- PancakeSwap grew to become multichain on Ethereum, BNB Chain, and Aptos.

- Whale exercise was famous on the community however market indicators have been bearish.

PancakeSwap [CAKE] not too long ago made one other main announcement that has the potential to extend the performance and capabilities of the chain.

It launched Syrup Swimming pools on Aptos, permitting customers to stake CAKE and earn tokens from brand-new Aptos initiatives. stAPT would be the first token within the Syrup Pool to earn.

✨ Introducing Syrup Swimming pools on Aptos

🥞 Now you can stake CAKE and earn tokens from brand-new Aptos initiatives

👉 To be taught extra about this, learn right here: https://t.co/qcE2JqcIzd pic.twitter.com/z2yZcxYy3z

— PancakeSwap 🥞 #Multichain (@PancakeSwap) December 20, 2022

Curiously, the whales additionally confirmed confidence in CAKE not too long ago. This could possibly be a constructive signal for potential buyers because it represented the likelihood of CAKE’s ascend.

In keeping with WhaleStats, a well-liked Twitter deal with that posts updates about whale exercise, CAKE was one of many prime ten bought tokens among the many 500 largest BSC whales within the earlier 24 hours of press time.

A 593.25x hike on the playing cards if CAKE hits Bitcoin’s market cap?

Can whales actually assist CAKE?

With the launch of the brand new Syrup Pool on Aptos, PancakeSwap grew to become multichain on Ethereum, BNB Chain, and Aptos. Although these updates regarded optimistic, CAKE’s efficiency didn’t match the expectations.

Its every day and weekly charts have been in detrimental territory. In keeping with CoinMarketCap, CAKE registered a decline of 9% over every week. On the time of writing, it was valued at $3.42 with a market capitalization of greater than $544 million.

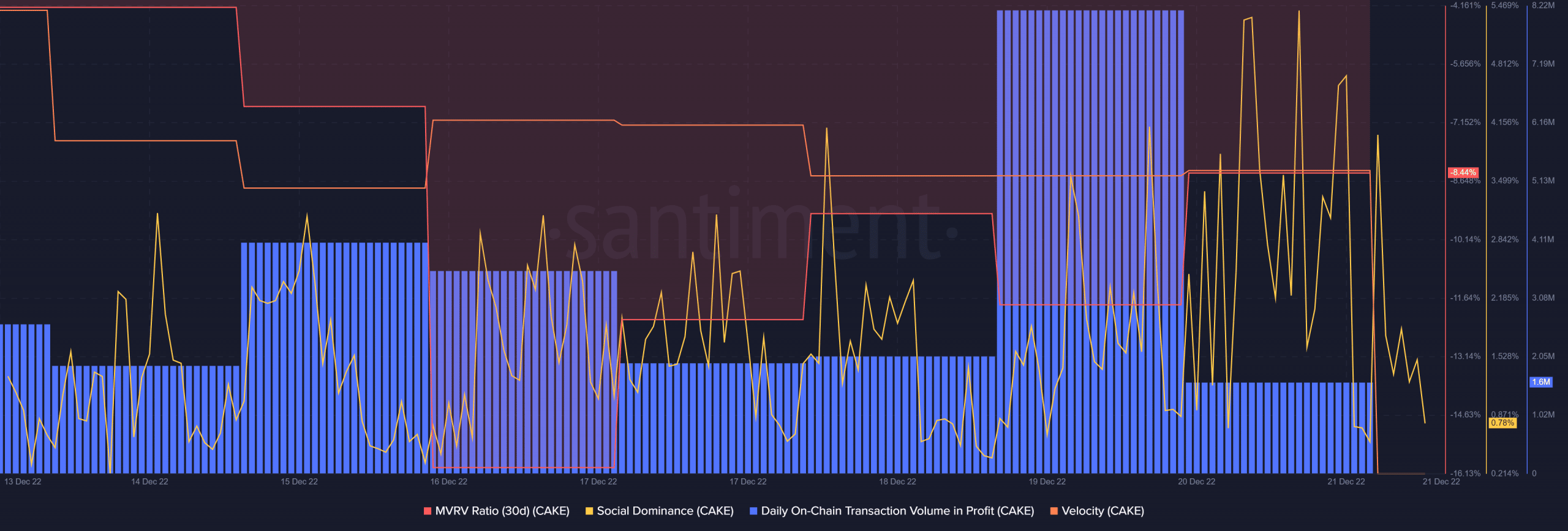

Santiment’s chart, nonetheless, revealed a considerably bullish image, hinting on the probabilities of a development reversal within the coming days.

As an illustration, CAKE’s MVRV Ratio registered an uptick, which was promising. Cake’s social dominance grew as properly, indicating the token’s widespread recognition.

Moreover, its every day on-chain transaction in revenue additionally elevated on 19 December. Nonetheless, the alt’s velocity went down during the last week, which considerably reduces the opportunity of a worth uptick.

Supply: Santiment

What number of CAKEs are you able to get for $1?

Wanting ahead

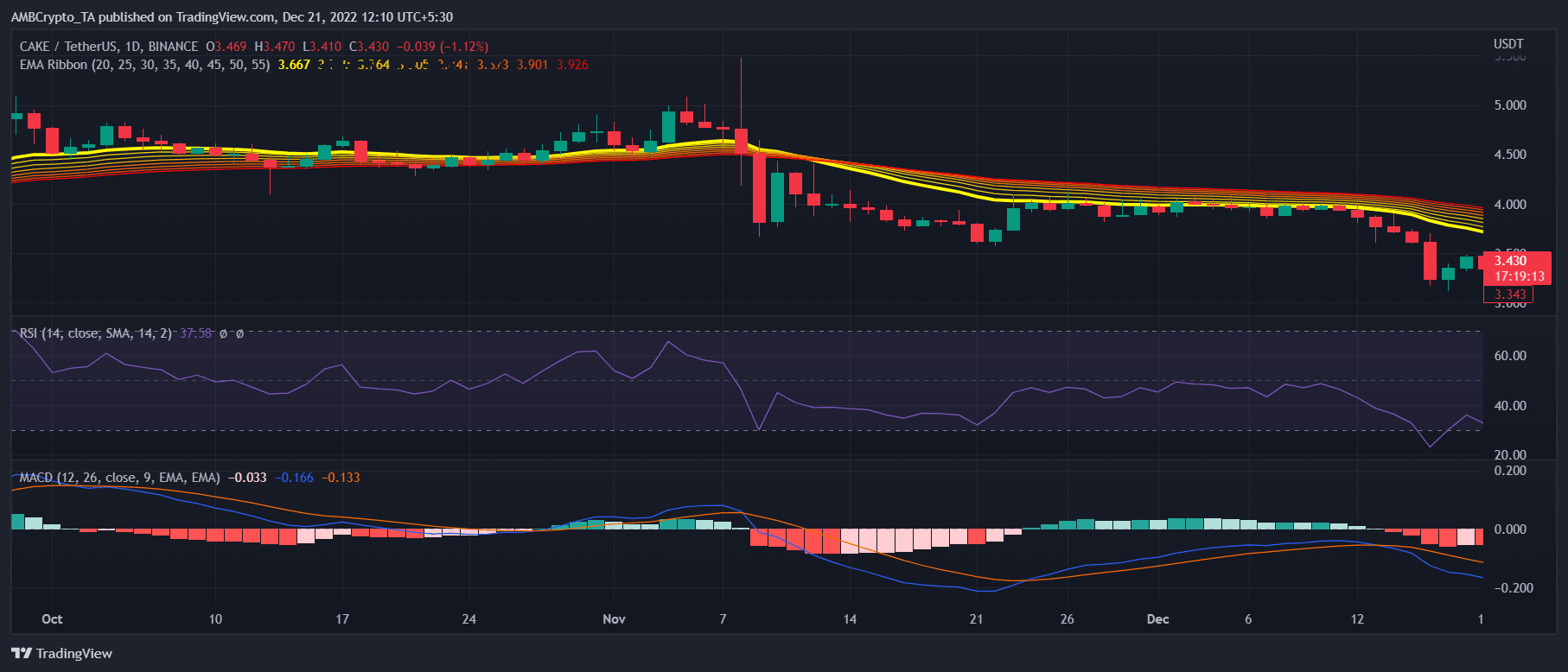

Whereas a number of metrics have been in favor of CAKE, the market indicators informed a distinct story. The Exponential Transferring Common (EMA) Ribbon advised a bearish edge available in the market because the 20-day EMA was under the 55-day EMA.

The MACD’s discovering was additionally just like that of the EMA Ribbon. Nonetheless, CAKE’s Relative Power Index (RSI) was heading in the direction of the overbought zone once more, which could flip issues in CAKE’s favor quickly.

Supply: TradingView