The introduction of blockchain expertise has introduced varied alternatives and improvements within the decentralized area. Together with these constructive outcomes, the adoption of crypto tax has taken the blockchain enviornment to a special horizon. Crypto taxes refers back to the taxes which might be levied on transactions involving cryptocurrencies, equivalent to Bitcoin or Ethereum.

The jargon and technicalities surrounding crypto tax guidelines have been very complicated relying on completely different geographical places and jurisdictions. Thereby, a platform that caters to accounting and crypto tax necessities of merchants, establishments, and enterprises turned the necessity of the hour.

Using the chance of the continued wave, Ledgible a crypto-tax accounting platform got here into the limelight. Ledgible is a one-stop platform specifically curated to deal with the crypto-related calls for of enterprises, establishments, and professionals.

Seeing the rise of buying and selling establishments within the crypto area Ledgible has additionally taken the initiative to spice up the TradFi adoption within the crypto area.

What’s Ledgible?

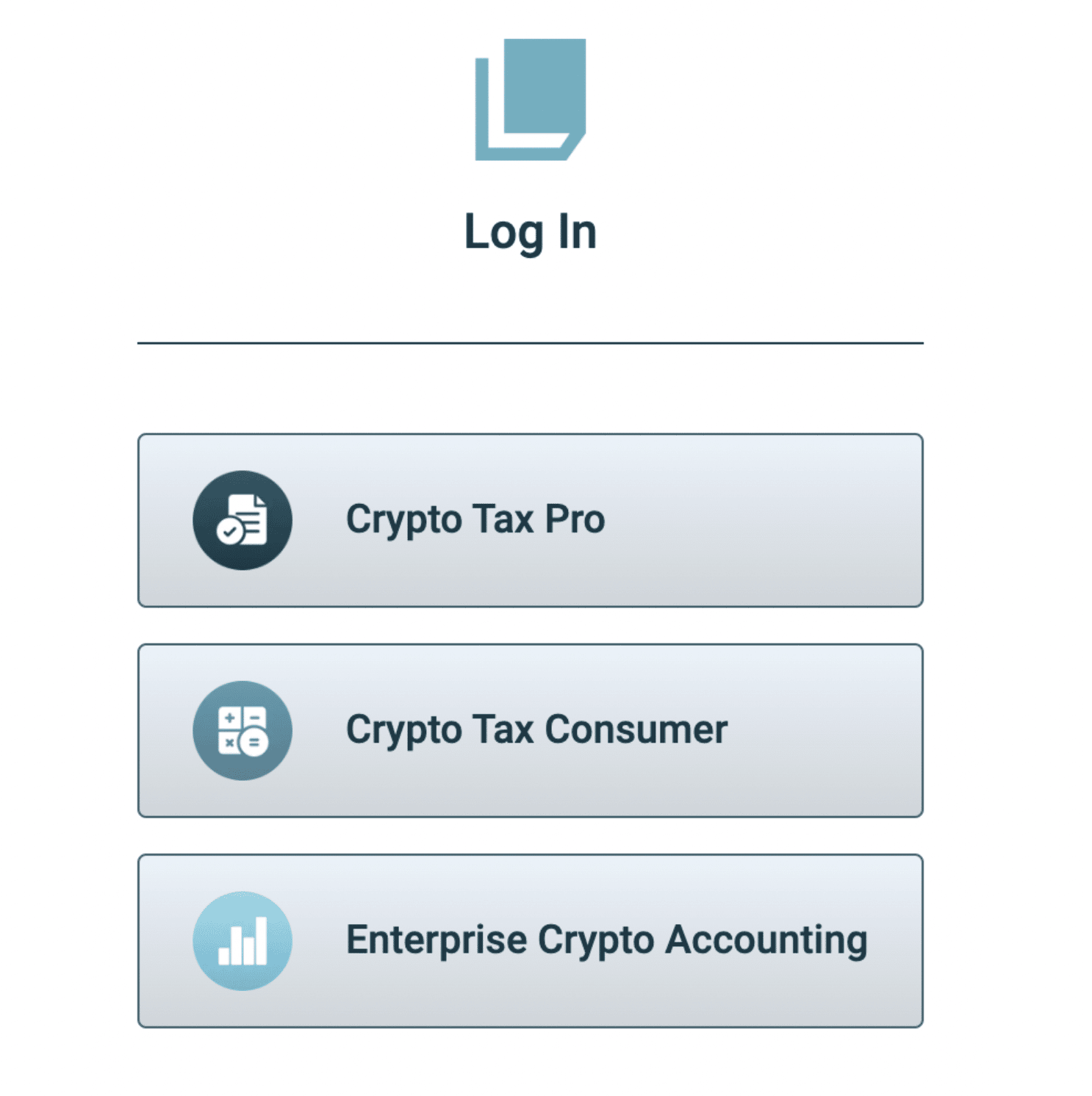

Ledgible is a scalable platform that has been designed as an answer for cryptocurrency tax and accounting. Since its inception, the platform has been utilized throughout the globe by varied monetary establishments, companies, CPAs, and accounting companies.

Ledgible has made crypto tax, crypto accounting, and crypto audit for billions of {dollars} of crypto belongings a cakewalk. Moreover, for customers who’re in search of conventional monetary verification, reporting, and assurance, Ledgible offers the instruments they require to effectively embrace cryptocurrency of their work.

It’s an AICPA SOC 1 & 2 Sort 2 assured tax reporting and portfolio monitoring platform established as a crypto asset resolution for tax and accounting professionals with main accounting companies, establishments, and main crypto corporations throughout the globe. Experiences counsel that the Ledgible Crypto Tax Professional is utilized by varied companies making tax reporting easy for professionals in addition to amateurs.

Benefits provided by TradFi

The mix of blockchain expertise into conventional finance (TradFi) has supplied a variety of advantages to merchants within the crypto area that are as follows:

- Effectiveness: With the utilization of tradeFi, customers can full their transactions straight between related events, with none middleman. The incorporation of good contracts additional enhances the whole course of by making it safe and automatic. All these leads to the sleek streamlining of commerce finance processes with minimal prices, and better transaction pace.

- Identifiable: Blockchain expertise makes monitoring items/belongings for each importers and exporters a lot simpler. Moreover, associated asset data may be obtained from the earlier and handed on to the brand new proprietor for doable motion enabling new financing alternatives and perfection of an curiosity within the buying and selling of products.

- Transparency: The distributed ledger expertise of blockchain by recording all of the transactions makes the whole course of transparent and reliable. Along with tradeFi, extra choices for financing commerce and decreasing the chance of data tampering can be found to the general public.

- Auditability: The sequential and indefinite recording of every commerce finance transaction is all doable due to blockchain expertise. The latter has resulted in life lengthy audit path of the traded asset and high quality verification of belongings authenticity with minimized compliance prices.

- Reliability: Impartial cryptography is utilized for the verification of every transaction inside the commerce community. The cryptographically protected keys and encryption securely transmit knowledge between completely different monetary establishments and thereby, privatize the whole knowledge.

Ledgible catalyzing TradFi adoption

Basically, the adoption of cryptocurrencies and cryptocurrency buying and selling platforms has elevated considerably in recent times, as extra folks have turn out to be on this asset class and the underlying expertise of blockchain. Many conventional monetary establishments and on-line brokers now supply cryptocurrency buying and selling, and there are additionally a lot of specialised cryptocurrency exchanges and buying and selling platforms out there.

Seeing the rising graph of crypto buying and selling establishments, Ledgible with its taxation and accounting options has streamlined the TradFi adoption course of. Corporations utilizing Ledgible, can now join their consumer’s portfolios, report crypto transactions and routinely calculate beneficial properties and taxes.

TradFi adoption can turn out to be a lot simpler with Ledgible’s direct built-in skilled tax software program. Moreover, automation of crypto exercise in a structured conventional format has additionally turn out to be simpler with the Ledgible platform. With its superior skilled taxation properties, companies can simply deal with crypto reporting and broaden their service choices and ship crypto advisory, reporting, and tax planning as and when required.

Ledgible and its key choices

Ledgible presents some stand-out options for its customers to eliminate the hustle of crypto taxing and accounting and in addition boosts the TradFi adoption:

- Built-in crypto tax devices: The platform is curated by professionals with superior options for consultants within the crypto tax subject. With Ledgible’s Crypto Tax Professional customers can now simply incorporate crypto into their present tax preparation workflow making tax preparation a lot simpler. Moreover, by making crypto legible, Ledgible permits customers to shortly account for the crypto tax whereas initiating their tax course of.

- Crypto monitoring and tax reporting: Customers by connecting their wallets, exchanges, and many others can calculate their crypto tax burden, ship present-year planning, and put together their tax reviews. Ledgible with its safe and automatic DIY crypto monitoring and tax reporting makes the general course of less complicated.

- One-stop crypto administration: The Ledgible Crypto Enterprise & Institutional Crypto Accounting utility is designed from the grassroots stage to streamline customers’ digital asset accounting operations and companies’ cryptocurrency. Customers can blindly depend on Ledgible to trace cryptocurrencies for his or her institutional and enterprise wants. All one must do is connect with their most popular accounting software program they usually can have one-stop entry and handle their crypto financials.

- Seamless pricing with increased worth: The platform offers a simple pricing construction for every utility. The clear upfront base pricing with clearly outlined transaction tiers leads to most worth era. The accounting staff additionally connects with the customers to organize reviews primarily based on the particular accounting wants of the person.

Closing ideas

The present scenario of the commerce finance course of is backed by varied limitations hampering the expansion of TradFI adoption. Unstructured knowledge, the burden of bodily paperwork, enormous compliance checks, and the regular rise in quantity errors have been the key bottlenecks of the present TradFi course of. Thereby, Ledgible with its crypto tax and accounting platform has taken the step to tempo up mass TradFi adoption.

Taking good care of all of the hubbub surrounding the crypto area, Ledgible has are available in as an answer to cater to all of the wants of merchants and traders. Partnering with Blockworks, Ledgible is all set to launch a crypto tax information for traders, accountants, and establishments by integrating crypto knowledge into their present monetary programs.

Moreover, Ledgible with the assistance of software program instruments can also be liable for creating, curating, and organizing cryptocurrency studying content material for consultants within the trade. The platform has additionally laid its key concentrate on increasing its crypto information base and making a hub for monetary professionals to hitch and find out about cryptocurrency and digital asset markets.

For extra data on Ledigble, please go to their official website or comply with their Twitter deal with.

Disclaimer: It is a paid submit and shouldn’t be handled as information/recommendation.