Litecoin’s [LTC] current, unprecedented surge could possibly be liable for making the altcoin a scorching matter within the cryptocurrency market. As per CoinMarketCap, LTC’s worth grew by greater than 29% within the final seven days.

This was considerably higher than most cryptocurrencies, nevertheless, LTC stood behind Polygon [MATIC]. On the time of writing, LTC was trading at $71.46 with a market capitalization of greater than $5 billion.

______________________________________________________________________________________

Right here’s AMBCrypto’s Value Prediction for Litecoin [LTC] for 2023-2024

______________________________________________________________________________________

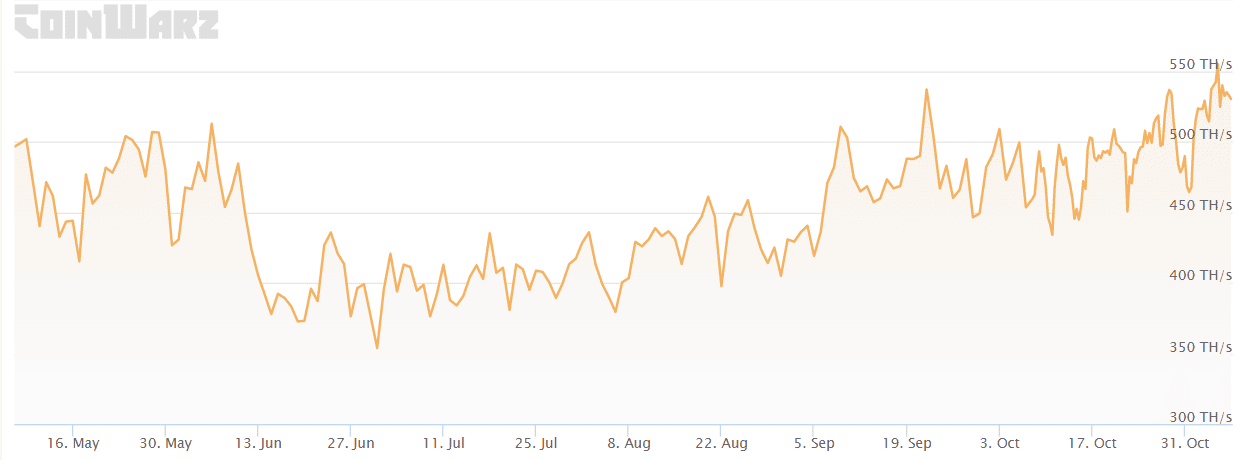

Apparently, LTC’s mining neighborhood could possibly be the explanation for this surge as LTC’s hashrate witnessed a major surge not too long ago. Knowledge from CoinWarz revealed that LTC’s hashtag was rising persistently over the previous few months. At press time, LTC’s hashrate stood at at 522.19 TH/s. Moreover, because of the hike in LTC’s hashrate, its mining issue additionally adopted the identical path and went up recently.

Supply: CoinWarz

A fast look on the metrics…

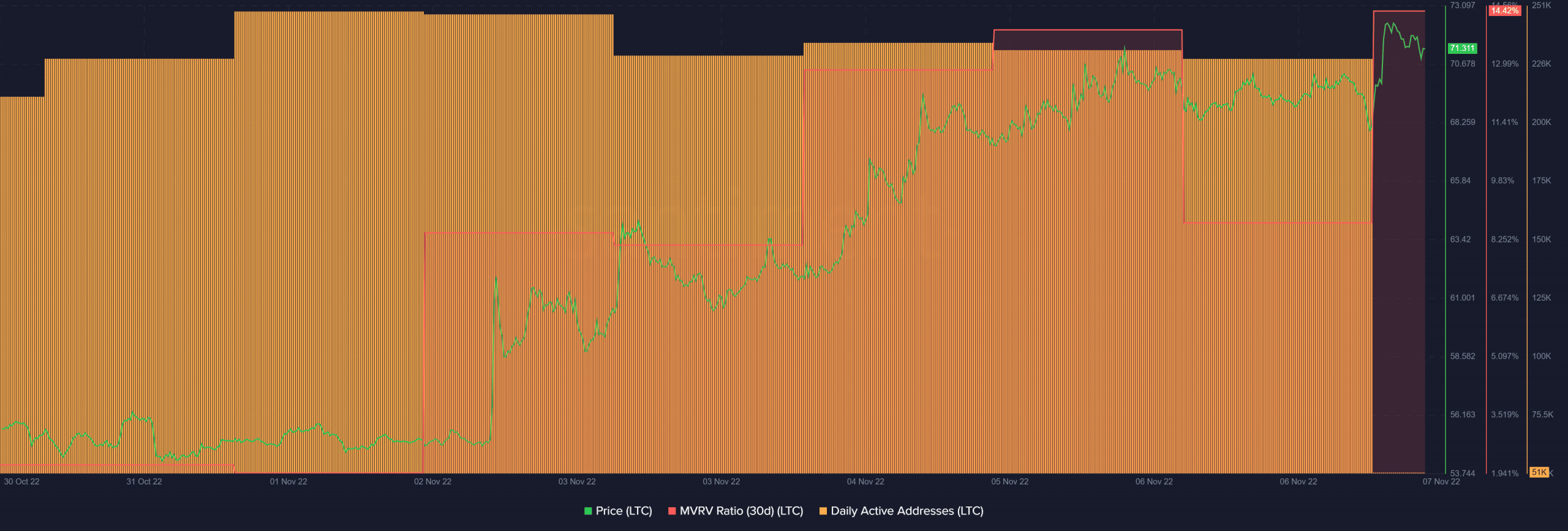

Because of the continued worth pump, some on-chain metrics have been in favor of LTC, as they recommended a continued uptrend within the coming days. LTC’s Market Worth to Realized Worth (MVRV) ratio was up, which was a optimistic sign for the community.

Furthermore, LTC’s day by day lively addresses additionally witnessed a constant excessive, thus indicating a secure variety of customers on the community.

Supply: Santiment

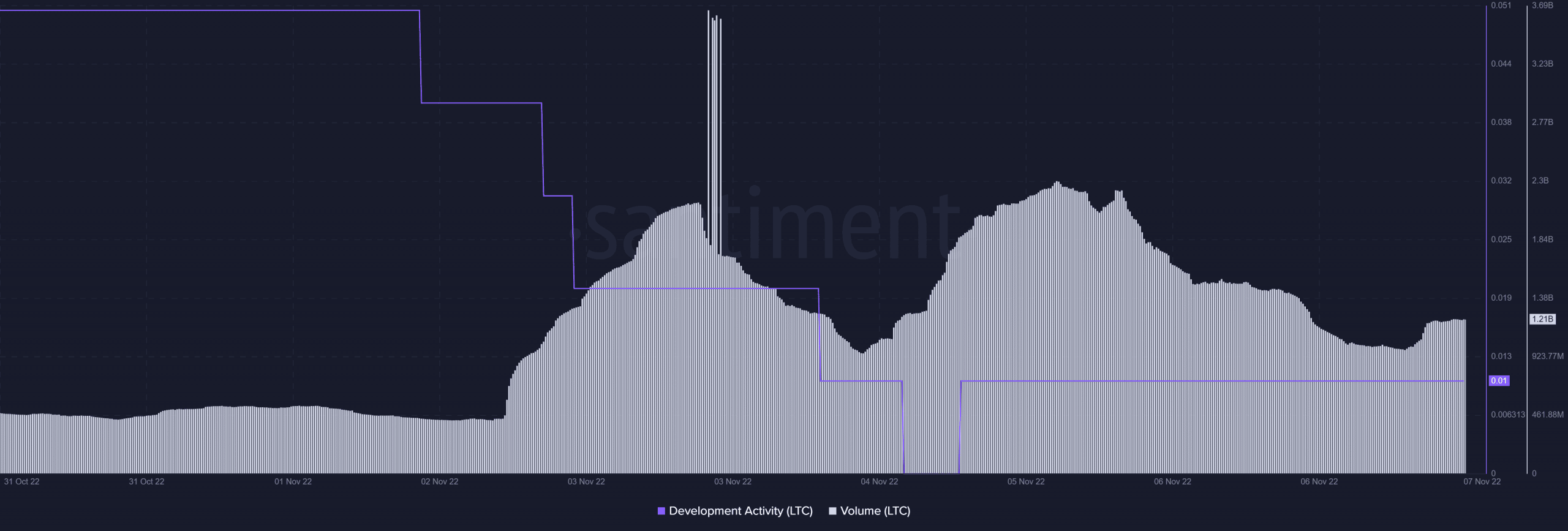

Nevertheless, the remainder of the metrics deliberate to maneuver in the wrong way. This could possibly be a matter of concern for buyers. As an example, LTC’s improvement exercise went down sharply during the last week, which was a unfavourable sign for the blockchain.

Furthermore, regardless of the hike in LTC’s worth, its quantity registered a decline up to now few days. Glassnode’s data revealed that Litecoin’s reserve threat spiked recently. This additionally indicated that it was not the fitting time for buyers to build up.

Supply: Santiment

That is what LTC merchants can anticipate

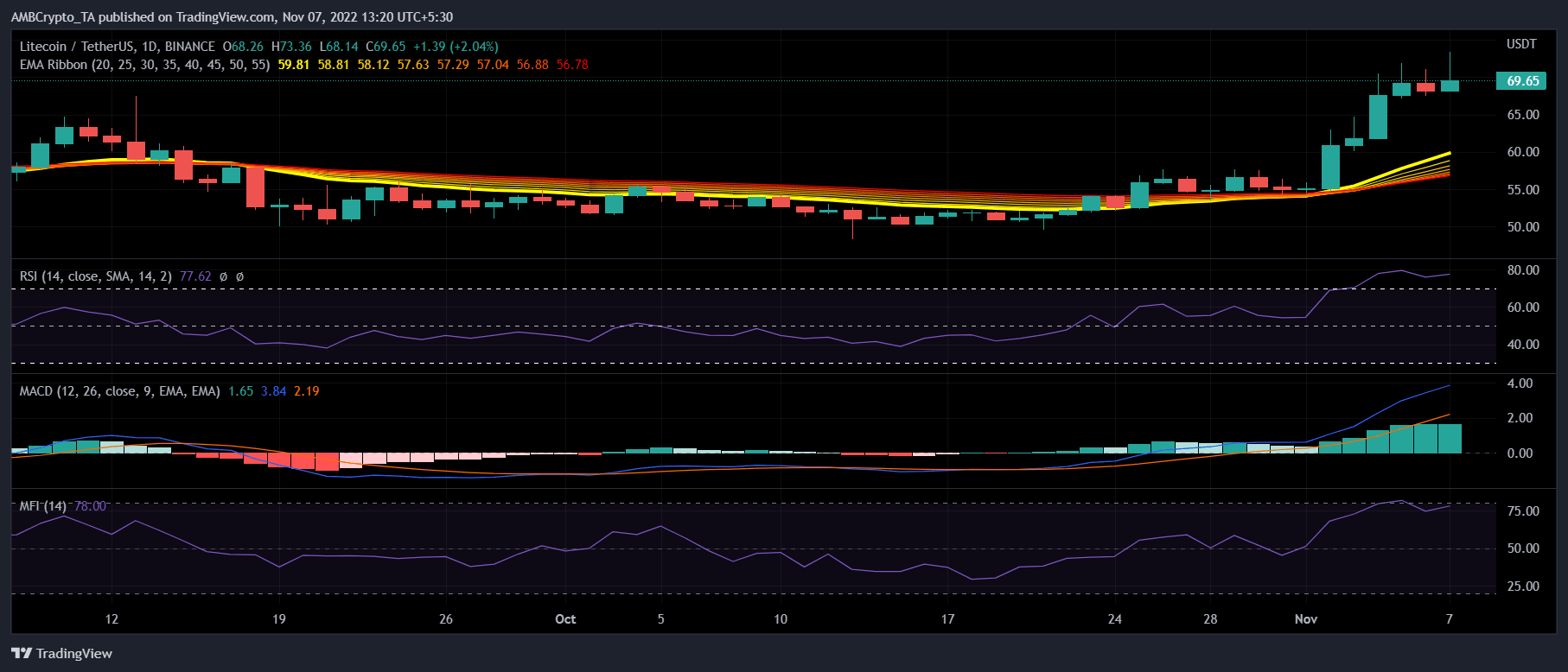

A have a look at LTC’s day by day chart painted a bullish image for the coin as a lot of the market indicators recommended a continued uptrend within the coming days. Examplar, the Exponential Shifting Common (EMA) Ribbon revealed consumers’ benefit available in the market. The Shifting Common Convergence Divergence (MACD)’s studying complemented that of the EMA Ribbon, because it too indicated that the bulls had an edge over the bears.

Nevertheless, the Relative Power Index (RSI) was within the overbought zone, which meant {that a} pattern reversal could possibly be on the best way. Furthermore, the Cash Movement Index (MFI) additionally registered an uptick and headed in direction of the overbought zone.

Supply: TradingView