Ripple has determined to take away particulars of its XRP transactions from its quarterly reviews, a change pushed by a lawsuit from the U.S. Securities and Trade Fee (SEC) towards the corporate.

Within the July 31 report, Ripple defined that the SEC’s motion pressured it to re-evaluate the position and contents of its quarterly report any more. Nonetheless, the agency said that it stays dedicated to being clear.

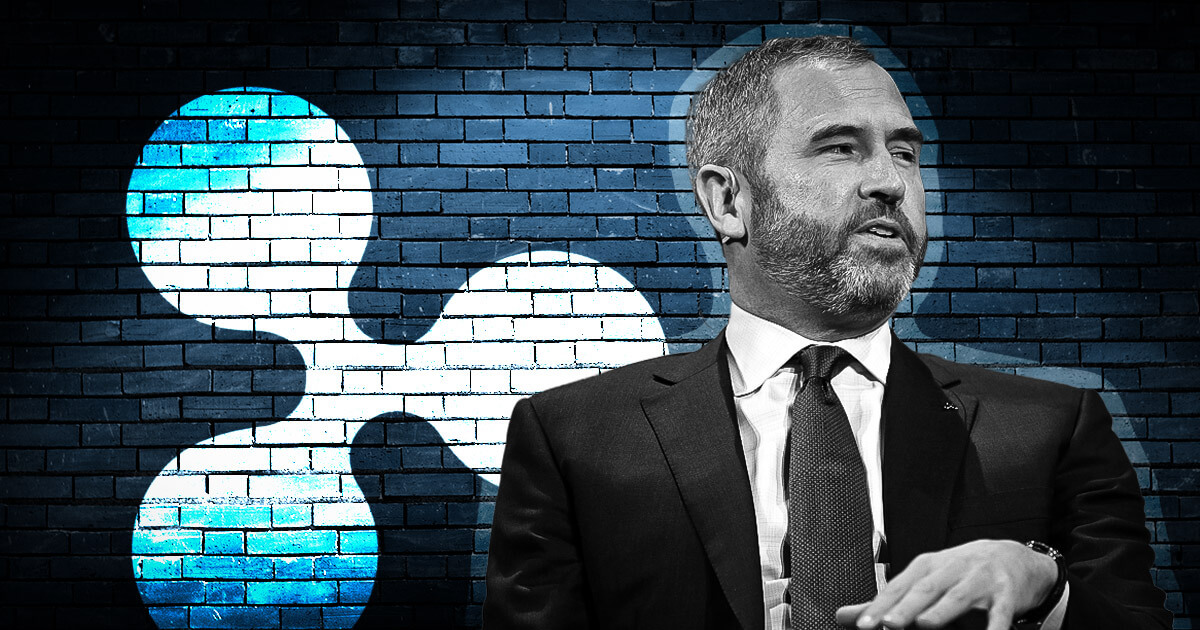

Brad Garlinghouse, Ripple’s CEO, additionally reiterated this remark in a separate tweet, saying:

“We started these reviews to voluntarily present updates given our XRP holdings. Sadly, they had been used towards us within the SEC lawsuit – nevertheless, we stay steadfast in our dedication to transparency however I think they’re going to look a bit totally different shifting ahead.”

Crypto lawyer John Deaton noted that Ripple was not obligated to supply the data it has been sharing since 2017 as a non-public firm.

However he added that Ripple’s transparency probably prevented the SEC from bringing any prices associated to fraud, manipulation, and misrepresentation towards the corporate.

Q2 takeaways

The latest XRP report emphasizes the courtroom choice within the SEC vs. Ripple case, through which the courtroom decided that the XRP digital asset is just not a safety.

Going by this, Ripple said that solely its XRP token and Bitcoin (BTC) had been the one property with authorized readability within the U.S.

“On July 13 the Court docket unequivocally dominated that XRP, in and of itself, is just not a safety. XRP, together with BTC, at the moment are the one two digital property within the U.S. with that readability”

Moreover, the crypto fee firm challenged SEC Chair Gary Gensler’s frequent assertion that each one cryptocurrencies, aside from BTC, are securities.

The agency wrote that the courtroom’s choice has put to mattress any “technique of intimidation and misinformation” the SEC may make use of in its quest.

Ripple additionally revealed a roughly 45 million enhance in its whole XRP holdings, from 5.5 billion to five.55 billion, throughout the quarter. Concurrently, the overall quantity of XRP within the Ledger Escrow dropped by over 900 million, from 42.8 billion to 41.9 billion.

The submit Ripple accuses SEC of weaponizing the corporate’s quarterly reviews in courtroom appeared first on CryptoSlate.