- Bitcoin accumulation has rallied because the collapse of FTX

- New BTC patrons have seen decrease losses than a median present BTC holder

As the final cryptocurrency market took a chew at restoration following the sudden collapse of FTX, Glassnode, in a brand new report, thought of whether or not Bitcoin’s [BTC] continued sell-offs represented a continuation of the bearish development. Was there a deeper psychological shift amongst BTC traders?

Learn Bitcoin [BTC]’s Worth Prediction 2022-2023

From distribution to accumulation

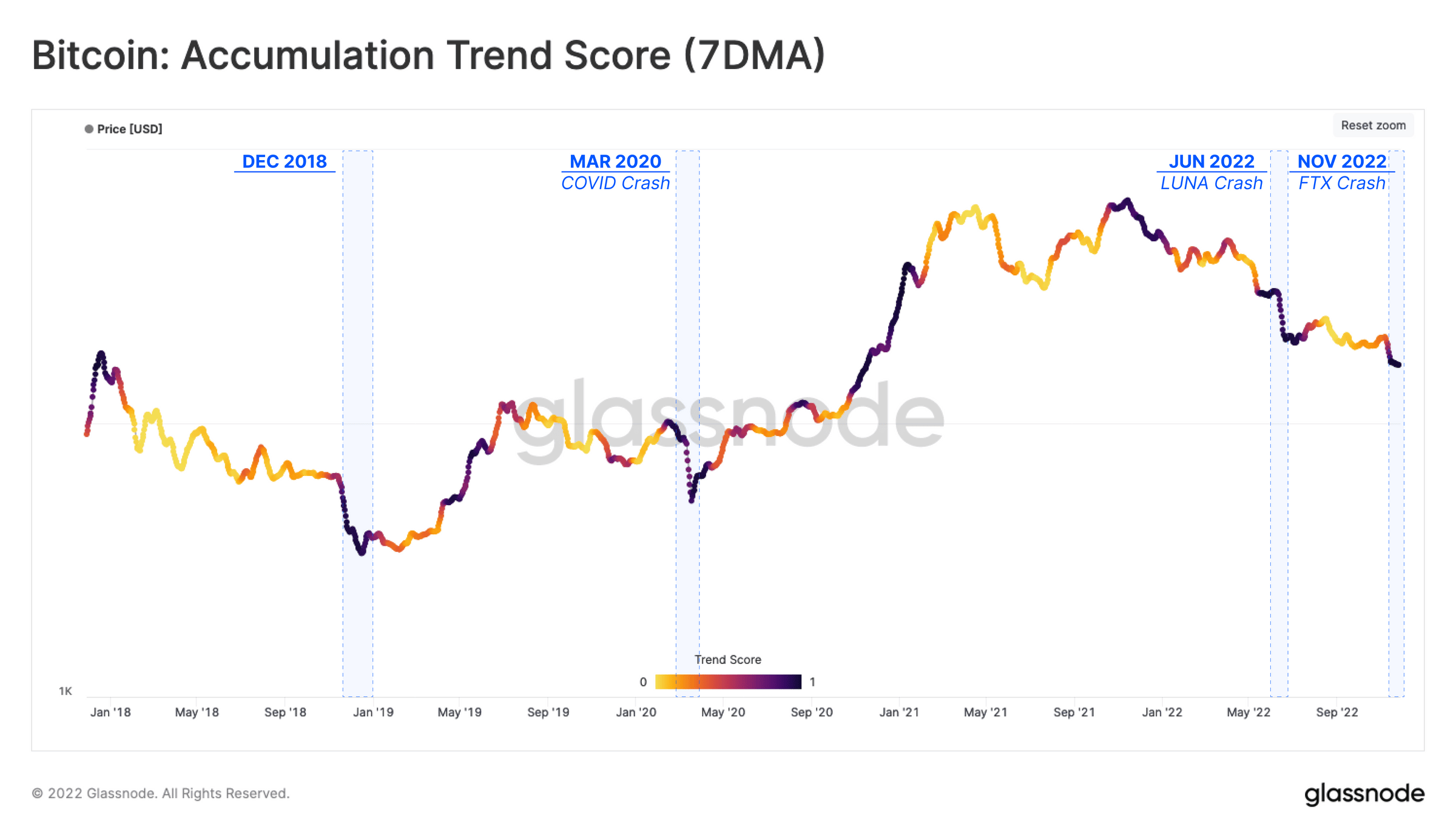

The on-chain analytics platform discovered that each one cohorts of BTC traders have pivoted in the direction of coin accumulation after the current value decline.

Glassnode assessed BTC’s Accumulation Pattern Rating metrics and located that the current surge in accumulation following the numerous sell-offs may very well be linked to 2018.

This behavioral shift has additionally adopted many main sell-off occasions, such because the March 2020 COVID crash, Could 2022’s LUNA collapse, and June 2022, when the worth first fell beneath $20,000.

Supply: Glassnode

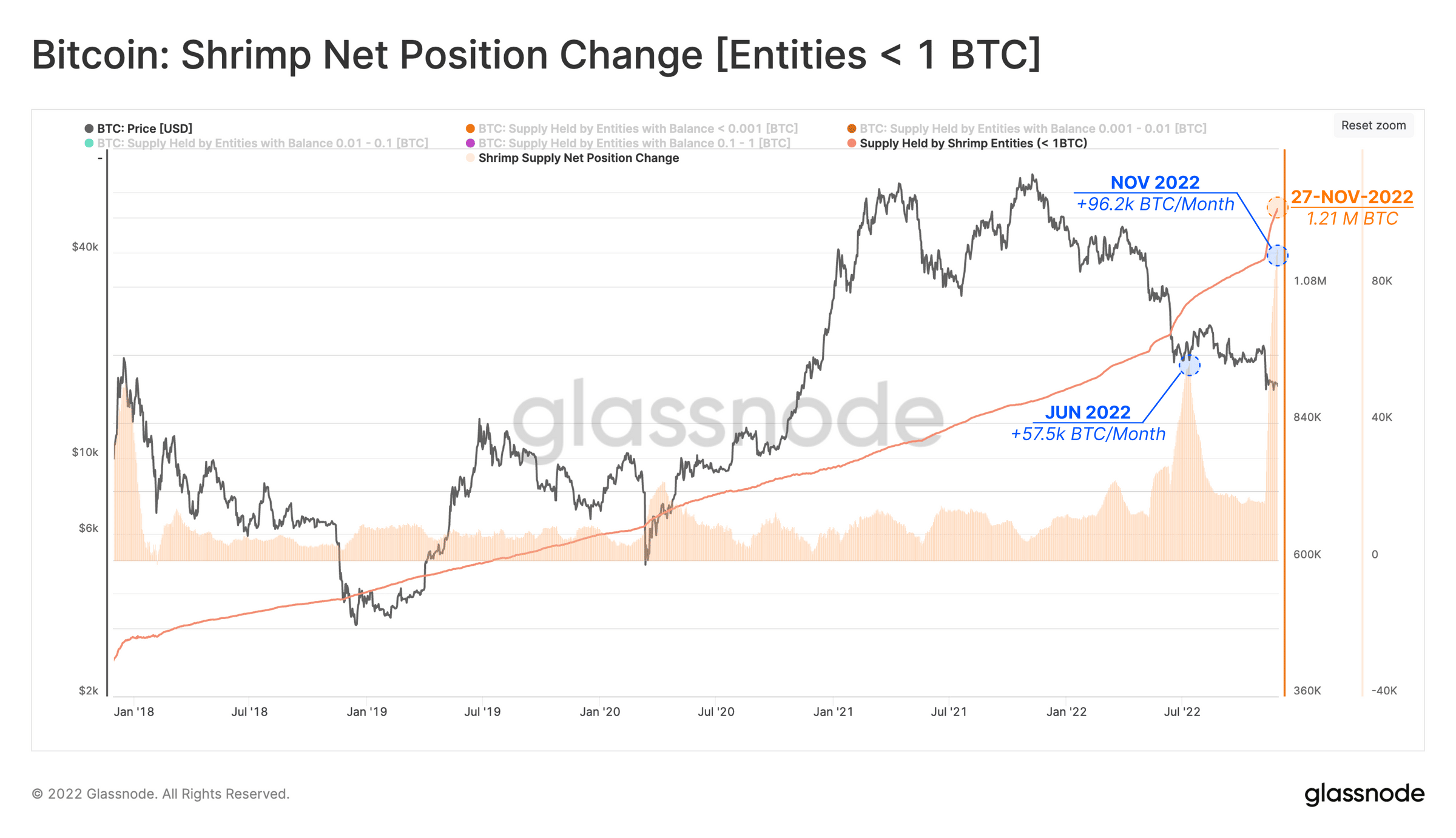

An investor cohort that completely exemplifies the buildup development is holders of lower than one BTC, often known as shrimps. Based on Glassnode, this class of traders has,

“…recorded two distinctive ATH waves of stability enhance over the past 5 months. Shrimps have added +96.2k BTC to their holdings because the collapse of FTX and now maintain over 1.21M BTC, equal to a non-trivial 6.3% of the circulating provide.”

Supply: Glassnode

The destiny of latest Bitcoin patrons

Glassnode went additional to evaluate the state of latest BTC investments following the FTX debacle. By observing the connection between the price foundation of Quick-Time period Holders and the Spot Worth, which was at $18,830k, Glassnode discovered that “the typical current purchaser is underwater by -12%.”

Whereas noting that new patrons had a superior entry level to the typical holder, Glassnode discovered that sellers approached exhaustion within the present BTC market, and heavy distribution was met with an equal proportion of accumulation. This, in response to Glassnode, drove the STH Value Foundation beneath the Realized Worth, placing new patrons .

Historical past within the making

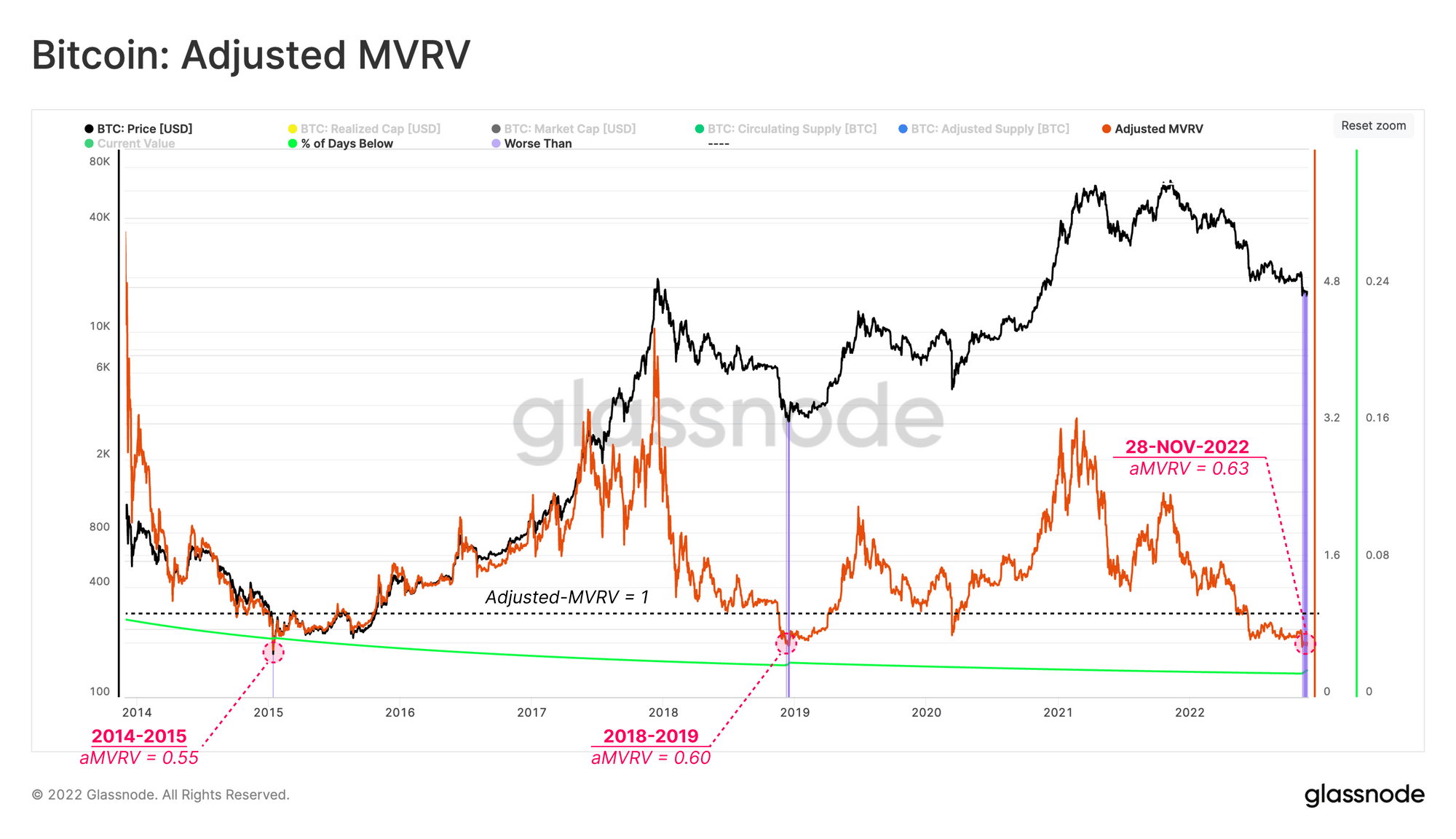

A have a look at BTC’s Adjusted MVRV Ratio revealed that the present BTC market was at its lowest “because the close to pico-bottom set in Dec 2018 and Jan 2015.” At any time when this metric is lower than one, it signifies that the energetic market is in an combination loss.

Glassnode discovered that this metric returned to a price of 0.63, “which could be very important since just one.57% of buying and selling days in bitcoin historical past have recorded a decrease Adjusted MVRV worth.”

Supply: Glassnode

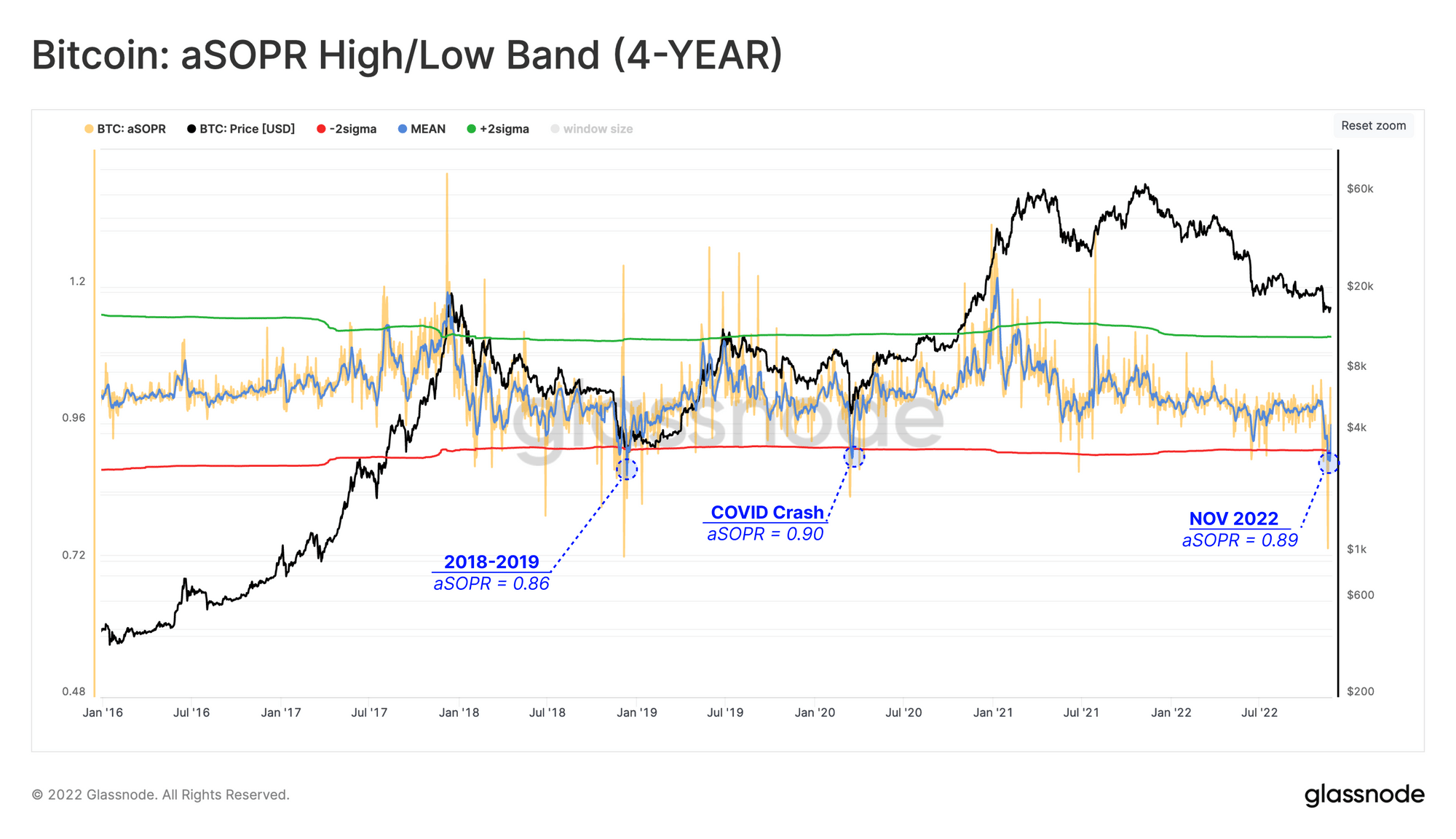

An evaluation of BTC’s aSOPR metric additionally revealed that “realized losses have additionally been historic in magnitude.” Based on Glassnode,

“The current market response to the FTX sell-off manifested as an aSOPR studying which broke beneath the low band for the primary time since March 2020. The importance of this occasion is once more solely comparable with the COVID crash and the capitulation of the market in December 2018.”

Supply: Glassnode