- SOL noticed a 55% low cost throughout this week’s bearish onslaught

- Extra promote strain is perhaps on the best way as over 47 million SOL is unstaked

Solana’s native cryptocurrency SOL has had an unexpectedly bearish week up to now. The appreciable low cost that it has acquired up to now means that now is perhaps a superb time to ape again in. Nonetheless, when you intend to purchase disounted SOL at its present degree, you would possibly wish to rethink for now and right here’s why.

Learn Solana’s (SOL) Worth Prediction for 2023-2024

Lambda Markets has reported an fascinating statement, one which means that SOL is perhaps about to expertise extra strain. In accordance with the findings, roughly 47.3 million SOL will probably be unstaked on Thursday. The prevailing assumption is that the unstaked SOL will possible discover its method onto exchanges, ushering in a brand new wave of promote strain.

New $SOL alert posted within the telegram channel.

~$845MM USD value of solana is because of be unstaked in 21 hours time from now.

We assume that that is being unstaked with the intention of promoting, sol volatility will probably be wild at this time. pic.twitter.com/F3N6ow4u2Y

— Lambda (@lambdamarkets1) November 9, 2022

If everything of the unstaked SOL is offered, then we must always anticipate over $890 million value of promote strain. This is sufficient to discourage different SOL holders to dump their SOL holdings within the hopes of shopping for again at decrease costs. In different phrases, we’d see over $1 billion value of promote strain flowing into exchanges.

Will SOL bulls be suppressed?

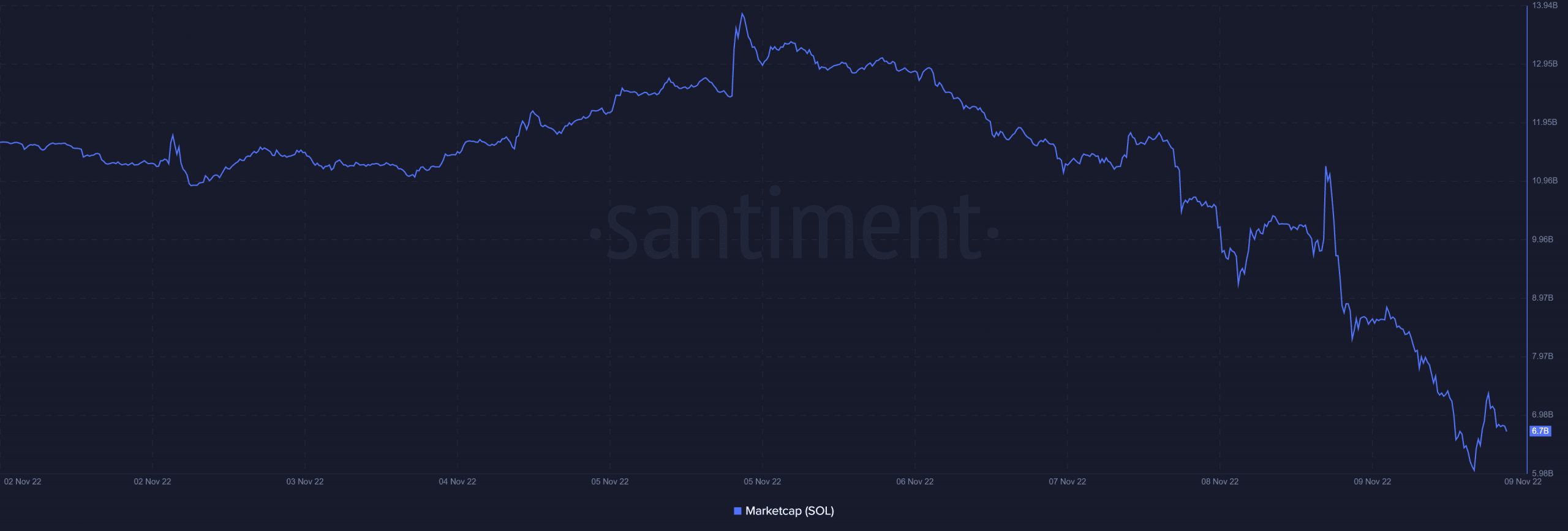

Solana’s market cap dropped by as a lot as $7.7 billion in a matter of simply 7 days. The SOL anticipated to be unstaked within the subsequent 24 hours represents a small fraction of the promote strain we noticed this week.

However, the incoming promote strain should outweigh demand at its current lows. Curiously, SOL’s market cap revealed that there was over $1.2 billion value of shopping for strain in the previous few hours, at press time.

Supply: Santiment

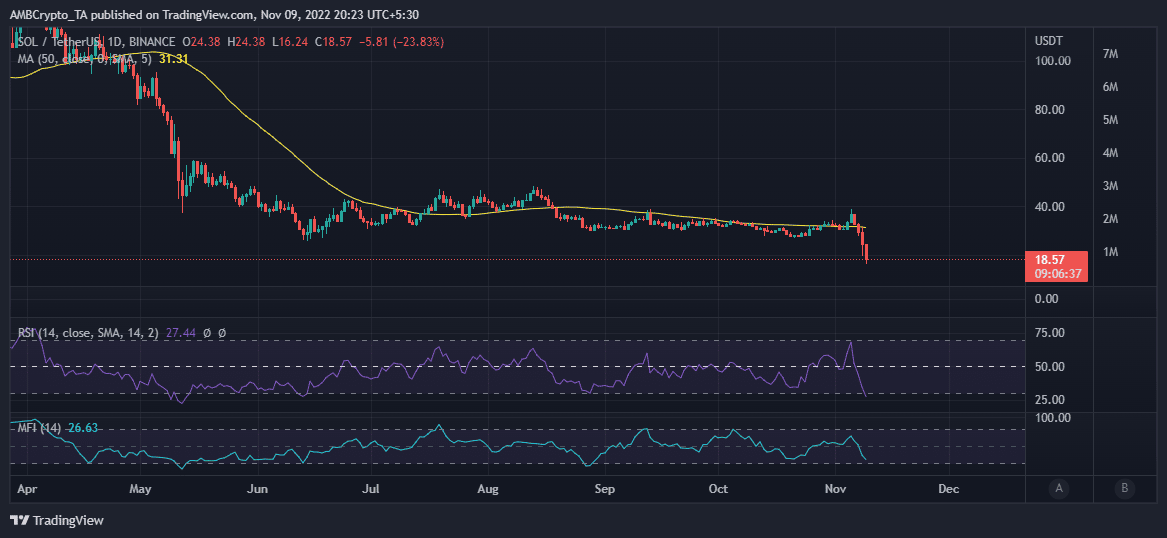

As anticipated, the sharp market cap drop resulted in an equally sharp decline in SOL’s worth.

It was buying and selling at $18.57 at press time – a brand new 2022 low. The expectations of a bullish restoration are primarily based on the truth that it’s now in oversold territory.

Supply: TradingView

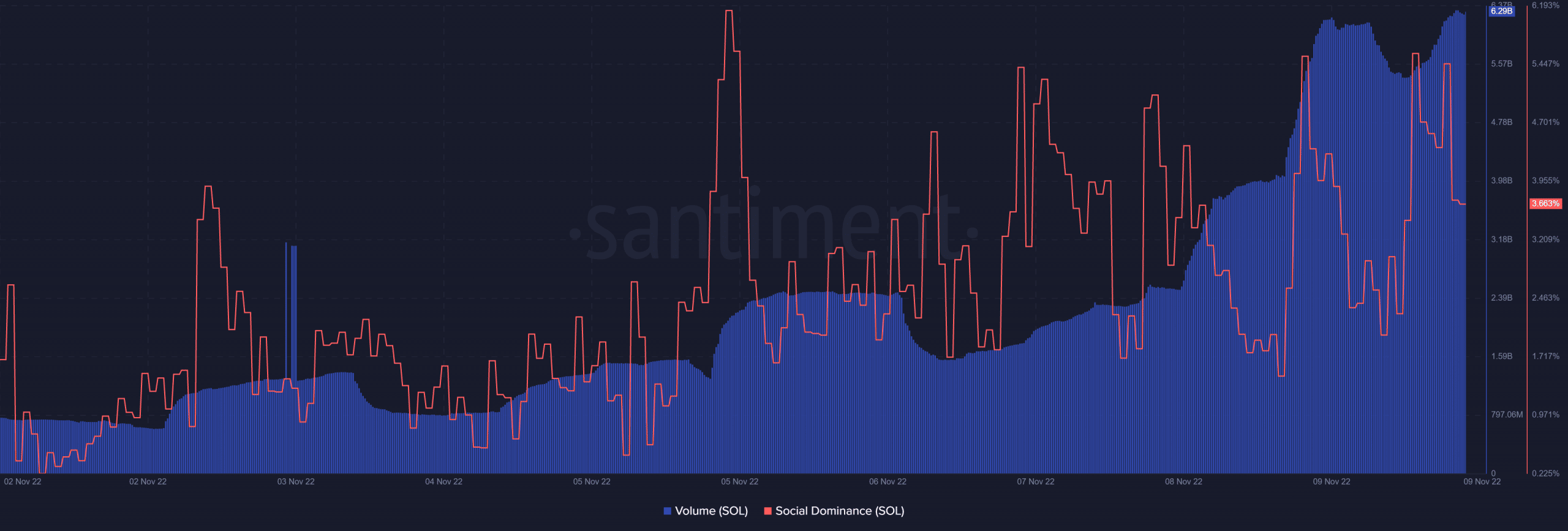

Solana’s quantity soared to its highest weekly and month-to-month degree within the final 24 hours too. Nonetheless, it did register a slight dip earlier than reaching its present highs.

The dip would possibly characterize the slowing down of promote strain and the return of bullish quantity merchants shopping for the dip. This would possibly clarify why SOL’s worth hovered throughout the $18 worth vary.

Supply: Santiment

SOL’s social dominance additionally registered important upside over the identical time interval. This implies Solana is now receiving plenty of consideration and traders is perhaps further delicate to optimistic or detrimental information.