ’22 to 16 Oct ’22, we noticed a interval of native accumulation of Bitcoin. Nonetheless, from 17 Oct ’22 to 24 Nov ’22, Bitcoin skilled one other native distribution section, which was much more potent than the distribution section that preceded the value excessive of $69,000.”

Supply: CryptoQuant

The CDD standing implied fatigue in sellers. Subsequently, it may result in an all-around market restoration, and accumulation wouldn’t decelerate.

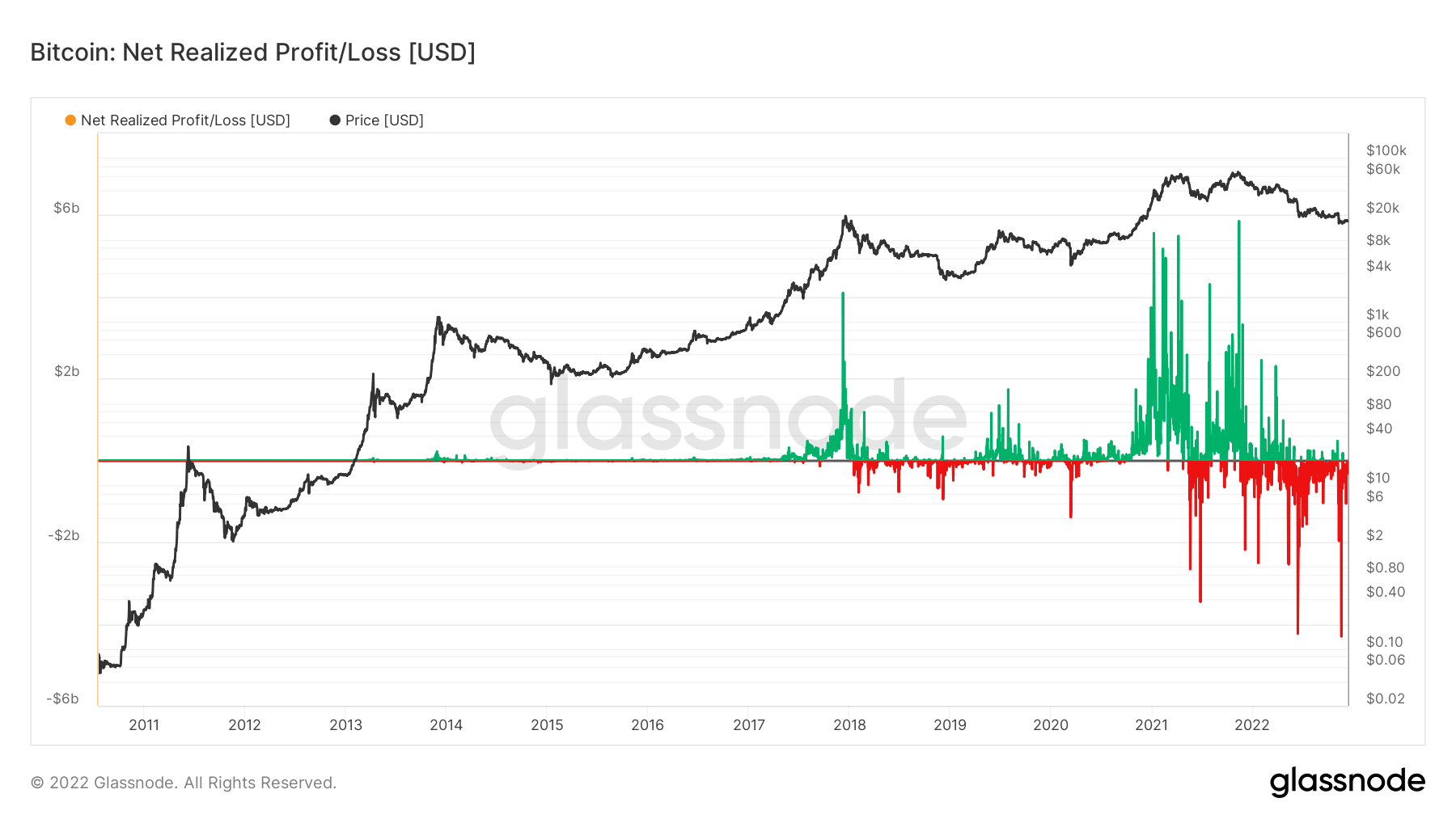

Moreover, the Bitcoin internet realized revenue and loss revealed that the difference in devaluation and beneficial properties was excessive. Based on Glassnode, the online loss was over $600 million, whereas income was far much less.

Notably, the realized revenue and loss had been at one of many lowest. This indicated that Bitcoin would require a young state of affairs regarding this metric earlier than Bitcoin impacts the tip of the bear market.

Supply: Glassnode