- An govt proposal has been carried out to extend DAI Financial savings Price to 1%.

- MakerDAO was momentarily displaced because the DeFi protocol with the most important TVL.

Following an govt proposal determined upon on 11 December and executed on-chain on 12 December, MakerDAO [MKR] carried out an increment of its DAI Financial savings Price from 0.01% to 1%.

DAI is a decentralized stablecoin whose worth is pegged to the greenback and backed by centralized stablecoins similar to USD Coin (USDC) and Pax Greenback (USDP) and different cryptocurrency belongings similar to Ethereum (ETH) and Wrapped Bitcoin (WBTC).

Learn MakerDAO’s [MKR] Value Prediction 2023-24

The DAI Financial savings Price was launched in 2018 to incentivize DAI holders to lock their stablecoins into the DAI Financial savings Price contract to generate curiosity.

Nevertheless, the rate of interest paid to holders who locked their DAI into the good contract had been pegged at simply 0.1%. With the brand new govt proposal, DAI depositors can now earn as much as 1% curiosity on their DAI holdings.

Along with a bump in rate of interest, different modifications carried out by the manager proposal included the distribution of 103,230 DAI to twenty Acknowledged Delegates, offboarding renBTC-A, the switch of 257.31 MKR to MakerDAO’s TechOps Core Unit, and a number of other parameter modifications from the most recent proposal of the MakerDAO Open Market Committee.

Maker dethroned momentarily

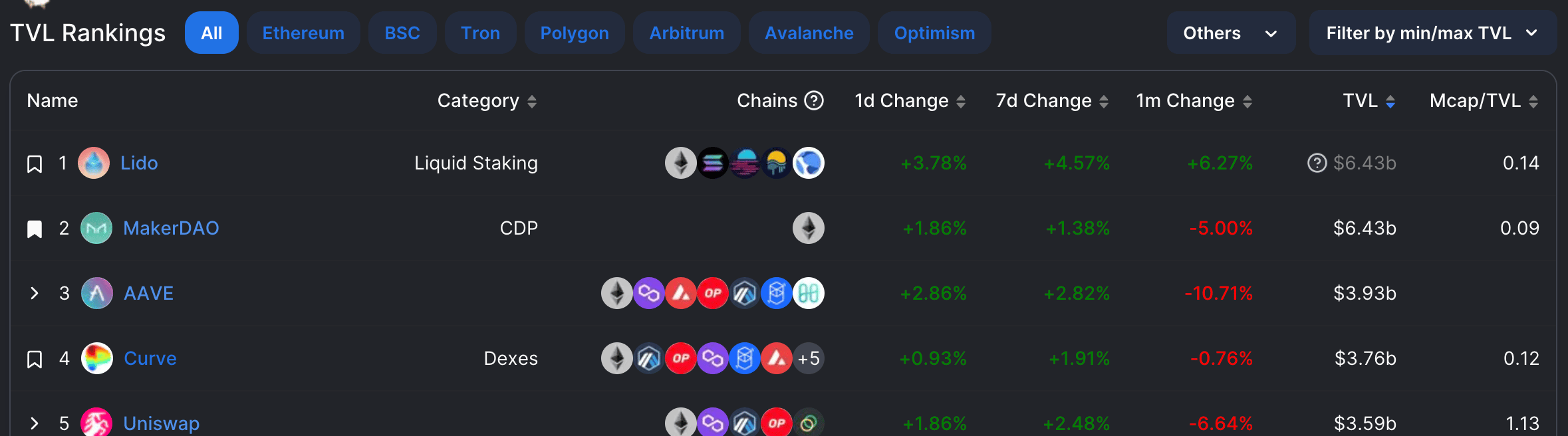

In the course of the intraday buying and selling session on 12 December, the main liquid ETH staking platform, Lido Finance, noticed its whole worth locked (TVL) climb to $6.45 billion to rank forward of MakerDAO as the most important DeFi protocol by TVL.

Lido is now the most important DeFi protocol by TVL, with $6.45b deposited pic.twitter.com/E8kkOPiStu

— DefiLlama.com (@DefiLlama) December 13, 2022

The expansion in Lido’s TVL was attributable to a leap in its staking annual proportion fee (APR) to an all-time excessive of 10.21% a number of weeks in the past. Whereas this has retraced to the 4% degree, staking deposits on the platform proceed to rally.

The latest bump in MakerDAO’s DAI Financial savings Price may symbolize makes an attempt by the DeFi protocol to incentivize present depositors additional and drive in new depositors because the DeFi panorama turns into more and more aggressive.

At press time, Lido Finance and MakerDAO every had a TVL of $6.43 billion.

Supply: DefiLlama

MKR refuses to be rebound

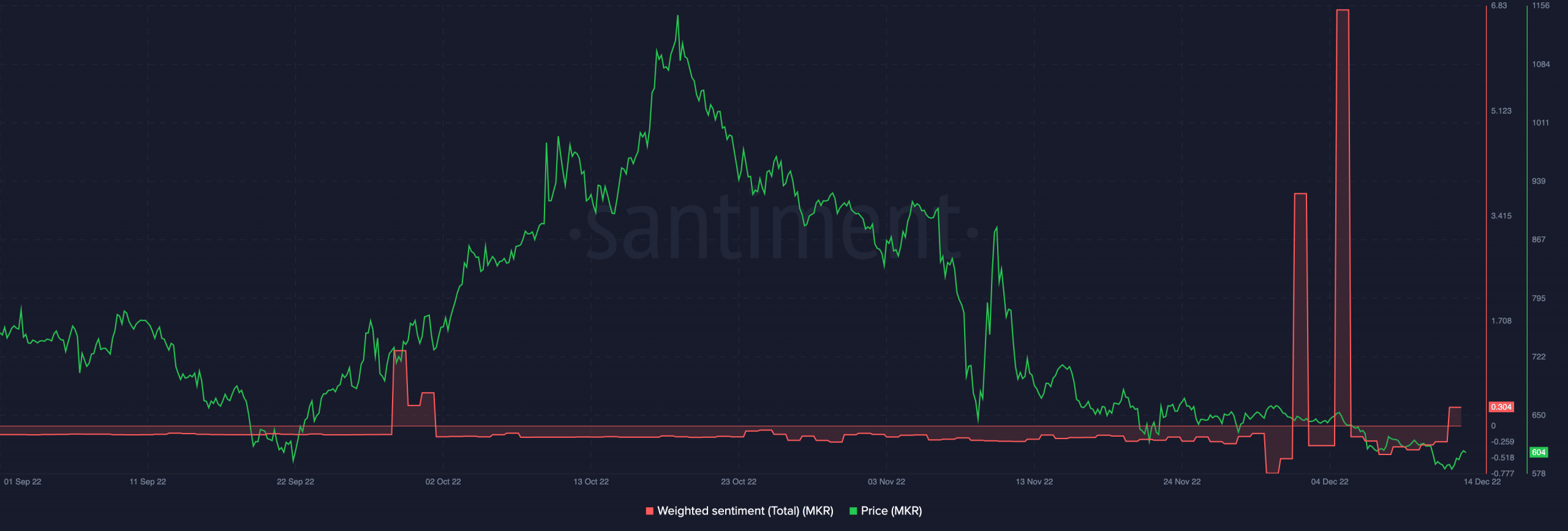

Exchanging palms at $604.43 at press time, MakerDAO’s native token MKR has seen a big decline in worth within the final month. Per knowledge from CoinMarketCap, MKR’s value has declined by 11% up to now 30 days.

Aside from the final market decline, the constant decline in MKR’s value can be attributable to the unfavorable sentiment that has trailed the asset since FTX’s demise.

Supply: Santiment