Because the Bitcoin worth reached a brand new yearly excessive of $31,840 final week, solely to invalidate the bullish breakout inside a couple of hours and fall in the direction of $30,000, there was an odd tranquility out there. Already since June 23, BTC has been within the buying and selling vary between $29,800 and $31,300, with each breakout try and the upside and draw back having failed inside a really brief time frame.

Nevertheless, one of the outstanding technical indicators, the Bollinger Bands, predict that this calm could quickly be over. Created by the esteemed dealer John Bollinger, these bands present invaluable insights into market volatility and potential worth ranges.

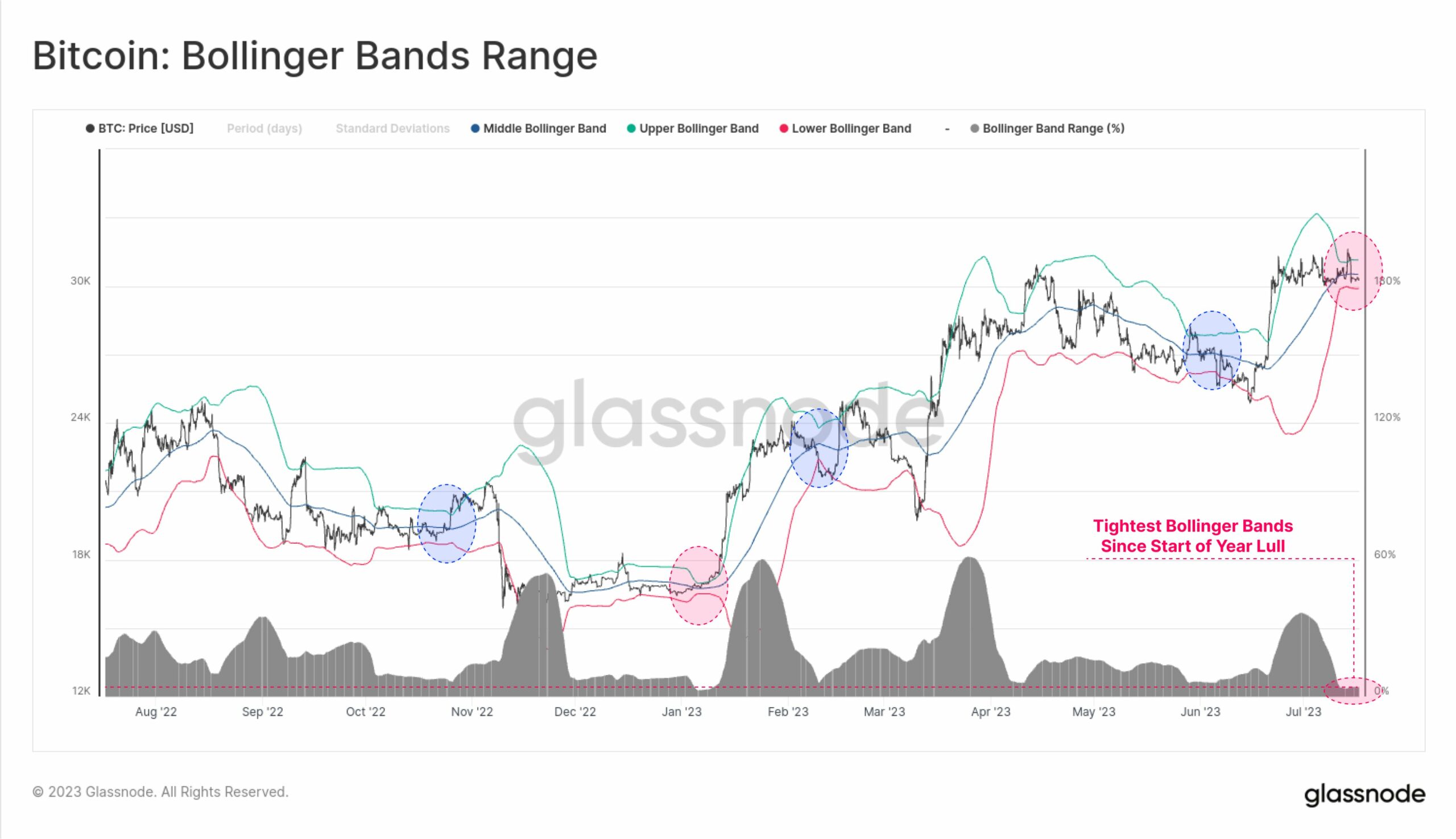

Bollinger Bands Predict Huge Transfer For Bitcoin

The Bollinger Bands encompass three distinct traces on a worth chart: the center band, the higher band, and the decrease band. The center band is a straightforward shifting common (SMA) that represents the typical worth over a specified interval. The higher and decrease bands are derived from the center band, with the higher band often set two normal deviations above the SMA, and the decrease band set two normal deviations beneath it.

The first function of the Bollinger Bands is to measure market volatility. When the worth of an asset experiences vital fluctuations, the bands widen, indicating elevated volatility. Conversely, in periods of diminished worth motion, the bands contract, indicating decrease volatility. This contraction is usually known as a “squeeze,” the place the higher and decrease bands come nearer collectively, forming a narrowing worth channel.

When the Bollinger Bands squeeze, the potential for a big worth motion looms. The squeeze means that the market is in a state of non permanent equilibrium, akin to a coiled spring able to launch its saved vitality. The path of the breakout determines whether or not it’s a bullish or bearish sign.

Up Or Down?

Glassnode, a revered on-chain knowledge supplier, highlighted at present the present state of the Bitcoin market, noting a remarkably low volatility setting. The 20-day Bollinger Bands are experiencing an excessive squeeze, with a mere 4.2% worth vary separating the higher and decrease bands. This means that Bitcoin is at present in a interval of restricted worth motion, “making this the quietest Bitcoin market for the reason that lull in early January.”

As Bitcoin traders could bear in mind, the Bollinger Bands squeeze in January marked the top of a prolonged downtrend. After the FTX collapse, the BTC market was in a state of shock paralysis, which was in the end resolved by Bollinger Bands squeeze, resulting in a 42% worth enhance in 26 days.

The Bollinger Bands’ squeeze, mixed with diminishing buying and selling volumes, creates a situation of mounting strain within the Bitcoin market. As buying and selling quantity declines, the potential vitality saved on this coiled spring intensifies.

In response to the analysts at CryptoCon, the bullish situation is the one to be favored in the mean time. “When Bitcoin volatility will get low in a bear market, it’s very bearish. When volatility will get low in a bull market, it’s insanely bullish,” the analysts say. As Bitcoin is unanimously seen to be initially of a brand new bull market, a powerful transfer to the upside may very well be in retailer.

Featured picture from iStock, chart from TradingView.com