- Solana’s NFT ecosystem registered a progress final week

- SOL’s funding fee spiked solely to go down later

Solana’s [SOL] latest efficiency gave chills to the traders as its value dropped drastically. This value SOL its spot on the highest 10 listing. Nevertheless, Solana lately confirmed progress in its NFT house, which could assist SOL reclaim its earlier place and register extra greens on its value chart.

Solana NFT Highlights Week 45

🔸 @Stepnofficial + ASICS Airdrop

🔸The @Solana NFT Celebration Contest on @instagram

🔸@MagicEden Launchpad now helps SFTs launches

(1/2) pic.twitter.com/Kg7ynWNAdb

— Solana Day by day (@solana_daily) November 9, 2022

Learn Solana’s [SOL] Value Prediction 2023-24

These NFT highlights embody Magic Eden’s latest replace, which was a launchpad supporting SFTs, the Solana NFT celebration contest on Instagram, Genopets v0.4.0 going stay within the App Retailer, and extra.

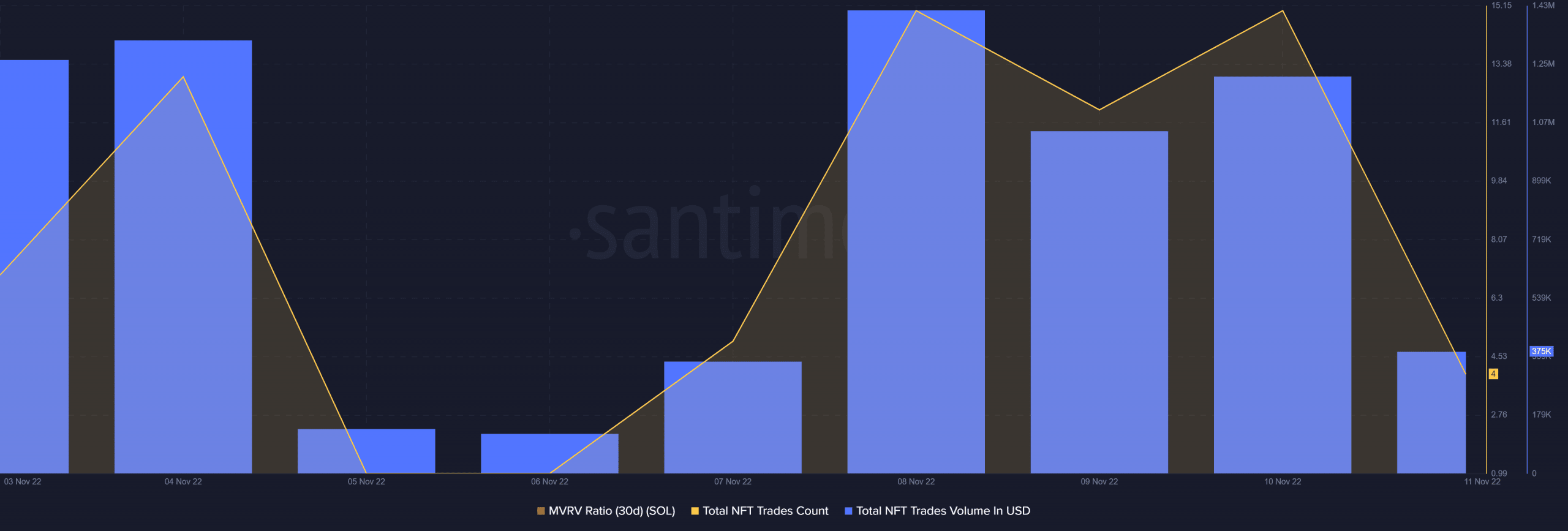

Moreover, Santiment’s chart revealed that metric progress was noticeable for Solana’s NFT ecosystem as effectively. Solana’s complete NFT commerce depend elevated sharply final week, as did its complete NFT commerce volumes in USD.

This was a optimistic improvement as a result of it confirmed that extra transactions had been going down on the community.

Supply: Santiment

Is a revival coming quickly for SOL?

Solana’s latest uptick and the expansion in its NFT house gave rise to optimism. At press time, SOL’s value was up by over 23% within the final 24 hours and was buying and selling at $17.40 with a market capitalization of greater than $6.32 billion.

Apparently, a number of on-chain metrics additionally revealed the same risk of a continued value surge within the coming days. As an example, CryptoQuant’s data identified that SOL’s value was in an oversold place, which is an enormous bullish indicator.

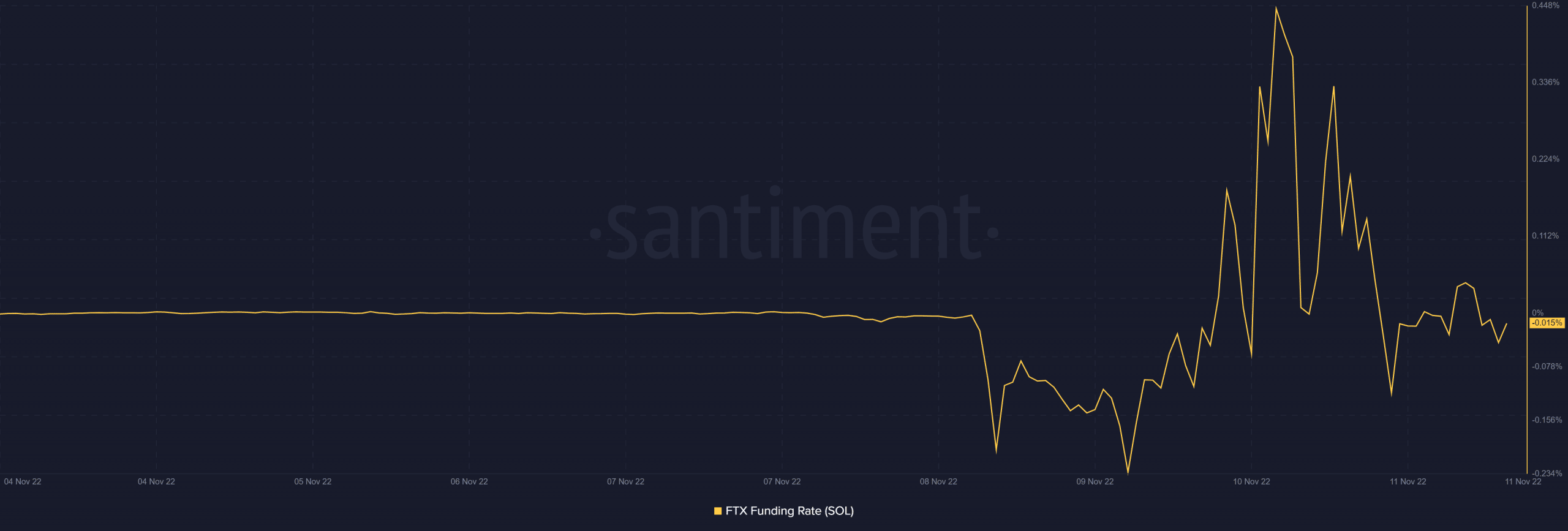

SOL additionally obtained fairly some curiosity from the derivatives market as its FTX funding fee registered a spike final week, however went down later.

Supply: Santiment

Trying ahead

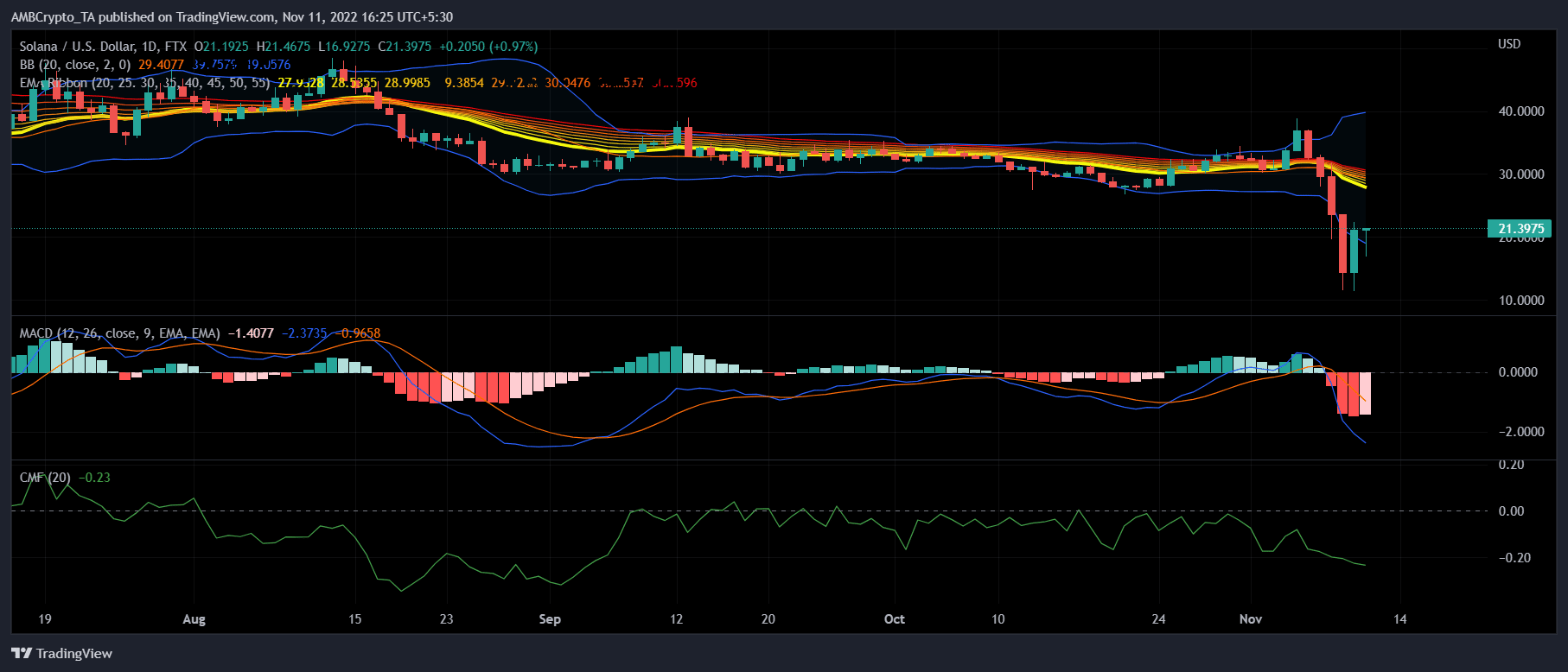

Sadly, the market indicators instructed that the arduous days for traders had been about to increase. Most indicators supported the potential for an additional value plummet. For instance, the Exponential Shifting Common (EMA) Ribbon indicated that the bears had a bonus out there.

The MACD’s studying additionally supplemented the info of the EMA Ribbon, additional growing the probabilities of a value decline. In addition to, SOL’s Chaikin Cash Movement (CMF) was effectively under impartial, indicating a bearish pattern.

The Bollinger Band indicated that SOL’s value was in a excessive volatility zone, which created a slight alternative for SOL to register an uptick, as instructed by the metrics.

Supply: TradingView

![Solana [SOL] investors’ worry might not end anytime soon because…](https://ambcrypto.com/wp-content/uploads/2022/11/dm-4-fi-1000x600.jpg)