Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation

- Bitcoin sees hefty outflows from exchanges to recommend an accumulation section

- A revisit to the month-long vary lows may current merchants with a chance

Tether Dominance has slowly elevated all through 2022. This meant that over the 12 months, the stablecoin occupied increasingly of the complete crypto sphere’s market capitalization. This metric’s positive factors since June highlighted how traders fled from holding crypto to staying in fiat.

Bitcoin itself has been in a downtrend from the $67k mark final 12 months. This downtrend wasn’t about to finish simply but.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Hypothesis that Bitcoin neared its backside within the markets was seen throughout social media. Others felt the sins of FTX may see the complete trade bleed for years. December noticed Bitcoin precariously perched atop $17k, but it surely could possibly be time for an additional transfer downward.

Bitcoin exhibits bearish momentum on the day by day chart with assist at $15.6k

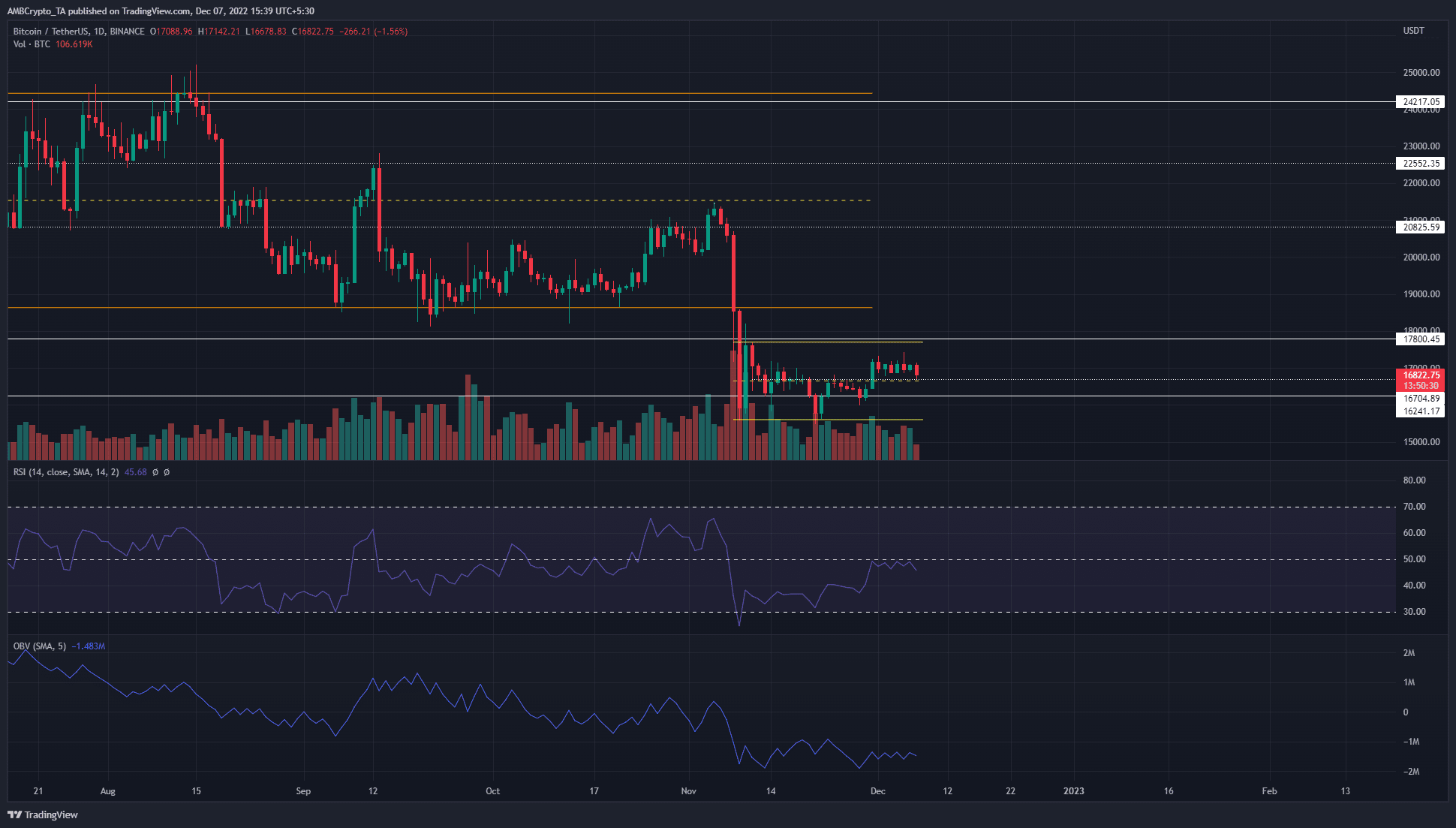

Supply: BTC/USDT on TradingView

Over the previous month, BTC traded inside a variety (yellow) from $15.6k to $17.7k. The mid-point lay at $16.6k and has served as an necessary stage up to now month. At press time, the Relative Power Index (RSI) was beneath impartial 50 whereas the On-Stability Quantity (OBV) didn’t possess any development just lately. Since August, the OBV has been in a downtrend and confirmed important promoting quantity.

From a technical standpoint, BTC has a bullish market construction. It has risen above the earlier decrease excessive at $16.6k, and retested the identical as assist. But, that doesn’t point out consumers may be .

The mid-range worth was a spot the place decrease timeframe merchants can look to bid. For higher probabilities of success, risk-averse merchants can look ahead to a transfer to the vary lows earlier than shopping for. They’ll additionally search for a sweep into $15.2k-$15.4k space and a reclaim of $15.6k, to commerce a swing failure sample.

The latest bloodshed noticed traders load up on Bitcoin, may a rally begin quickly?

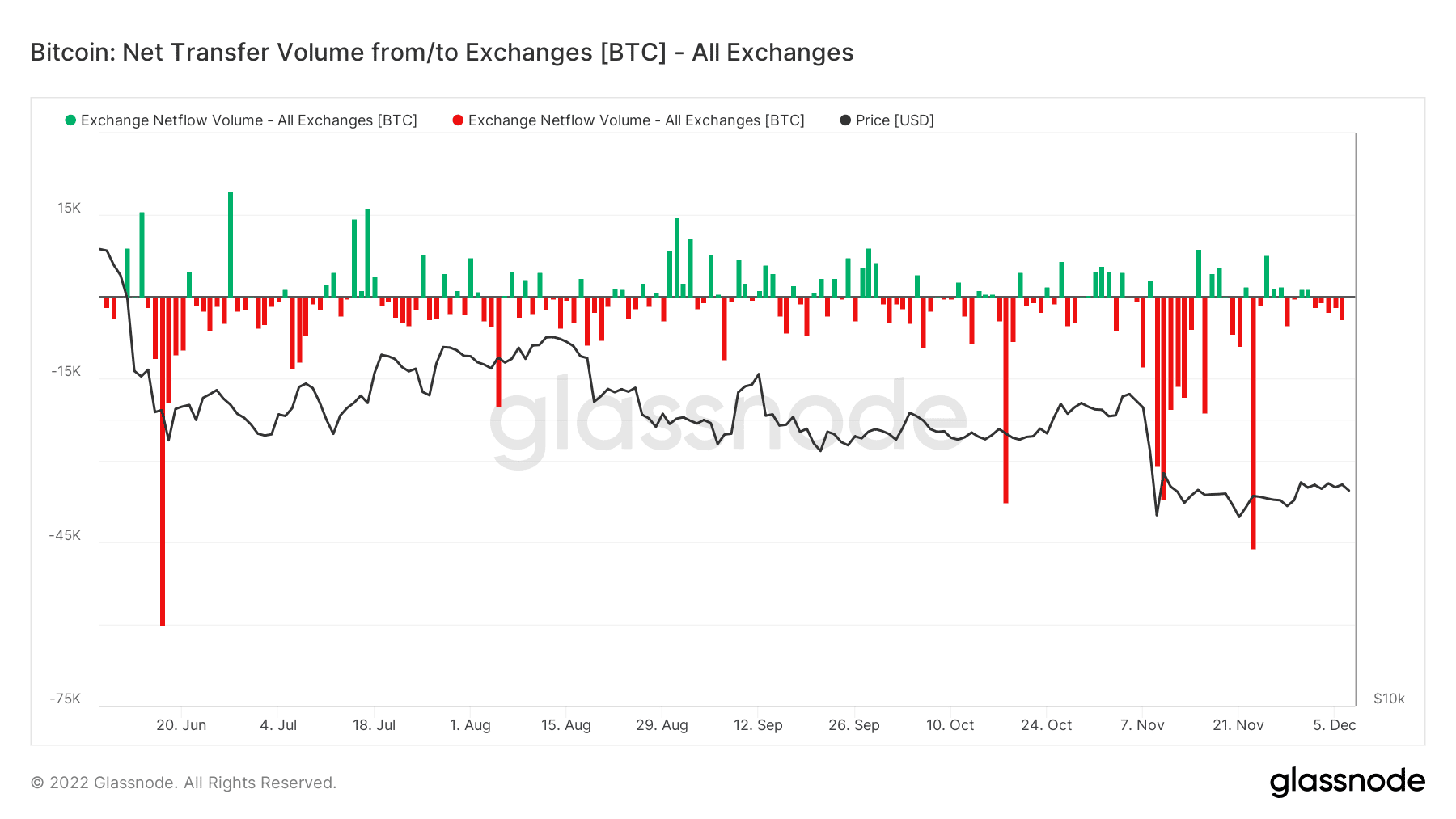

Supply: Glassnode

Glassnode knowledge confirmed that Bitcoin leaving exchanges has been a dominant development since November. This instructed that traders moved their BTC out of exchanges and sure into chilly storage. It may be a response to the FTX crash, but it surely is also a sign that consumers noticed these costs as profitable.

This knowledge by itself doesn’t assist the concept of a rally. One other drop beneath $15.6k remained a risk. But, regardless of all of the concern available in the market Bitcoin has been capable of maintain on to the $16k space. Derivatives merchants anticipating additional losses on Bitcoin have gotten their fingers scalded.

Merchants can keep on with the aforementioned vary, whereas traders should train persistence. Bitcoin may be near discovering a backside when it comes to value, but it surely could possibly be very removed from discovering a backside when it comes to time.