- Lido finance information a decline in TVL and APR within the final week.

- LDO’s worth continues to fall following FTX’s collapse.

Main Ethereum [ETH] staking platform Lido Finance [LDO] suffered a decline in its complete worth locked (TVL) within the final week attributable to a decline within the worth of native tokens, together with Polygon’s MATIC, Solana’s SOL, and main altcoin ETH.

Learn Lido [LDO] Value Prediction 2023-2024

Per knowledge from DefiLlama, Lido’s TVL stood at $6.2 billion, having fallen by over 2% within the final seven days. Lido, in a tweet, confirmed that the decline in TVL was as a result of decline in worth suffered by ETH, MATIC, and SOL inside the similar interval. “Native tokens worth lower dragged Lido TVL down,” Lido tweeted.

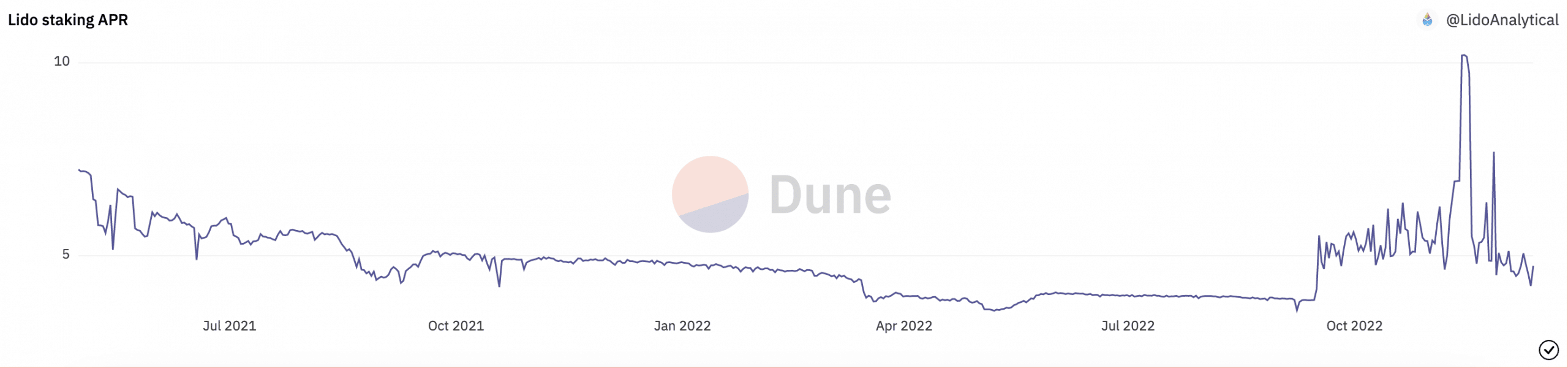

⚡️Lido staking APR ⚡️

Lido protocol APR decreased to 4.68% due to decrease Ethereum community exercise resulting in average Execution Layer rewards in the mean time. pic.twitter.com/qkluQupuqb

— Lido (@LidoFinance) December 12, 2022

Along with a drop in its TVL, Lido’s staking annual proportion price (APR) decreased to 4.68%. This decline in staking APR got here a month after Lido logged an all-time excessive of 10.21% in APR on the platform, per knowledge from Dune Analytics.

Supply: Dune Analytics

In response to Lido, the autumn in APR was attributable to “ decrease Ethereum community exercise resulting in average Execution Layer rewards in the mean time.”

Additional, whereas staking deposits on Ethereum, Solana, and Polkadot noticed progress within the final week, staking deposits on Polygon and Kusama declined by 1% and 4%, respectively.

The decline in staking deposits on each networks was as a result of restricted rely of stakers inside the interval below evaluation. Per knowledge from Staking Rewards, the rely of stakers on the entire of Polygon solely grew by 1% within the final seven days, whereas the identical fell by 6% on Kusama.

Regardless of the assorted declines on Lido, its ETH and stETH reserves on Curve Finance “grew proportionally, contributing to the secure change price between the 2 belongings.” In response to Lido, “stETH/ETH remained in a slender hall between 0.9874 and 0.9900 over the past week and at present sits at 0.9892.”

Does LDO stand an opportunity?

Within the final week, LDO’s worth fell from the $1 mark to commerce momentarily at $0.99. Though it regained the $1 worth stage, its worth was nonetheless down by 2% within the final week, knowledge from CoinMarketCap confirmed.

Whereas the remainder of the market took a stab at restoration following FTX’s surprising collapse, LDO continued in a downtrend. For the reason that FTX’s fallout, LDO’s worth has fallen by 39%.

An evaluation of the alt’s efficiency on a every day chart revealed a constant decline in LDO accumulation. As well as, key indicators, such because the Relative Power Index (RSI) and the Cash Circulate Index (MFI) remained under their respective impartial zones at 42.38 and 43.96, respectively, each in downtrends.

Equally, its Chaikin Cash Circulate (CMF) returned a damaging worth of -0.12, indicating that sellers overpowered the patrons.

Supply: TradingView