Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- UNI fell beneath $6.381 after BTC’s short-term downward transfer

- A break beneath the $6.10 assist stage supplies a shorting alternative

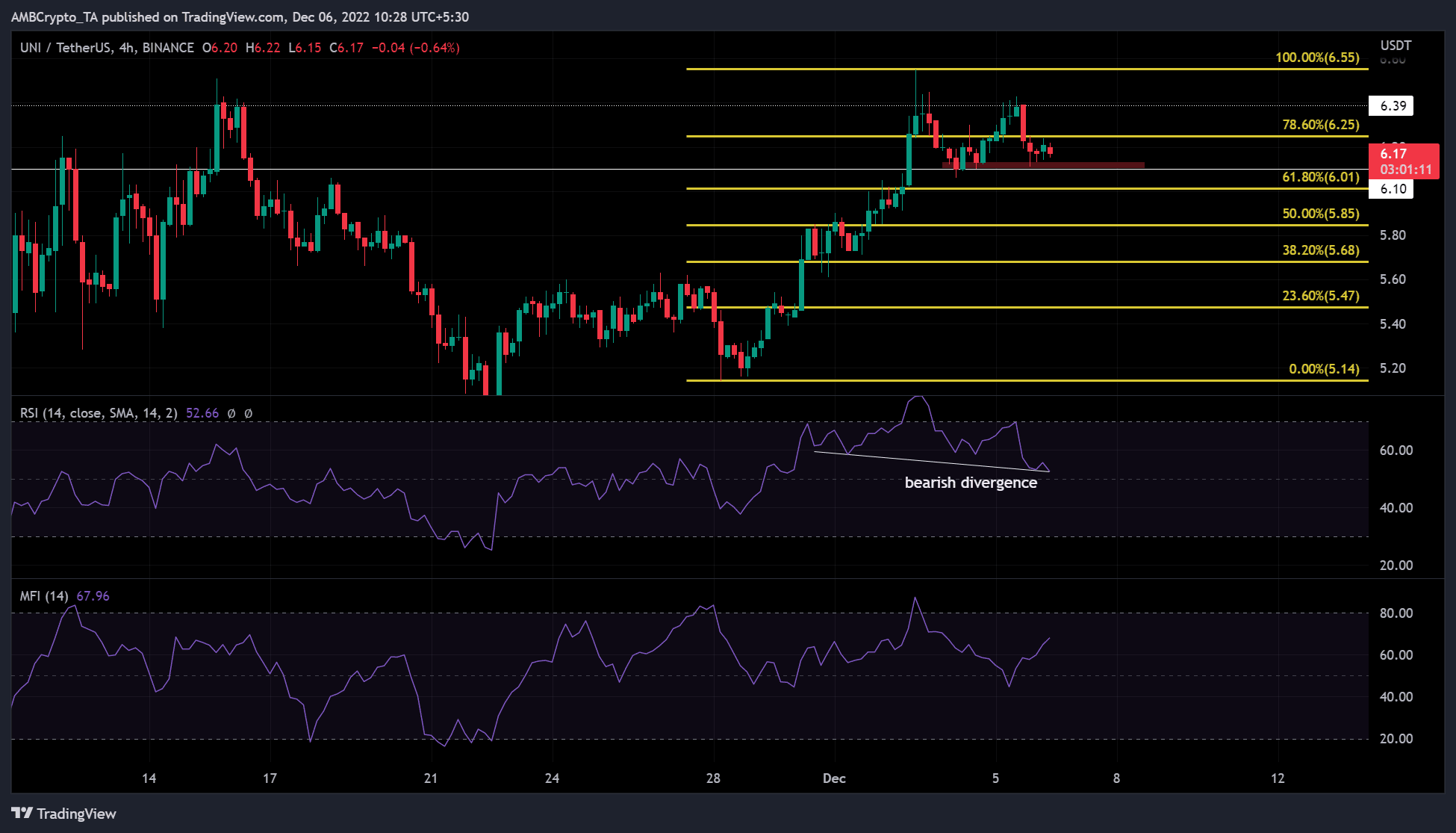

Uniswap [UNI] fell beneath $6.381 after Bitcoin [BTC] dropped beneath $17.32K on 5 December. At press time, UNI was buying and selling at $6.17, and BTC was holding simply above $17K assist. Thus, any additional downward motion in BTC may result in UNI breaking the bullish order block and the assist zone at $6.10.

Learn Uniswap’s [UNI] worth prediction 2023-2024

The above break beneath $6.10 may present a brief alternative if UNI falls to the 61.8% Fibonacci retracement stage ($6.01). However can the bears maintain the momentum?

UNI is displaying a bearish divergence: Will the bears push it decrease?

Supply: TradingView

UNI has been in a correction that would retest or break the present assist stage of $6.10. Nonetheless, primarily based on technical indicators, it was extra possible that UNI will break the present assist stage and head decrease.

Specifically, the four-hour chart confirmed a declining Relative Power Index (RSI). This indicated that purchasing stress was steadily weakening, giving huge leverage to sellers. As well as, there was a bearish divergence between the RSI and the worth motion. This might point out a doable additional downtrend for UNI.

Due to this fact, UNI can fall to $6.01 if sellers continued to achieve leverage. This may be the short-selling goal, so merchants may pocket the distinction in the event that they promote at $6.10 and purchase once more at $6.01.

Nonetheless, the risk-reward ratio wasn’t very excessive, and a break of resistance at $6.25 would negate the above bearish outlook. On this case, the speedy goal for the uptrend may very well be the bearish order block at $6.39.

UNI recorded income and a slight decline in growth exercise

Supply: Santiment

In accordance with Santiment, the 30-day Market Worth to Realized Worth (MVRV) ratio was optimistic. This confirmed that short-term holders of UNI recorded positive factors in current days.

Nonetheless, UNI’s growth exercise decreased sharply on the time of publication after rising steadily just lately. Given the numerous influence on the worth of UNI, such a pointy decline may result in an additional downward pattern. Nonetheless, if BTC develops a bullish sentiment, UNI may enter an uptrend and invalidate the above bearish forecast.