Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- LTC’s market construction was bearish.

- Value motion retested the $81.81 assist.

Litecoin [LTC] depreciated 20% since mid-February after value rejection at $103. The growing market uncertainty since mid-February has elevated promoting strain on LTC.

The U.S. Employment Report on Friday (March 10) may provide particular value motion over the subsequent few days/weeks and is value monitoring, particularly for macro-investors.

A greater-than-expected job report may result in a market rally and increase LTC’s restoration, whereas dismal outcomes would exert extra promoting strain.

Learn Litecoin [LTC] Value Prediction 2023-24

Can the bulls defend $81.89 assist?

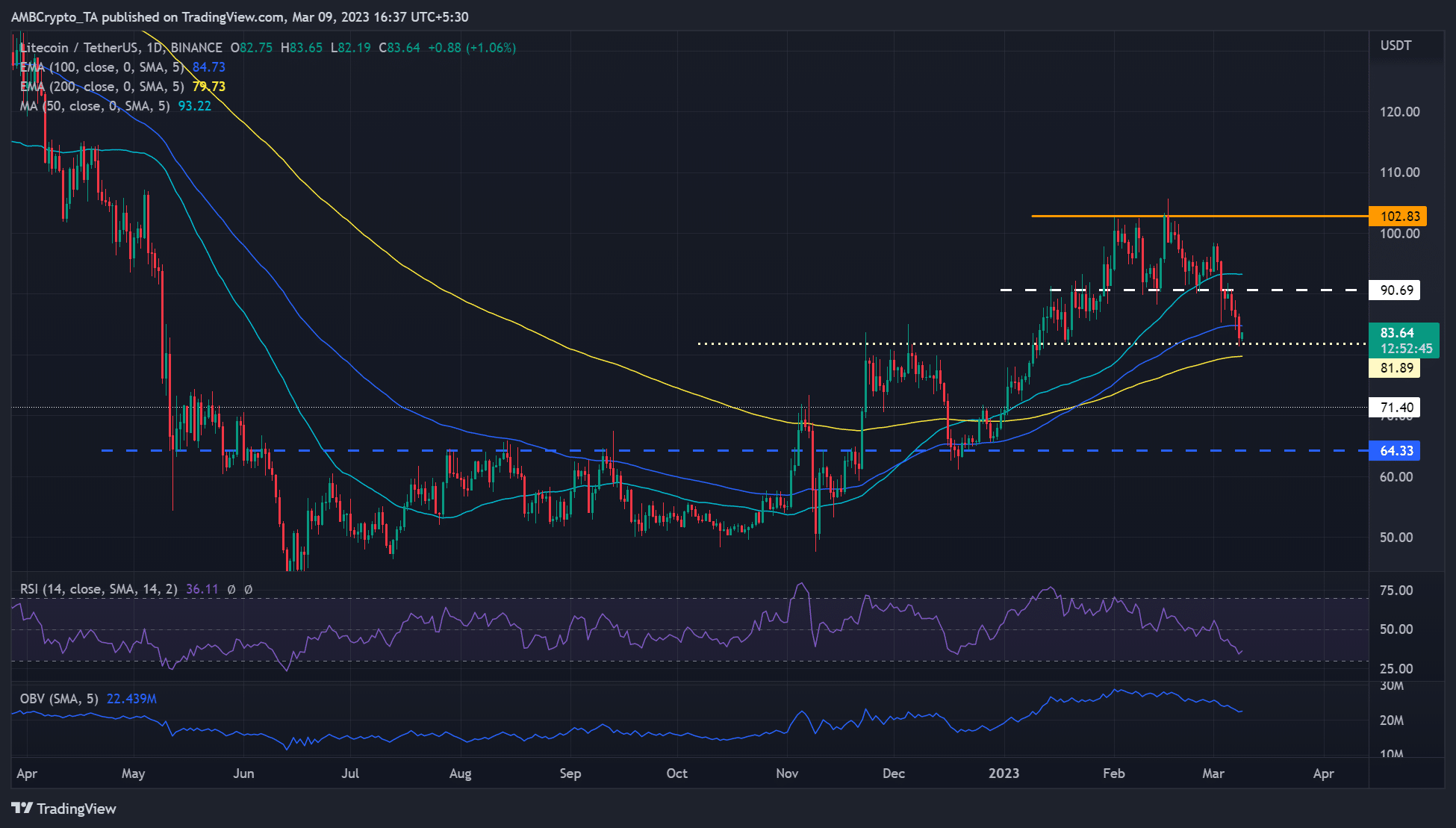

Supply: LTC/USDT on TradingView

The $103 has been a key resistance degree in February, stopping additional upward LTC motion. LTC consolidated within the $103 – $90.7 vary all through February however broke the sideway construction on 3 March after bears breached the $90.7 assist.

Bears cleared the hurdles on the 50-day MA (Transferring Common), $90.7, and 100-day EMA (exponential transferring common). At press time, the worth rebounded from the quick essential assist at $81.89 and will come to the bulls’ rescue if the roles report is spectacular.

Lengthy-term bulls should defend the $81.89 assist to maintain bears off the market. The following hurdle for bulls can be the 100-day EMA ($84.73) to allow them to succeed in the goal of $90.7.

Alternatively, LTC may face aggressive promoting if bears dent the gentle bullish sentiment by sinking it under $81.89. Nevertheless, bears should clear the 200-day EMA to realize the leverage to devalue LTC towards $64.

The every day chart’s RSI (Relative Energy Index) was within the decrease vary, indicating intense promoting strain. As well as, the OBV (On Steadiness Quantity) declined, suggesting that buying and selling volumes dropped considerably in February.

90-day MVRV flipped to adverse amidst unstable demand

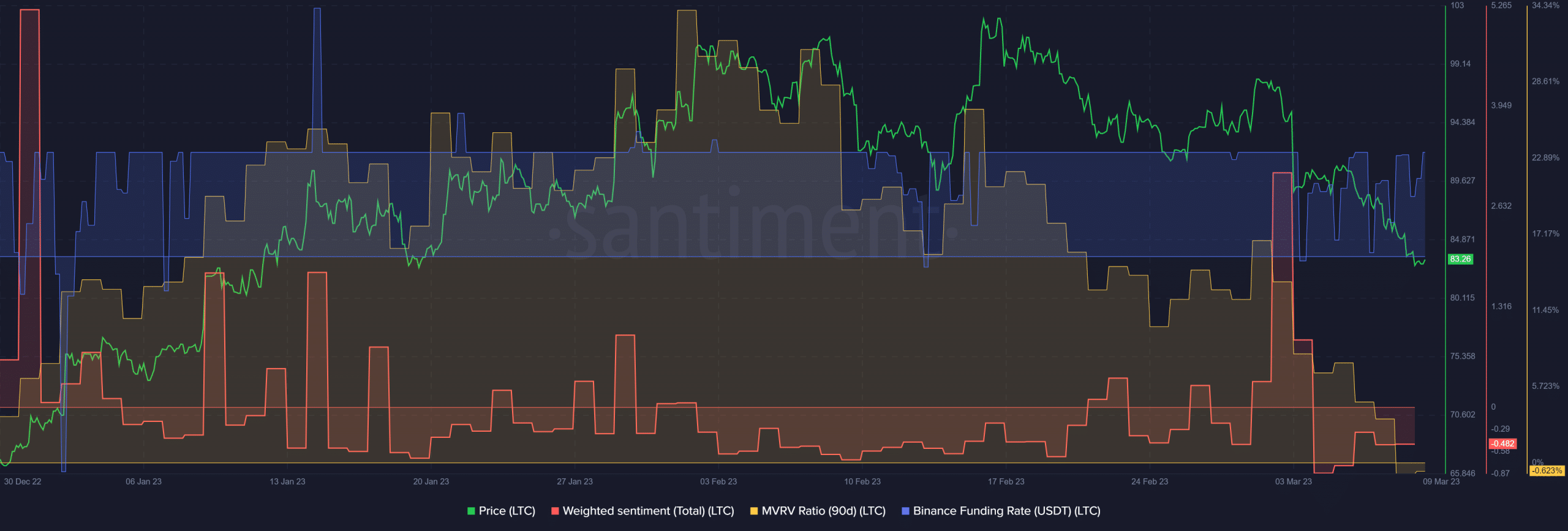

Supply: Santiment

In keeping with Santiment, LTC noticed unstable demand within the derivatives market for the reason that starting of March, as proven by the fluctuating Funding Charges.

As well as, the 90-day MVRV (Market Worth to Realized Worth) ratio declined and flipped to adverse on the time of writing. It exhibits quarterly LTC holders’ income had been cleared, they usually had been struggling losses at press time.

Is your portfolio inexperienced? Test the LTC Revenue Calculator

Though the weighted sentiment barely improved, it was nonetheless within the adverse territory, additional capturing the underlying market uncertainty; however the value course could possibly be outlined after the roles report on March 10.