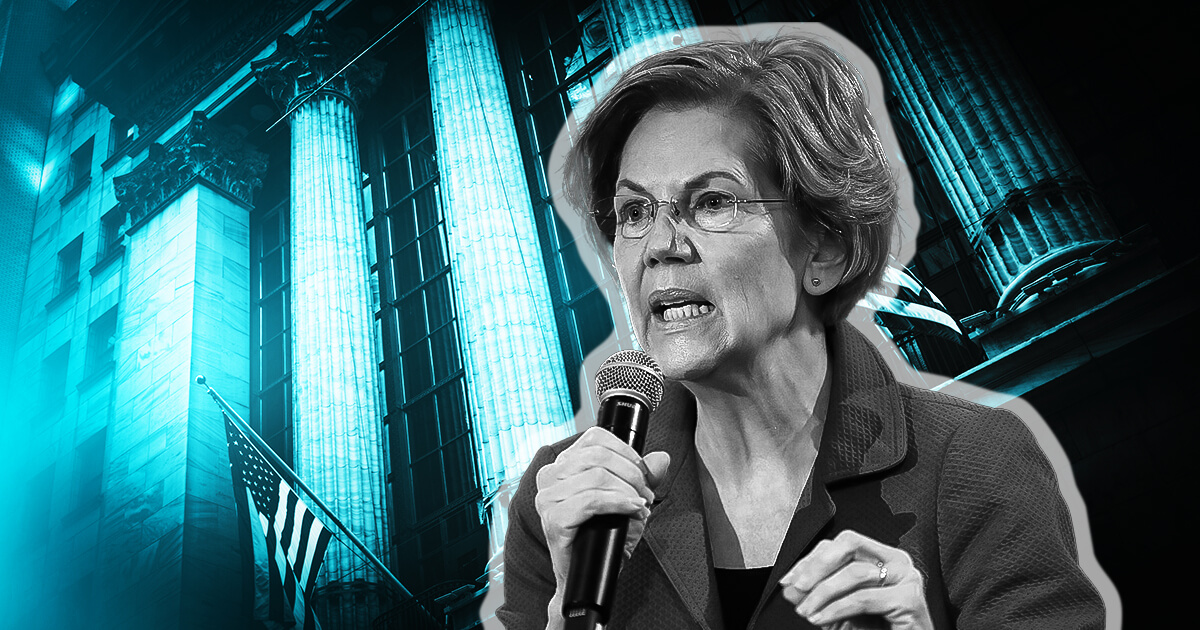

U.S. senator Elizabeth Warren reintroduced the Digital Asset Anti-Cash Laundering Act on July 28, backed by unlikely allies — the Wall Avenue banks.

The Financial institution Coverage Institute, a monetary coverage suppose tank made up of a cohort of banks, backed the laws that goals to mitigate the nationwide safety dangers posed by cryptocurrencies. Traditionally, Warren has been a fervent critic of The Financial institution Coverage Institute, however they appeared to have discovered widespread floor — the necessity to crack down on crypto.

Noting that cryptocurrencies have grow to be the “fee technique of selection” amongst cybercriminals, Warren stated in a press launch:

“This bipartisan invoice is the hardest proposal on the desk to crack down on crypto crime and provides regulators the instruments they should cease the stream of crypto to dangerous actors.”

Holding crypto gamers to banking requirements

The laws, which was first launched in December 2022, will impose the obligations below the Financial institution Secrecy Act (BSA) on crypto pockets suppliers, miners, and validators. Crypto service suppliers and community contributors will, subsequently, want to fulfill know-your-customer necessities if the laws is handed.

The 7-page invoice requires the Treasury Division to arrange a compliance examination and overview course of to make sure all crypto cash service companies adjust to the anti-money laundering and countering the financing of terrorism (AML/CFT) obligations below BSA. The invoice can even direct the Securities and Alternate Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) to arrange related overview processes for the crypto companies below their purview.

Moreover, crypto companies should file a Report of International Financial institution and Monetary Accounts (FBAR) with the Inside Income Service. Crypto service suppliers should file the report at any time when any U.S. buyer makes use of a number of offshore accounts to conduct crypto transactions over $10,000, as per the invoice.

The invoice will direct the Monetary Crimes Enforcement Community (FinCEN) to implement the rule it proposed in 2020 to shut the regulatory hole created by self-custody wallets. The brand new rule will make it necessary for banks and cash service companies to confirm buyer and counterparty identities, preserve information, and file reviews for particular crypto transactions involving self-custody wallets or wallets hosted in non-compliant jurisdictions.

The invoice additionally goals to mitigate the dangers of crypto ATMs. It would require FinCEN to make sure that ATM house owners and directors usually report and replace the bodily addresses of their kiosks. ATM operators should additionally confirm buyer and counterparty identification for all transactions.

Lastly, the invoice will direct FinCEN to information monetary establishments on mitigating the dangers related to dealing with, utilizing, or transacting with crypto whose origin has been obscured utilizing mixers or different anonymity-enhancing applied sciences.

The invoice goals to control crypto companies in the identical means as banks. As Senator Roger Marshall, a supporter of the invoice, acknowledged:

“The reforms outlined in our laws will assist us battle again and safe our digital belongings by utilizing confirmed strategies that our home monetary establishments have been complying with for years.”

Senator Lindsey Graham, who has additionally backed the invoice, added that “most of the identical guidelines that apply to the greenback ought to exist for crypto.”