Following Bitcoin’s [BTC] current resurgence above $21,000, it was not out of the query that buyers might need heaved a sigh of reduction. Nonetheless, the solace would possibly solely final for a brief interval. This assertion was as a result of the sign on-chain appeared to correlate with the bearish drawdown of the previous.

Right here’s AMBCrypto’s Value Prediction for Bitcoin [BTC] for 2023-2024

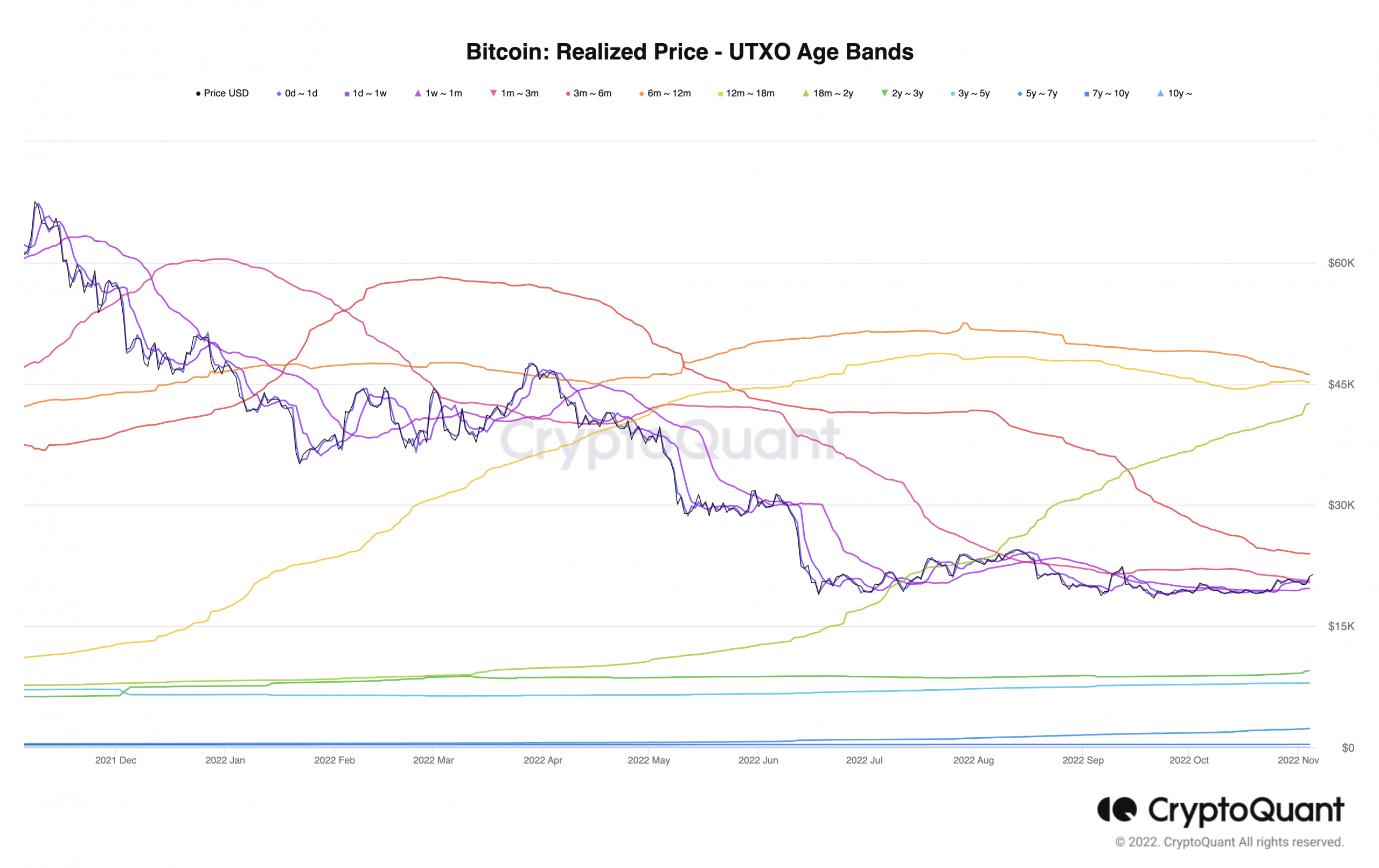

In response to CryptoQuant analyst, Chartoday, Bitcoin has been reacting similarly per the one-week and one-month band of the 2018 capitulation. Laying causes for his declare, the analyst referred to the Unspent Transaction Output (UTXO). The analyst famous that the UXTO state had damaged the one-month and one-week bands. Per the occasions of 2018, Bitcoin capitulated to $6,000.

Supply: CryptoQuant

On assessing the Bitcoin realized worth per the UXTO above, CryptoQuant revealed that the holding conduct of the latest age distribution contrasted with that of the long-term devoted. Primarily based on the pattern, the present age bands had been in defiance of shifting their lively provide. In flip, these holders had been stalling progress. Because of this conduct, BTC confronted the specter of falling into bearish wishes.

Decoding the probabilities

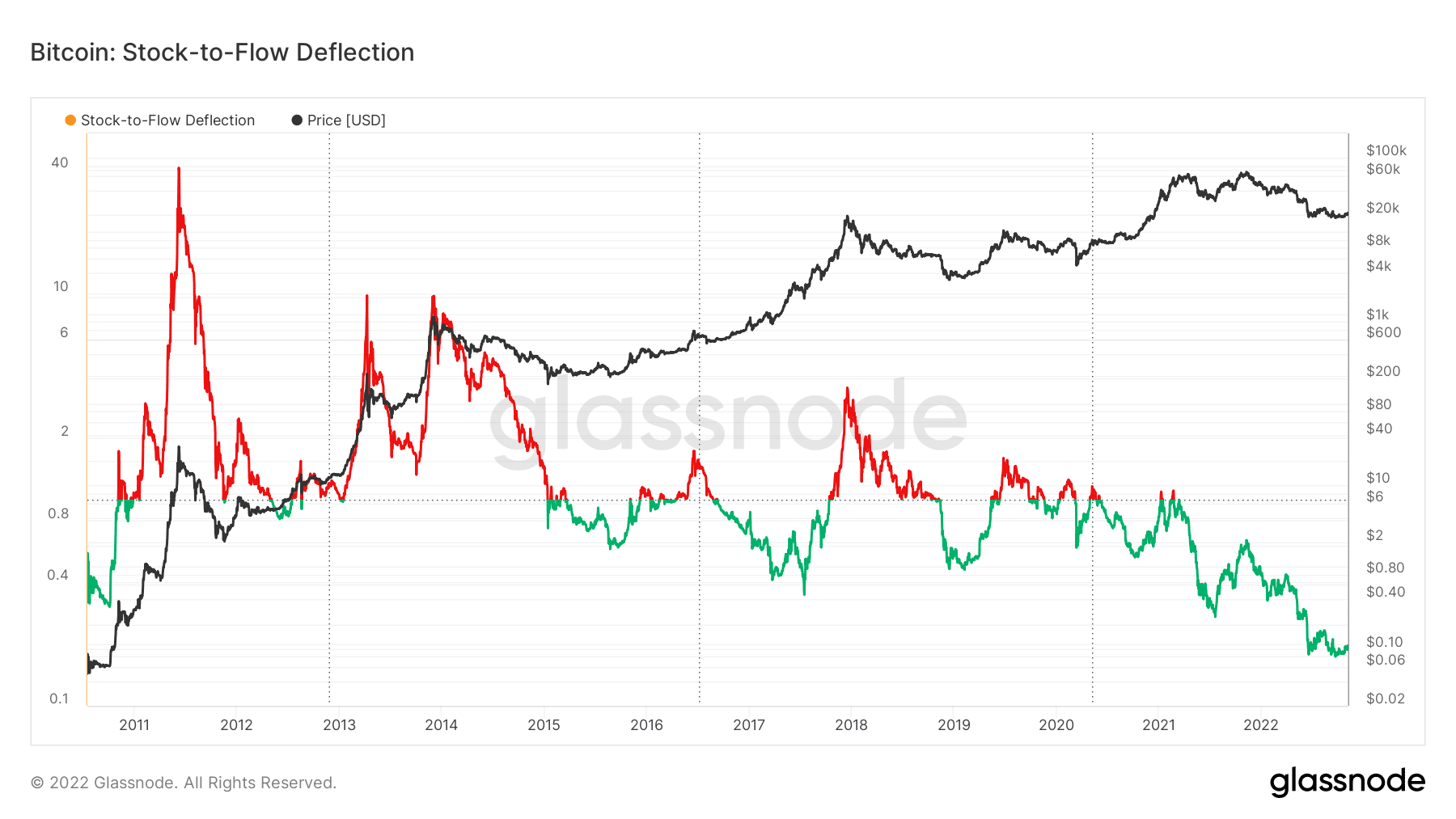

Nonetheless, a facet of the Bitcoin’s on-chain information that appeared to disagree with the take was the stock-to-flow deflection. In response to Glassnode, BTC’s stock-to-flow deflection was 0.189 at press time. Because the worth was nowhere near or better than 1, BTC was assumed undervalued. Therefore, the probabilities of capitulating additional at this state had been minimal.

Supply: Glassnode

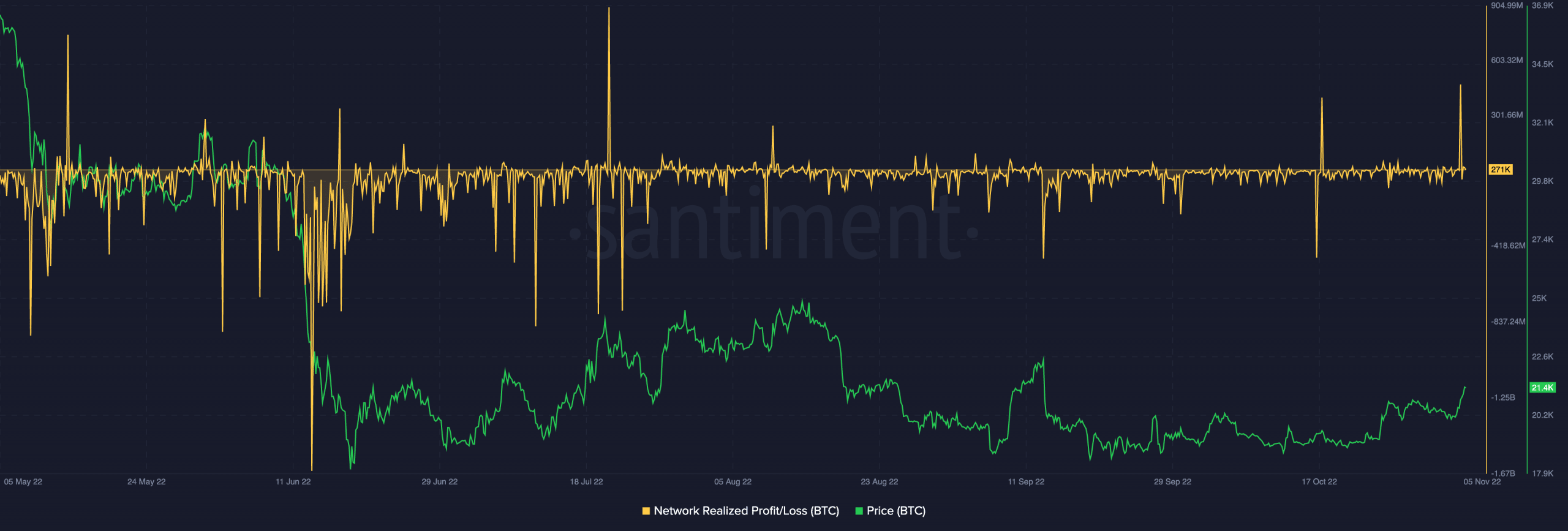

Be that as it might, had been there different metrics that indicated a probable fall off the charts? Indicators from the community realized revenue and loss aligned with the stock-to-flow indicators. Primarily based on Santiment information, the community realized revenue and loss at 271,000, confirmed that the combination market sentiment was primarily optimistic.

As well as, this state revealed that there had been extra capital inflows. Regardless of the highs, buyers would possibly must train warning. This was as a result of rising peaks of the realized revenue or loss may recommend a transfer to the promote possibility. It is perhaps worse if demand decreased and short-term buyers actively started taking income.

Supply: Santiment

In a case the place the demand shrinks and the UXTO stays in the identical state, BTC may succumb to the urge from bears.

Will BTC give up?

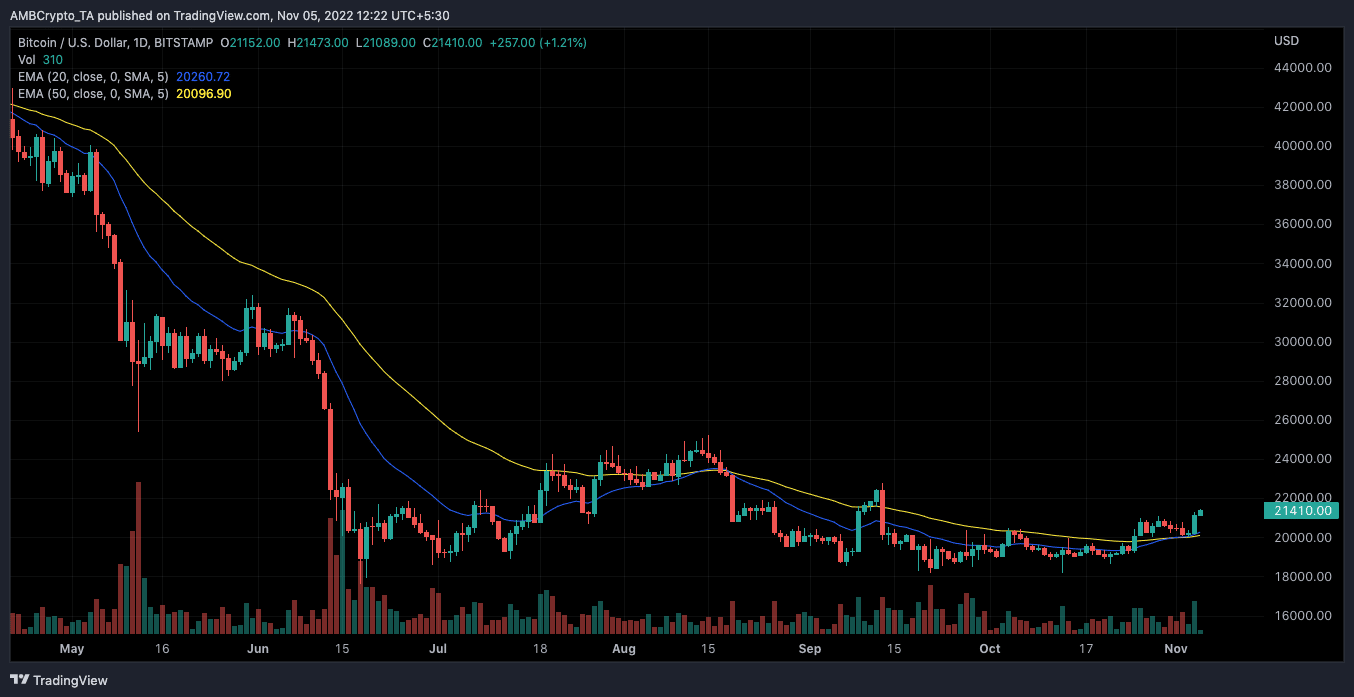

Whereas the indicators couldn’t be ignored, it didn’t appear to be Bitcoin was ready to assist the bearish momentum change into a actuality. At press time, the every day chart revealed that the short-term Exponential Transferring Averages (EMAs) had been in a misplaced battle for relevance.

Primarily based on indications from the chart, the 20 EMA (blue) and 50 EMA (yellow) had been virtually on the identical spot. Regardless of the Bitcoin worth rising above these ranges, the present place indicated that the king coin was susceptible to a reversal or consolidation between $20,000 and $21,000.

Supply: TradingView