- Tron’s Relative Energy Index (RSI) was overbought at press time

- TRX’s metrics and market indicators strongly favored the bears

Tron’s [TRX] worth motion of final week was extraordinarily sluggish, because it registered destructive development. New data from CryptoQuant revealed that the upcoming days could be even worse, as TRX’s RSI was in an overbought place. This pointed in direction of an extra decline in its worth.

On the time of writing, TRX was down by greater than 1% within the final 24 hours and was trading at $0.05328 with a market capitalization of greater than $4.9 billion. Nevertheless, TRX might witness a change in development contemplating the previous few developments.

Learn Tron’s [TRX] Value Prediction 2023-2024

The place does Tron stand?

Final week, the Dominican authorities gave Tron an allowance to problem Dominica’s nationwide token. This was an optimistic replace because it mirrored elevated adoption of Tron on a world scale. Justin Solar, the founding father of Tron, additionally joined the Reuters NEXT Management Summit on-line and gave a number of interviews on the theme of “crypto winter.”

🧐Try #TRON Highlights from this week (Nov 26, 2022 – Dec 02, 2022).

🙌We’ll replace you on the primary information about #TRON and #TRON #Ecosystem. So keep tuned, #TRONICS! pic.twitter.com/VDOylmFG3R

— TRON DAO (@trondao) December 3, 2022

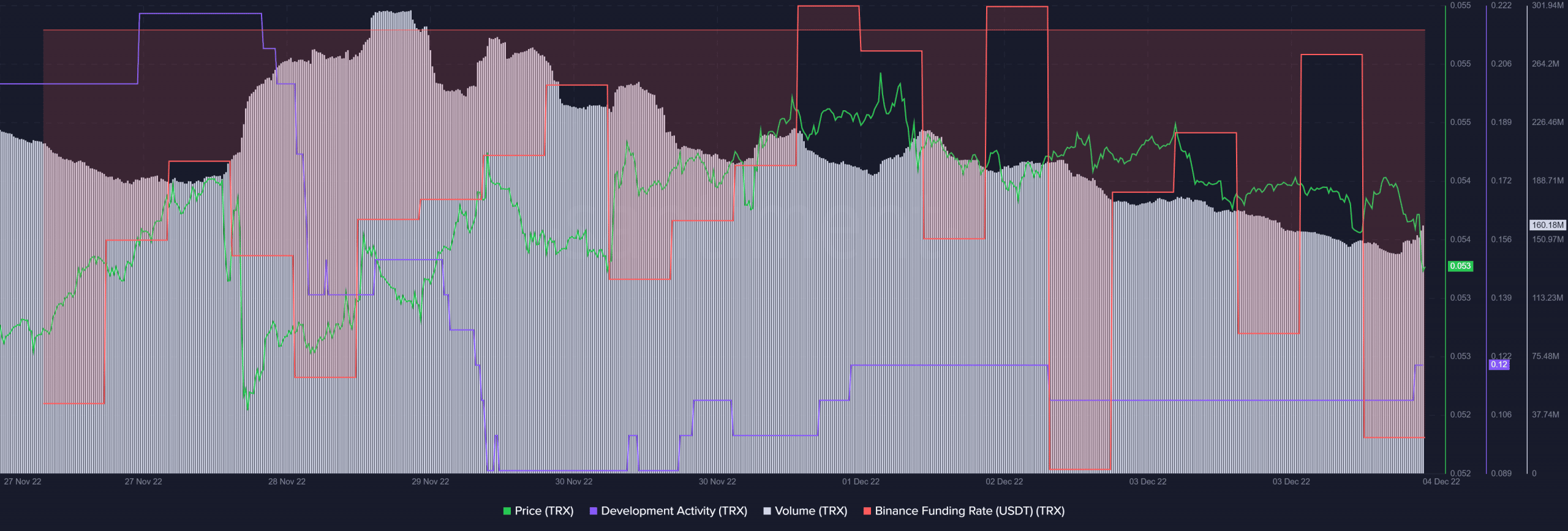

Nonetheless, issues didn’t appear to work in TRX’s favor on the metrics entrance. As an illustration, because the starting of this month, Tron’s whole worth witnessed a downfall. Moreover, Santiment’s chart revealed a number of extra metrics that indicated a worth fall.

As an illustration, TRX’s growth exercise went down over the past week. TRX’s quantity additionally adopted the same path and declined. Moreover, TRX additionally failed to achieve curiosity from the derivatives market as its Binance funding charge was persistently low.

Supply: Santiment

On the mercy of the bears

Not solely the metrics, however fairly a number of market indicators additionally supported the bears. TRX’s Cash Circulation Index (MFI) was hovering across the overbought zone, which was a destructive sign.

The 50-day Exponential Transferring Common (EMA) (purple) was additionally significantly above the 20-day EMA (inexperienced), additional growing the possibilities of a downtrend. Nevertheless, the Transferring Common Convergence Divergence (MACD) supplied a much-needed aid because it revealed that the bulls nonetheless had the higher hand out there.

Supply: TradingView