Circle, the corporate behind USDC, the second largest stablecoin available on the market, introduced its ambitions to increase using its Euro-backed stablecoin, EUROC. Circle supplied a Euro-backed token along with its US Greenback-backed USDC token.

Including assist for one more chain was a part of the plan to broaden the stablecoin’s attain and adoption. This information round EUROC got here throughout Solana Breakpoint 2022 that witnessed a number of different vital bulletins.

1/ On stage at #SolanaBreakpoint we introduced the enlargement of native assist for Euro Coin and developer entry to our Cross-Chain Switch Protocol on @Solana within the first half of 2023. https://t.co/j8NVLG9nsi

— Circle (@circle) November 6, 2022

Circle to carry the Euro to Solana?

The tweet by the stablecoin issuer additionally talked about that it hoped to carry its cross-chain protocol to Solana by the primary half of 2023. As of now, Ethereum served because the underlying platform for the Euro Coin. Moreover, FTX can be anticipated to lend a serving to hand within the migration to Solana.

Moreover, the corporate additionally talked about that a number of decentralized finance protocols expressed an curiosity to assist with the introduction of the Circle Euro Coin. By giving merchants a second base foreign money to work with, and enabling Euro Coin lending and borrowing, a variety of functions is anticipated to come back by.

Along with USDC, the coin could be accepted for Solana Pay as a way of cost.

EUROC lacks reputation for now… however might that change?

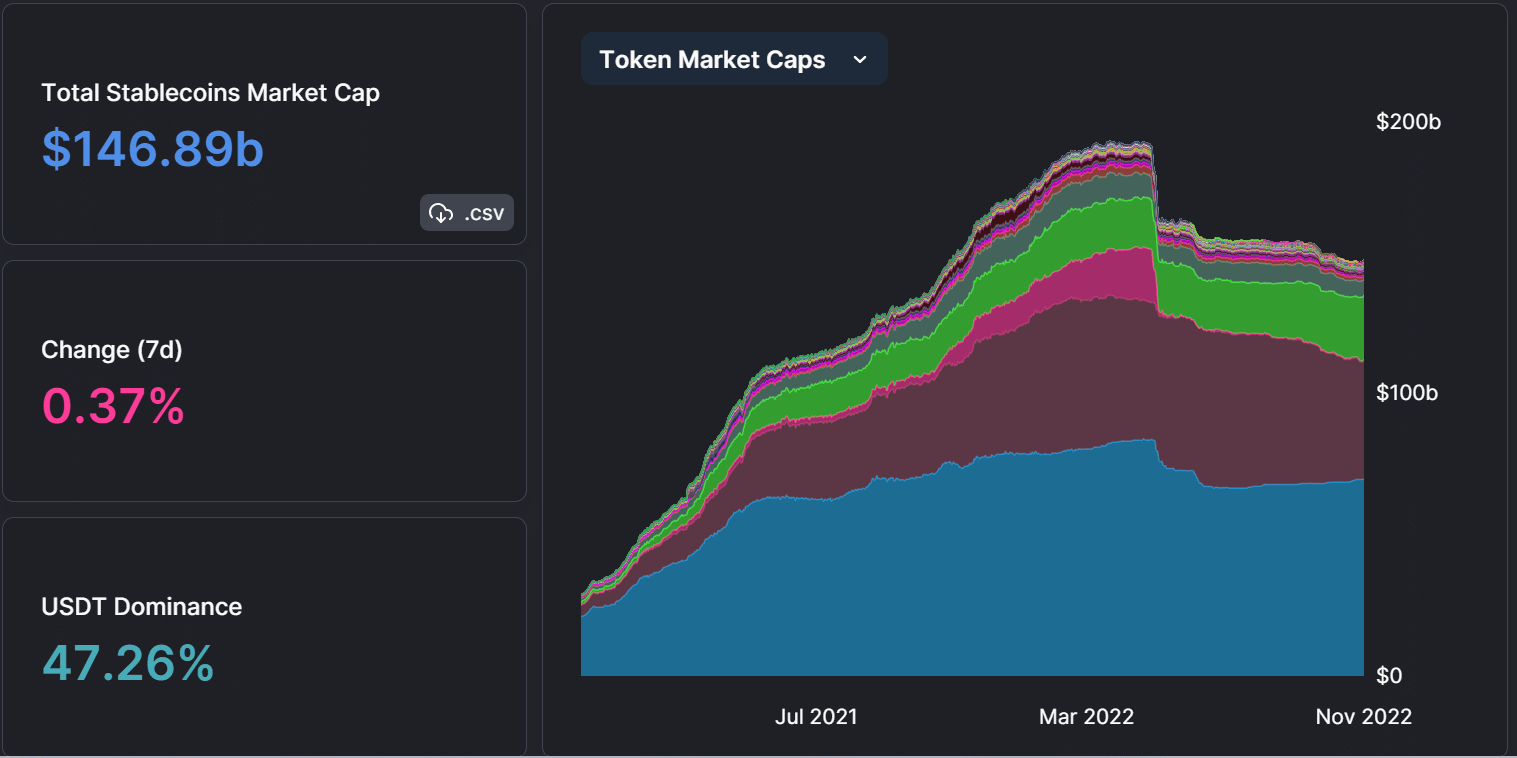

In keeping with DefiLlama, the market capitalization of stablecoins as of seven November stood at $146.89 billion. With a market share of over $69 billion of your complete marketcap, USDT held essentially the most chunk of it. USDC adopted USDT with a market cap of over $45 billion. With a marketcap of just a bit bit over $80 million, EUROC stood at a distant rank of #18.

Supply: DeFiLlama

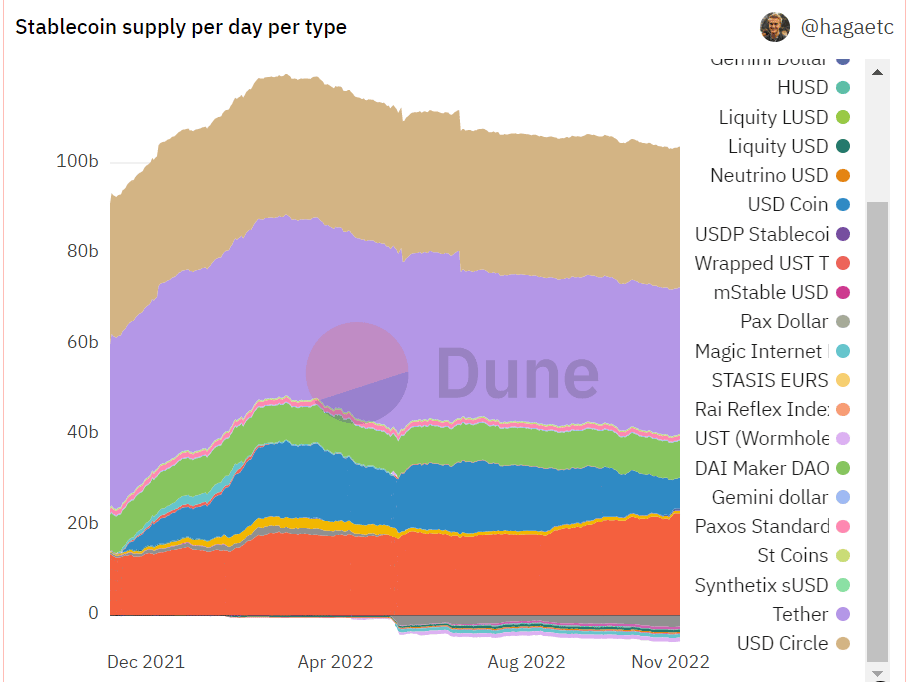

The dollar-denominated stablecoin from Circle ranked in second place to USDT when taking a look at stablecoin provide per day knowledge from Dune Analytics. Nevertheless, EUROC didn’t maintain a spot there. This was an indication of its poor person reputation, which can be largely on account of the truth that it wasn’t built-in with different protocols.

Supply: Dune Analytics

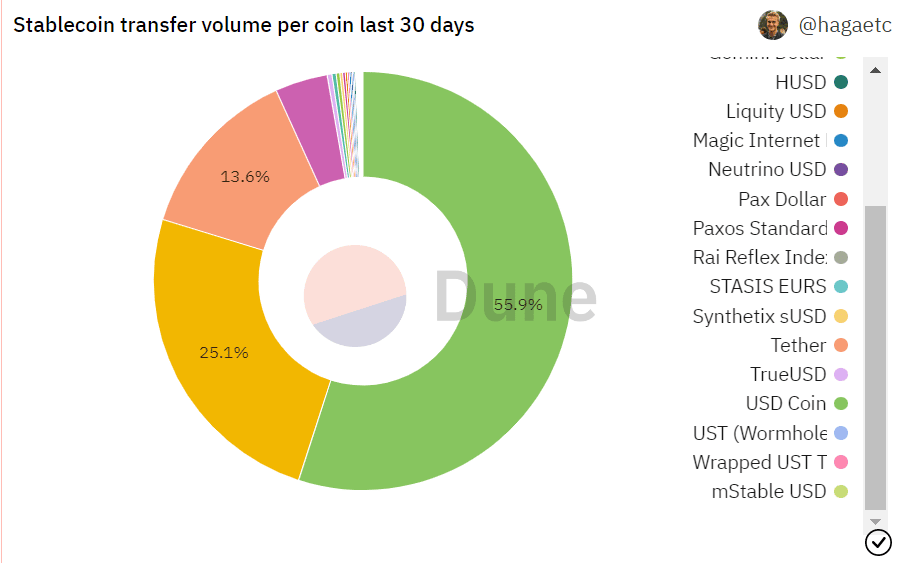

The stablecoin switch quantity per coin over the previous 30 days additionally revealed that customers didn’t favor EUROC. Other than USD, there didn’t appear to be sufficient data to rank the euro-denominated stablecoin among the many most traded stablecoins.

Supply: Dune Analytics

Circle’s transfer stands out as the want of the hour

Given that almost all proof factors to Euro Coin’s lack of recognition, Circle’s choice to maneuver on this method might show to be the perfect plan of action. Its utility will improve because it provides assist for Solana and different decentralized protocols. This may occasionally in flip pave the best way for future chain migrations.