Within the newest in a string of authorized actions regarding the crypto business in latest weeks, Alex Mashinsky, the co-founder and former CEO of the now-bankrupt cryptocurrency lending platform Celsius, was taken into custody on Thursday, Bloomberg reported. The event follows an intensive investigation into the corporate’s abrupt downfall, in accordance with a supply acquainted with the scenario.

The U.S. Securities and Change Fee (SEC) has leveled accusations of securities fraud towards each Celsius Community and Mashinsky. This lawsuit was swiftly adopted by authorized actions from the Commodity Futures Buying and selling Fee (CFTC) and the Federal Commerce Fee (FTC).

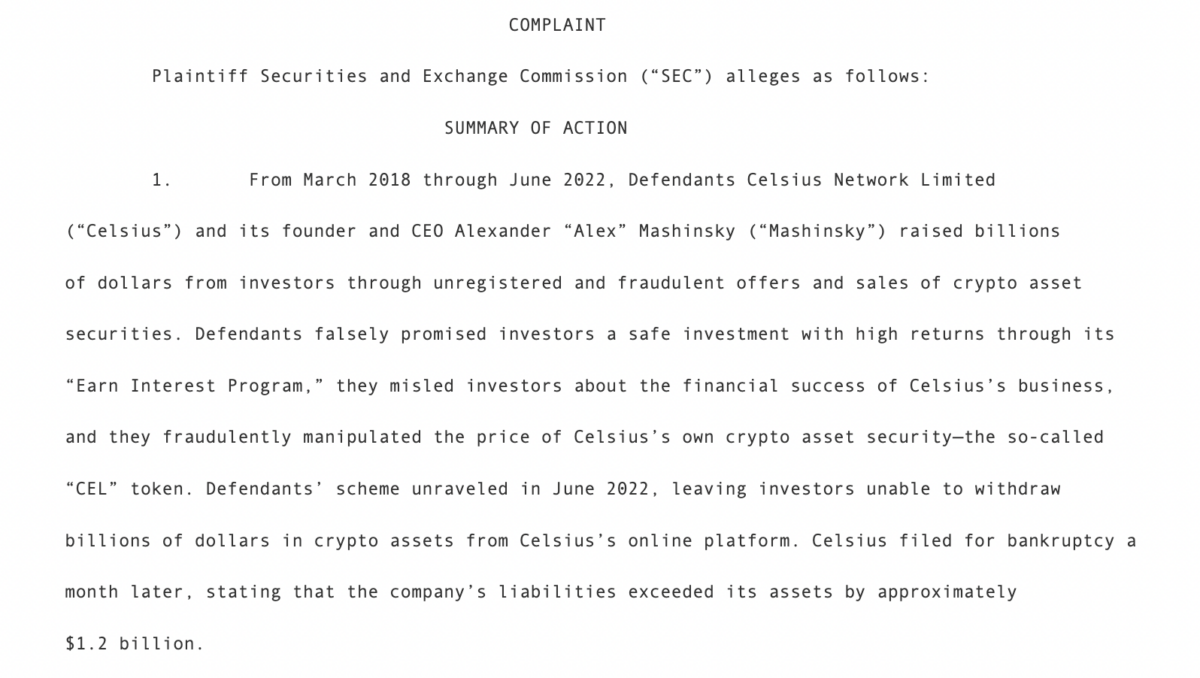

“From March 2018 via June 2022, Defendants Celsius Community Restricted and its founder and CEO Alexander Mashinsky raised billions of {dollars} from buyers via unregistered and fraudulent presents and gross sales of crypto asset securities,” the SEC’s authorized submitting reads. “Defendants falsely promised buyers a protected funding with excessive returns via its ‘Earn Curiosity Program,’ they misled buyers in regards to the monetary success of Celsius’s enterprise, they usually fraudulently manipulated the value of Celsius’s personal crypto asset safety—the so-called ‘CEL’ token.”

The SEC’s criticism contends that Celsius Community’s token, CEL, and its Earn Curiosity Program are securities. The criticism states, “On this case, Celsius provided and bought CEL and the Earn Curiosity Program as securities […] Celsius and Mashinsky by no means filed a registration assertion or had one in impact with the SEC for his or her presents and gross sales of securities via the Earn Curiosity Program.”

A foregone conclusion

Earlier this month, reports emerged suggesting that Mashinsky and Celsius Community may very well be going through authorized motion from the CFTC. The investigators at that physique have reportedly concluded that the defunct lender and its CEO violated regulatory guidelines by offering deceptive data to buyers.

Celsius Community declared chapter in July of final 12 months. Subsequently, the crypto consortium Fahrenheit emerged because the profitable bidder for the corporate’s belongings.

New York Lawyer Common Letitia James had beforehand filed a lawsuit towards Mashinsky, alleging that he had deceived buyers in regards to the monetary well being of the corporate.

Mashinsky’s arrest and the authorized actions towards Celsius Community underscore the rising regulatory scrutiny going through the cryptocurrency business. Because the sector continues to develop and mature, navigating regulatory compliance will probably be a key issue within the success and longevity of crypto platforms and companies. Nevertheless, some consider the stringent nature of the SEC’s regulatory method is driving crypto innovation out of the U.S.