Following on from one of many craziest days in crypto historical past on Nov. 9, the 24/7 crypto markets hold traders busy. Binance launched its proof-of-reserves, FTX’s stablecoin stability nears zero, the Curve 3pool turned concentrated with USDT, and 60,000 BTC left Binance. Rumors are brewing of an Alameda Analysis brief place on Tether USDT because it probably seems to be for a last-ditch lifeline.

Binance proof-of-assets

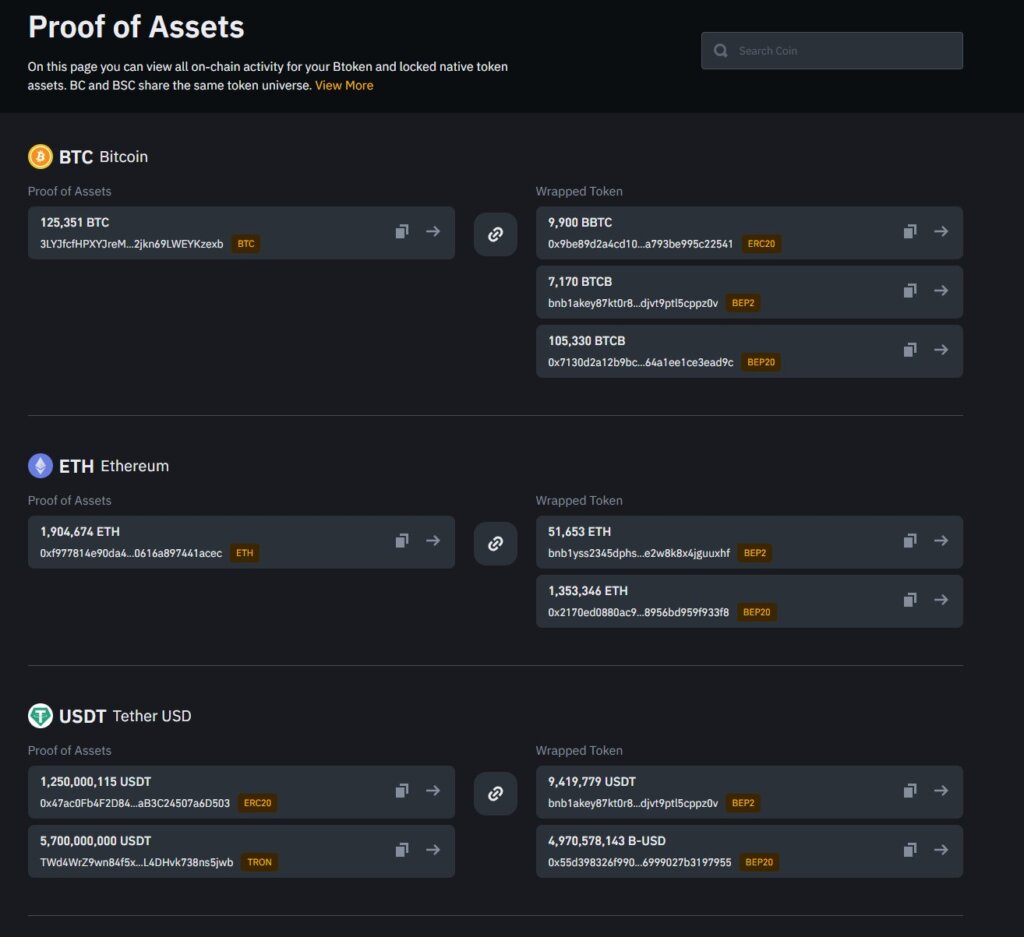

Binance launched the proof-of-assets data that CZ had promised following the approaching collapse of FTX. In a extra meant to buoy the markets and inject belief into the alternate after it was revealed that FTX had a gap in its stability sheet of $8 billion and no method to course of consumer withdrawals, Binance printed a brand new web page of its web site entitled “Proof of Assets.”

Binance outlined all of its asset holdings, and the alternate included all of the on-chain addresses for every token together with a hyperlink to point out the correlation with bridged belongings on different chains. The power to open the blockchain explorer for every community and look at the info on-chain showcases the ability and skill of exchanges to be absolutely clear.

The extent of transparency proven by Binance is second to none and provides traders confidence that there is no such thing as a belief required. Following claims from alternate leaders at Celsius, Voyager, and now FTX that their belongings have been absolutely backed up till the purpose the place the businesses introduced insolvency, the trustless strategy to transparency by Binance is to be applauded.

Some notable holdings are listed under:

- 125,351 BTC

- 1,904,674 ETH

- 6,950,000 USDT

- 50,805,657 DOT

- 469,665,508 XRP

- 745,000 LTC

- 5,325,500,000 BUSD

- 987,571,153 ADA

- 878,999,999 USDC

- 100,000,000 DAI

The full worth of the above belongings is round $18.3 billion. Nevertheless, there are 385 tokens throughout the whole alternate, so a full breakdown of all belongings can be required to offer an correct determine on the overall holdings.

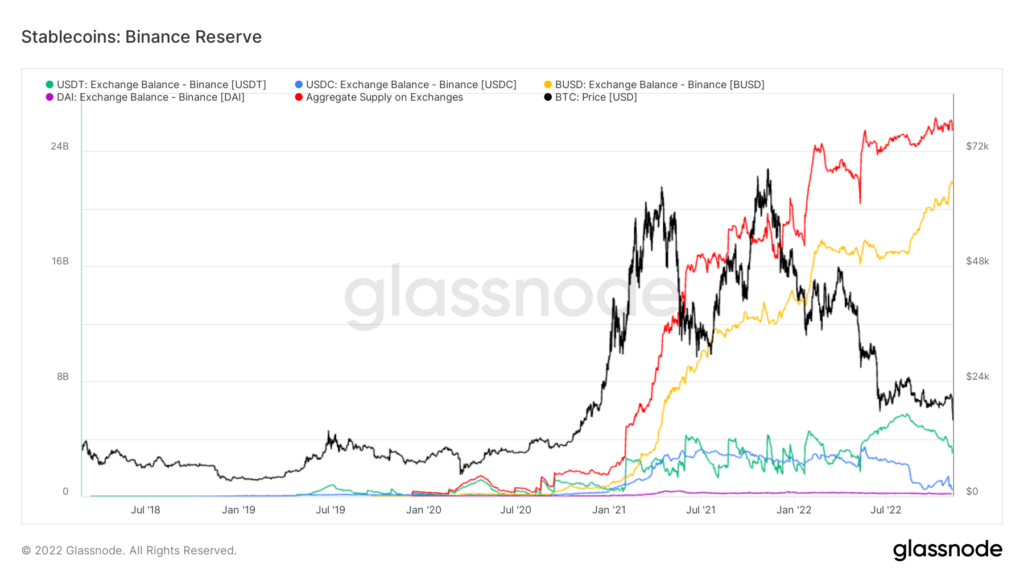

Stablecoin reserves deplete

One token that has seen elevated inflows to Binance over the previous few days is Binance USD (BUSD), which is the one stablecoin to see a rise in deposits. The mixture provide of all stablecoins on Binance nears $26 billion. The chart under reveals the online influx of BUSD onto Binance in distinction with different stablecoins.

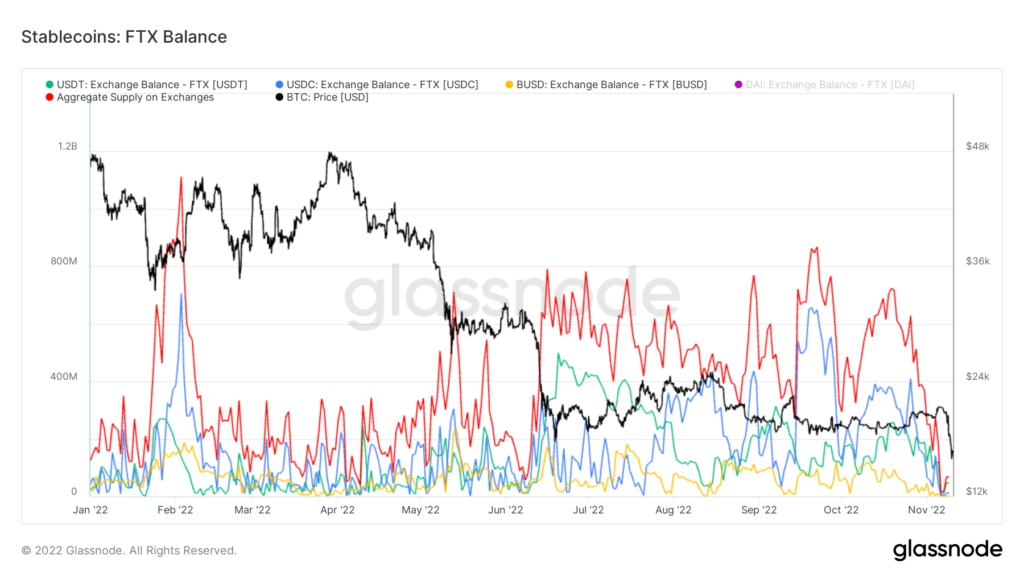

The bancrupt FTX has a really completely different story of its stablecoin balances as BUSD, USDC, USDT, and DAI are all close to zero as tokens have been withdrawn from the platform. Withdrawals are presently closed on the alternate, and new person accounts can’t be created.

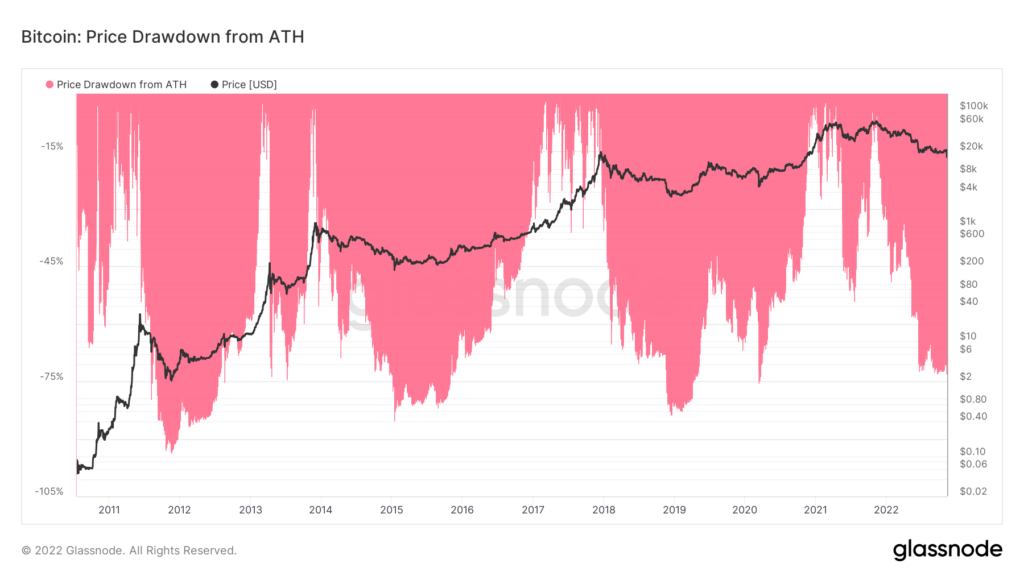

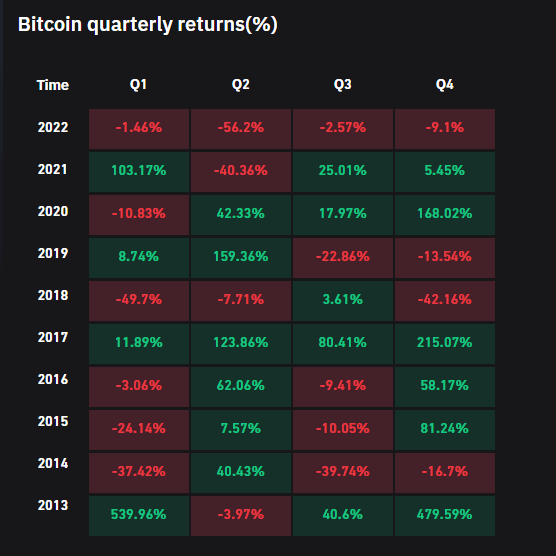

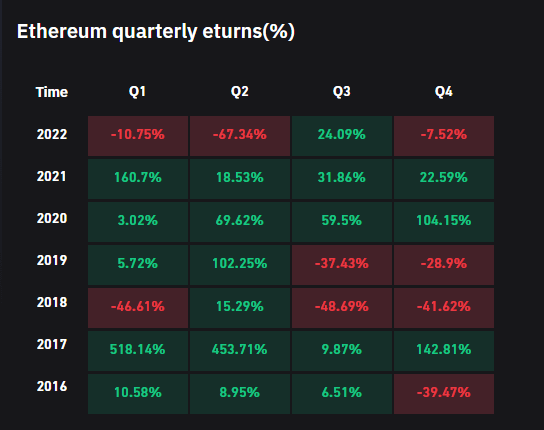

Bitcoin is down 77% from its ATH

The necessity for elevated transparency by Binance throughout this era of excessive volatility has additionally been mirrored within the worth of Bitcoin. The main cryptocurrency by market cap is down 77% from its all-time excessive in its fourth most vital drawdown of all time because it falls under ranges reached in the course of the Terra Luna collapse of Could this yr.

Ethereum is now 77.3% down from its all-time excessive, which marks its fourth most vital drawdown ever.

The ensuing downward stress of the value of Bitcoin places it on target for the primary time in its historical past to be down in all 4 quarters of the yr.

Ethereum had a stable third quarter as traders rallied into The Merge. Nevertheless, This autumn is now seeking to be the third quarter this yr that Ethereum has closed down.

DeFi stablecoin imbalances

Whereas the fallout from FTX’s collapse has rocked main tokens, the DeFi business is now exhibiting indicators of stress. For instance, the Curve 3pool has develop into 84% focused on USDT as DAI and USDC balances fell under 8% every. A major imbalance might result in liquidity points as customers try and withdraw funds in several denominations than these used to deposit.

This actually made me say “holy fucking shit” out loud 3 occasions in a row. https://t.co/HU9ySzcleb

— DIRTY BUBBLE MEDIA: FISH IN A BARREL (@MikeBurgersburg) November 10, 2022

Twitter person astromagic recognized a commerce for $250k made by Alameda to swap USDT to USDC. The commerce seems to be part of a bigger technique to brief USDT to the tune of a number of hundred thousand {Dollars}. Whereas the determine could appear inconsequential given the scale of the crypto business, it begs the query of why Alameda is making such a commerce presently.

so alameda is attempting to brief $usdt?

>provide USDC on aave

>borrow USDT on aave

>swap USDT to USDC on curvedafuq man…https://t.co/F3tQvDMfF8

— astromagic (Trust_No_One) (@astro__magic) November 10, 2022

The stablecoins have been used as collateral to borrow extra USDT after which promote these borrowed funds again into USDC, making an on-chain web promote of round $550k USDT.

What you’re seeing under is an Alameda pockets deposit of $300k USDC into @AaveAave – Borrow $250k $USDT after which immediately promote it again to $USDC

That is technically an on-chain in need of USDT, nothing important however wtf is happening right here? pic.twitter.com/A9pLXLCE4h

— blocmates. Behind on DMs apologies (@blocmatesdotcom) November 10, 2022

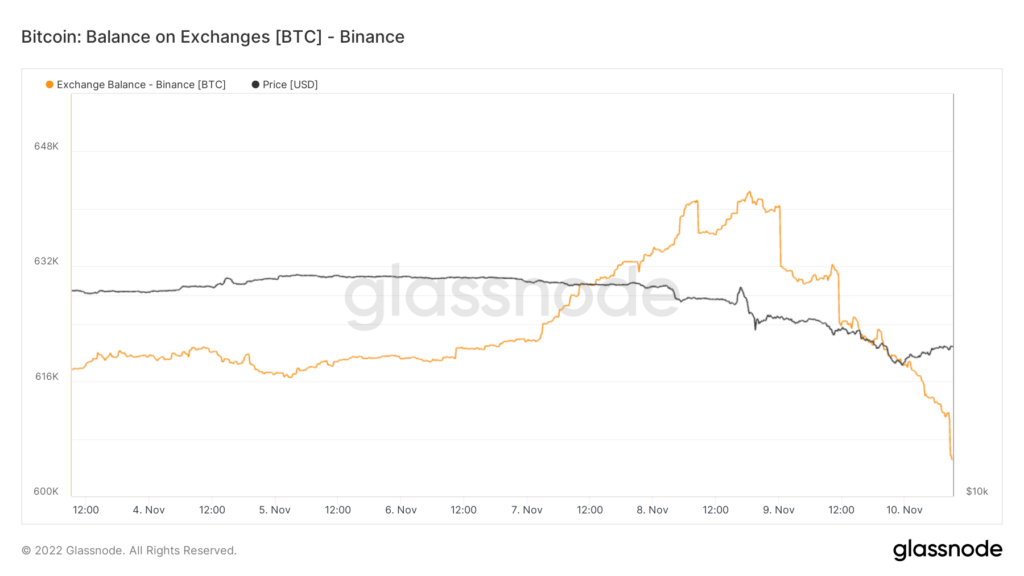

Withdrawals enhance throughout exchanges.

The worry, uncertainty, and doubt throughout the crypto business is rising as customers look to seek out safer grounds and keep away from any potential contagion. For instance, following the collapse of Terra Luna earlier within the yr, Voyager, BlockFi, and Celsius all bumped into rapid liquidity points. As well as, FTX, Alameda Analysis, and FTX Ventures have extremely shut ties, and their investments considerably contribute to the crypto business. In consequence, contagion inside different initiatives is extremely attainable.

On Nov. 9, 60,000 BTC left exchanges, with the bulk coming from Binance as customers withdrew cash. The chart under reveals the quantity of BTC that went to Binance over the previous seven days. Nevertheless, the info from Glassnode signifies that Binance nonetheless has over 600,000 BTC in its custody which is considerably greater than introduced in its proof of belongings report.

As of press time, the value of Bitcoin has recovered to $17,526 from a low of $15,600 in a single day. Ethereum is again to $1,290 from a low of $1,069, whereas FTX’s FTT token is up 214% to $3.40 from a brand new all-time low of $1.08.

Bitcoin dominance has fallen to 40% from a neighborhood excessive of 42% on the finish of October. Nevertheless, apparently Bitcoin’s dominance has fallen all through the present turmoil out there, whereas in the course of the Terra Luna collapse, it recorded an 11-month excessive of 48.5%.