- YFI has elevated by nearly 18% within the final couple of days.

- There have additionally been heightened actions in every day lively addresses.

On 3 March, most cryptocurrencies reported losses, however Yearn Finance (YFI) seems to have damaged free from the final pattern. The worth motion indicated that it was buying and selling profitably, including to the times when it had closed trades profitably.

Real looking or not, right here’s YFI’s market cap in BTC’s phrases

Craving for the highest

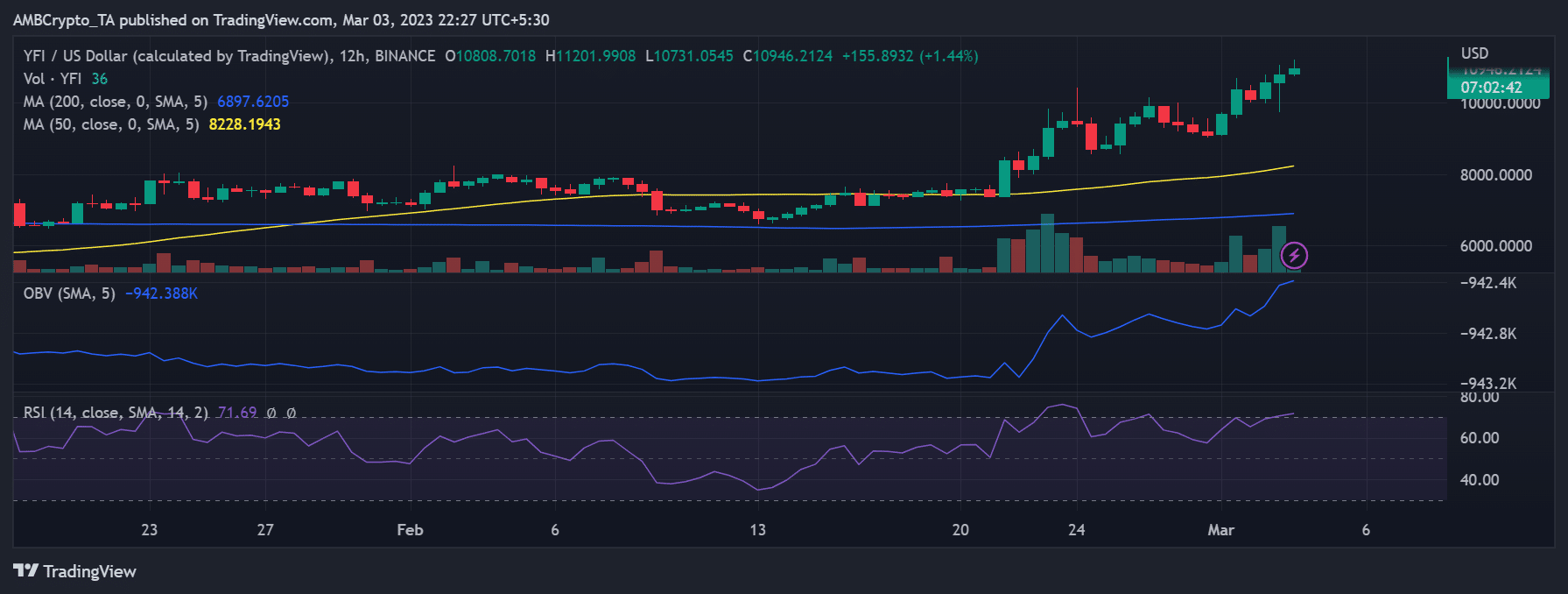

On a every day timeframe chart, Yearn Finance (YFI), at press time, was buying and selling at roughly $10,900. It was buying and selling at a revenue of greater than 2%, marking the third consecutive day it had completed so.

Apart from sooner or later, it had traded profitably for the earlier six days, bringing its general achieve to roughly 18%.

Supply: TradingView

YFI had entered the overbought space as a result of monumental worth spike it was experiencing. Yearn Finance’s Relative Energy Index (RSI) line was over 70, suggesting a powerful bull pattern (YFI). As seen by the On Stability Quantity, there was additionally a touch of worth and quantity convergence (OBV).

Lively handle put up yearly excessive

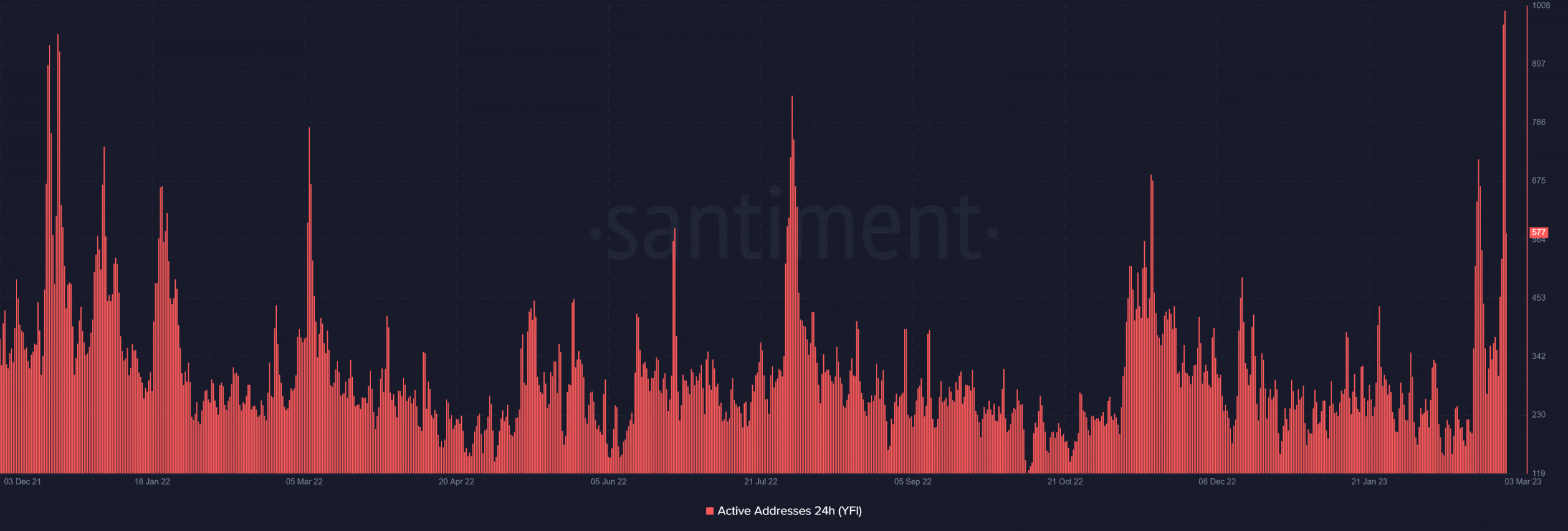

The 24-hour lively handle measure revealed that Yearn Finance (YFI) had seen a excessive exercise degree in line with the pricing.

There gave the impression to be an increase on the every day chart, and as of this writing, there have been 578 lively addresses.

It was additionally attainable to look at that the degrees reached over the earlier two days have been the very best in over a 12 months.

Supply: Santiment

A attainable motive for the pump

The announcement made by Yearn Finance final week is among the many extra believable explanations for the sustained rise of YFI.

Yearn Finance revealed in a put up in February that it could introduce Ethereum Liquid Staking By-product (LSD).

Because it aids in danger discount and diversification, this type of funding has been rising in reputation.

Even when different property are on a downward pattern, this announcement has saved the token rising and created sufficient curiosity round it.

Moreover, as extra stakeholders use the protocol, this may additionally improve Yearn Finance’s Complete Worth Locked (TVL).

Is your portfolio inexperienced? Take a look at the Yearn Finance Revenue Calculator

As of this writing, Ethereum, Fantom, Optimism, and Arbitrum made up the $443.14 million Complete Worth Locked (TVL) on Yearn Finance, per DefiLlama.

This might appear little compared to different Decentralized Finance protocols. But, the TVL would possibly see an uptick as a result of upcoming debut of its LSD.