Solana’s [SOL] ecosystem was fairly lively final week contemplating the announcement of a number of promising developments. Most lately, Google Cloud tweeted that it was working with Solana to convey Blockchain Node Engine to the Solana chain subsequent 12 months. This partnership would assist anybody seeking to launch a devoted Solana node within the cloud.

Did you suppose we solely had one announcement? Suppose once more.

Google Cloud is working with @solana to convey Blockchain Node Engine to the Solana chain subsequent 12 months, so will probably be straightforward for anybody to launch a devoted Solana node within the cloud ↓ https://t.co/CzrM90fQpp

— Google Cloud (@googlecloud) November 5, 2022

____________________________________________________________________________________________

Right here’s AMBCrypto’s Value Prediction for Solana [SOL] for 2023-24

____________________________________________________________________________________________

The official announcement mentioned,

“Whereas self-managed nodes are sometimes troublesome to deploy and require fixed administration, Blockchain Node Engine is a completely managed node-hosting service that may decrease the necessity for node operations.”

SOL’s DeFi house additionally witnessed a substantial quantity of updates. Notably, JupiterExchange built-in Solana’s transactions v2, and Solanamobile allowed Saga pre-ordered customers to mint the Saga Go NFT.

Solana DeFi Spotlight Week 44

🔸 @SolanaFndn launched the @Solana Community Efficiency Report

🔸 @solanamobile allowed Saga pre-odered customers mint Saga Go NFT

🔸 @JupiterExchange has built-in Solana’s transactions v2

(1/2) pic.twitter.com/zR12OW0TNM

— Solana Day by day (@solana_daily) November 6, 2022

Curiously, Solana’s chart was additionally painted inexperienced contemplating final week because it registered over 8% weekly good points. A have a look at SOL’s metrics additionally signaled in the direction of a optimistic future, as most of them supported a continued worth surge.

SOL showcases an uptick

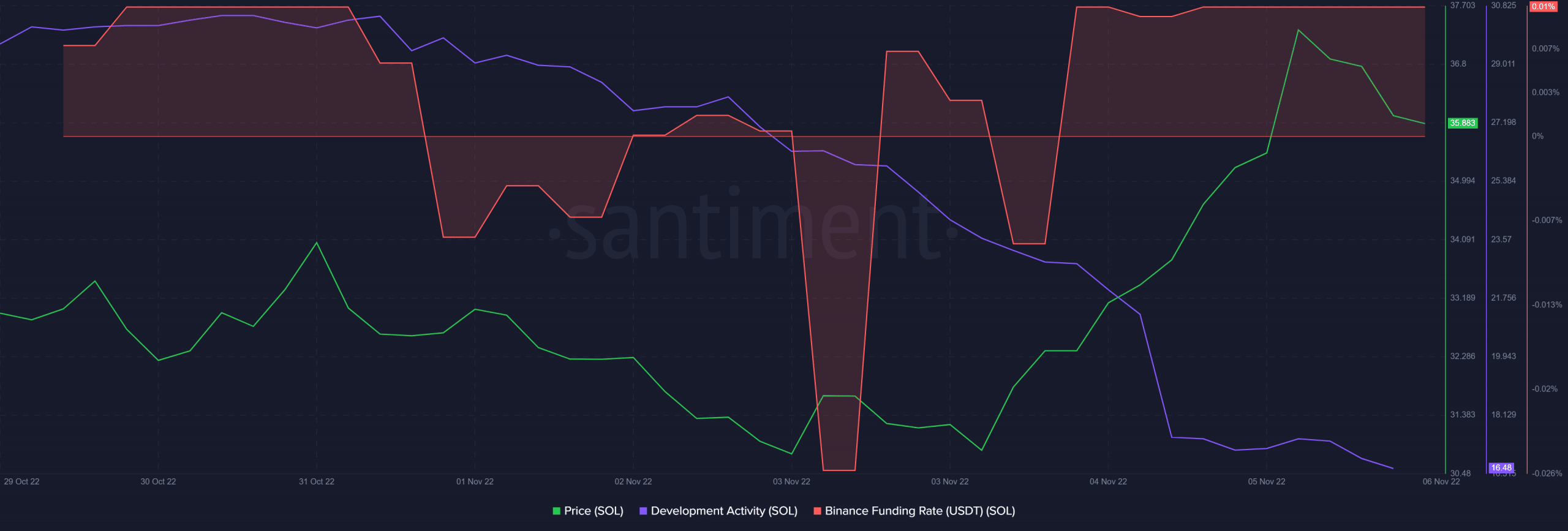

On the metric entrance, Solana acquired vital curiosity from the derivatives market as its Binance funding fee was notably excessive.

Picture Supply: Santiment

In keeping with DeFiLlama, SOL’s whole worth locked (TVL) registered an uptick recently. Its NFT commerce counts spiked on 1 and 4 November, indicating one other worth surge within the coming days.

Nonetheless, regardless of these updates and integrations, SOL’s growth exercise went the other method and declined during the last week. This may very well be thought of as a unfavorable sign for a blockchain. Nonetheless, SOL’s market indicators might assist us perceive the situation higher.

Bulls or bears?

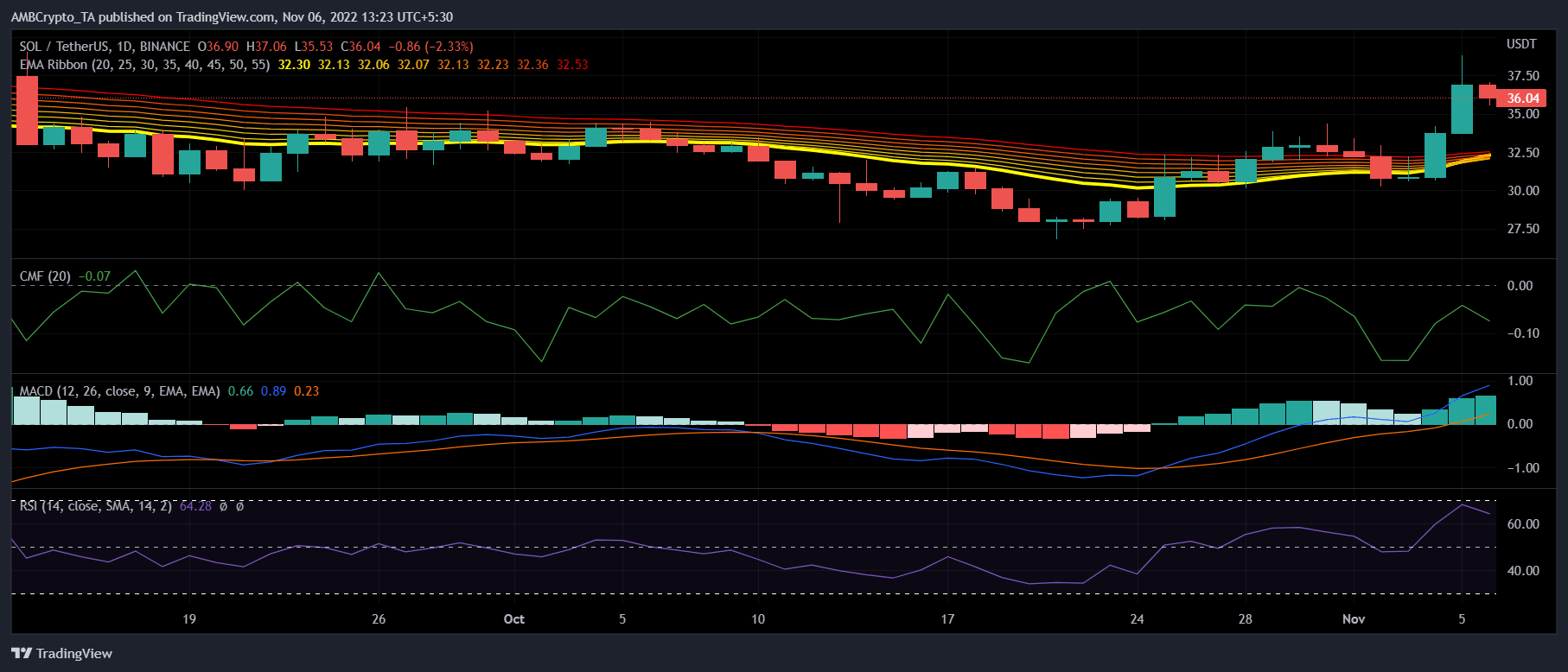

SOL’s Transferring Common Convergence Divergence (MACD) indicator displayed a current bullish crossover. This might provide some respite to distressed buyers. Not solely this, however the Exponential Transferring Common (EMA) Ribbon revealed the potential of one other upcoming bullish crossover. Thus, growing the possibilities of an uptrend.

Nonetheless, the Relative Energy Index (RSI) and Chaikin Cash Move (CMF) registered downticks. This might act as a roadblock within the in SOL’s total bullish rating.

Picture Supply: TradingView