- ETH managed to cross the $1,200 bar within the final weeks of 2022

- ETH whales most well-liked to carry on to the altcoin than promote their holdings

Now that Ethereum [ETH] has crossed the $1,200 vary, it is just logical to surprise the way it will conclude 2022. Listed here are some current observations which will set the tempo for ETH’s efficiency within the quick time period.

Learn Ethereum’s [ETH] Worth Prediction for 2023-24

ETH delivered an total bullish efficiency final week, a becoming conclusion for an in any other case bearish November. Nonetheless, the most recent observations recommend that the cryptocurrency’s efficiency this week is likely to be characterised by low volatility. One of many newest Glassnode alerts revealed that Ethereum’s transaction quantity dropped to a brand new month-to-month low of 56, 868.45 ETH.

📉 #Ethereum $ETH Transaction Quantity (7d MA) simply reached a 1-month low of 56,868.457 ETH

View metric:https://t.co/XkgWqRvVqj pic.twitter.com/1NmrgzVjQI

— glassnode alerts (@glassnodealerts) December 4, 2022

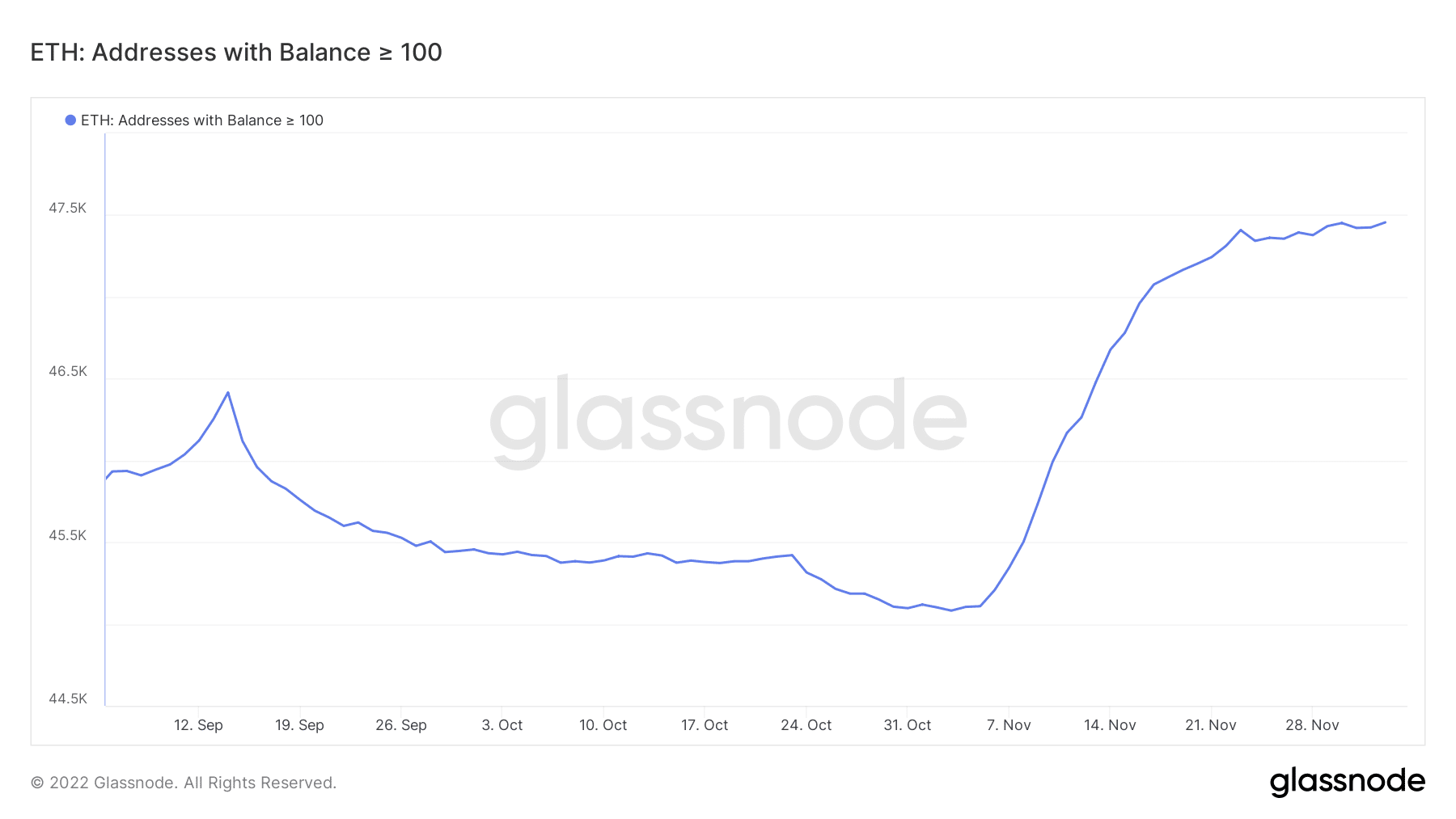

The above commentary confirmed that ETH was dropping the bullish momentum noticed final week. In different phrases, the cryptocurrency won’t preserve its upside. Additionally take into account this subsequent commentary earlier than formulating a bearish expectation. The variety of addresses holding greater than 100 ETH lately achieved a brand new 21-month excessive. This might imply that consumers have been accumulating ETH and HODLing, moderately than promoting.

📈 #Ethereum $ETH Variety of Addresses Holding 100+ Cash simply reached a 21-month excessive of 47,491

View metric:https://t.co/FbjiMG3uFX pic.twitter.com/GJXMKzgm1I

— glassnode alerts (@glassnodealerts) December 4, 2022

The uptrend noticed within the ETH addresses with balances greater than 100 ETH metric confirmed the above commentary. This was additionally an indicator that whales had been prepared to promote for now.

Supply: Glassnode

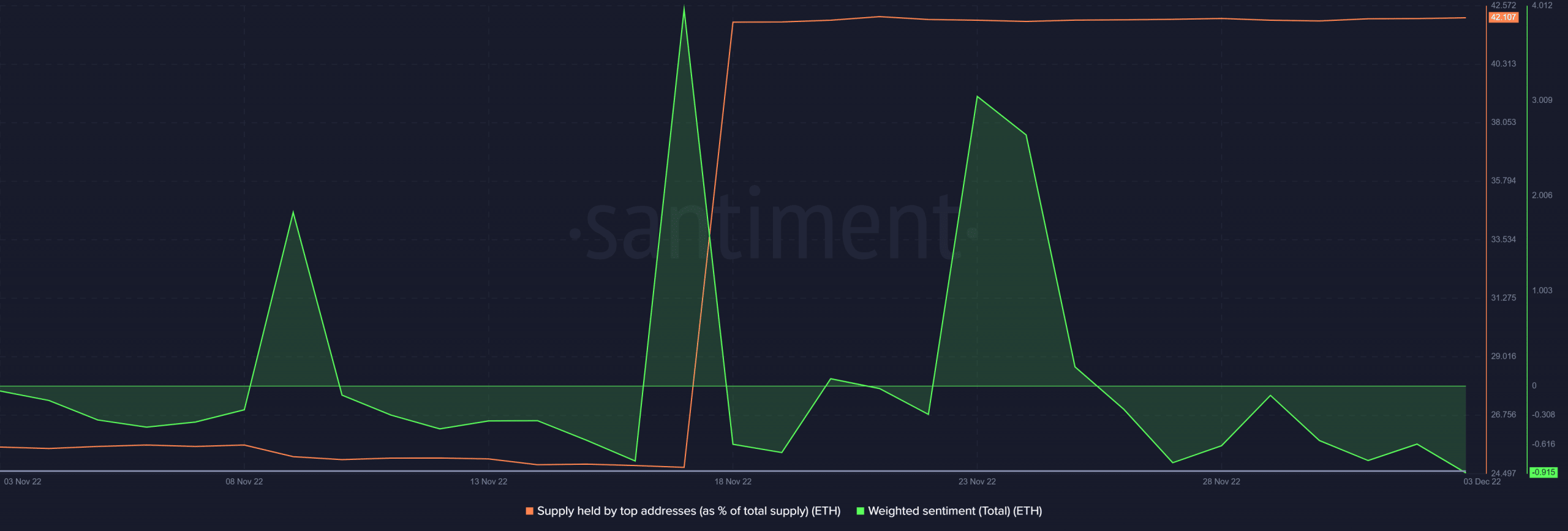

This commentary might set the tempo for ETH value motion this week, particularly if these addresses and better whale classes maintain on to their cash. There haven’t been any outflows from prime addresses. Moreover, the provision held by prime addresses (as a % of complete provide) confirmed a big accumulation in mid-November.

Supply: Santiment

The identical metric didn’t register any promote strain from prime addresses. Thus, this can be affirmation that the whales weren’t promoting simply but. This was the state of affairs regardless of a drop within the weighted sentiment, paving the way in which for a better chance of draw back. Nonetheless, the bearish sentiment mirrored the beforehand talked about drop in momentum.

Cloudy with an opportunity of sideways motion

Primarily based on the above observations, ETH’s value motion might ship some sideways motion quickly. If the highest addresses keep away from promoting, as was the case at press time, then there shall be low promoting strain. A scarcity of bullish momentum might additionally imply that the worth will possible be in limbo. Therefore, the probability that it’ll transfer sideways.

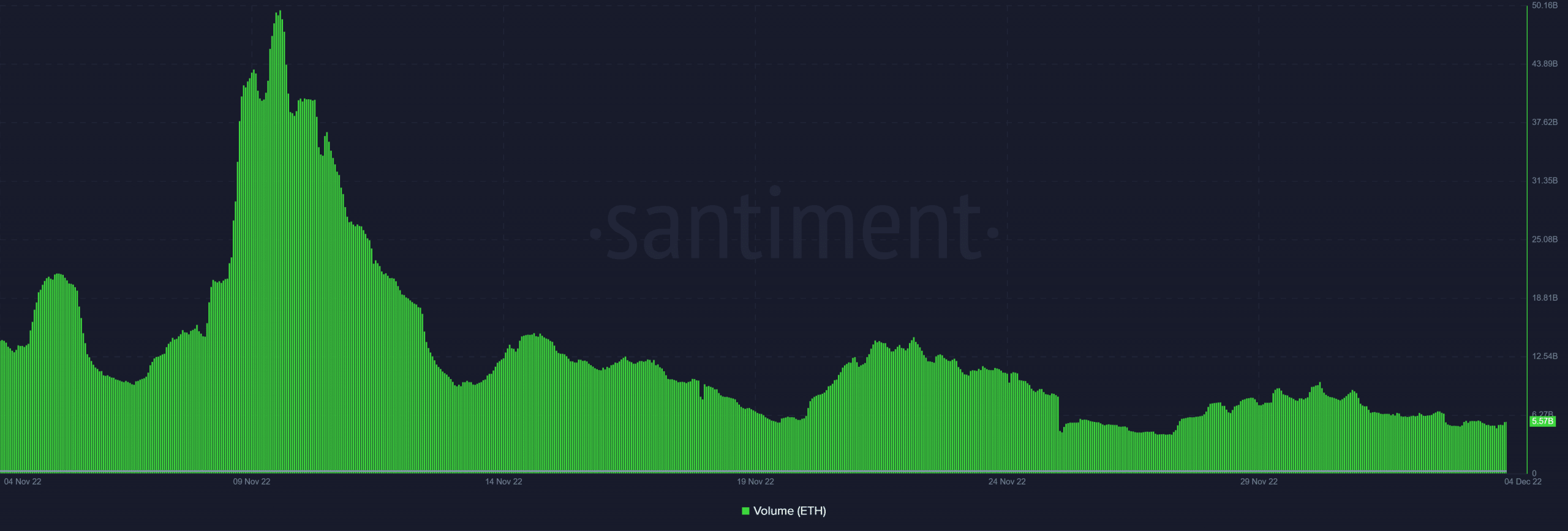

Apparently, ETH’s quantity dropped near its present four-week low, additional supporting the expectations of low volatility.

Supply: Santiment

Though the present expectation is that there shall be a whole lot of lateral motion, a distinct final result continues to be on the desk. Traders and merchants ought to maintain an eye fixed out for any market change which will set off a distinct final result.