- Terra Traditional topped all different altcoins with a surge in social engagements and mentions

- Regardless of a large rise in burn actively, LUNC’s momentum edged nearer to bearishness

Terra Traditional [LUNC] topped the altcoin market on 3 December as regards to its social exercise. In response to LunarCrush, the social intelligence monitoring platform, LUNC had its ever-ready group to thank for the milestone.

Learn Terra Traditional’s [LUNC] Value Prediction 2023-2024

The breakdown of the small print confirmed that social contribution shaped 12.19% whereas engagements accounted for 71.3%. This surge indicated that there was a reawakening of actions throughout social platforms from the LUNC tent.

The #terraclassic group is at it once more at present🚀. Let’s check out at present’s social exercise 🔥.

Terra Traditional has hit an AltRank™ of 1 out of the highest 4,023 cash throughout the market.

Social contributors +21.9%

Social engagements +71.3%Insights: https://t.co/igt3vnyzpC pic.twitter.com/zpkdNVyp4G

— LunarCrush (@LunarCrush) December 3, 2022

Take all of the tokens, burn it up

The token hitting such heights may be related to the latest landmark hit with LUNC’s burn exercise. As of 1 December, LUNC burn hit an unprecedented 6,389,633,879 — a 972,516% enhance.

In response to some sections of the LUNC group, Binance, who backed the burn system, may have contributed to the spike. Nevertheless, the momentum appeared to have dipped, as LunaBurnTracker revealed that there had been a 100% lower to three,167,134 LUNC within the final 24 hours.

🔥 Each day Burn Stats for Fri Dec 02 2022! 3,167,134 #LUNC ($569) burned! 📉 -100% lower. 33 burns @ 2 BPH. 1 LUNC = $0.00017959 #LunaBurn

— LunaBurnTracker (@LunaBurnTracker) December 3, 2022

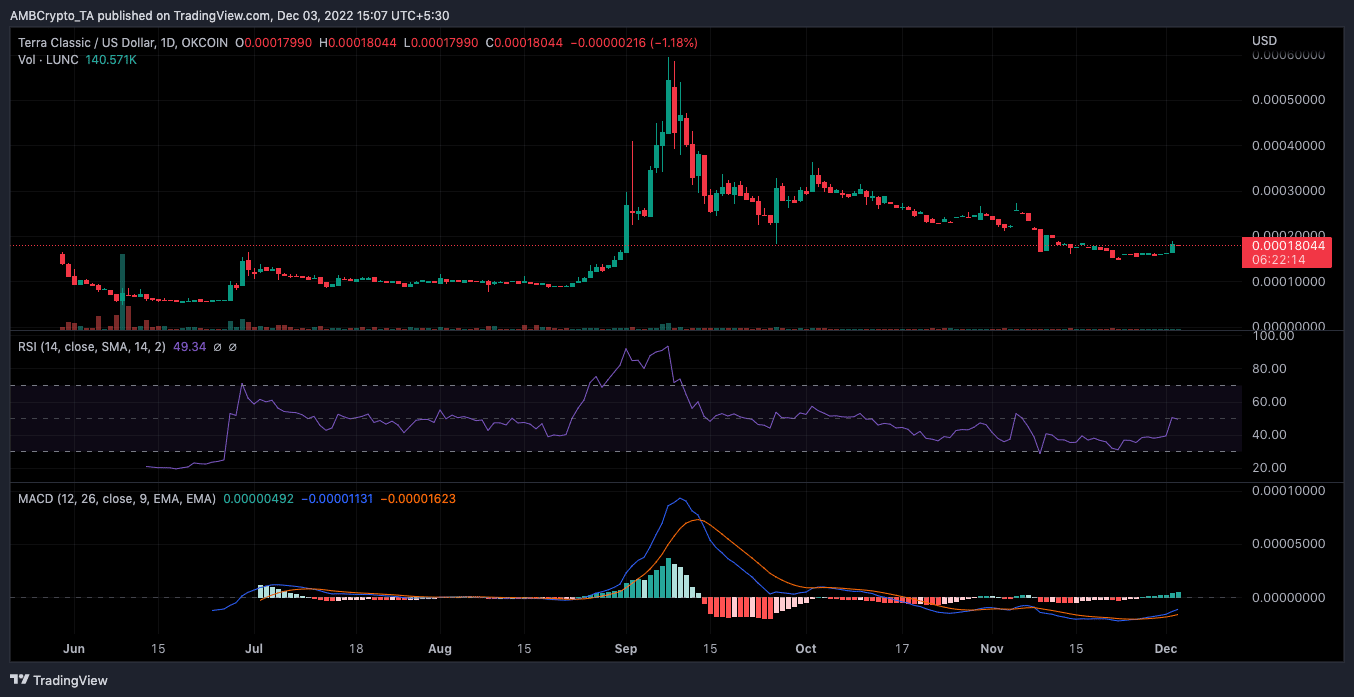

As for its value, LUNC didn’t react positively to the replace. At press time, LUNC exchanged arms at $0.000179. This was a 2.20% decline from the worth on 2 December. Quite the opposite, its efficiency within the final seven days elevated by 10.67%, based on CoinMarketCap. As well as, the uptick enabled the token to retrieve a $1 billion market cap.

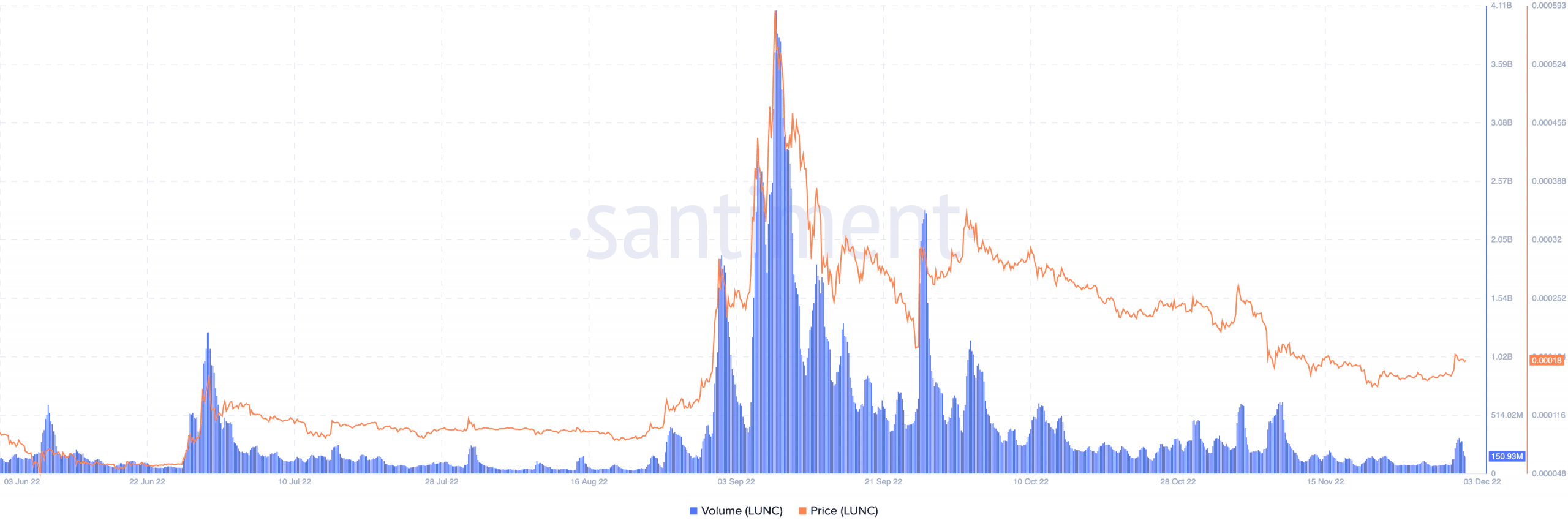

As of this writing, LUNC’s market cap was $1.07 billion. Nevertheless, it was not the identical as the amount. In response to Santiment knowledge, its quantity had declined 44.86% within the final 24 hours. Contemplating the lower, it meant that LUNC traders had avoided elevated participation in transactions on the community.

Supply: Santiment

Per value motion, LUNC had comparatively good momentum. As of this writing, the Relative Energy Index (RSI) was at 49.34. This signified a impartial floor, as LUNC was neither oversold nor overbought.

For the Transferring Common Convergence Divergence (MACD), it was a heated contest between patrons and sellers. Based mostly on the each day chart revelations, purchaser and vendor energy was beneath the zero-point histogram. This indicated a bearish momentum. Nevertheless, the MACD being at 0.00000492 on the optimistic axis meant that patrons had some potential to regain management.

Supply: TradingView

Enhancements down

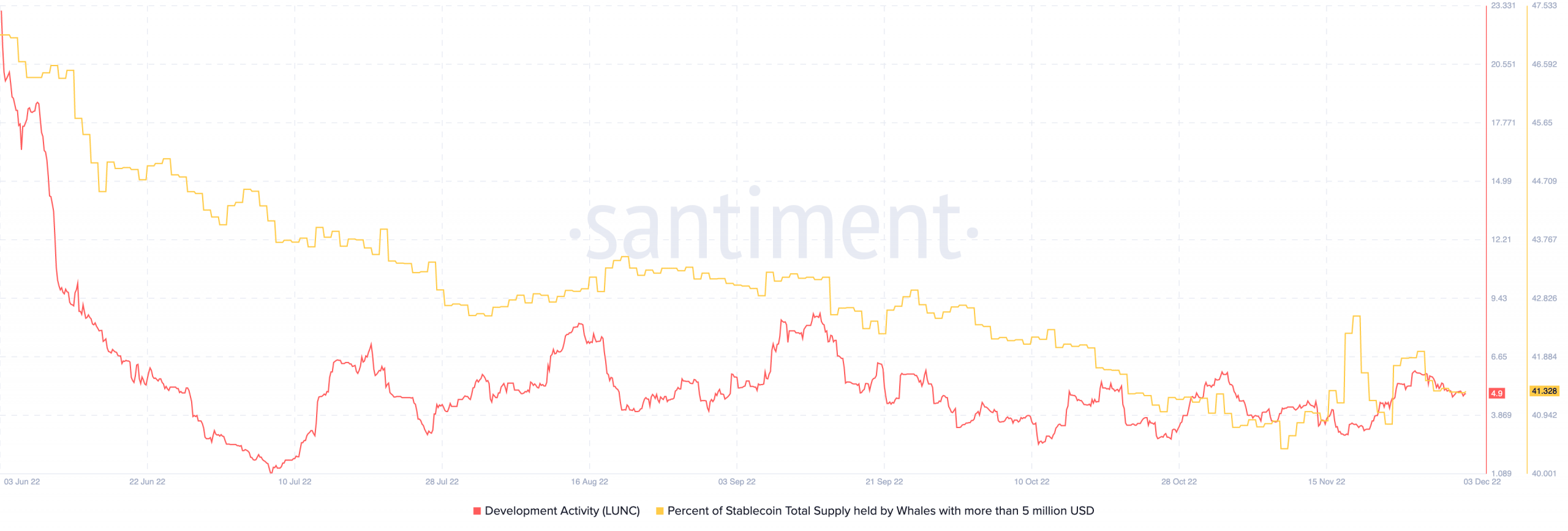

Within the case of its improvement, Santiment revealed that LUNC towed in direction of the draw back. In response to the on-chain data platform, LUNC’s improvement exercise was right down to 49.34.

Within the meantime, it meant that the Terra builders weren’t actively making noteworthy upgrades to the community. For whales, this was no time so as to add to their holding as the provision held decreased to 41.328.

Supply: Santiment