Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- The bias gave the impression to be firmly bearish on the each day chart

- Decrease timeframes additionally confirmed robust bearish sentiment

Optimism [OP], at press time, was buying and selling close to its lowest level, a degree it reached on 5 March. Following the weekend dump, the value bounced to the $2.5-zone however confronted rejection round that space of resistance. The bounce in value coincided with the replace that Optimism just lately shared relating to the Goerli nodes.

Learn Optimism’s [OP] Worth Prediction 2023-24

Owing to the uncertainty round Bitcoin and the sentiment throughout the market, it seems seemingly that OP may see additional losses over the subsequent two weeks. And but, one other bounce in the direction of $2.5 can’t be discounted.

A spread formation, sustained dump, or a bullish breakout for OP?

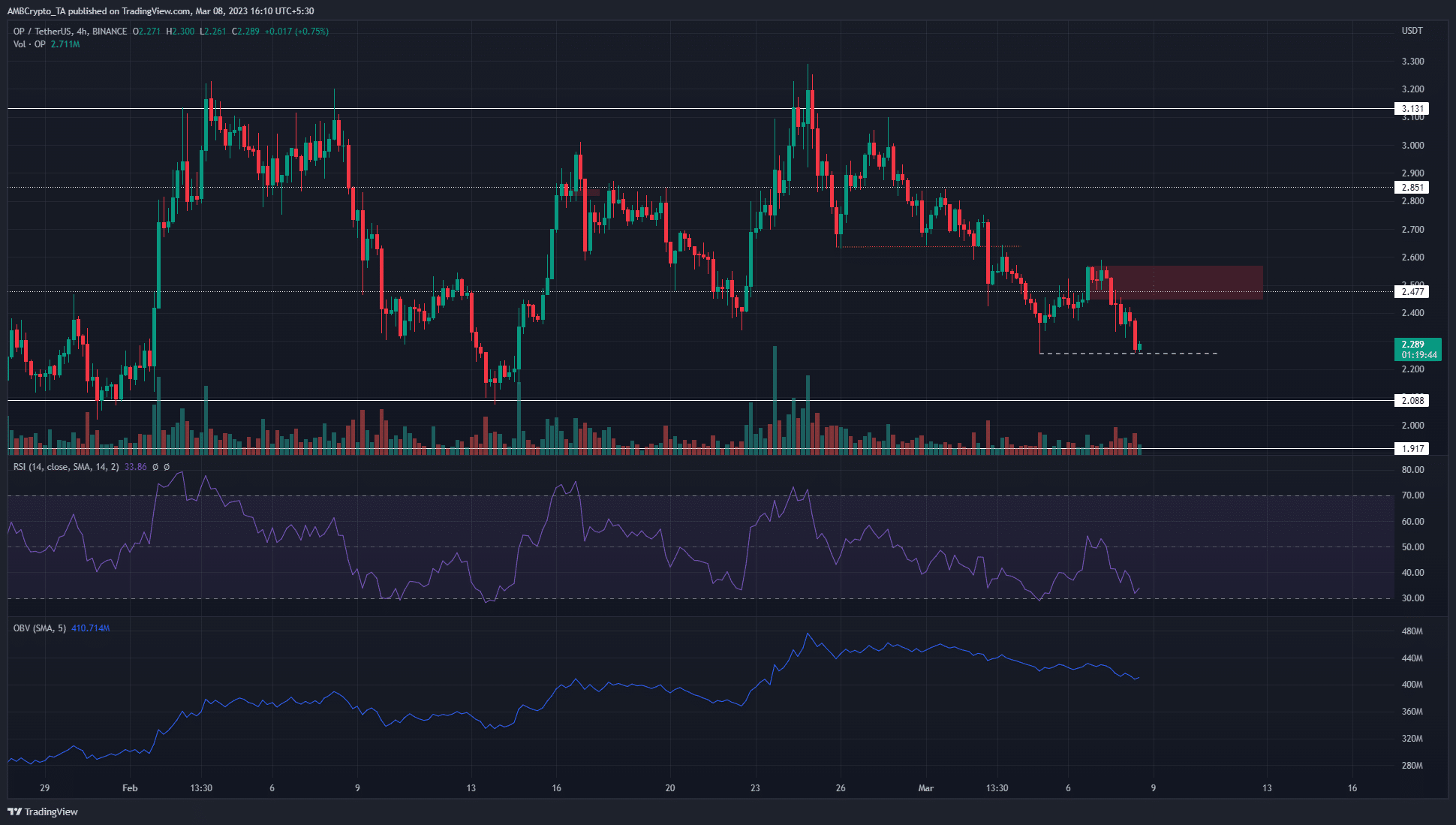

Supply: OP/USDT on TradingView

The 4-hour charts confirmed a transparent break out there construction on 3 March, when a better low on the chart was breached. The identical degree was later retested as resistance earlier than additional losses. At press time, the value sat atop the latest decrease low at $2.25, one marked by the dotted white line.

Two situations may unfold within the coming days. One was a bounce in value in the direction of the $2.5-mark to revisit the earlier bearish order block earlier than the subsequent transfer south. The following situation could be a straight drop under $2.25, one which might be indicative of aggressive promoting throughout the market.

Therefore, there are two doable trades – A extra conservative strategy could be to attend for OP to retest the bearish order block at $2.45-$2.55. A rejection from that zone may very well be used to enter a brief place, with invalidation above $2.59.

Alternatively, aggressive promoting within the coming hours may push OP underneath $2.25. In that situation, a retest of the $2.25-$2.4 area can be utilized to quick the asset. Nonetheless, the construction would solely be damaged on a transfer again above $2.59, which makes this situation riskier for merchants.

How a lot are 1, 10, 100 OP price at the moment?

The RSI was under impartial 50 on the 4-hour chart and the OBV has been on a gradual downtrend during the last ten days. This steered that promoting stress was important and will proceed to stay that approach.

To the south, $2 and $1.9 are ranges the place consumers may drive a bounce in costs and the place short-sellers can look to e-book income.

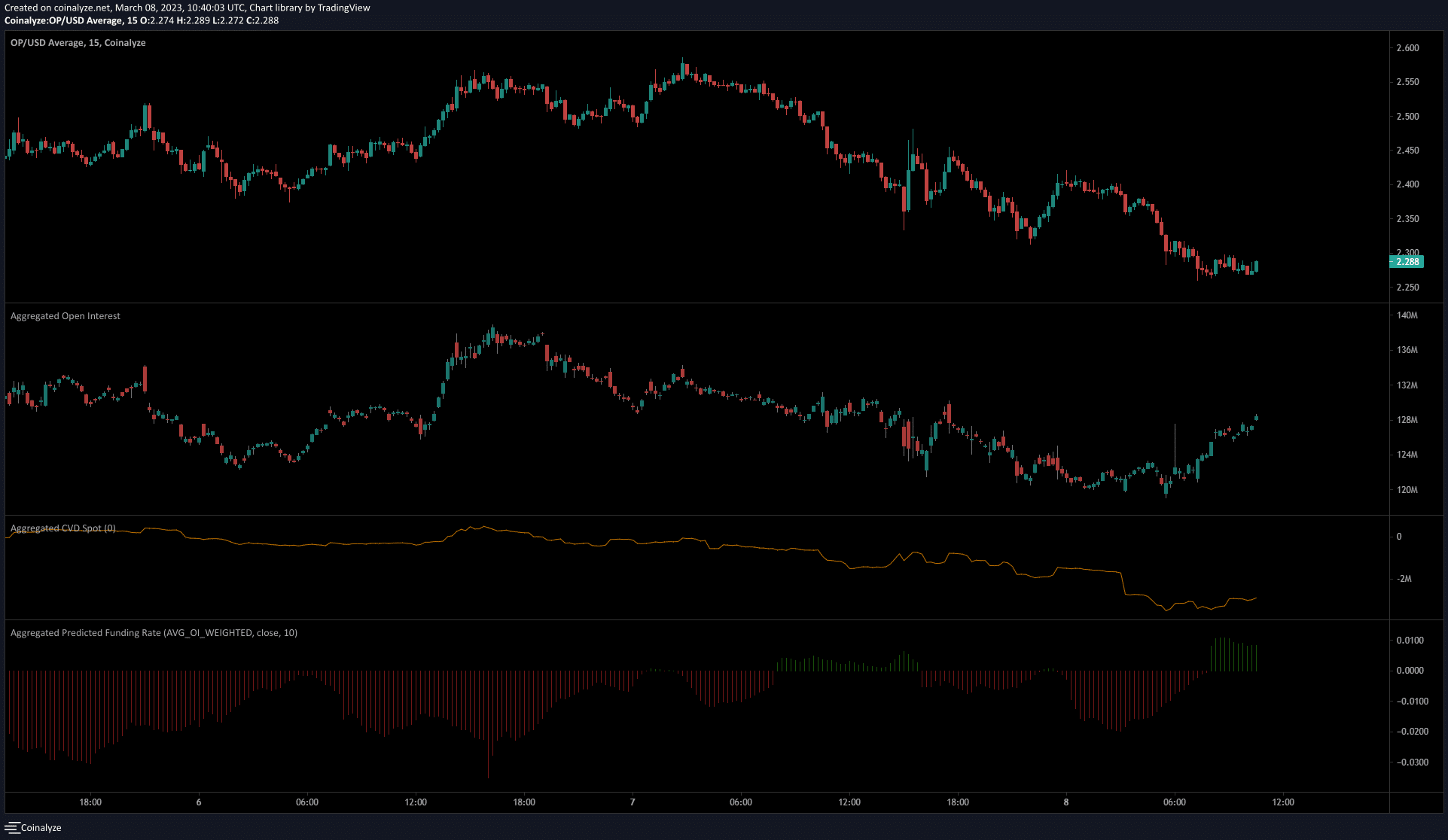

Open Curiosity steered aggressive promoting may very well be imminent

Supply: Coinalyze

The funding charge was optimistic, however that was the one brilliant spot for decrease timeframe bulls. OP registered a big hike in Open Curiosity, one which measured near $10 million over the previous few hours. Throughout that point, the value was steadily falling on the charts too.

This signalled the excessive likelihood of huge quick positions being opened and was an indication of heavy bearish sentiment. And but, the spot CVD noticed a tiny uptick over the identical interval – Proof of some pushback from the bulls.

![Calculating the odds of Optimism [OP] sliding down to $2 this week](https://ambcrypto.com/wp-content/uploads/2023/03/PP-3-OP-cover-2-1000x600.jpeg)