- Bitcoin miners face the warmth as promoting strain rises

- Each day exercise and velocity declines, nonetheless, retail traders present religion

Bitcoin miners have been a kind of sections of the crypto group who have been impacted massively by the crypto winter, because of the promoting strain. Based on the founding father of Capriole Fund, Charles Edwards, the rise in miners’ stress may additionally paint a destructive outlook for the king coin in the long run.

We’re seeing the third highest Bitcoin Miner promoting of all time. The extent of Bitcoin miner stress immediately is seconded solely by 2 different events. The two different instances? Bitcoin was simply $290 and, get this… $2.10! pic.twitter.com/tKmKiAh8jO

— Charles Edwards (@caprioleio) November 30, 2022

Learn Bitcoin’s [BTC] Value Prediction 2022-2023

A spike in miners’ strain has all the time led to a value drop up to now. If the miner strain continues to say no, there’s a chance that BTC’s costs would drop even additional. Quick sellers may thus reap the benefits of this chance.

Supply: Twitter

The miner’s dilemma

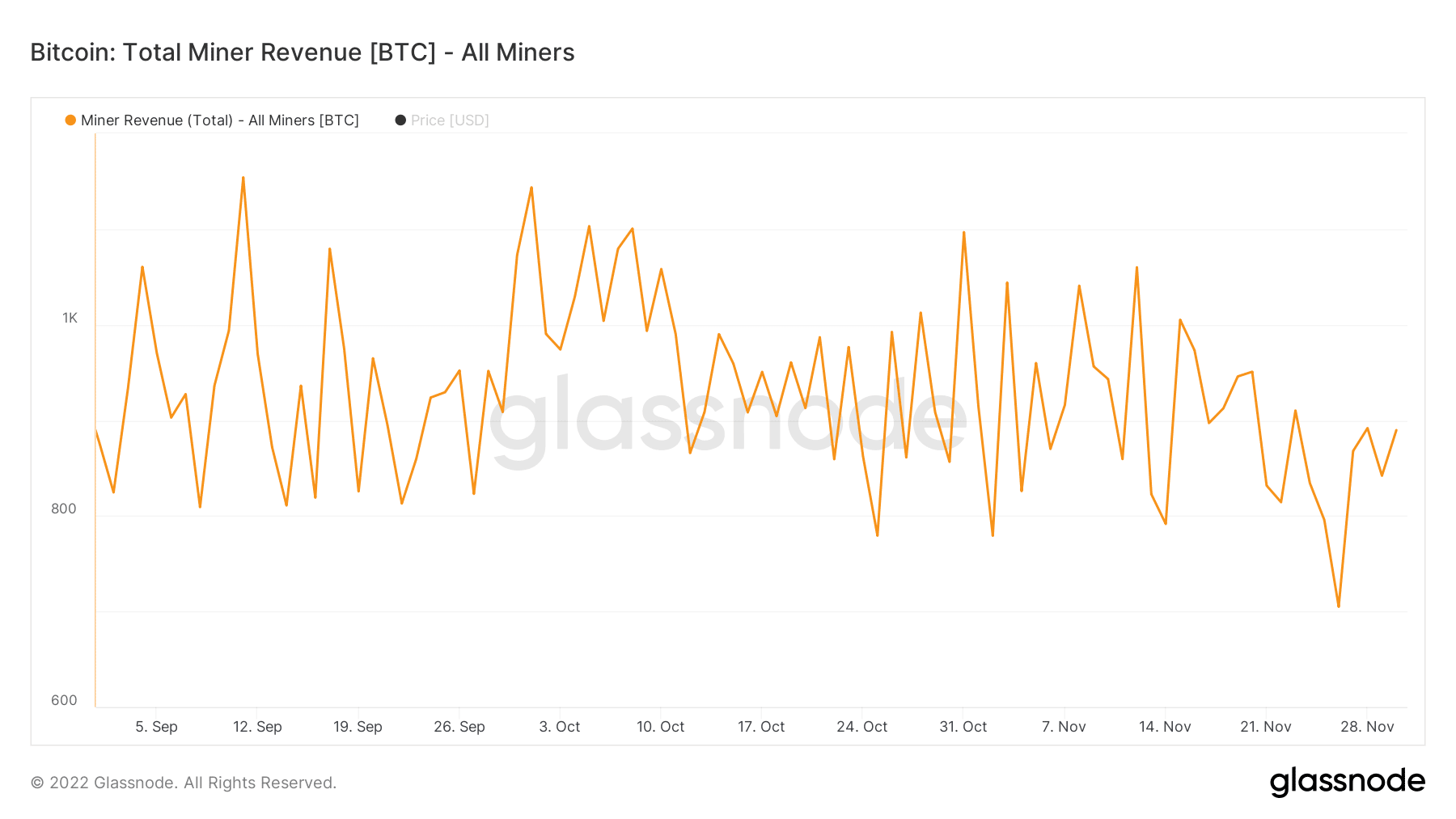

One motive for the rising promote strain on miners could be the declining miners’ income. As could be seen from the picture under, the miner income for Bitcoin declined considerably during the last two months.

This decline in income has been forcing miners to promote their BTC to make a revenue. Bitcoin’s hashrate, alternatively, continued to extend in keeping with knowledge supplied by Messari.

A rising hashrate indicated that it might take extra computational effort for miners to mine Bitcoin. Coupled with rising power prices, it might be very troublesome for miners to remain worthwhile beneath these circumstances.

Supply: Glassnode

Traders’ continued hope in Bitcoin

Regardless of these bearish indicators, retail traders continued to indicate religion in Bitcoin. Based on knowledge supplied by Glassnode, the variety of addresses having greater than 0.1 Bitcoin reached an all-time excessive on 1 December. Together with that, the variety of addresses holding greater than 10 cash additionally reached a 22-month excessive.

📈 #Bitcoin $BTC Variety of Addresses Holding 0.1+ Cash simply reached an ATH of 4,096,393

Earlier ATH of 4,096,121 was noticed on 30 November 2022

View metric:https://t.co/hZY8dBLpzX pic.twitter.com/hdzVvBYmY1

— glassnode alerts (@glassnodealerts) December 1, 2022

Sadly, massive addresses holding over a thousand cash have been noticed to be exiting their positions.

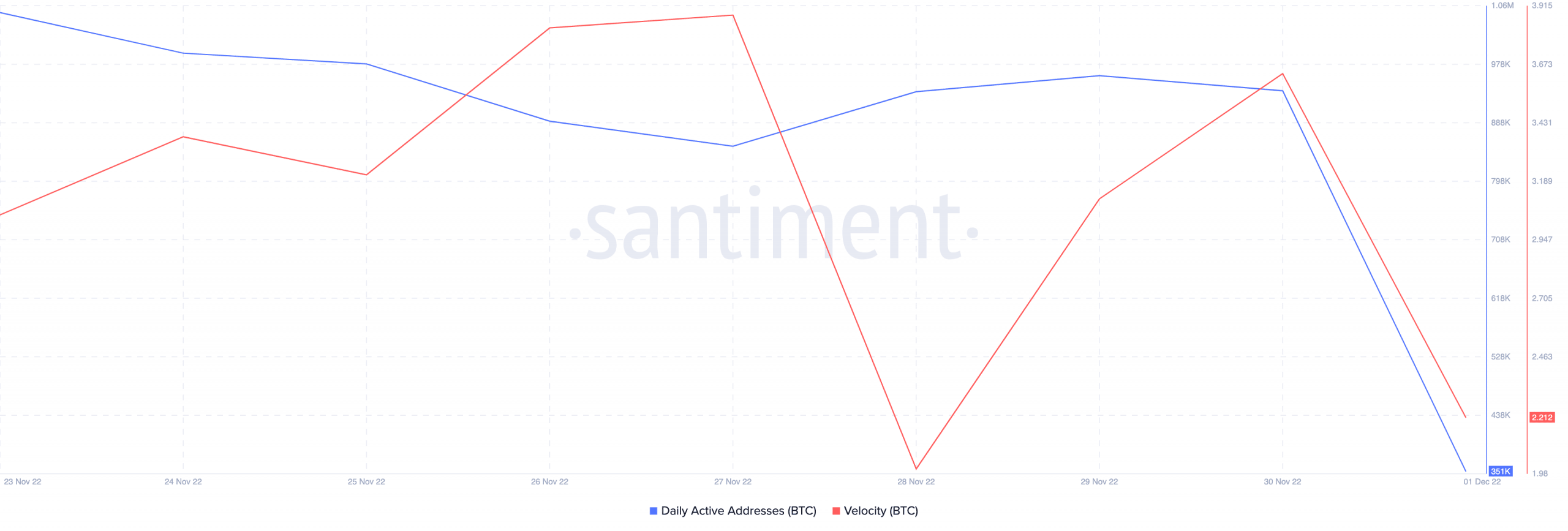

By way of on-chain metrics, Bitcoin witnessed a drop in exercise. Its each day lively addresses noticed a decline over the previous few days. Together with that, Bitcoin’s velocity additionally took successful. Thereby, suggesting that the frequency at which BTC was being traded had declined immensely.

Supply: Santiment

It stays to be seen whether or not Bitcoin will succumb to the strain and drop additional by way of value.

Nevertheless, at the time of writing, the ratio of longs to shorts was 0.96, suggesting that there have been extra individuals shorting Bitcoin within the final 24 hours, according to Coinglass.