- Bitcoin’s worth reacted negatively because the FOMC report indicated an increase in rates of interest.

- Bitcoin examined the $18,000 area earlier than falling again, however there are indications of a possible improve.

Bitcoin (BTC) and the cryptocurrency market couldn’t have requested for a greater consequence from the Federal Open Market Committee (FOMC) assembly that ended on December 14.

After recording a achieve that introduced it to a stage it had not seen for the reason that starting of the month, BTC responded unfavorably to the info from the FOMC. How massive of an impact did the information have on BTC, and what can we anticipate within the coming days?

A dive into the report

The Shopper Value Index (CPI) was issued on 13 December, previous the FOMC report by Chair Jerome Powell. Inflation in america slowed to 0.1% from 0.4% in October, a optimistic growth for the Federal Reserve’s efforts to rein in skyrocketing costs.

Bitcoin (BTC) costs rose after the report was launched as a result of buyers believed the Federal Reserve can be inspired to sluggish the tempo of rate of interest hikes if inflationary pressures on shoppers had been lessened.

Nevertheless, Bitcoin’s (BTC) market habits following the discharge of the FOMC report steered that the information had dampened buyers’ enthusiasm. U.S. rates of interest had been elevated by 50 foundation factors (Bps) on 14 December.

Additionally it is price noting that it has been 15 years for the reason that federal fund’s goal vary was this excessive. The Federal Reserve Board Chair Jerome Powell has steered that the ultimate rate of interest (terminal fee) can be better than 5%.

Value drops, however the development stays bullish

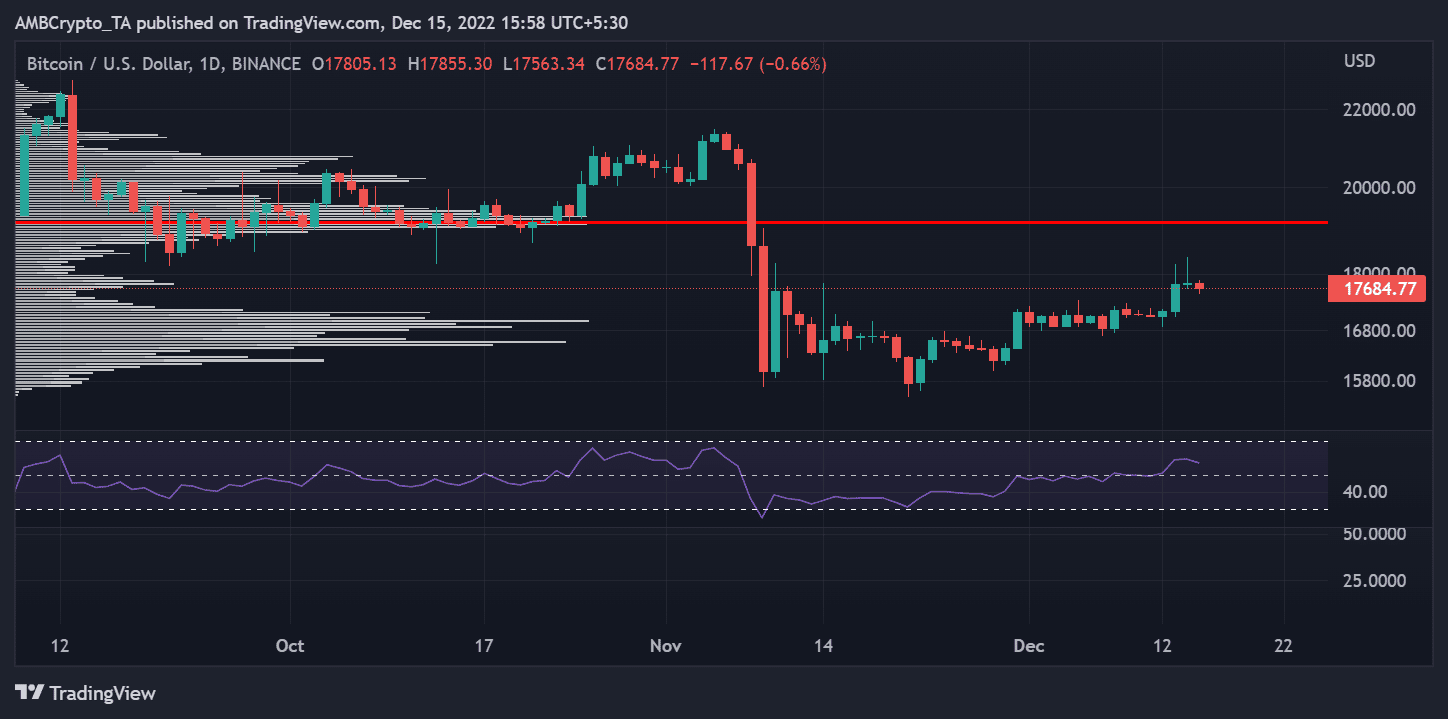

When trying on the each day timeframe for the BTC chart, it was clear that the asset didn’t reply nicely to the information. In response to the graph, Bitcoin’s worth peaked across the $18,000 space on 13 and 14 December earlier than crashing to roughly $17,600 on the time of writing.

The Seen Vary Quantity Profile evaluation confirmed that the value may nonetheless go greater regardless of the obvious decline.

Supply: TradingView

As Bitcoin approaches $17,600, it enters a low-volume node area, which can point out imminent worth volatility. A big worth settlement typically accompanied by much less fast worth fluctuation is represented by a high-volume node.

When in comparison with high-volume nodes, low-volume nodes denote much less bustling hubs. To succeed in the subsequent space of settlement, costs usually transfer swiftly via these zones. The Relative Energy Index (RSI) indicator revealed that Bitcoin was nonetheless fairly bullish regardless of the obvious, albeit modest, worth downturn.

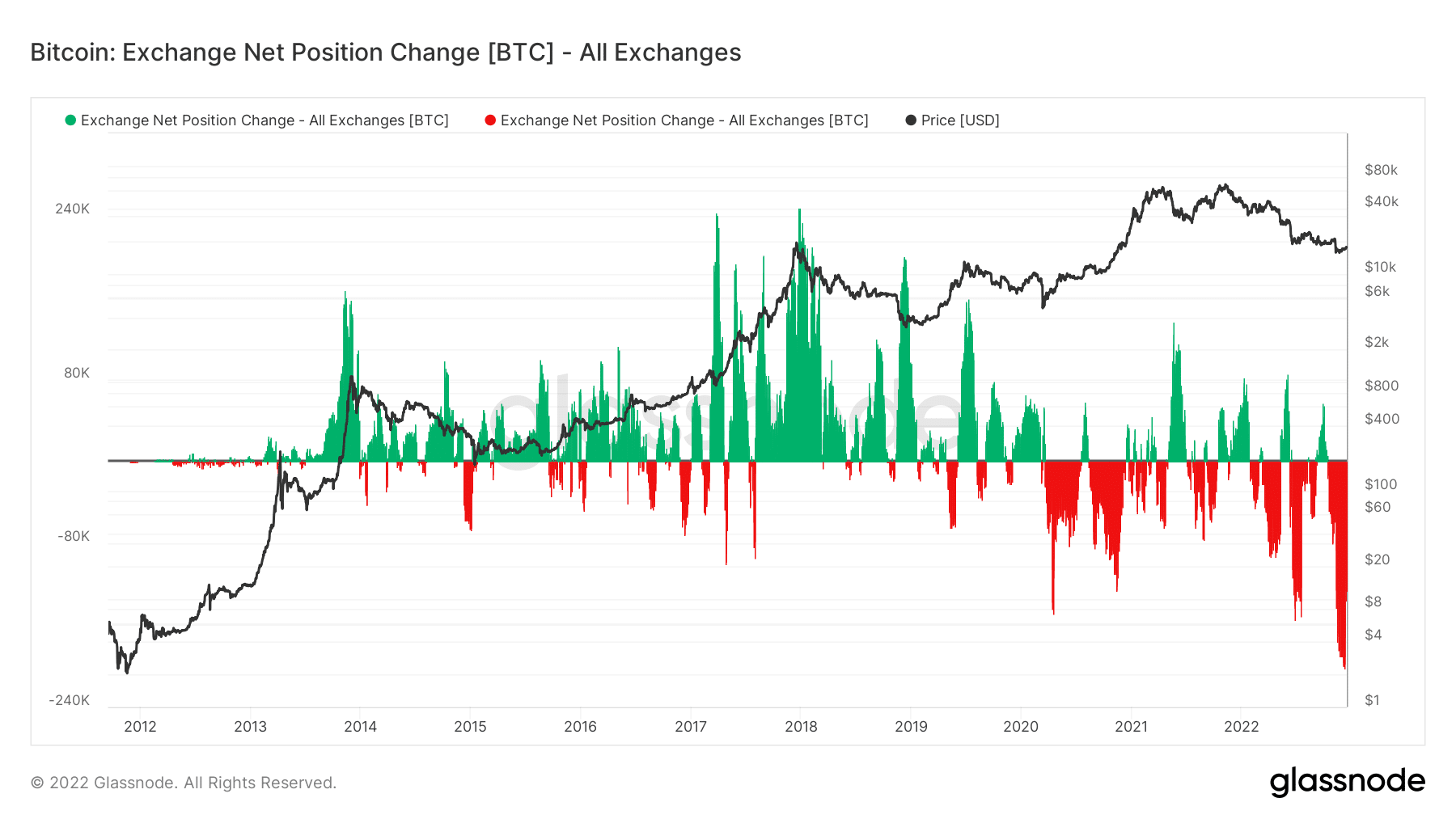

BTC outflow dominates

The Trade Web Place Change metric might clarify why Bitcoin remained bullish regardless of its obvious worth decline. Glassnode’s knowledge confirmed that the general share of BTC leaving exchanges had elevated.

If the worth of this indicator is optimistic, it signifies that there at the moment are extra deposits being made to exchanges than withdrawals being made.

Supply: Glassnode

As buyers sometimes deposit their BTC in preparation for promoting, this development could be bearish. When the indicator’s worth drops under zero, nonetheless, it signifies that extra cash are being faraway from change wallets than deposited, which may translate to a bullish development.

It’s vital to do not forget that the present market circumstances characterize a interval of traditionally low costs whereas analyzing BTC’s worth motion. Traditionally, December and January are essentially the most bearish for belongings.

![Here is what Bitcoin [BTC] holders can expect after the FOMC reports](https://ambcrypto.com/wp-content/uploads/2022/12/andre-francois-mckenzie-iGYiBhdNTpE-unsplash-4-1000x600.jpg)