- A brand new report means that the subsequent Bitcoin halving might set off a rally

- Nonetheless, miners might face the stress as revenues and costs dwindle

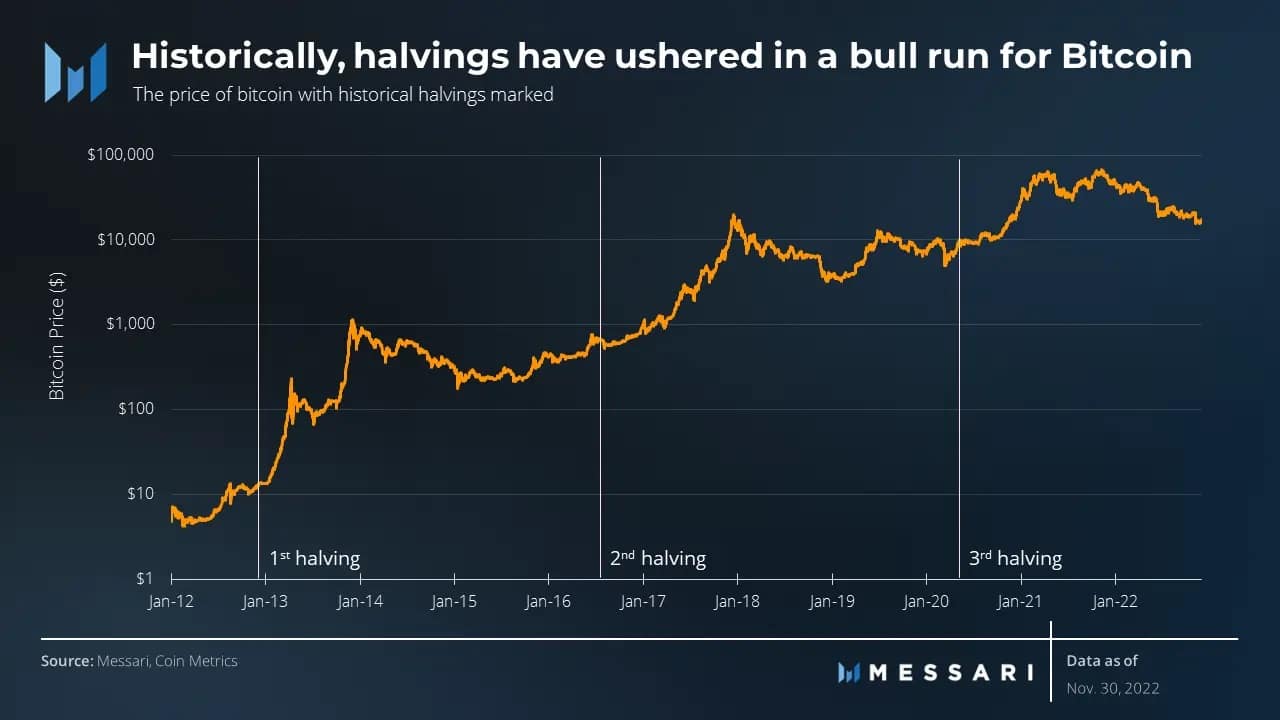

The following Bitcoin [BTC] halving, which is anticipated to happen in 2024, might affect Bitcoin holders positively. In line with a brand new report by Messari, a brand new Bitcoin halving can induce a BTC rally.

#Bitcoin‘s halvings cut back the safety expense of Bitcoin in $BTC phrases.

Via the lens of the Anticipated Demand for Safety Mannequin, it appears pure that the greenback demand for safety will not be affected by halvings, as demand for safety stays regardless of the block rewards. pic.twitter.com/K2tHbLWz30

— Messari (@MessariCrypto) December 11, 2022

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Glass ‘halve’ full

A Bitcoin halving is an occasion that happens when the reward for mining Bitcoin transactions is reduce in half. As may be seen from the picture under, halving was at all times met with a spike in costs and a momentary rally.

Though this halving might have an analogous impact on BTC’s costs sooner or later, miners may very well be affected.

Supply: Messari

Slicing Bitcoin’s rewards in half would negatively affect the already struggling mining business. In line with Glassnode, miner income had reached a one-month low on the time of writing.

📉 #Bitcoin $BTC % Miner Income from Charges (7d MA) simply reached a 1-month low of 1.981%

Earlier 1-month low of 1.998% was noticed on 10 December 2022

View metric:https://t.co/NphJIZNcsL pic.twitter.com/haLVdFDR6C

— glassnode alerts (@glassnodealerts) December 11, 2022

The charges being paid to miners had additionally decreased and had reached a one-month low as effectively, in response to Glassnode. This decline in income and costs earlier than the halving might pose a severe menace to miners.

For mining to stay worthwhile, Bitcoin costs must soar to new heights.

Supply: Messari

Weighing the professionals and cons of Bitcoin

At press time, the outlook for Bitcoin was wanting unsure. The variety of addresses holding over one coin had reached an all-time excessive of 192,000. This steered that there was rising curiosity in Bitcoin from massive buyers.

Though massive addresses had proven their curiosity in Bitcoin, the variety of merchants going lengthy on BTC had decreased. As may be seen from the picture under, the variety of merchants who held a protracted place on Bitcoin decreased over the past month.

On 12 November, 70% of the highest merchants had gone lengthy on Bitcoin. Since then, that worth decreased and at press time, the share of merchants going lengthy on Bitcoin was 53/19%, in response to knowledge supplied by Coinglass.

Supply: Coinglass

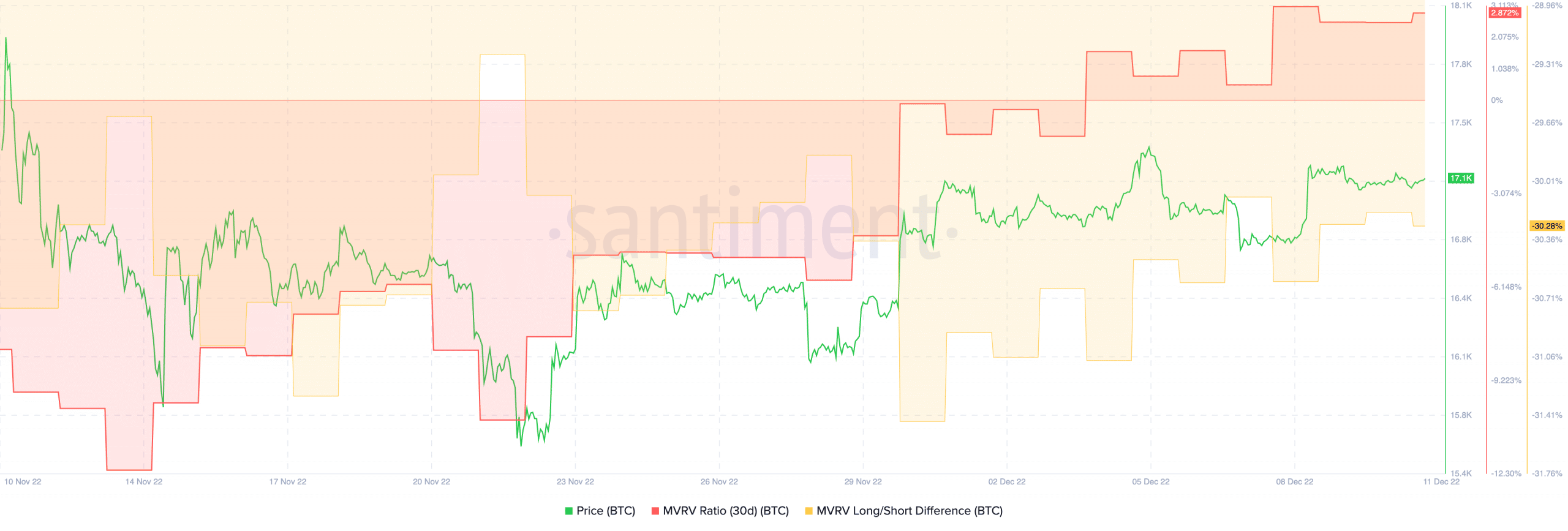

One other issue that might have an effect on BTC’s costs may very well be the motivation of short-term holders to promote their positions. Within the picture under, it may be seen that the Market Worth to Realized Worth (MVRV) ratio elevated. This implied that promoting BTC at press time would generate a revenue.

Though long-term holders and maximalists weren’t inclined to promote, a declining lengthy/quick distinction confirmed that short-term holders would revenue from this commerce. If short-term sellers succumb to the promoting stress, it might result in a slight depreciation of Bitcoin’s costs within the close to future.

Supply: Santiment