- Many ETH merchants exited their positions out of the volatility worry.

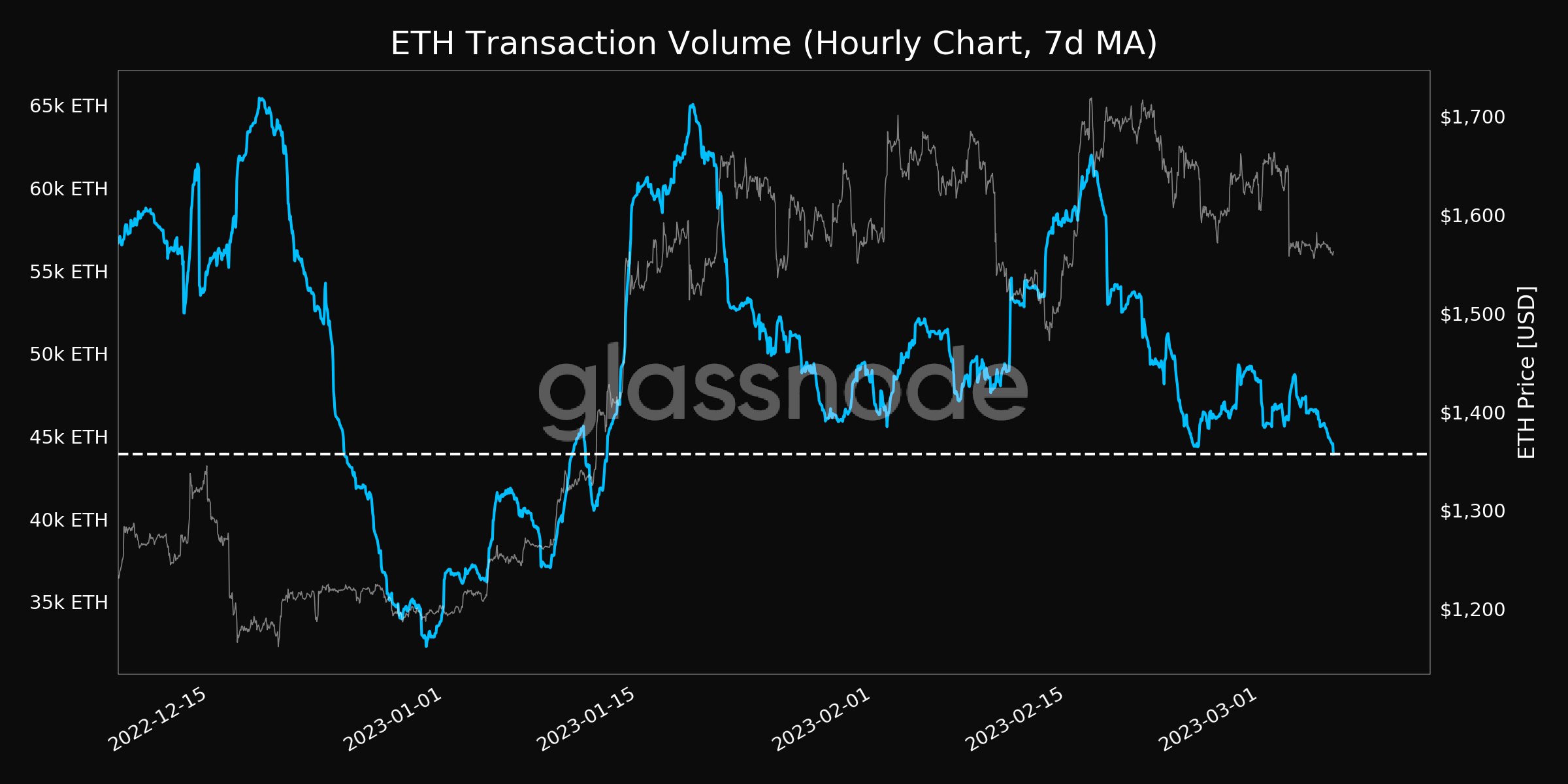

- Apparently, the variety of transactions on the community declined.

Ethereum, within the final month, loved a rally as its costs surged because of growing demand. Nonetheless, merchants didn’t exhibit the identical enthusiasm towards ETH at first of March.

Lifelike or not, right here’s ETH’s market cap in BTC’s phrases

Based on Nansen.ai’s tweet, all-time PnL merchants who profited $40k or extra noticed a 50% lower in ETH holdings since Could.

Reportedly, a lot of the PnL DEX merchants have halted the vast majority of their buying and selling actions as they’re anticipating excessive volatility within the close to future.

Continuing with warning

Alternatively, retail traders have continued to purchase ETH on a big scale. This was indicated by the variety of non-zero addresses on the Ethereum community which reached an all-time excessive of 95.04 million addresses.

These addresses have been noticed to be holding on to their ETH as an alternative of promoting.

The discount within the variety of ETH transactions over the past month backs up the earlier assertion.

Supply: glassnode

Moreover, the general curiosity within the Ethereum NFT market additionally declined. Based on Santiment’s information, the variety of NFT trades being made on Ethereum fell significantly over the previous month.

This additionally impacted the typical fuel utilization on the community which fell in accordance with the NFT trades on the community.

Supply: Santiment

You solely get one brief

On account of these occasions, the variety of brief positions taken towards ETH started to extend. Coinglass’ information confirmed that the share of brief positions taken towards Ethereum rose from 49% to 51% up to now month.

Learn ETH’s Value Prediction 2023-2024

Nonetheless, regardless of these elements, the validators on the Ethereum community continued to extend.

Staking Rewards’ information indicated that over the previous month, the variety of validators on the Ethereum community rose by 5.71%. Moreover, the income produced by these stakers additionally elevated by 24.23% throughout the identical timeframe.

Supply: Staking Rewards

Because the Shanghai Improve inches nearer, it’s essential to notice that a number of elements will affect ETH’s costs going ahead.