- DOT’s funding charges dropped, signifying that brief merchants took over the market

- DOT’s worth continued on its month-long decline spree

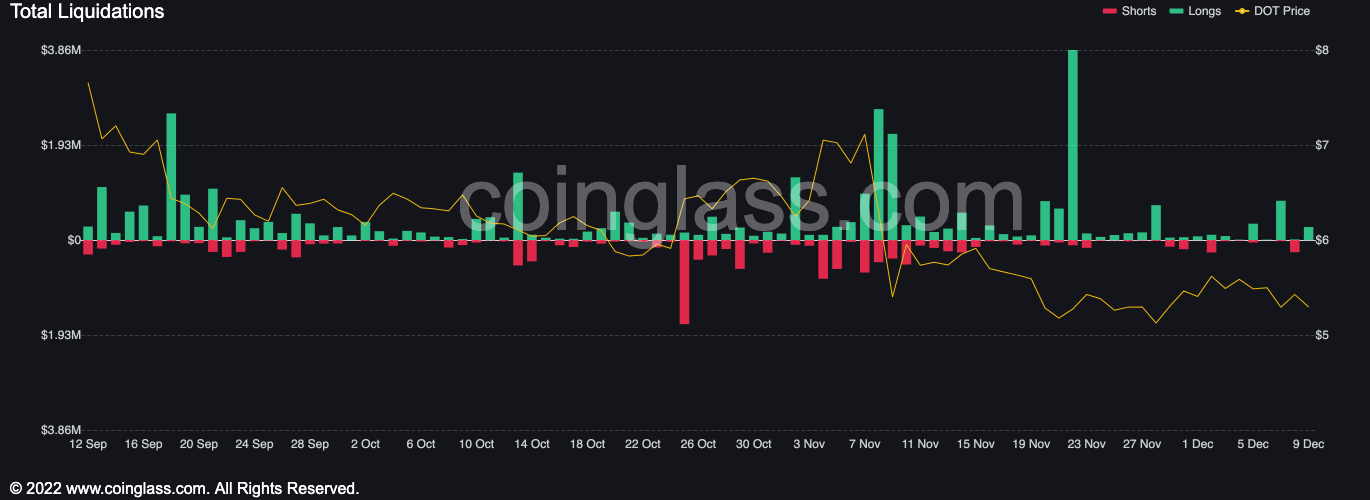

Weekend buying and selling commenced with a big decline in Polkadot’s [DOT] funding charges. This indicated that a number of brief positions have been opened, per knowledge from Santiment.

Learn Polkadot’s [DOT] Value Prediction 2023-24

In response to the on-chain analytics platform, DOT was pegged at -0.000213 at press time. You will need to notice that elevated brief positions usually result in an increase within the worth of an asset. This led to most brief merchants in a severely liquidated place.

Per knowledge from Coinglass, liquidations within the cryptocurrency market within the final 24 hours totaled $18.53 million, with 6,720 merchants liquidated. DOT liquidations of $264,000 accounted for 1.5% of the overall sums faraway from the market.

Supply: Coinglass

In case you might be shorting Polkadot…

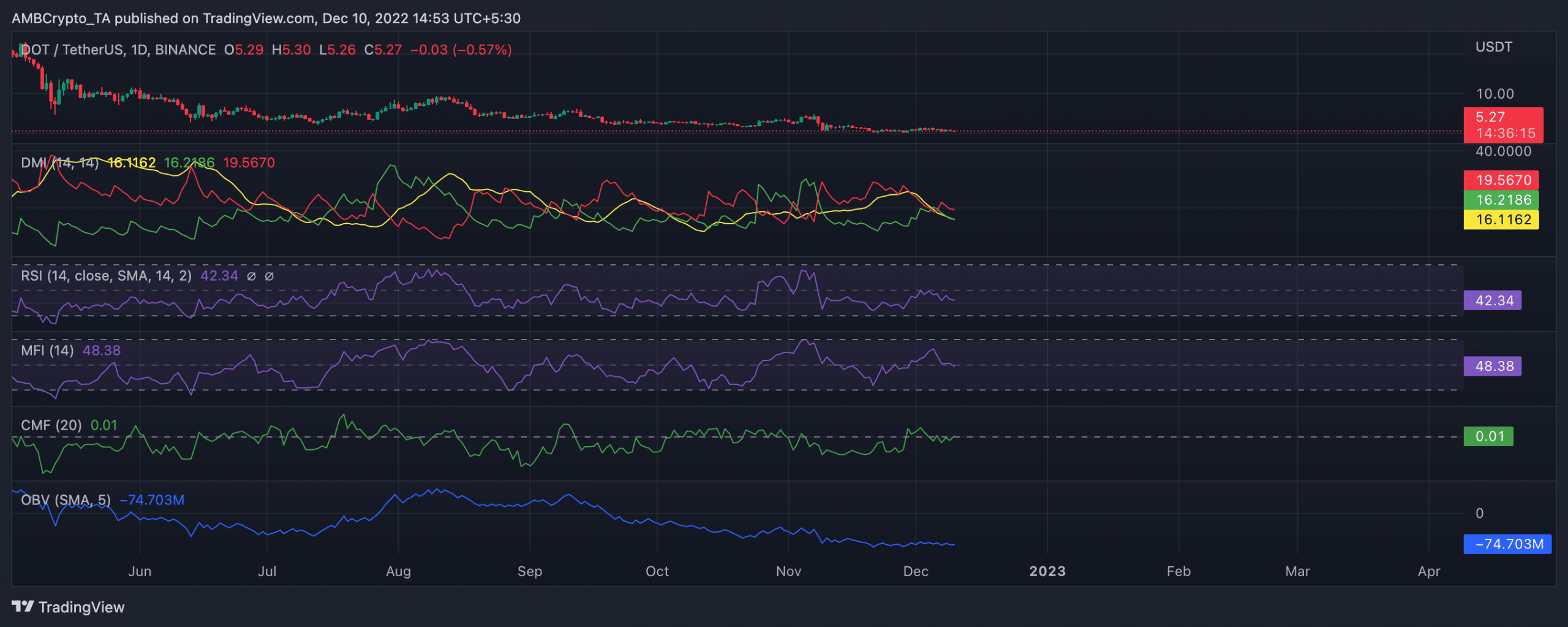

As of this writing, DOT traded at $5.28. Its worth was down by 2.33% within the final 24 hours. Buying and selling quantity additionally declined by 10% inside the similar interval, per knowledge from CoinMarketCap.

On a every day chart evaluation, DOT’s shopping for stress steadily declined since 3 November. The alt’s worth fell by 5% within the final seven days. A more in-depth have a look at the alt’s efficiency revealed that DOT’s distribution climbed step by step since FTX’s collapse. Since then, DOT’s worth has fallen by 26%.

Elevated DOT distribution put sellers in charge of the market as of this writing. The place of DOT’s Directional Motion Index (DMI) confirmed this. A have a look at the DMI revealed the sellers’ energy (purple) at 19.56 sat solidly above the consumers’ (inexperienced) at 16.21.

Likewise, key momentum indicators had been southbound at press time, indicating that purchasing stress fell additional. DOT’s Relative Energy Index (RSI) rested under the 50-neutral spot in a downtrend at 42.34. Equally, its Cash Move Index (MFI) was pegged at 48.38 at press time, additionally in a downtrend.

As DOT’s worth fell, a studying of its On-Stability-Quantity (OBV) confirmed an identical decline. Often, when the value of a cryptocurrency asset and its OBV are making decrease peaks and decrease troughs, the value decline is prone to proceed. As of this writing, DOT’s OBV was -74.703 million.

Supply: TradingView

On the chain…

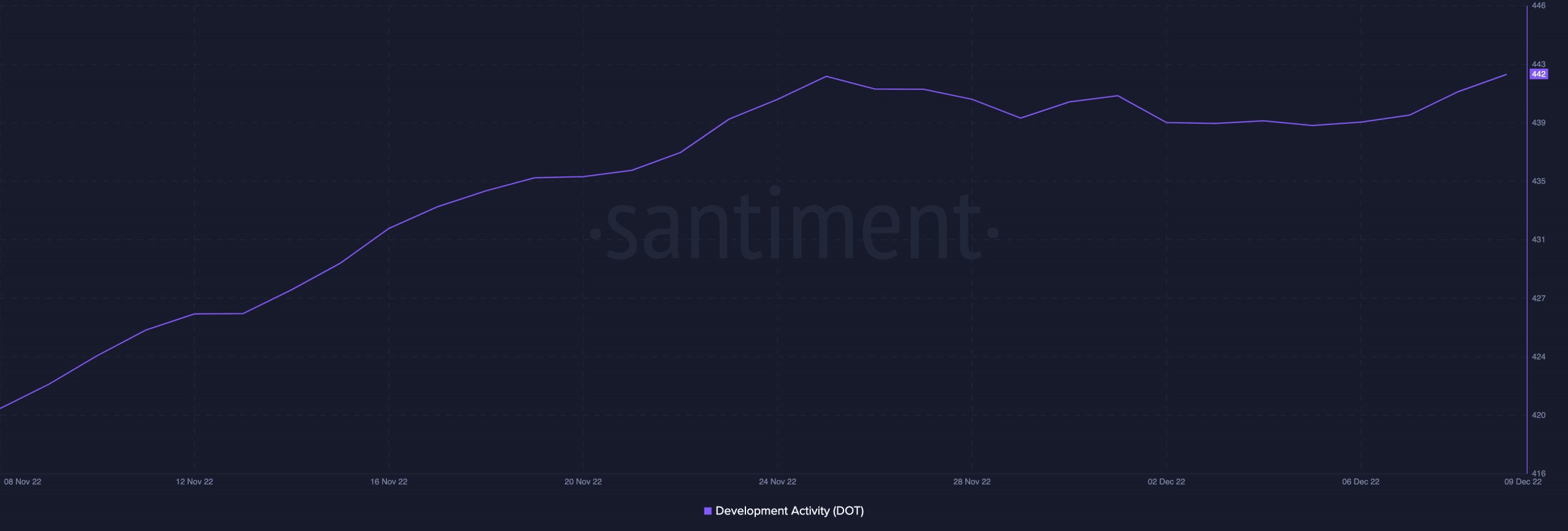

Polkadot’s improvement exercise continued to climb, putting it above Solana and Cardano by way of sub-ecosystems, repos, and weekly commits by builders.

So @Polkadot is 2nd solely to @ethereum by way of sub-ecosystems, repos, and weekly commits by builders (in line with @Artemis__xyz), however is probably least mentioned amongst the most important smart-contract protocols: ideas on the explanations for this? https://t.co/KYcleosH60 pic.twitter.com/yLTwGL1QoJ

— Chris Burniske (@cburniske) December 8, 2022

Within the final month, Polkadot’s improvement exercise grew by 5%.

Supply: Santiment