- Bitcoin risked main a market cap fall to $620 billion, based on an analyst

- Volatility ensured that Bitcoin remained extra balanced

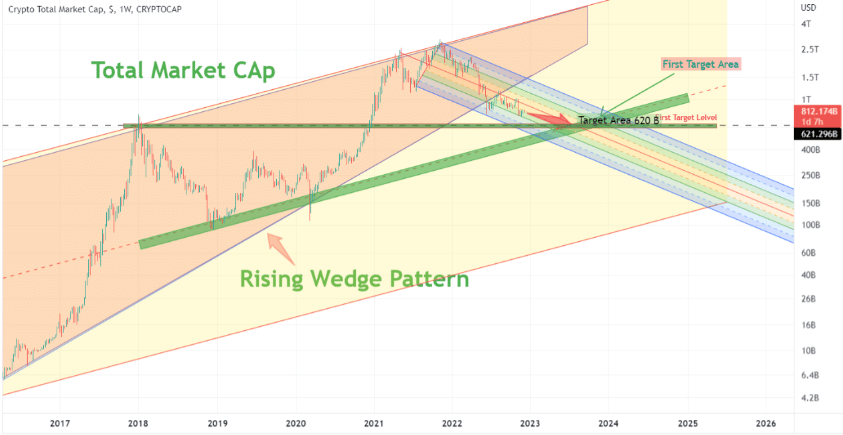

Bitcoin [BTC] traders might need one other trigger to worry as a result of the crypto market capitalization risked one other fall, CryptoQuant analyst Ghoddusifar revealed.

The analyst mentioned {that a} $1 trillion restoration shouldn’t be the short-term concern. As an alternative, traders must be distressed about the potential of your entire market cap plunging to $620 billion.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Be on guard

In keeping with Ghoddusifar, the explanation for this projection was as a result of breakdown of the rising wedge sample. Within the chart proven by the analyst, the crypto market cap misplaced assist of a possible market cap enhance. Thus, it was reverting in direction of a bearish development.

Supply: CryptoQuant

In supporting his stance, the analyst referred to earlier cycles the place the wedge break resulted in his forecasted consequence. The opinion may maintain some credibility, though the market cap was $857.66 billion at press time.

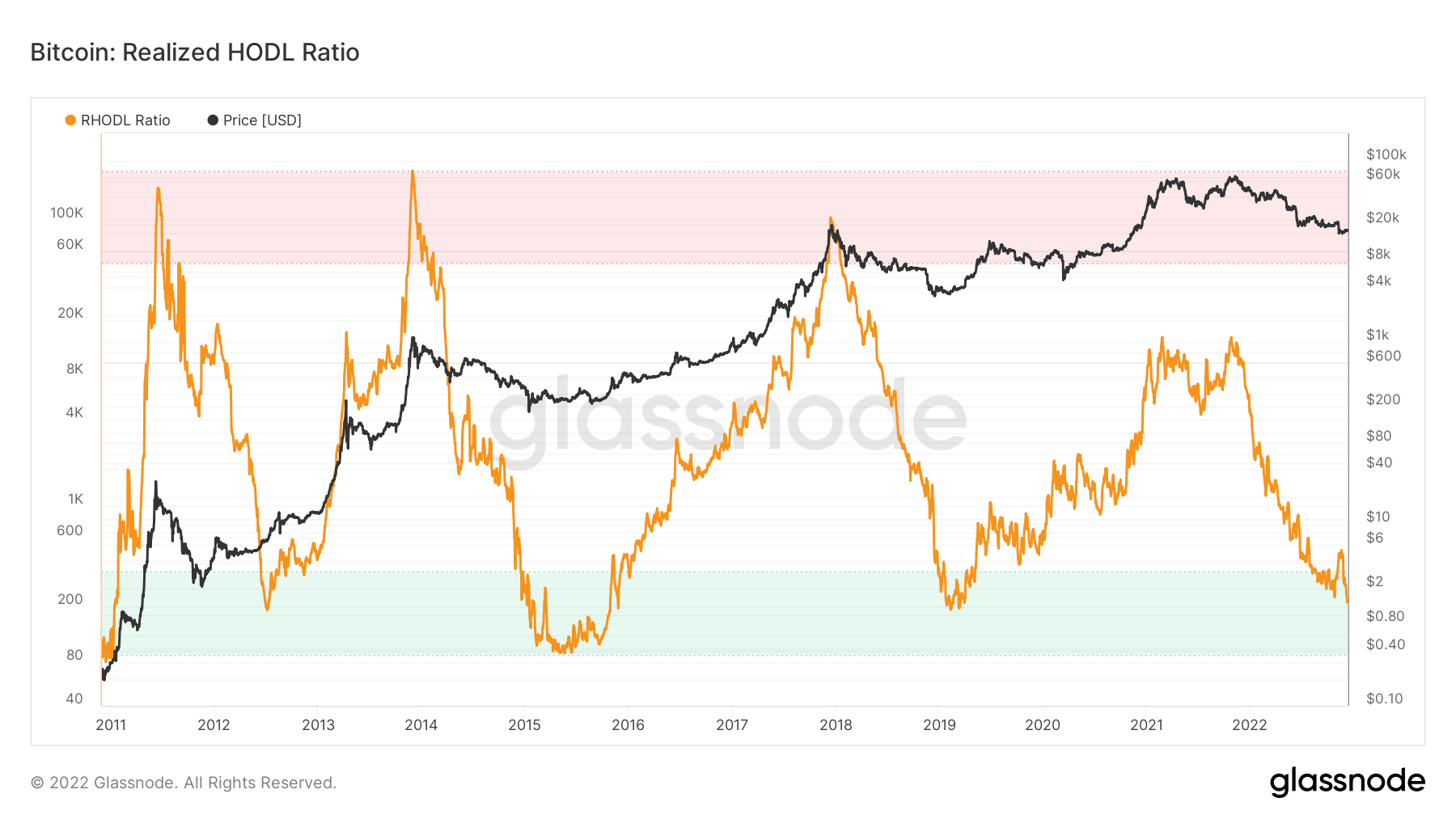

In keeping with Glassnode, the Bitcoin Realized HODL (RHODL) ratio was 242.60. For context, the RHODL ratio decided overheated market circumstances and market tops. Due to this fact, the ratio’s poor standing implied that the market was not at an overheated provide price.

Therefore, the present BTC worth was nowhere near hitting tops. Since Bitcoin had an extravagant influence on market course, this might have an effect on the additional lower of the market cap.

Supply: Glassnode

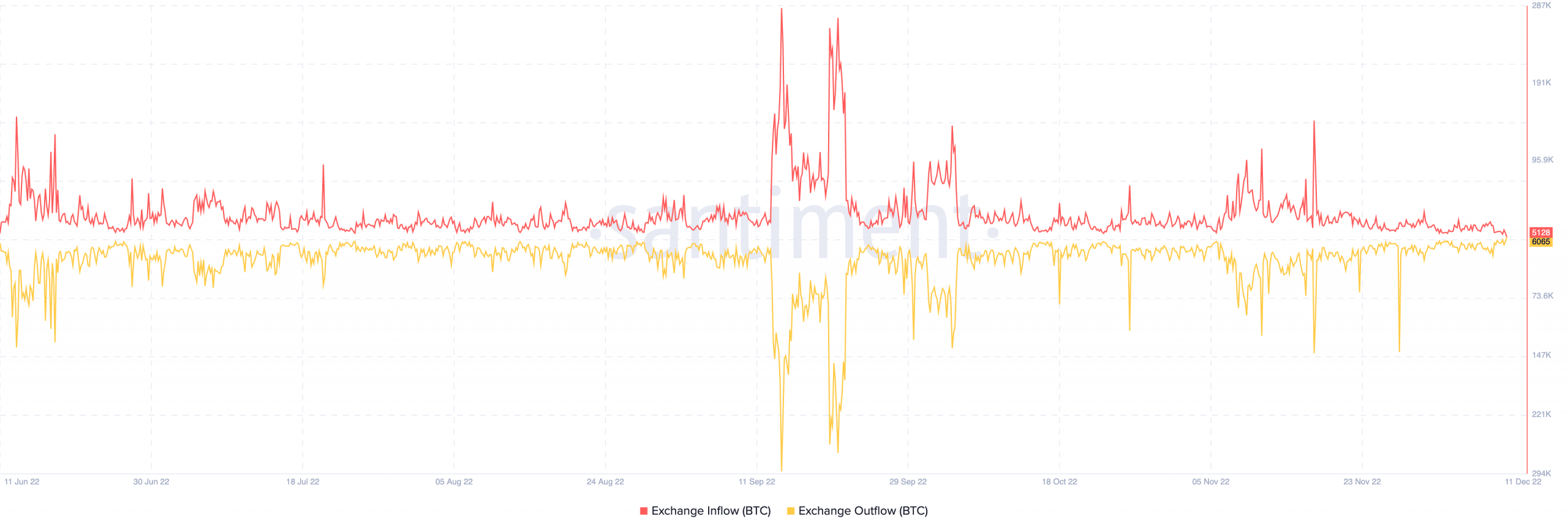

On the subject of the alternate circulation, Santiment showed that the inflow and outpouring had been at shut vary. On the time of writing, BTC’s alternate influx was 5128. In the meantime, the alternate outflow was 6065.

Since influx and outflow weren’t terribly giant, it was unlikely to count on a lightning worth development. Equally, a notable worth fall may not be imminent. So, this might assist create a stability to keep away from huge market capitulation.

Supply: Santiment

Will volatility rescue Bitcoin?

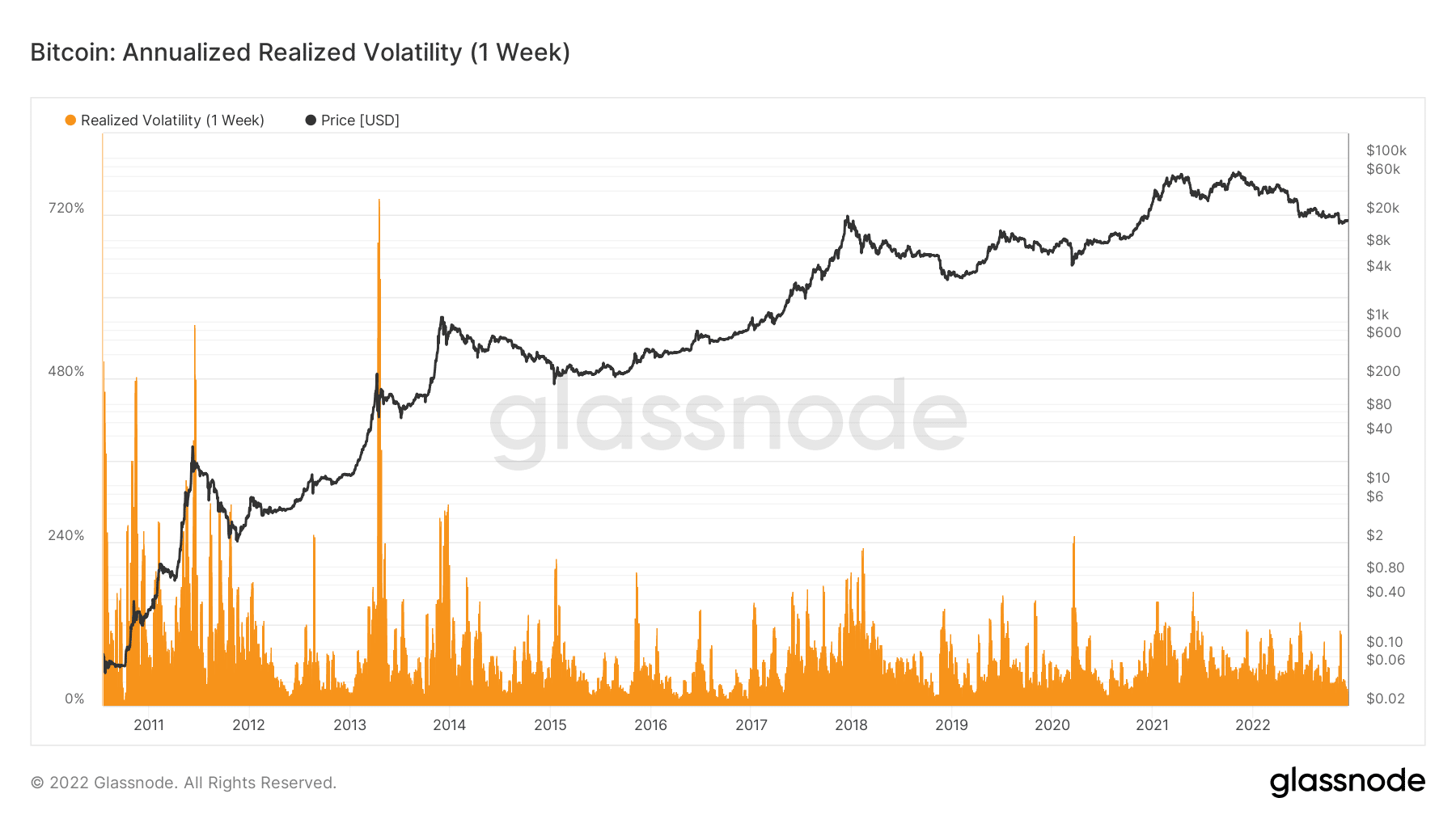

On an prolonged evaluation, Bitcoin deteriorated per its volatility. This was as a result of the one-week realized volatility, at press time, was 30.33%. At this section, it meant that the market was not in a high-risk mode. This implied that returns on volatility remained in a low state over the seven-day window, yielding solely a minimal enhance.

Supply: Glassnode

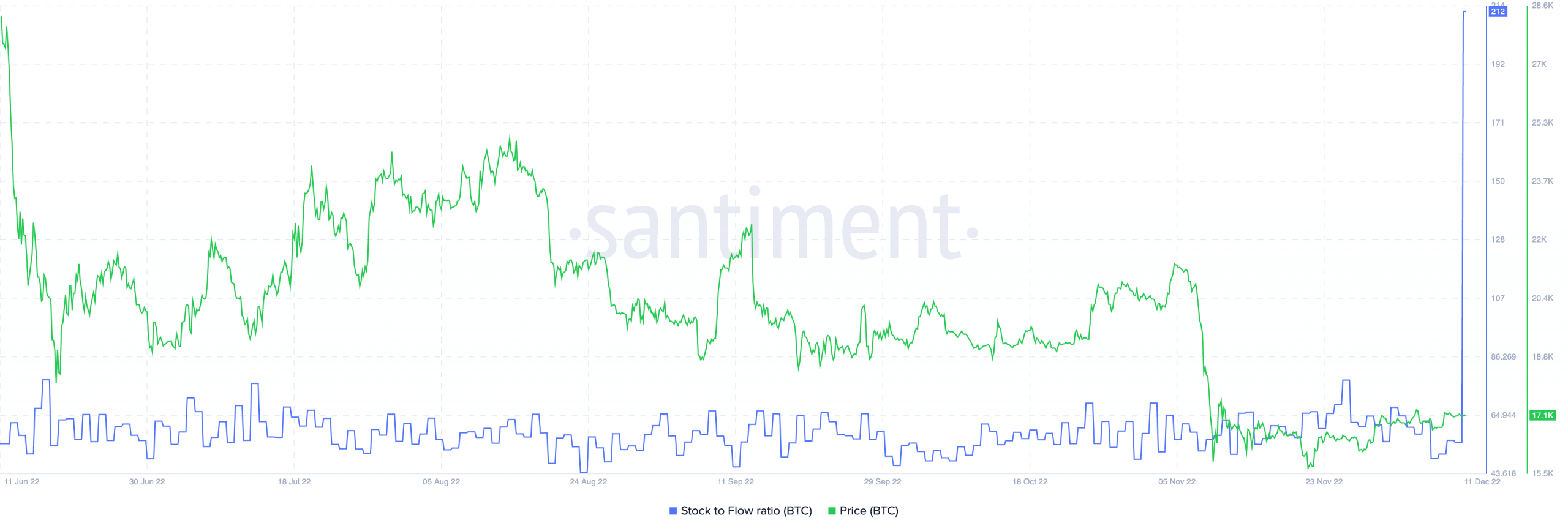

As for the stock-to-flow ratio, Santiment confirmed that BTC’ provide was in abundance. In keeping with the on-chain knowledge, the ratio had spiked to 212 — a 150% enhance from 9 December.

As in comparison with BTC’s worth, which aimed to stay above $17,000, the stock-to-flow confirmed improved minting.

Supply: Santiment

Contemplating the situation of those metrics, it was doable that Bitcoin may escape the Ghoddisfar-projected dump. Nevertheless, the king coin may require immense energy to neutralize the likelihood.

No matter the occasions, BTC addresses appeared to have taken benefit of the low cost at the moment supplied.

🐳🦈 There are actually 151,080 addresses that maintain between 10 to 1,000 $BTC. After an enormous decline that started in December, 2020, these addresses have elevated considerably all through 2022 as #Bitcoin has progressively change into extra inexpensive. https://t.co/5rdAno5SKy pic.twitter.com/uahECloHyR

— Santiment (@santimentfeed) December 11, 2022